stockcam

Investment Thesis

We view Airbnb, Inc. (NASDAQ:ABNB) as an experience marketplace with value creation potential. We assume that the platform will continue to be technologically cutting edge, expand to other sectors such as accommodation for hybrid work, and enact barriers to entry which will allow it to be a leading application between people and hosts.

ABNB is a young growth company that is disrupting the tourism businesses. Besides traditional property listings, ABNB now offers an experience marketplace, and is also expanding in the hybrid work segment by allowing employees to book extended stays close to their place of work.

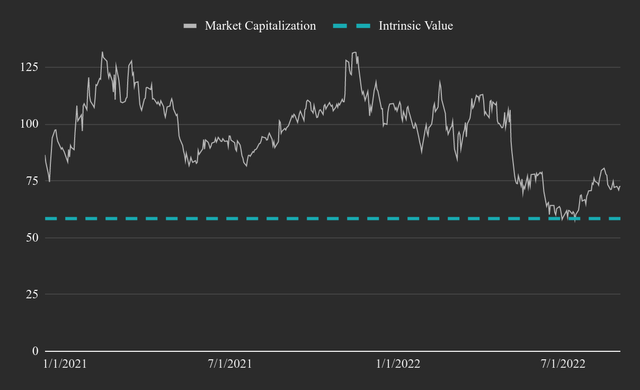

We estimate the intrinsic value of Airbnb at $58.5b or $91.4 per share. This makes for a 1-year price target $100 per share, representing a 12% downside from the September 4th price levels. In practical terms, we estimate that ABNB will be a $3.6b annual free cash flow earning company at maturity.

The intrinsic valueline of the business is presented against the market cap in the chart below:

Chart 1. Airbnb’s Historical Market Capitalization and the Current Value Line (Author image using data from FMP)

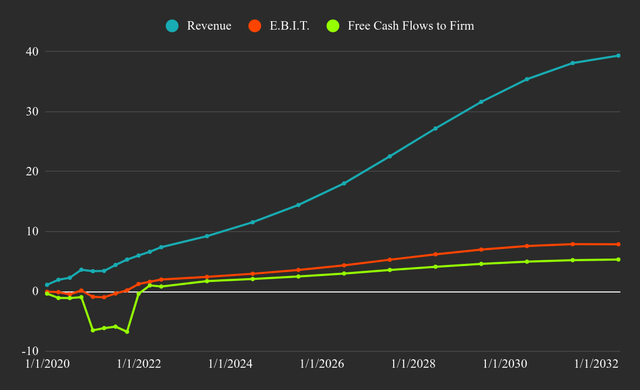

This means that ABNB will 5x revenues from 7.38 billion in the last 12 months, to $39+ billion at the end of the 10-year forecast period. After the growth period for the company stabilizes, we can expect capital returns which should start increasing the price per share while maintaining a value at maturity of around $80 billion.

Our forward estimates model for ABNB:

Chart 2. Airbnb’s Historical Fundamentals and 10-Year Estimates (Image created by author using data from FMP)

The largest valuation pressure is the current discount rate of 9.5% which currently makes this stock a hold. However, since the current price is not too far from value, we would be interested in monitoring the stock for a lower price entry around our intrinsic value. We are neutral on rates (10-year T. Bond currently at 3.26%) and refrain from assuming that the macro situation will improve or deteriorate. Instead, the bull case for our thesis is that the company will unlock additional value as they build their platform and expand to other market segments.

What is the Travel Market Worth

Revenue from the global online travel market was estimated at $433 billion in 2021, up from $396 billion in 2020. The market is forecast to grow another 60% to about $691 billion by 2026 (Statista, 1). The hotel and resort industry is currently worth around $720 billion (Statista, 2), with the recovery capacity to 2019 levels at $1.52 trillion. We seem to be in the decline phase of this market cycle, and cannot make a good prediction when a recovery will ensue. However, it is reasonable that markets will recover after some time and more people will be able to spend on leisure activities. Given both estimates, we can see that ABNB is currently competing in a $1.5+ trillion industry. However, the company is currently present in the online portion which is estimated to reach more than $700 billion at the end of our forecast period (2032).

How Much Revenue can ABNB Make

The take rate of ABNB is currently about 17%, and may increase to 20% as the company develops. Assuming a 25% market share leadership position, we can estimate the revenues of ABNB as:

Online travel market capacity * take rate at maturity * est. market share = revenues at maturity.

This translates as:

$700*0.2*0.25=$35 billion in annual revenue.

As our forecast period reaches 2032, we feel comfortable pushing the annual revenue to around $40 billion, which is what you see in our valuation model. If ABNB expands away from software, then we can increase the total addressable market value (TAM) to 1.5t+, however, that would impact margins, and the company may not approach that vertical anytime soon.

Valuation

In order to value the company, we utilize a classic discounted FCFF (free cash flows to the firm) valuation model. This requires some key assumptions about future growth, profitability and risk. We break down our valuation driver in the following sections.

Investors can also view the full excel model here, or (if you don’t have a Gmail account) the view-only version here. Feel free to copy the model and change it according to your vision of the company.

How will ABNB Grow in the Future

We estimate a slowing down of growth rates as the current economic situation indicates stagnation or contraction. Nonetheless, we have priced-in a 25% CAGR for ABNB’s revenues in the next 5 years, with a decay function converging at a 3.2% sustainable growth rate at year 10. We think that ABNB will still grow even in this environment, but will start to reach their full potential after 5 years.

Profit Margins

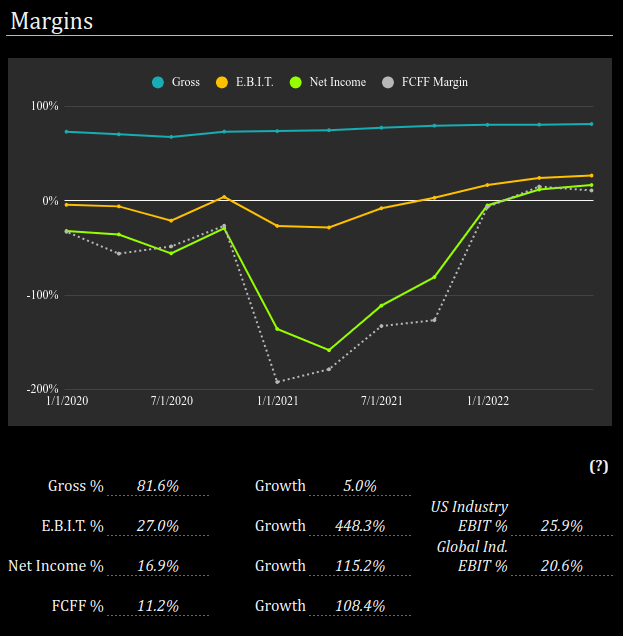

We choose to go with a lower 20% EBIT margin in our valuation model because ABNB will need to create a business mix with more than just software infrastructure, which could include future real-estate investments, equity deployment for hosts, supplementary services such as insurance and mobility, etc. If investors feel that we are too bearish on margins, assuming a 25% EBIT convergence margin instead will yield an intrinsic value of $69.4b or $108.6 per share, placing the current price around fair value.

The chart below shows the historical profitability margins for ABNB:

Chart 3. ABNB’s Profit Margins on a TTM Basis (Image created by author using data from FMP)

In a way, ABNB is a decentralized platform, which needs to efficiently manage and incentivize the development of many listings/experiences. This means that the management team will need to find solutions that make their hosts’ businesses more viable than the standardized hotel solutions.

As mentioned, we have already seen ABNB taking a step in this direction with air cover, which is an insurance scheme that aims to better the stay experience of guests in case of a bad event. Solutions like this will need to be enacted in the future and will likely push down ABNB’s margins. This will still make it a great business, but it will have to scale down on the margins in order to grow. Further, as ABNB develops in global markets, we can expect margins to shrink as the company gains less profit from hosts.

The power of ABNB as a business is in allowing the market to distribute the development of tourism activities – the company is not opinionated about what activities should be offered to tourists, but building a platform that allows the market to find buyers. This approach taps into previously undiscovered tourism activities, leading to an expansion of their business. It is fair to say that developing the business will require some patience from ABNB investors as hosts have to optimize their listings and slowly learn best practices in the business.

Risk Factors

In order to understand the young business, we must discuss some of the key risk factors associated with it. While we will go through multiple risk factors, it doesn’t mean that the company does not have the capacity to overcome them, rather, it gives our investment thesis some color and allows us to make better predictions about the future of the business.

In our valuation we have employed a discount rate of 9.5%, which aims to encapsulate the idiosyncratic risk of the business. This is the risk that investors cannot mitigate with diversifying their portfolio. The 9.5% discount rate seems high on first glance, as investors usually expect a 7% to 8% rate. However, there are numerous reasons why this rate is currently appropriate and here is a list of the quantifiable factors:

- Current risk-free rate is 3.2%

- Enterprise risk premium is at 5.7%

- Levered beta of the stock is estimated at 1.13

The ERP comes from the geo-distribution of ABNB revenues. Half of the revenue comes from the US market which has an ERP of 5.1%, but the other half is international, which leads us to a weighted average ERP of 5.7%.

The levered beta is mostly comprised of business risk, as debt accounts for only about 3% of the beta. This means that we see the business as being 10% more risky than the average stock. In our view, a 10% risk above the average is not an overreach as the company is positioned in a field where the technology is becoming consistently cheaper to develop and many competitors may try to imitate the platform or entice some of the hosts to move to their services.

In addition to this, we will elaborate on two more key risk factors that ABNB will need to overcome.

Host Leakage

Hosts will naturally gravitate to distributors with the highest reach and lowest take rate. An ABNB listing is relatively cheap to set-up and allows the host to start making some side-income. However, once a listing matures to a viable business, hosts may look for alternative distribution vendors or go independent. ABNB will be increasingly faced with the issue of listing hosts that want to avoid giving a cut to the company, which is why it must develop a mix of incentives and obligations for the hosts and ensure long-term loyalty.

We can see that the company is already experimenting with making the platform more sticky for hosts and developing barriers to entry which would be harder to build as a competitor or standalone host projects. These mostly encompass providing a superior service under the ABNB brand, the new insurance scheme, experimenting with capital funding for properties, etc.

Government Regulation

As governments navigate housing shortages, they may institute higher taxes on ABNB rentals and make the business less viable for hosts in many corners of the world. This is more likely from developed countries, which in-turn will push some of ABNB’s business to less industrialized countries and possibly more exotic locations where governments are looking for growth in their tourism industry.

A young company like ABNB is expected to have many risk factors, which is why investors need to be aware that it may take a longer time for their investment to yield returns.

Conclusion and Investment Approach

Luckily, we are in the negative sentiment phase of a market cycle, which means that if (not a small if) you are bullish on the long-term economy, now may be the time to look at investments like this more closely. As mentioned in the previous section, investors may need to have a longer time horizon e.g. 5 to 10 years, before the investment starts producing returns. We can also expect that the company will require additional funding and share dilution in order to grow – this is specifically priced-in the cost of equity (9.7%) and is expected from a company in this stage.

For these reasons, we see ABNB as a high risk investment that is trading slightly above intrinsic value, but a great business with value creating potential in the long-term.

Be the first to comment