JasonDoiy/iStock Unreleased via Getty Images

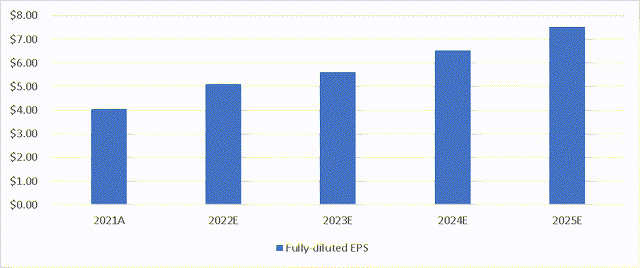

NetApp (NASDAQ:NTAP) has surprised many in recent years by capitalizing on the public cloud opportunity. From here, sustaining growth will entail additional investments but even with the margin headwinds, NTAP’s updated 2025 guidance implies an EPS of >$7/share, equivalent to an inexpensive ~10x fwd P/E multiple relative to the current market cap. This leaves ample room for a re-rating, in my view, with any positive updates on cloud ARR, revenue, and margins likely to drive upward pressure on NTAP’s multiple going forward. In the meantime, supply chain and macro headwinds present meaningful hurdles, but as conditions inevitably improve post-COVID, patient, long-term-oriented investors stand to be well-rewarded.

Source: NetApp Disclosures, Author

Transition to Public Cloud Expands the Addressable Market Opportunities

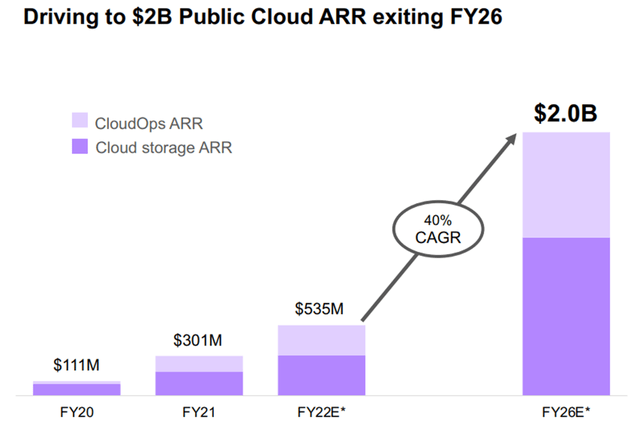

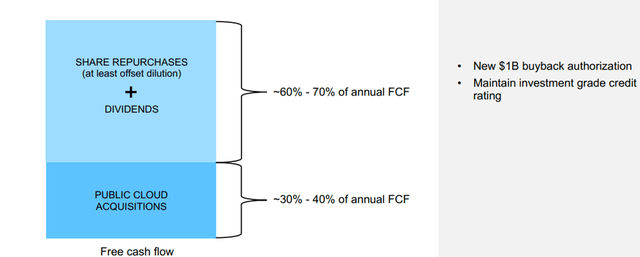

NTAP has built up a significant competitive advantage over the years – not only is it the only enterprise storage vendor offering a native multi-cloud solution, but it also differentiates by enabling on-premise and cloud data management on a single platform. The signs are positive moving forward as well – NTAP has most recently revised its Public Cloud growth target higher to ~$2b in ARR by 2026, implying a 40% CAGR (vs its previous ~$1bn 2025 guidance). Some of the delta is likely due to acquisitions but given management commentary indicating most of it will be from organic growth, it signals that NTAP’s previous acquisitions have been integrating well. The catch is that this growth could cost more than anticipated – NTAP expects to invest ~30-40% of FCF in reinvestments and strategic opportunities (i.e., M&A), with many of these investment dollars unlikely to be immediately accretive in the initial years.

Source: NetApp CFO Deck (Investor Day 2022)

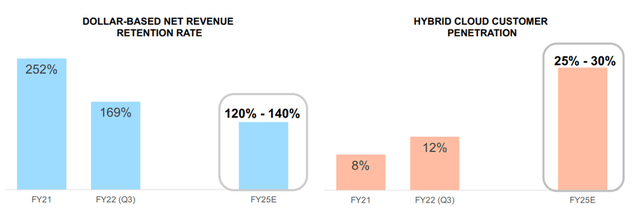

Beyond the public cloud, NTAP’s exposure to the fast-growing TAM from its Cloud Operations business ($11bn by 2025 or ~20% CAGR) also represents an attractive acquisition channel for new logos. The opportunity here isn’t only from industry growth but also cross-selling opportunities – per management, most cloud customers today are public cloud-focused, with limited overlap. For instance, only ~12% of public cloud customers currently leverage the hybrid cloud, highlighting the massive untapped cross-selling opportunity within the NTAP customer base. Plus, the guidance for customers leveraging multiple solutions (e.g., cloud and hybrid) to double to 25-30% by 2025 (vs. ~12% today) strengthens the case for accretive growth, in my view. Some skepticism on the execution is fair at this point, but NTAP’s success in sustaining a >150% dollar-based net retention is testament to its cross/upselling runway and gives me confidence in underwriting its 2025 targets.

Source: NetApp CFO Deck (Investor Day 2022)

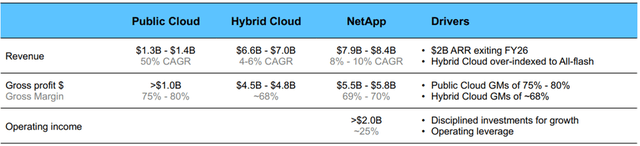

Gross Margin Expansion Path Clouded by Opex Outlook

The transition to a more public cloud heavy revenue mix at >16% in 2025 (up from ~6% in 2022) will add 2-3%pts to the overall gross margin target at 69%-70%. That said, the higher gross margin will not fully offset investments in go-to-market and cross-selling opportunities, as well as R&D capitalization from future acquisitions, so the ~25% operating margin target for 2025 implies a smaller ~1.5%pt expansion. Still, NTAP deserves a lot of credit for its pricing power – per management, it has already taken price increases in hybrid cloud in the ~10% range with limited impact on retention, so I wouldn’t discount further opex pressure being passed on to customers down the line. Given that the most recent hike took place in February, expect to see the full benefit flow through later this year. In the interim, I would keep an eye on the impact of supply constraints on the margin targets, particularly with Cisco (CSCO) penciling in long-term margin pressure at its prior investor update.

Source: NetApp CFO Deck (Investor Day 2022)

Dissecting NetApp’s Capital Allocation Opportunities

NTAP’s capital allocation strategy is to invest 30-40% of its FCF on public cloud M&A, with the remainder allocated toward shareholder return (i.e., dividends and buybacks). The consistency makes sense – focusing on deploying capital into its cloud operations business via the acquisitions of Spot and CloudCheckr has unlocked new growth avenues for the company. Additionally, the YTD stock price underperformance has made buybacks a more accretive consideration, and thus, the latest authorization of another $1bn in buybacks (~$250m deployed in Q4 2021) makes sense. Should the stock normalize higher, however, expect NTAP to return to its previously 70-75% of FCF target allocation to capital return (vs. the ~100% of FCF through dividends/buybacks in recent quarters). In the meantime, management’s aggressive commentary on share buybacks should be a positive catalyst for EPS growth going forward.

Source: NetApp CFO Deck (Investor Day 2022)

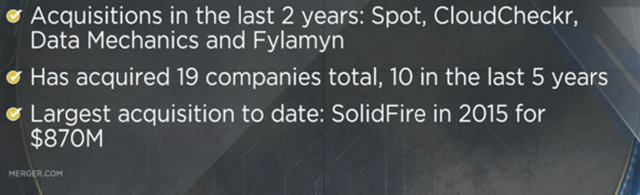

Another avenue worth considering is the potential for an NTAP buyout scenario given recent private equity activity in the cloud space (recall, NTAP’s key competitor EMC was taken out by Dell/Silver Lake) and its ~$791m net cash position. Plus, the slew of acquisitions NTAP has made (19 over the last five years) could make it an attractive addition to a strategic cloud platform going forward.

Source: CNBC TechCheck

Unlocking $7/Share of Earnings Power by 2025

All in all, NTAP’s higher revenue and gross margin outlook mark the start of a bright new chapter for the company. While the stock moved lower on news of the lower operating margin guide, the additional reinvestments (mainly SG&A) are necessary to unlock the targeted mid-term earnings power of ~$7/share in 2025. Relative to the current market cap, NTAP’s earnings power implies shares are trading at ~10x P/E on an fwd basis, as the market stays in “wait-and-see” mode despite the bright fundamental outlook as well as the added optionality from its net cash balance. Thus, I think patient investors willing to buy into the recent pullback stand to be well-rewarded.

Be the first to comment