CHENG FENG CHIANG/iStock via Getty Images

The key to success in investing is to own a basket of quality stocks, and this holds especially true for the income investor. In fact, Warren Buffett went as far as to say that he wants 90% of his wealth to be allocated to the S&P 500 (SPY) after he passes away.

While I’m not a fan of index investing, I do see the merits to Buffett’s line of thinking. This brings me to MPLX LP (NYSE:MPLX), which is far from being the only player in its industry, but has merits on its own as a solid income producer. This article highlights what makes MPLX a worthy candidate as an income stock, so let’s get started.

MPLX: Boost Your Income With This 8% Yield

MPLX is a master limited partnership (issues K-1) that was spun off from Marathon Petroleum (MPC) in 2012. The company owns and operates a network of pipelines and terminals that are used to transport crude oil, refined products, and natural gas.

The business model for MPLX is quite straightforward. It owns and operates long-lived assets, including pipelines and storage tanks, which are used to transport energy products from one point to another. MPLX also has an inland marine business, docs, and NGL processing and fractionation facilities linked to key U.S. supply basis, particularly in the Appalachia region.

While MPLX may not be the top dog in its industry, it does have several things going for it. For one thing, it benefits from its affiliation with its general partner, Marathon Petroleum Corporation, which continues to hold a significant equity interest in the company. Many of MPLX’s assets were built to serve MPC, locking in a stable income stream through fee income.

Additionally, the Russia-Ukraine war has sent oil and gas prices soaring, and BlackRock (BLK) CEO Larry Fink recently said that this marks an end to globalization as we know it. This is perhaps best reflected by the fact that the U.S. last month banned the import of Russian oil, liquified natural gas, and coal. This bodes well for domestic energy players up and down the value chain, including MPLX as a large cap midstream company.

Moreover, MPLX has produced continued growth, with adjusted EBITDA growing by 6.6% YoY to $1.45 billion and distributable cash flow growing by 4.5% to $1.2 billion in 2021. This was driven by higher throughput in its logistics and storage segment, and by higher NGL prices in its gathering and processing segment, offsetting lower volumes.

This equates to strong distribution coverage of 1.64x, putting MPLX on par with that of industry bellwether, Enterprise Products Partners (EPD). MPLX’s distribution has grown at a respectable 6.3% rate over the past 5 years, and has grown continuously for 9 consecutive years.

Furthermore, MPLX’s management has also demonstrated a propensity for unit buybacks, with $630M worth of unit repurchases last year, equating to around 2% of MPLX’s equity market capitalization. MPLX also maintains low leverage for an MLP, with a consolidated debt to adjusted EBITDA ratio of 3.7x.

Risks to MPLX include its indirect and direct ownership stakes in Dakota Access and Tesoro High Plains pipeline systems. This could impact EBITDA by less than $100M should they be shut down. Additionally, MPLX carries ESG risks in a climate-conscious political environment. Encouragingly, MPLX has the potential for renewable fuels, hydrogen, and carbon capture through its system, and management highlighted these opportunities during the recent conference call:

While our capital outlook is primarily focused on our current L&S and G&P footprint, we also continue to evaluate low carbon opportunities where we can leverage our competitive advantage through technologies that are complementary with our expertise and our asset footprint. Near term, these opportunities are likely to be in support of MPC’s renewable efforts such as investment in our logistics assets supporting MPC’s Martinez renewable fuels project.

While MPLX no longer remains cheap at the current price of $33.83, I still see value in the units at the current EV/EBITDA of 11.3x, which is more-or-less in line with its pre-pandemic range. This is considering the strength of its balance sheet, capital returns to unitholders, and potential catalysts from increased demand from domestic customers, especially considering the difficulties in getting new pipeline projects approved in today’s political environment.

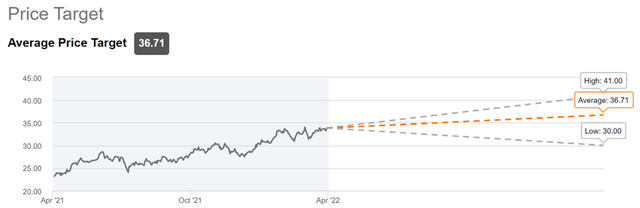

Sell side analysts have a consensus Buy rating, with an average price target of $36.71, implying a potential 17% total return including distributions.

MPLX Price Targets (Seeking Alpha)

Investor Takeaway

MPLX is a quality midstream MLP that remains a good value at the current price. While it may not be the cheapest midstream player out there, it does offer a good combination of yield, growth potential, and downside protection. It stands to benefit from increased domestic production and maintains a strong balance sheet. I see value in MPLX for high income in a well-diversified portfolio.

Be the first to comment