koto_feja/E+ via Getty Images

Beam Therapeutics (NASDAQ:BEAM) is a preclinical stage gene editing company which has a $3.7bn valuation because its founder happens to be David Liu, the same Broad Institute and Harvard biochemist who also founded Editas. I covered Beam multiple times before, here, here and here. The company is trading at 52-week lows now, so here’s another look at what’s been happening at Beam since we left off last year.

Beam has two potential assets in SCD and b-thalassemia, BEAM-101 and BEAM-102. Their difference lies in their scientific approaches. 101 is using a fetal haemoglobin activation approach, while 102 is going for direct correction of sickle-causing mutation. BEAM-101’s IND was approved in November last year.

BEAM-101 is an autologous treatment, meaning it is specific to a patient, from whom cell lines are derived. It is a haematopoietic cell therapy meant to be given just once to patients with sickle cell disease or SCD and beta-thalassemia or BT. These two diseases occur when the adult body lacks a functional hemoglobin gene caused by a single point mutation for SCD, while for BT there could be any one of a possible 200+ point mutations.

BEAM-101 works in a very interesting manner. Hemoglobin present in the fetus, called Fetal hemoglobin or HbF, persists in certain individuals throughout their lives. BEAM-101 cells have a certain gene edit done to them outside the body using a method called base editing, which is very suitable for point mutations. This makes them mimic the single nucleotide polymorphism seen in people with hereditary persistence of HbF. This is supposed to compensate for the lack of hemoglobin in SCD/BT patients. The method here is not directly editing the mutation in the gene responsible for the disease.

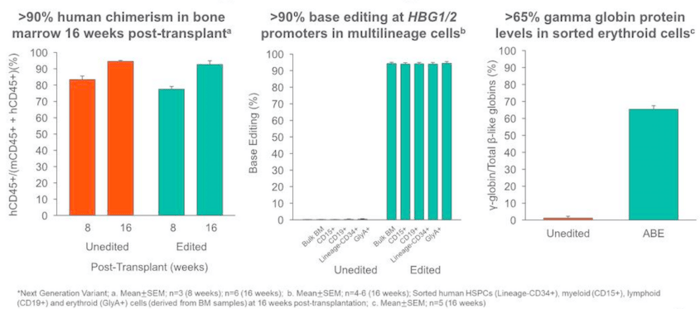

Data from a number of animal studies show that not only was base editing successful, it also showed robust HbF induction using the above method:

Beam animal studies (Beam Therapeutics presentation)

Last year, Beam went up considerably after preclinical data was presented in two abstracts at ASH. I discussed this data in detail earlier. One abstract showed that Beam manages to bypass two potential off-target effects of base editing. The other one showed that BEAM-101 and 102 were both able to achieve very high levels of allelic editing.

Since then, not a lot happened at Beam barring a few preclinical data announcements. Then in November it got its IND approved, and started plans for a phase 1/2 trial called BEACON-101 in SCD patients. Finally, in Jan this year, there was a major news in the form of Pfizer’s announced collaboration with Beam “focused on in vivo base editing programs for three targets for rare genetic diseases of the liver, muscle and central nervous system.” Beam will receive an upfront payment of $300M and is eligible for potential milestone payments of up to $1.35B, and is also eligible to receive royalties on global net sales for each licensed program. The two companies will use mRNA and lipid nanoparticles to deliver base editors to the target organs. In February last year, Beam acquired GuideTx to get access to its Lipid Nanoparticle (LNP) Screening Technology and Lipid Library. This LNP delivery will be used for in vivo base editing using mRNA based editors and guide RNAs. I liked how Beam used its high valuation at that time to buy GuideTx through an equity stake in its stock instead of paying cash outright.

Pfizer has tried to get into gene therapy for long, but has faced hurdles. According to Evaluate, two of its assets have been on clinical hold, including for one with a patient death. Ex vivo gene editing is the next logical step for Pfizer, and here Beam is one among a set of leaders. If its programs pan out well, the Pfizer deal will work out to be very useful for Beam.

According to Endpts, Beam CEO John Evans said:

[Given Pfizer’s experience with LPN through BioNTech] “They’re (Pfizer) very clear that they see the transient delivery of an editor with a permanent effect on the genome as the next logical step and were very clear that of all the options in editing, they liked base editing. So they called us and wanted to talk.”

One positive aspect of the Pfizer-Beam deal is that Beam “has an option clause to jump back in one of its candidates after Phase I/II, picking up the smaller end of a 65-35 split with Pfizer on later-stage development and marketing costs as well as profits.” This sort of agreement is done when the smaller company providing the R&D has a high level of confidence in its technology. Beam has similar clauses with other partners like Verve and Appelis. So this tells me they are not content to just get royalties, but want to get the hard work done by themselves and get a larger piece of the pie. (Source: Kyle Blankenship).

Financials

BEAM has a market cap of $3.6bn and a cash reserve of $1.2bn, which includes the $300mn Pfizer upfront. R&D expenses were $96.8 million for the fourth quarter of 2021 and $387.1 million for the full year ended December 31, 2021, while G&A expenses were $17.8 million and $57.2 million respectively. I am a little surprised by that huge, huge expense for a preclinical stage company. At that rate, they have a cash runway for 3 years; however, if that’s what they are spending on preclinical studies, I guess they will need an entire accounting company to keep track of their clinical stage spending.

Bottomline

BEAM is gearing up to become a leader in ex vivo gene editing using its base editing method. It has solid cash, and a few strong partnerships. There’s no human data yet, however the technology looks promising. The stock, too, is trading near 52-week lows. I am wondering if I should get out of my current bear-market mindset and get in on a few BEAM shares. Let me chew on that thought for a few weeks.

QAbout the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment