staraldo/iStock via Getty Images

Alcoa (NYSE:AA) is an American industrials company based in Pittsburgh, Pennsylvania, and was established way back in 1888. The company as it is known now is the mining and manufacturing side of the business, while its refining and processing segment operates under the name Arconic (NYSE: ARNC). The branching of the parent company occurred back in 2016, with both sides trading publicly on the New York Stock Exchange. Alcoa’s name is derived from the phrase Aluminum Company of America, as aluminum is the primary product that it produces. Currently, Alcoa is one of the largest producers of aluminum in the world and the largest producer in the United States. Mining companies like Alcoa began to grab the headlines when supply constraints began to draw down inventories which caused a massive increase in output market values and their stock price by extension. Today, we will look at this mining stock and discuss what investors can expect going forward.

Commodity Prices Have Been a Boon

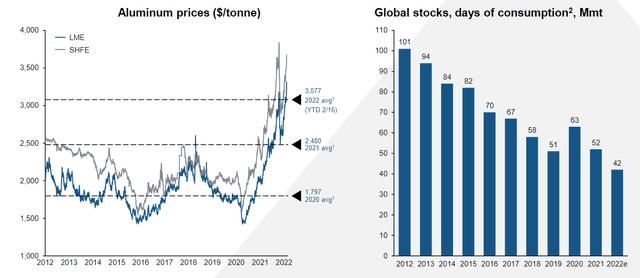

With the rise in demand for manufacturing during the COVID-19 pandemic and the difficulties involved with the logistics of global supply chains, the price of aluminum has surged.

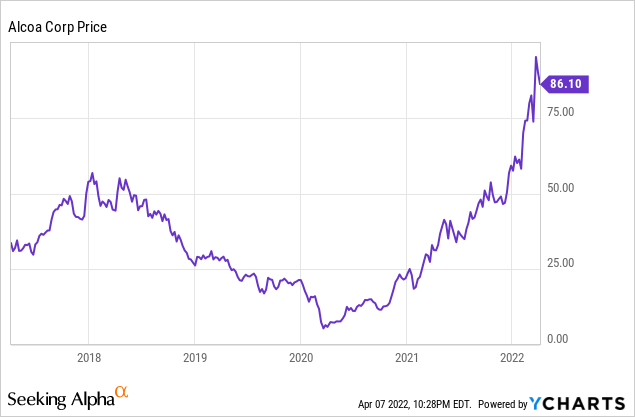

Like other commodities, the price of the metal has risen alongside the reopening of the economy, particularly with manufacturing returning to somewhat normal levels. Like lumber in early 2021, aluminum’s rally has been relentless. This has seen the metal surpass its 2008 highs and nearly triple from the lows of March 2020. Although the price has pulled back slightly, supply imbalances look set to continue to support elevated pricing. Alcoa’s shareholders reaped the benefits of the sky-high price as shares have returned more than 1500% from the pandemic lows.

Like many companies who saw a downturn during the pandemic, Alcoa recently announced that it will be initiating a new stock repurchasing program as well as re-introducing its quarterly dividend at $0.10 per share.

Outlook

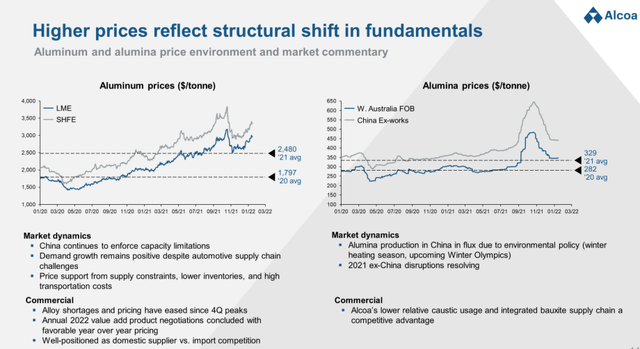

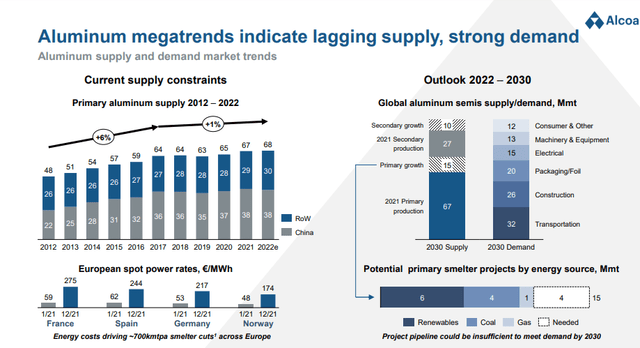

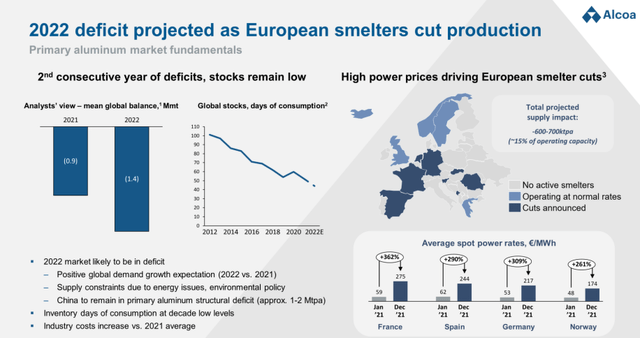

Alcoa had a blowout Q4 2021 performance. Revenue stood at $948 million, up 40% from the same period last year, with adjusted EBITDA up $168 million to $896 million sequentially and up $535 million year-over-year. These are stellar growth numbers, but this is a mining company, not a tech company. So investors have to wonder, will prices be brought down to earth anytime soon? In short, no. A fundamental shift in aluminum production has created this deficit, and it does not look as though it will resolve any time soon. It would not be prudent for investors to expect another year of unhinged bullish price action like 2021. The North American market looks set to be strong, at least through the calendar year 2022, but the European market is much more fluid.

With China looking set to maintain capacity constraints and European smelters cutting production combined with already low inventory levels, I would expect that Aluminum prices should stabilize at elevated levels for the calendar year 2022.

This includes the expectation that producers will increase their capacity to capitalize on these attractive commodity prices. In fact, Alcoa has already begun adjusting. Management is implementing a new strategic operations plan that will be working towards eliminating debt and reopening smelter locations that will nearly double both aluminum and alumina production capacity. There is also Alcoa’s new Sustana product line which is helping to deliver sustainable and low-carbon alumina and aluminum products in an effort to meet a global standard of carbon neutrality over the next two decades. It is the world’s first low-carbon alumina product line and is creating its aluminum product line from at least 50% recycled materials.

Alcoa is also the world’s second-largest miner of bauxite, a naturally occurring mineral that is the primary ore in the production of aluminum. Alcoa has full or partial ownership of seven bauxite mines worldwide and is one of the main providers of raw materials for other aluminum producers.

Valuation and Expectations

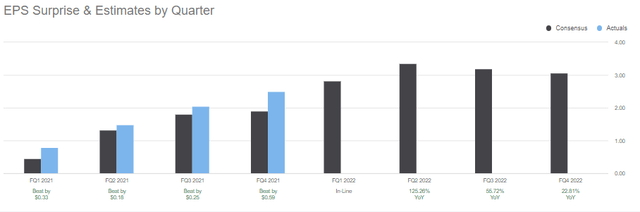

Despite the massive run-up, Alcoa’s valuation is far from being stretched. The stock currently trades at a PE ratio 11.91 of and a forward PE of 7.07. As you may have guessed, Alcoa has made a recent habit of demolishing earnings expectations, beating consensus estimates each of the last four quarters. Naturally, this is what investors want to see more of. Due to the recent performances, expectations have been adjusted, but Alcoa might keep going.

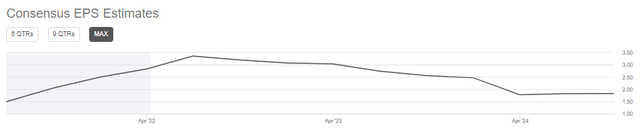

EPS estimates remain strong through the calendar year 2023, with the most notable drop-off happening in 2024. This is a welcome sight for investors as it seems like the general expectation is that the strong revenue performances will persist.

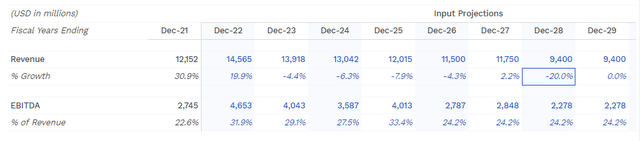

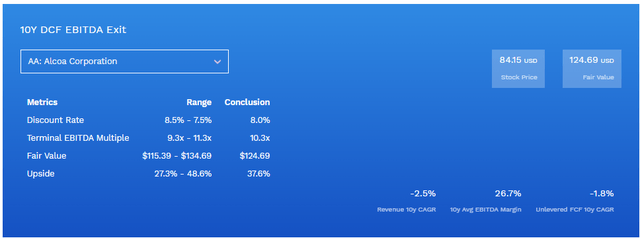

To add a bit of color to the valuation story, we will be using Finbox to calculate a fair value. The general expectation is that solid trends will continue through 2023, with a notable drop-off in 2024. By the calendar year 2025 onwards, we expect the supply shock to be fully behind us, resulting in a return to normalcy with respect to Alcoa’s revenue.

We get an implied fair value of $124.69, and when we take into account a 20% margin of safety gives us a fair value right around the $100 mark, which represents an almost 19% upside.

I encourage you to input your estimates into the model. The model can be found here.

The Takeaway

Alcoa is benefiting from some extremely favorable circumstances with respect to the global supply chain in its space. These conditions will persist at least partially throughout 2022, which is excellent news for investors. The stock has an awful lot of good news priced in, but there will likely be more upside. As a result, I rate Alcoa as a Buy with a long-term price target of $100 per share.

Be the first to comment