Juan Jose Napuri/iStock via Getty Images

The Q1 Earnings Season for the Silver Miners Index (SIL) is just around the corner, and one of the first companies to report its preliminary results is Endeavour Silver (NYSE:EXK). Overall, the company had a solid start to 2022, with silver production up 25%, partially offset by a double-digit decline in gold production. While Endeavour Silver continues to be one of the best organic growth stories sector-wide, I don’t see anywhere near enough margin of safety at current levels. So, while a construction decision on Terronera would be bullish, I continue to favor growth stories at more reasonable prices.

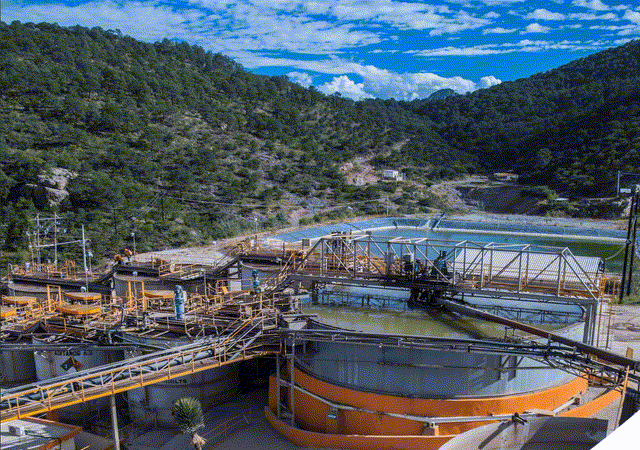

Endeavour Silver Operations (Company Presentation)

Endeavour Silver released its preliminary Q1 results this week, reporting production of ~1.31 million ounces of silver and ~8,700 ounces of gold. This translated to a 25% increase in silver production year-over-year, helped by another solid quarter from its flagship Guanacevi Mine. However, gold production was down by 22% year-over-year, partially offsetting the higher silver production. Let’s take a closer look below:

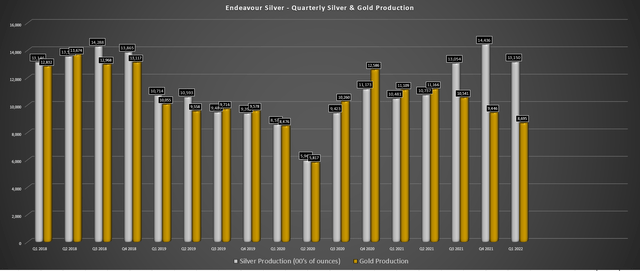

Endeavour Silver – Quarterly Silver & Gold Production (Company Filings, Author’s Chart)

As the chart above shows, Endeavour Silver (“Endeavour”) has struggled to make much progress from a production standpoint over the past few years, with the company placing two of its assets on care and maintenance: El Cubo and El Compas. However, with its Guanacevi Mine firing on all cylinders, the company has maintained a respectable production profile in Q4 and Q1 with just two assets: Bolanitos and Guanacevi. In fact, the company saw a 25% growth in silver production from two assets vs. three in the same period last year, with Guanacevi reporting higher grades and throughput year-over-year.

However, while silver production was able to beat Q1 2021 with ease, gold production did fall considerably. This was evidenced by Q1 2022 gold production of ~8,700 ounces, down from ~11,100 ounces in Q1 2021. While this might be disappointing at first glance, it’s important to note that much of this was due to El Compas being in care & maintenance. The reason is that while El Compas wasn’t a huge contributor to silver production (Q1 2021: ~23,700 ounces), it was a significant contributor to Endeavour’s relatively small gold production profile.

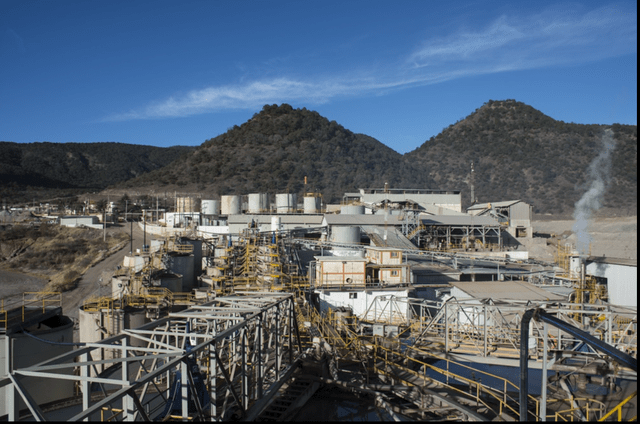

Guanacevi Operations (Company Presentation)

In fact, if we adjust for the ~2,200 ounces produced in Q1 2021 at El Compas, gold production was only down 200 ounces on a year-over-year basis, with this related to lower gold grades at Bolanitos. So, while it’s easy to be negative about the declining production, Endeavour put up a solid performance all things considered. As noted earlier, the star performer per usual was Guanacevi, which reported production of ~1.13 million ounces of silver and ~3,500 ounces of gold, up from ~918,000 ounces of silver and ~2,700 ounces of gold in Q1 2021.

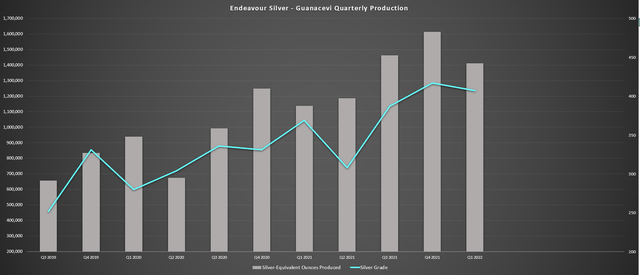

Guanacevi Mine Production (Company Filings, Author’s Chart)

As the chart above shows, silver-equivalent production at Guanacevi has been steadily increasing, helped by grades being maintained above the 300 gram per tonne mark over the past year. This is a massive improvement from FY2018 and FY2019 when silver grades came in at 222 and 234 grams per tonne, respectively. Meanwhile, gold grades have also been much higher, coming in at 1.19 grams per tonne gold. Combined with slightly higher throughput, this has picked up the slack and allowed Endeavour to maintain a solid production profile despite the loss of El Cubo.

Financial Results

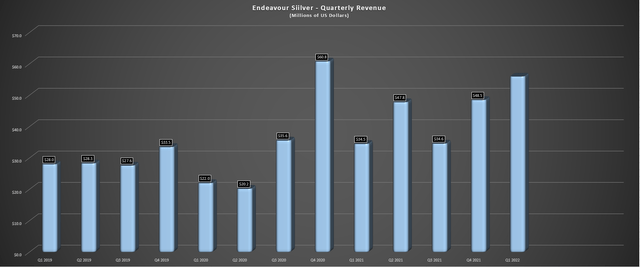

If we look at the below chart, we can see that Endeavour Silver is set up for high double-digit revenue growth in Q1 2022, based on sales of ~1.72 million ounces of silver and ~8,400 ounces of gold. This should generate well over $52 million in revenue, a meaningful improvement from $34.5 million in Q1 2021. Due to Endeavour’s strategy of withholding inventory and selling at more favorable prices, it’s tough to put too much weight into year-over-year growth on a quarterly basis vs. some peers that don’t have this strategy, given that sales can fluctuate gradually. However, even on a year-over-year basis, Endeavour should be able to post higher revenue.

Endeavour Silver – Quarterly Revenue (Company Filings, Author’s Chart)

This is based on guidance of ~4.5 million ounces of silver production and ~33,000 ounces of gold production, which is slightly above the ~3.86 million ounces of silver sold in FY2021, partially offset by sales of ~39,100 ounces of gold. However, while sales could be similar, assuming all inventory is sold, Endeavour has an extra tailwind this year, which looks to be the gold price. As shown below, while gold sales will be lower due to no contribution from El Compas (~4,300 ounces in FY2021), the gold price looks like it should come in well above the average price of $1,790/oz in FY2021.

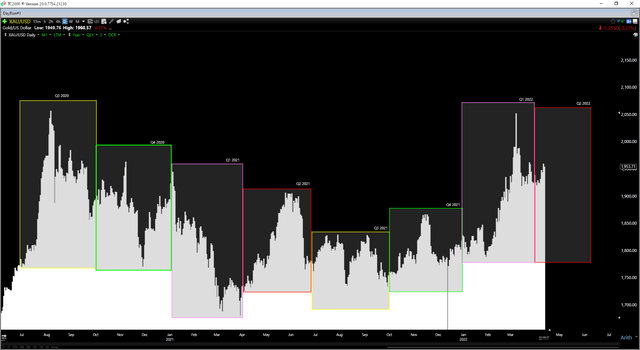

Gold Futures Price (TC2000.com)

As the chart above shows, gold has already averaged $1,920/oz for Q2 2022, and averaged a price north of $1,860/oz in Q1 2022. I do not have a crystal ball, but given the attractive position of real rates and the strong start to the year, I do not think an average gold price of $1,910/oz in FY2022 is unreasonable. Hence, Endeavour Silver should enjoy higher silver sales at similar prices, and its lower gold sales should be partially offset by higher gold prices. Therefore, the difficult year-over-year comps I was worried about (assuming gold continued to hang out below $1,825/oz) appear to be less significant.

Finally, while there was a concern that margins might be compressed in FY2021 if silver prices were flat to down given that they were expected to rise at a low single-digit rate this year, we could see less impact here as well. This is because the company should benefit from slightly higher by-product credits with the stronger gold price. So, while Endeavour Silver is certainly one of the weakest producers from a margin standpoint with AISC margins below 25% (costs: $20.50/oz vs. silver price of $25.00/oz), the higher gold price could help out a little this year, allowing the company to beat its guidance mid-point of $20.50/oz.

Valuation

Based on a current share price of $5.32 and with an updated fully diluted share count of ~187 million shares, Endeavour has a market cap of ~$995 million. This translates to a P/NAV of ~1.85x after adjusting for estimated corporate G&A of $60 million, net cash of ~$100 million, and project NPV of ~$500 million. This estimate includes Pitarilla, which I’ve valued at $100 million to be conservative. Based on this valuation of ~1.82x P/NAV, Endeavour’s valuation compares unfavorably to Hecla at ~1.65x P/NAV with better margins, safer jurisdictions, and longer mine lives.

Some investors will argue that Endeavour should trade at a premium to its peers, given that it has an enviable growth profile with a combination of higher production and drastically improved margins. This growth profile is due to Terronera, which will be one of the highest-margin silver mines globally. However, while I agree that some premium to net asset value makes sense, there are similar stories out there in safer jurisdictions at much more attractive valuations.

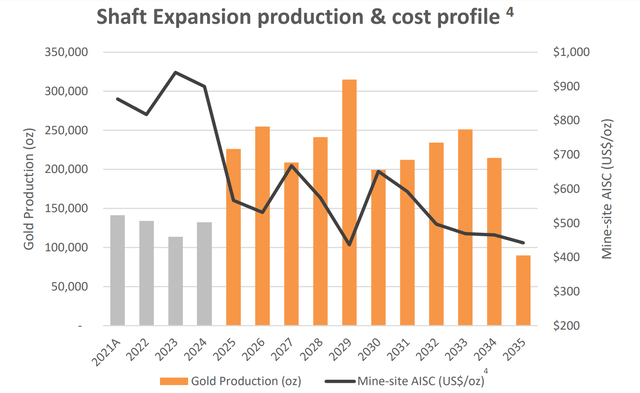

Island Gold – Phase 3 (Alamos Gold Company Presentation)

For example, Alamos Gold (AGI) broke ground for its Phase III Expansion last week, with Island Phase III plus Lynn Lake expected to help Alamos grow production by 50% over the next four years at 30% lower consolidated costs ($1,200/oz to $800/oz). However, despite this growth profile, Alamos trades at half the P/NAV multiple of Endeavour Silver, and it has a much more attractive jurisdictional profile. So, while some premium to NAV for Endeavour makes sense, I think there are more attractive ways to get growth in this sector without paying ~1.80x P/NAV.

Endeavour Silver Gold Pour (Company Presentation)

Endeavour Silver reported a solid start to the year, and while costs will remain elevated in FY2022 ($20.50/oz guidance mid-point), the company does have a path to much lower costs with Terronera. However, at the current valuation, I see some of this upside priced into the stock, and it’s still a distance away, given that Terronera will be lucky to head into commercial production by Q4 2024. Therefore, I don’t see any way to justify chasing the stock here above $5.30. In fact, if EXK were to see the stock rally above US$6.05 before July, I would view this as an opportunity to book some profits.

Be the first to comment