Instants/E+ via Getty Images

Introduction

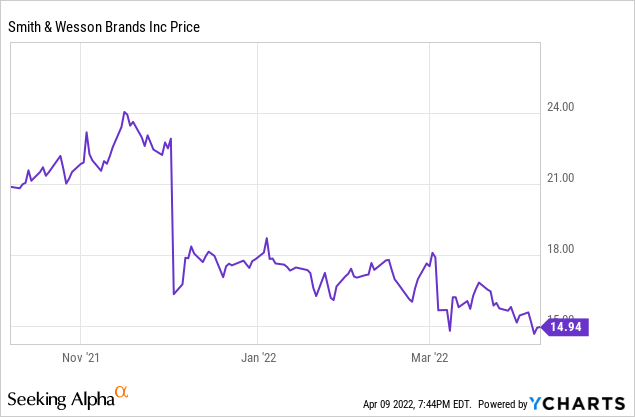

The first quarter of the year marked continued punishment for Smith & Wesson (NASDAQ:SWBI) and other firearm manufacturers across the board. Following a difficult fiscal second quarter, SWBI’s stock dropped dramatically in December as tepid firearm demand translated to weak sales. Falling sales and revenue associated with the discontinuation of the Thompson/Center Arms product lines led to a 30% decline in share price.

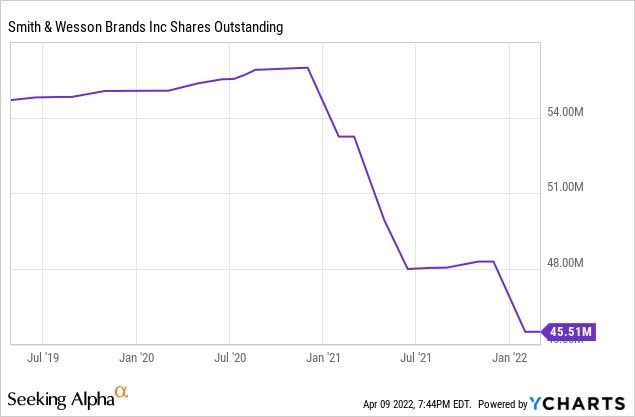

The market has pushed SWBI lower despite positive trends from recent earnings. Unfortunately, the broader slowdown of the firearm market has overshadowed any strength shown by SWBI. For example, for the quarter ended January 31, the company reported strong results including triple digit sales growth over a two year period and the successful repurchase of 2,788,152 shares for $50,000,000. So why have SWBI shares continued trending lower?

The obvious answer lies in the 31.0% decrease in year over year sales, a steep, but expected decline as the business cools from the COVID-19 related bump in firearm sales. While the firearm industry has displayed incredible long term strength as annual background check numbers continue to trend higher, 2020 led to circumstances which are unlikely to be replicated in the future. As with any business, a 31% decline in sales is inherently problematic no matter the circumstances. Today, we are going to take a deeper look at SWBI and see if this business can weather the current storm and emerge stronger.

Who is Smith & Wesson?

Smith & Wesson is one of the most iconic firearm manufacturers in the United States. The brand was established in 1856 and is today one of the oldest operating firearm manufacturers in the world. The company’s origins lie in the classic American six shooter, originating as a revolver manufacturer. Over the next century, the brand diversified and expanded across firearm categories, now manufacturing pistols, revolvers, shotguns, and rifles. We trust that many readers need no introduction to the brand.

Over time, the company has undergone transformations which have redefined the objectives and mission. Most recently, Smith & Wesson spun off from American Outdoor Brands Corporation (AOUT), a conglomerate manufacturer of outdoor equipment and recreational products. While SWBI, was originally absorbed into the business on the thought process of diversifying away from purely firearm manufacturing, the marriage was unsuccessful. Management decided that it made the most sense for Smith & Wesson to operate as an independent entity focusing purely on the manufacture and sale of firearms.

However, the split marked a more meaningful change to the business as a whole. Following the unsuccessful business combination, the split also marked a significant transformation in the management style and mission of the company separate from the brand. Management indicated that they would shift their approach to be more shareholder oriented. This meant the reintroduction of the dividend in the initiation of the share repurchase program. Both are strongly beneficial to shareholders.

That said, the company’s operations are almost meaningless without a strong foundational market. As mentioned above, the market clearly begun to show weakness because of cooling over the past 12 months. Let’s look at a brief overview of the market and then put the pieces together.

Firearm Market Update

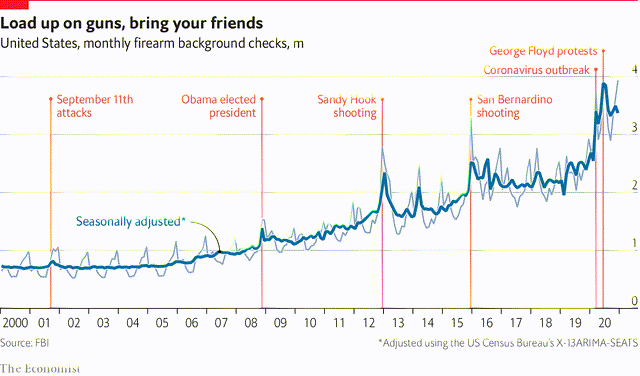

The past two years have been undoubtedly wild ride for the firearms market. The COVID-19 pandemic initiated a sense of urgency in many Americans to expand their repertoire of safety and security measures. For many Americans, this meant the purchase of a firearm and as a result the firearm market saw an extraordinary and uncharacteristic bump in FBI background checks, the accepted measure for firearm demand.

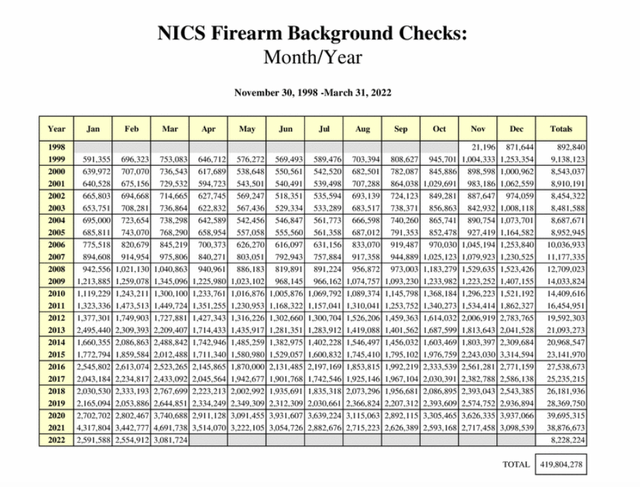

Looking prior to 2020, we see two decades of strong and consistent demand growth which has been periodically interrupted by events which are perceived as risk factors to firearm ownership. While the increase in demand as a result of the pandemic was not unsurprising, the degree was somewhat unexpected. According to the FBI, there were slightly over 28 million background checks in 2019. For 2020, this number increased to nearly 40 million. 2021 nearly sustained this demand with almost 39 million background checks completed for the year. However, over the past six months, demand waned substantially with an unusual decline in background checks.

As almost everybody expected, the market has begun to soften as a result of the increased demand over the past two years. This risk is systemic and will impact manufacturers across the board regardless of their business model and niche. So, with reality setting in and the party stopping, a focus on quality and durability becomes paramount. Let’s take a look at the business and see if it can continue with less wind in its sails.

Business Update

As we mentioned, SWBI’s spin off into an independent pure play firearm manufacturer marked as substantial transformation for the business as a whole. In addition to the dividend and share repurchase program, the company took measures to become more conservative in anticipation of a market slowdown. While times were good, the company took steps to protect itself from coming fluctuations in demand which are now beginning to materialize. One of these important measures paying down entirely of the company’s debt load. As it stands today, the company remains debt free and continues to proactively repurchase shares, which is accretive to shareholders.

Since March of 2020, the company has transformed, paying down $160 million of debt, buying back stock, and distributing $20 million in dividends to shareholders. It appears management has taken all of the right steps to bolster and secure the business. Their strategy has paid off as gross margins remain strong at 39.6% proving the business can continue to operate profitably in challenging conditions.

Overall, the firm remains well capitalized. With no long term debt, there are few liabilities which pose a risk to SWBI’s long term financial viability. SWBI maintains over $107 million in cash on hand, which is flat year over year. Inventory has notably increased from $78 million to $134 million as demand softens, but luckily perishability is not an issue.

The firm’s balance sheet is healthy, but the unrelenting share price punishment has left the company too cheap to ignore. Currently, SWBI is trading at 3.64x forward earnings. The business’s enterprise value to EBITDA multiple is 2.12x on a forward basis, meaning shares are dirt cheap. We acknowledge that SWBI is mature business with limited growth vectors given its dominant position in a constrained industry. However, these valuation multiples are unheard of in a perpetually well priced market.

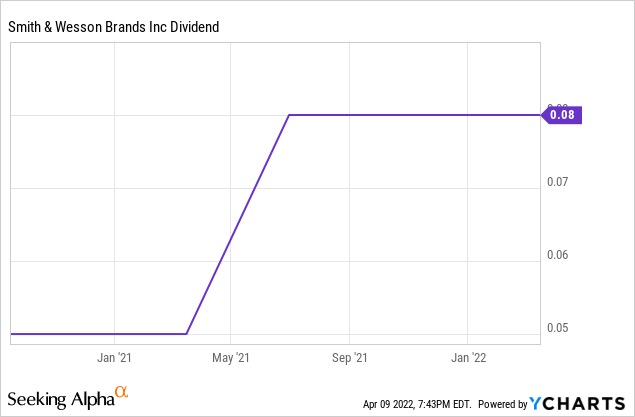

The Dividend

One important and often overlooked aspect of the company is the dividend. Introduced just over one year ago, the distribution was a component of the firm’s commitment to returning to a shareholder oriented focus. The firm has taken the approach of paying a flat consistent dividend, as opposed to a flexible approach based on prior quarter’s earnings. Given firearms are a cyclical and unpredictable industry, with fluctuating demand, paying a level dividend can be somewhat challenging. Competitor Ruger (RGR) has taken a different approach and instead pays a variable dividend which is a fixed portion of the prior quarter’s earnings. To account for the volatility and unpredictability, SWBI initiated a conservative dividend with a low payout ratio.

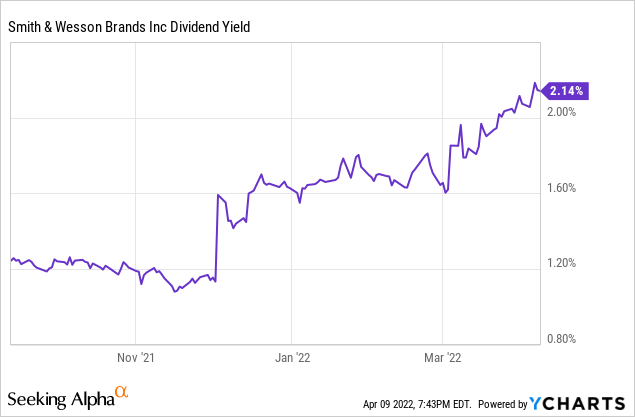

Initially, the company paid a dividend at $0.05 per share per quarter which corresponded to a single digit payout ratio. Soon thereafter, management decided to increase the dividend adding three cents per share per quarter, a 60% increase. Even accounting for this increase, the dividend payout ratio remains conservative at 6.60%. So, for a typical business a sales decline of approximately 30% would surely put the dividend at risk. However, this is clearly not the case for Smith & Wesson given their dividend remains very conservative. With such a low payout ratio, investors would expect that the company generates a paltry yield. Recent declines in share prices have given us an unusual reason to celebrate as the fall from all-time highs has strengthened the company’s dividend yield.

The balance sheet and strength as a business combined with a position as an undeniable market leader, means the brand is likely here to stay. For investors who might be willing to stomach long term volatility in share prices as investor enthusiasm advances and retreats, the current yield presents an interesting opportunity when combined with the rapid growth potential. It is not unrealistic to see another significant increase to the firm’s dividend in the short term being that the payout ratio remains conservative. A similar dividend of $0.03 per share per quarter would push the yield to almost 3.00% based on today’s share prices. While the yield may not be the most attractive of the broad market, it is appealing on the basis of being conservative by measure of valuation multiples and lack of debt. Additionally, the long term viability of the firearm market will continue to support the brand’s operations.

Conclusion

Over the past six months, this company has fallen victim to problems stemming from investor enthusiasm as historically strong sales began to slow. Even still, the company’s fundamental operations remain remarkably strong and there is significant upside which remains based on distribution potential and the firm’s share buyback program. While a $50 million buyback program is small, it is meaningful given the company’s market capitalization is under $700 million. So, with share prices falling despite management taking all the right steps, where can this company go?

Should the market normalize over the next few years, it is likely that volatility will begin quelling and share prices will stabilize. Rapid growth of the dividend, combined with the firm’s repurchase program, leaves meaningful upside for share prices as they could begin to rise on account of the firm’s yield potential. With no long term debt on the balance sheet, there are limited financing risks in the short term which could threaten the company’s operations. While some investors have remained wary of the company on account of uncertainty surrounding firearm legislation, a strong and increasing dividend could provide a reason that is too good to ignore. With limited risk factors, we believe the future remains bright regardless of the market’s pessimism.

Be the first to comment