Mohammed Haneefa Nizamudeen/iStock via Getty Images

ImmunoGen

Know what you own, and know why you own it. – Peter Lynch

As a biotech investor, you should pay close attention to clinical data reporting. After all, a data release (i.e., binary) event can either substantially strengthen or weakened an investing thesis. Now, there are times when the data release is robust yet Wall Street expected better outcomes. In this situation, you’d see an unreasonable sell-off which created an excellent opportunity for you to build more shares.

That being said, ImmunoGen (NASDAQ:IMGN) epitomized the aforesaid phenomenon. The stock tumbled by 18.2% on the day of what is seeming strong data reporting. It appears that investors interpreted the data out of context and thereby dismissed the stock. In this research, I’ll feature a fundamental analysis of ImmunoGen and provide my expectation for this intriguing “turnaround” equity.

StockCharts

About The company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the subsequent section. Headquartered in Waltham Massachusetts, ImmunoGen dedicates its efforts to the development and launch of antibody-drug conjugate (“ADC”) to fill the unmet needs in various cancer indications.

As a leader in ADC medicine, ImmunoGen grows by out-licensing its technology to other companies. The company then uses the revenues generated to boost development in a dedicated pipeline of “smart medicine.” I noted in the prior research,

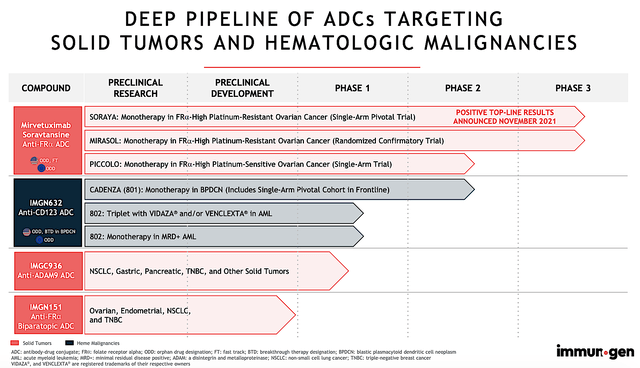

The crown jewel of this pipeline is mirvetuximab (i.e., Mirve). It’s currently being assessed (either as monotherapy or in combo with other drugs) for treating ovarian cancers. As shown below, ImmunoGen is also developing IMGN-632, IMGC-9326, and IMGN-151 for both solid tumors and blood cancers.

ImmunoGen

Robust SORAYA Trial Results

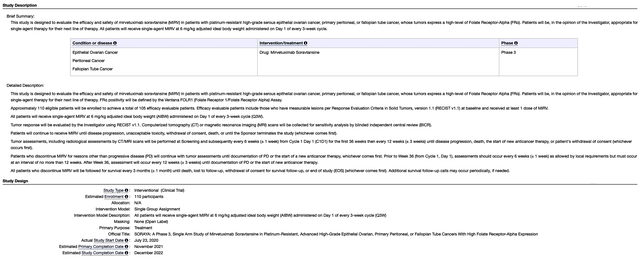

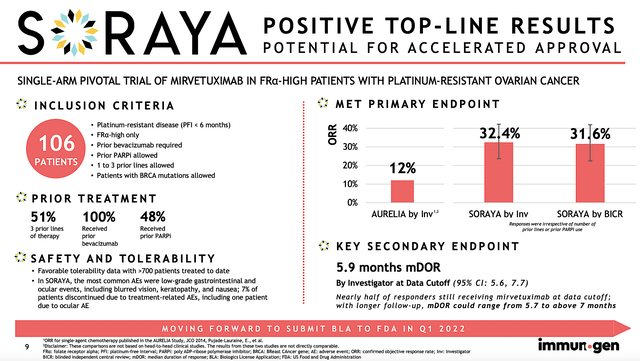

Given the importance of a data event, let us take a closer look at SORAYA outcomes. As a single-arm Phase 3 study, SORAYA assesses the safety and efficacy of Mirve in patients with high FRα expression who already went through one to three prior treatments (at least one of which is bevacizumab).

Notably, the study’s primary endpoint is the objective response rate (ORR) while the key secondary endpoints are the duration of response (i.e., DOR) and progression-free survival (i.e., PFS). Keep in mind, that you only need the clearance of the primary endpoint for approval. However, the hurdle to approval would be substantially lowered if the secondary endpoints are also achieved.

ClinicalTrials.gov

Of the 106 patients enrolled, most had at least three prior regimens. Having exhausted three prior treatments, that tells you these patients are very sick and Mire is their best hope. As you can imagine, ovarian cancer is a highly deadly cancer to which most patients would succumb to the disease. Accordingly, there was a 32.4% confirmed ORR. Of that figure, there were five complete responses. As depicted below, patients who had more prior therapies demonstrated a lower ORR which made sense. That is to say, the more prior therapies they received, the worst their condition is.

1-2 prior lines of therapy: ORR by investigator was 35.3% (95% CI: 22.4%, 49.9%).

3 prior lines of therapy: ORR by investigator was 30.2% (95% CI: 18.3%, 44.3%).

Prior PARPi exposure: ORR by investigator was 38.0% (95% CI: 24.7%, 52.8%).

Without prior PARPi exposure: ORR by investigator was 27.5% (95% CI: 15.9%, 41.7%).

SORAYA Trial results

Asides from the robust ORR, there was a 5.9 months DOR. Moreover, the PFS showed 4.3 months. Now both the DOR/PFS might not seem much. And that’s why Wall Street downgraded and thereby sparked a recent sell-off. Nevertheless, when you view the data from the appropriate disease context, patients afflicted by ovarian cancers would become treatment-resistant to nearly all medicines. In other words, ovarian cancer is extremely aggressive and lethal.

In light of the deadly nature of ovarian cancer, the 5.9 DOR and 4.3 PFS were quite meaningful. As I will show in the competitor analysis below, Mirve’s figures are quite competitive. Safety-wise, Mire was well-tolerated without any significant adverse events. Commenting on the data, the SVP and CMO (Dr. Anna Berkenblit) remarked,

We are thrilled with the SORAYA results, which are remarkably consistent with data previously generated with Mirve in a heavily-pretreated population of platinum-resistant ovarian cancer patients that included prior exposure to bevacizumab. Based on the impressive anti-tumor activity, durability of response, and safety profile observed in SORAYA, we believe Mirve has the potential to displace single-agent chemotherapy as the standard of care for FRα-high platinum-resistant ovarian cancer … we expect to submit the Biologic License Application (BLA) for Mirve this month to support potential accelerated approval in the US this year. The strength and consistency of the SORAYA data give us confidence in a positive outcome in the ongoing confirmatory MIRASOL trial, intended to support the potential full approval of Mirve, with top-line data anticipated in Q3.

Confirmatory MIRASOL Trial

As you read, ImmunoGen is poised to file a BLA this month. Based on the totality of the data, I ascribed a 65% (i.e., more than favorable) chance of approval. That is to say, the study cleared both important primary and secondary endpoints. Along with the MIRASOL trial (having anticipated results in 3Q), the FDA would likely approve Mirve sometimes in H2.

Similar to the SORAYA trial, I forecasted that MIRASOL would generate positive data results. Leveraging my integrated system of forecasting, I ascribed a 70% (i.e., strongly favorable) chance of robust data outcome. I based my forecasting on prior trial data, disease context, and over a decade of forecasting experience.

Competitor Landscape

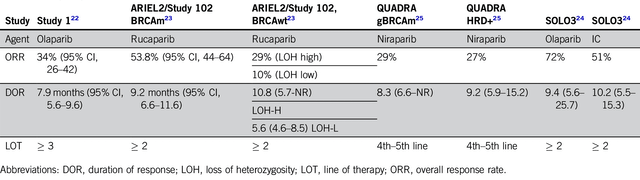

About competition, the key competitor for Mirve is chemotherapy/immunotherapy like bevacizumab and various PARP inhibitors. Among the PARP inhibitors, you have rucaparib (Rubraca) of Clovis Oncology (CLVS), olaparib (Lynparza) of AstraZeneca/Merck, and niraparib (Zejula) that GlaxoSmithKline (GSK) acquired from Tesaro (TSRO) for $5.1B.

Viewing various ORRs below, you can see that Mirve’s 32% ORR is competitive against Lynparza, Rubraca, and Zejula (which range in the 27% to 34%). Now, the weakness for Mirve is its 5.9 months DOR and 4.3 months PFS but that’s still competitive.

ASCO Pubs

Addressable Market

Each year, 21K women in the U.S. are diagnosed with ovarian cancer. About 66% (i.e., 14K) of those patients will die from the disease. After all, ovarian cancer has a very high mortality rate. Treatment is typically started with surgery and then platinum-based chemotherapy along with PARPi & and bevacizumab. As you can imagine, the cancer will progress after 6-month to render those treatments obsolete. Therefore, the demand for novel medicines is extremely strong which favors developing drugs like Mirve.

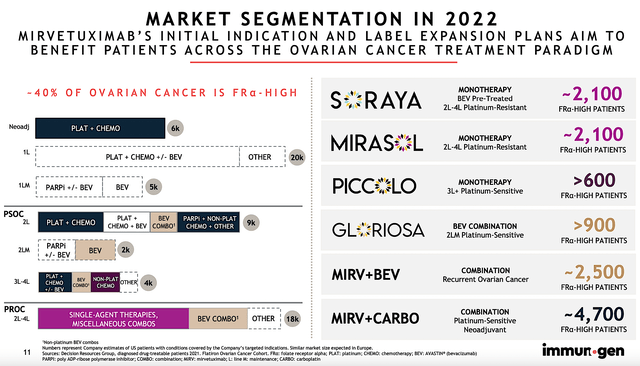

By 2028, the global ovarian cancer market is projected to reach $2.3B, as it’s powered by the 6.7% CAGR. Based on the various studies below, you can expect Mirve to capture a significant size of this market. In other words, SORAYA/MIRASOL is expected to serve 2.1K patients. Other studies (PICCOLO, GLORIOSA, Mirve+Bev, and Mirve+Carbo) will expand Mirve’s label to additionally 8.7K patients.

ImmunoGen

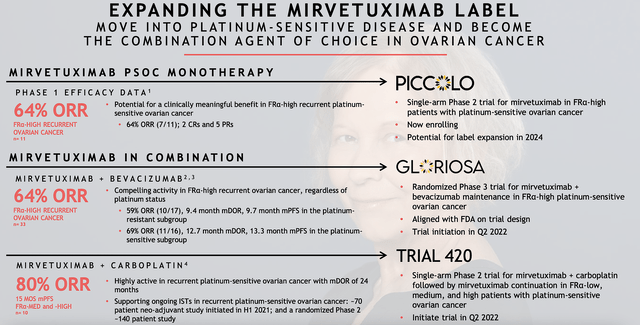

As you know, investors were disappointed with the PFS of SORAYA that was in the ballpark of competitors. Notwithstanding, the early data for other studies as shown below demonstrated extremely strong survival. For instance, the Phase 2 (Trial 420) posted 80% ORR with a median DOR of two years. Furthermore, the Phase 3 (GLORIOSA) posted the 64% ORR with the PFS of 9.7 months to 13.3 months.

ImmunoGen

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 4Q2021 earnings report for the period that ended on December 31.

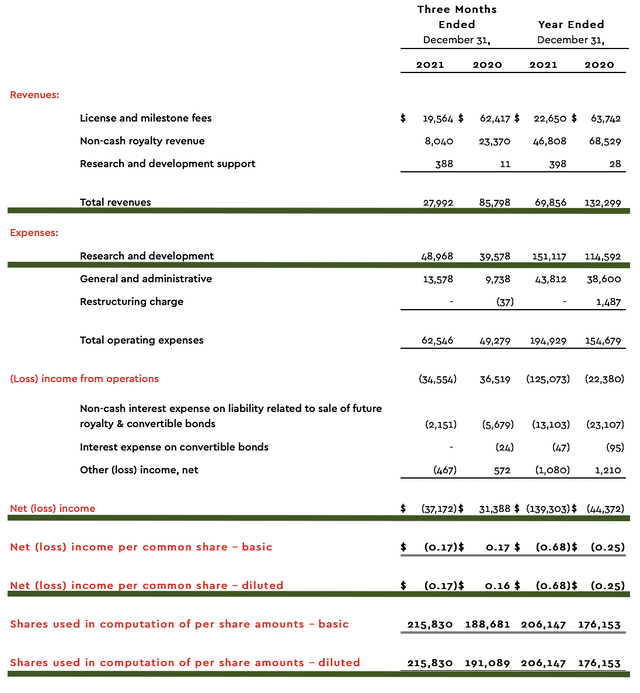

As follows, ImmunoGen procured $27.9M in revenues compared to $85.9M for the same period a year prior. The significant revenues reduction is due to recognition of upfront fees received from the prior year’s collaboration with Jazz Pharmaceuticals (JAZZ). Given that ImmunoGen has yet to launch its own medicine, it made sense for you to focus on other metrics.

On that note, the research & development (R&D) for the respective periods registered at $388K and $11K. I view the R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $37.1M ($0.17 per share) net loss compared to $31.3M ($0.16 per share) decline for the same comparison. On a per-share basis, the bottom-line remains essentially the same. And, this reflects the slight R&D increase.

ImmunoGen

About the balance sheet, there were $478.8M in cash and equivalents. Against the $62.5M quarterly OpEx, there should be adequate capital to fund operations into yearend 2023. Simply put, the cash position is robust. While on the balance sheet, you should check to see if ImmunoGen is a “serial diluter.” A company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 191.0M to 215.8M, my math reveals a 12.9% annual dilution. At this rate, ImmunoGen cleared my 30% cutoff for a profitable investment.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for ImmunoGen is whether Mirve would be approved in 2H2022.

There is also a small risk that the confirmatory MIRASOL trial won’t generate positive results. With my confidence in the positive outcomes of Mirve, I correspondingly ascribed a 30% overall risk. Even if approved, it’ll still be difficult for ImmunoGen to massively market Mirve to patients. It’s a small company going alone in the launch. That aside, ImmunoGen might grow too aggressively and thereby runs into cash flow constant.

Final Remarks

In all, I maintain our recommendation on ImmunoGen, a strong buy with a 4.8 out of 5 stars rating. Being a turnaround play, ImmunoGen is definitely not for the “faint of heart.” Nevertheless, the stock comes with a high level of rewards. That is to stay, if the turnaround is successful you’re looking at getting multiple-fold returns for your investment. Due to the negative market sentiment toward SORAYA, the stock traded down substantially far below its intrinsic value. Nevertheless, the stock price does not always correlate to its true worth in the short term.

In the long haul, ImmunoGen is a solid investment. After rigorous data analysis, I conclude that Mirve is a stellar drug that is most likely to gain approval. Other Mirve’s trials would also be highly likely to deliver excellently and even potentially far superior results. Additionally, the younger assets will come into prominence in the coming year to deliver additional value.

As usual, I’d like to remind investors that the choice to buy, sell, or hold ImmunoGen is always yours to make. In my view, you should either hold your stock “as is” or purchase more at the dips.

Be the first to comment