onurdongel/E+ via Getty Images

EQT (NYSE:EQT) management mentioned they are not buying at the current market prices. This company made two sizable acquisitions before the market realized there was an oil and gas price rally underway. Management feels that those acquisitions have increased in value (and I tend to agree). But management also feels that pricing is now out of the bargain sale range that they like to shop. Therefore, the acquisitions option has shut down.

That is an interesting stance by a very savvy management. Deals are still going on. But investors now have an opinion that those deals may be getting expensive. Investors pay management to bring them bargains. Very few managements spend the time to make sure the bargain really benefits the shareholders.

There is an “out” in this industry due to the “lower of cost or market” calculation that accompanies the accounting choice many of these companies make. Management can therefore overpay for an acquisition and then write that overpayment off in the next downturn because “prices forced the write-off”.

The only way that investors can spot an excess payment is by calculating average returns throughout the business cycle while watching the cash flow statement for decent cash flow from investments made. Managements are thoroughly aware that the market often “keeps up with the Joneses” rather than relying upon good fundamental work to purchase a bargain. The effects of good management are often shown long term because some managements are very good at giving the market what it wants in the short term to raise the stock price.

One of the things that EQT management pointed out in the conference call was that they do not like to pay for Tier 2 acreage. Obviously, that means that a fair amount of speculative acreage (or at least less than prime acreage) came “for free” or dirt cheap. Otherwise, management was not going to do the deal. The company shareholders will, therefore, benefit from any upside potential on that Tier 2 acreage in the current environment. The huge consideration is that if the acreage is disappointing, it did not cost anything to acquire in the first place.

Compare To Chesapeake Energy

Chesapeake Energy (CHK) recently came out of bankruptcy with post-bankruptcy management and all the turmoil that goes with it. The challenge is that the post-bankruptcy management may not have the experience that long-term industry management of EQT has. This may be more apparent to investors during the next industry downturn.

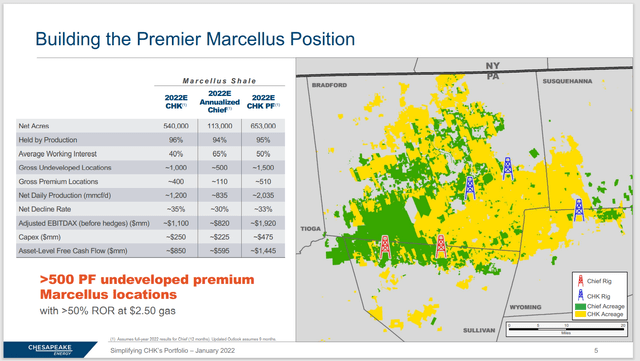

Chesapeake Energy Chief E & D Holdings Acquisition (Chesapeake Energy January 2022, Corporate Presentation)

Chesapeake Energy recently acquired the following for about $2 billion plus 9.44 million common shares of the company. This rather large acquisition looks cheap on the first glance. However, the calculations shown above are before hedging calculations. Current prices are far above the pricing when EQT made its acquisitions. The going forward assumptions are likely to be much more optimistic than when EQT made its purchases.

Above all, the ROR shown for $2.50 is actually fairly low when one considers natural gas prices of the previous years.

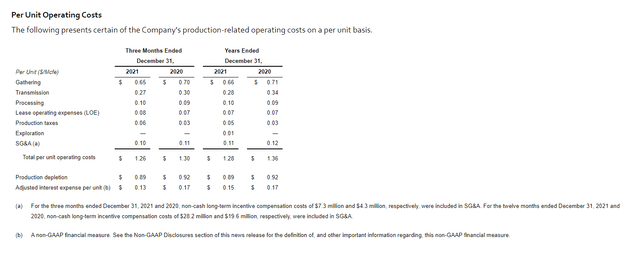

EQT Corporation Fourth Quarter 2021, Operating Cost Summary (EQT Corporation Fourth Quarter 2021, Earnings Press Release)

The major acquisitions made have allowed EQT to decrease the corporate costs after the acquisitions. Those costs are lower than many competitors before the progress management is currently reporting. EQT is a very large company even before the acquisitions. Therefore, the new costs that combine into the corporate average cost need to be significantly lower (and material as well) to lower overall corporate costs. Clearly, the new wells contribute to the cost reduction and are likely to be more profitable than the rate of return shown by the Chesapeake Energy acquisition.

Both companies have made “bolt-on” acquisitions that supposedly create synergies for cost savings. The difference is that EQT management was shopping for bargains in 2020 and 2021 before the market realized that the oil and natural gas situation was improving. But Chesapeake Energy management is riding the current enthusiasm for the industry by making “cheap acquisitions” during a time of far more optimistic pricing and outlook.

Many managements do not include the acreage cost when disclosing to shareholders the breakeven price of their wells. Chesapeake Energy is likely to have a far higher acreage cost that is not disclosed to shareholders than is the case for EQT Corporation. This will show itself as decreased average profitability throughout the full business cycle for Chesapeake Energy as well as a reduced cash flow per investment amount.

It is sometimes hard for shareholders to discern that difference because it is over the full business cycle. Sometimes it takes a while for excessive “lower of cost or market” adjustments to become apparent to the market. Sooner or later, above-average performance becomes apparent to the market.

Conclusion

EQT management has clearly accomplished quite a bit in the short time it has managed the company. Much of the accomplishments were on the cost side, because that was the easiest to tackle and results would be immediate. Now, there is finally some long-term transportation arrangements that are coming due and can be rearranged to get the natural gas to better markets outside the basin.

The pricing improvement is going to take some time because sales arrangements are often long term. However, those benefits are likely to become apparent to shareholders simply due to the significantly better pricing available out there.

Natural gas prices have recently risen to levels seldom seen (let alone levels seldom seen at the end of winter). Part of this is due to the increased ability of the North American industry to export natural gas products. That ability should continue to increase which would allow North American natural gas prices to mirror far stronger world prices than has been the case in the past.

In addition, management acquired some acreage that would allow for more liquids production. Therefore, the company can thrive under a greater variety of industry conditions in the future. In the meantime, the rock-bottom industry leading cost structure should allow for decent profitability while management untangles the sales situation.

This company will not have to grow production to grow cash flow and earnings. There is plenty of issues for management to deal with that will produce better results over time.

The current industry conditions will allow for both deleveraging as well as share repurchases when management feels comfortable initiating shareholder return policies. In the meantime, shareholders can look forward to improving results throughout the business cycle to lead to a better stock price than in the past.

Good management is often the most important asset not on the balance sheet. This management treated shareholders very well when they sold their company to EQT a while back. Shareholders can probably expect another round of “good treatment” in the future from this management. Good management tends to surprise on the upside. There are likely to be a lot of upside surprises in the future.

Be the first to comment