kmatija

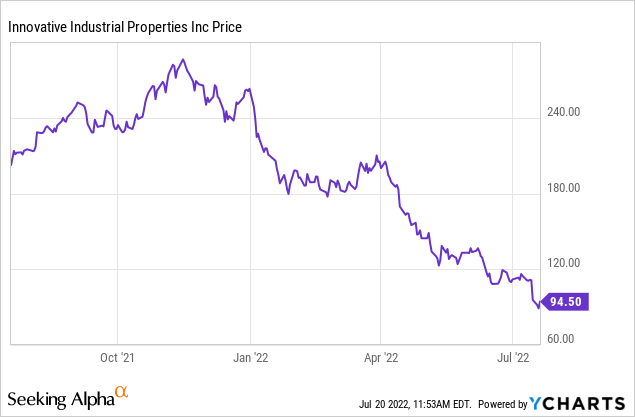

Innovative Industrial Properties (NYSE:IIPR) saw its stock drop around 15% last week, culminating a near 70% plunge from all-time highs. While the news of a tenant failing to pay rent is a clear negative, Wall Street is underestimating the long-term growth opportunity of the company, and the current valuation has already priced in the bad news and more. With the stock yielding in excess of 7%, investors are getting paid handsomely while waiting for multiple expansion. I rate the stock a strong buy.

What Happened

On the day prior to the 15% plunge last week, the company released the following press release:

“On July 13, 2022, Tenant defaulted on its obligations to pay base rent and property management fees for the month of July under each of the Leases, and defaulted on its obligations to reimburse Landlord for certain insurance premiums at the properties incurred by Landlord that are payable by Tenant as operating expenses under the Leases. Tenant’s monetary default under all of the Leases was approximately $2.2 million in the aggregate, consisting of approximately $1.8 million of base rent and property management fees for the month of July and approximately $382,000 of insurance premiums, but excluding applicable late charges and default interest.

The Company is continuing discussions with Tenant regarding the Leases, and has commenced discussions with other operators regarding potential re-leasing of certain of such properties.”

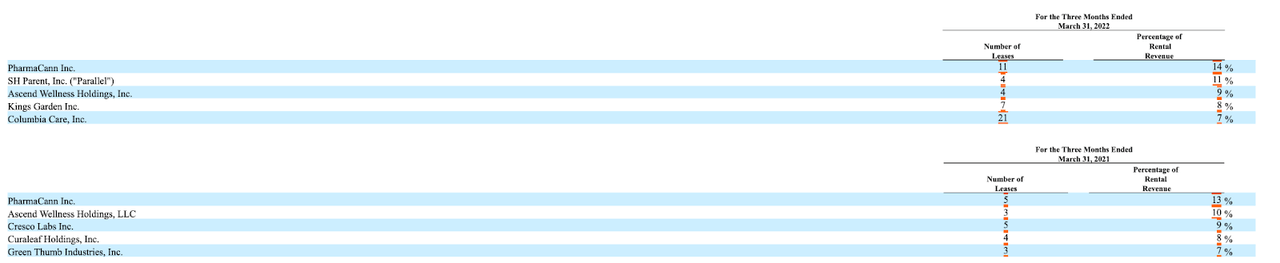

King’s Garden made up 8% of their total revenues as of the latest quarter.

2022 Q1 10-Q

Taken at face value, if 8% of total revenues were to simply disappear, then adjusted funds from operations (‘AFFO’ – the proxy for real estate earnings) would go down by around 10% to $1.84 per share. By that measurement, it would appear that the 15% plunge on Friday makes some sense. But that is not the whole picture. For starters, IIPR was already down over 60% from all-time highs heading into the end of the week:

The company has minimal debt, and even assuming a worst-case scenario could still pay its 7.3% dividend yield in full. This is a company which has ~3% annual lease escalators, meaning that assuming no external acquisitions, it could grow revenues by 3% annually by contractual commitments alone. The company’s heavy allocation to a California operator is not a positive considering the unlimited license nature of that market. But realistically speaking, the company should be able to make up for lost revenues over time through external acquisitions, as the rising interest rate environment will likely help support elevated cap rates in the cannabis real estate sector. Furthermore, remember that IIPR is a landlord – it could also simply dispose of the properties as well. Perhaps it needs to take a big haircut – but we already saw that the stock is cheap even assuming zero recovery. The stock is now trading at less than 12x AFFO – this is a stock that typically trades in the 30x-40x AFFO range. Even after assuming the worst scenario above, IIPR is trading at under 13x AFFO. Consider that non-cannabis net lease REITs like Realty Income (O) or National Retail (NNN) trade at around 15x-19x FFO. Those REITs are acquiring properties at a 6% to 7% cap rate and have annual lease escalators in the 1% to 2% range. IIPR, on the other hand, is acquiring properties at a 12% to 15% cap rate and has annual escalators around 3%. Due to the stronger growth engine, IIPR has historically traded at a huge premium to traditional NNN REITs, but the current environment is very pessimistic on growth stocks. Wall Street seems to think that Kings Garden is only the first bad tenant. Indeed, there may be other bad tenants in the portfolio, but at these valuations, the stock is still trading too cheaply here.

Closing Thoughts: The Preferred Stock

I will close out by lastly discussing the preferred stock (NYSE:IIPR.PA). It trades just around $26.05 per share and has a yield of 7.7%. Preferred stocks have a “call price” of $25 per share – IIPR’s earliest call date is October of this year. Between now and then, there is one ex-dividend date on October the 15th, meaning that shareholders will receive $0.5625 in dividends between now and the earliest call date. If IIPR decides to call the preferred stock, then preferred shareholders would lose money over the next 3 months even including the future dividend payment. It is arguably unlikely that IIPR calls this preferred stock due to its acquisition cap rates having ~15% ROI, though one shouldn’t rule out the possibility that IIPR eventually seeks to refinance the preferred stock with a lower yielding issue. Nonetheless, the risk is present, and I greatly prefer the 7.3% yielding common stock as it has far more upside. In my view, preferred stocks won’t generate satisfactory returns relative to equity unless they are purchased with leverage, and that is not a strategy that I employ. While IIPR may show above-average volatility in the near term, its long-term thesis remains intact.

Be the first to comment