jetcityimage

Elevator Pitch

I have a Hold investment rating assigned to 3M Company’s (NYSE:MMM) stock.

I reviewed the attractiveness of 3M Company as a potential dividend play in my previous initiation article for MMM published on August 19, 2021. Taking into account 3M Company’s stock price underperformance in recent times, my attention turns to the potential catalysts which might help to re-rate MMM’s valuations and the long-term view of the stock in this article.

3M Company remains at a Hold rating for me. MMM’s valuations are cheap and there are two upcoming catalysts for the stock that are worth watching. However, 3M Company doesn’t qualify as a good long-term investment candidate in my view, as I don’t expect a further separation of its business segments beyond the planned healthcare business spin-off.

MMM Stock Key Metrics

MMM’s key headline financial metrics were a disappointment for investors.

3M Company had a good run of top line and bottom line beats between the first quarter of 2021 and the first quarter of 2022, but the company’s financial performance in the most recent quarter was much more modest.

For the Q1 2021-Q1 2022 period, MMM achieved quarterly earnings beats between +10.9% and +20.8%. In contrast, 3M Company’s Q2 2022 non-GAAP adjusted earnings per share or EPS exceeded the sell-side’s consensus bottom line projection by just +1.7%. Also, MMM’s second-quarter revenue was just in line with the market’s consensus top line estimate of $8.7 billion. As a comparison, 3M Company’s quarterly revenue beats between Q1 2021 and Q1 2022 ranged from +0.7% to +4.9%.

To make things worse, 3M Company has lowered its guidance for full-year FY 2022 in tandem with its most recent Q2 2022 earnings release. The midpoint of MMM’s fiscal 2022 organic revenue growth guidance was cut from +3.5% previously to +2.5% now. Also, 3M Company revised its full-year non-GAAP EPS guidance from $11.00 to $10.55.

Why Did 3M Stock Drop This Year?

3M Company’s shares have done badly on both an absolute and relative basis this year. MMM’s stock price fell by -32% year-to-date in absolute terms. On a relative basis, 3M Company has underperformed the S&P 500 which is down by -18% in 2022 thus far.

There are two key reasons for the drop in 3M Company’s stock price in 2022 year-to-date.

The first key reason is that MMM’s financial performance in the near-term could be weaker than what the market is expecting, as evidenced by the company’s decision to lower its management guidance. The key headwinds for 3M Company include the strong US dollar, and the weakness for specific geographies and product segments. At the company’s Q2 2022 earnings call on July 26, 2022, 3M Company noted that “80% of our (revenue and EPS) guide down was due to FX (Foreign Exchange).” Also, the company has exposure to European markets and consumer-related products which might be hit by weak demand. As per its FY 2021 10-K filing, EMEA (Europe, Middle East, and Africa) contributed approximately 19% and 17% of MMM’s FY 2021 top line, respectively.

The second key reason is that 3M Company’s plans to deal with claims have not proceeded as well as it hoped.

MMM’s Strategy To Tackle Claims

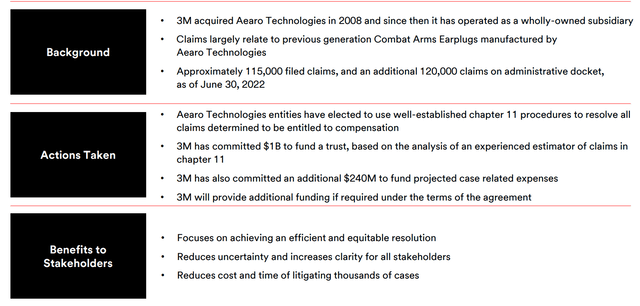

3M’s Q2 2022 Earnings Presentation

As highlighted in the chart presented above that is taken from MMM’s Q2 2022 earnings presentation, 3M Company had earlier decided on utilizing Chapter 11 as a means of dealing with claims relating to the company’s subsidiary, Aearo Technologies and the earplugs it produced.

However, 3M Company’s new approach towards tackling the issue of claims might have suffered a setback. A recent August 26, 2022 Seeking Alpha News article mentioned that “U.S. Bankruptcy Judge Jeffrey J. Graham ruled against a temporary stay of suits” against 3M Company and Aearo Technologies, and highlighted that this “disrupts 3M’s plan to settle the lawsuits with a bankruptcy filing for Aearo.”

In the subsequent section, I touch on two potential catalysts for 3M Company.

What 3M Stock Catalysts Should You Watch For?

Investors should watch out for two specific catalysts relating to MMM.

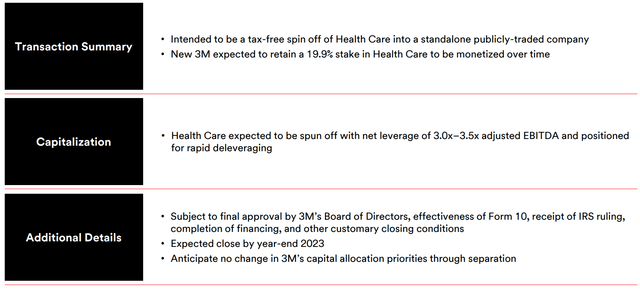

The first catalyst is the planned spinoff of 3M Company’s healthcare business.

Details Of MMM’s Planned Spinoff

3M’s Q2 2022 Earnings Presentation

3M Company is a conglomerate with multiple business, and there is naturally a sum-of-the-parts or holding company valuation discount assigned to the company’s shares. As such, the proposal to separate its healthcare business (as detailed in the chart above) will go some way towards narrowing the conglomerate discount for the company’s shares.

The second catalyst is a potential change in investors’ styles and preferences as the market environment evolves.

In the current environment where investors are worried about economic weakness, the market is shunning high-flying growth stocks in favor of stable albeit boring companies. Thanks to its scale and diversified mix of businesses across various geographies, 3M Company’s financial performance is expected to remain relatively stable even in the event of a recession. This means that there is a high possibility of more investors choosing to allocate a greater portion of their funds or capital to 3M Company in the future, which could push 3M’s shares upwards as a result of portfolio reallocation.

Looking beyond short-term catalysts, I evaluate 3M Company’s appeal as a long-term investment in the next section.

Is 3M A Good Long-Term Investment?

I am of the opinion that 3M isn’t a good long-term investment.

The key factor is that further portfolio restructuring following the planned healthcare spinoff to create further value for shareholders is less likely.

3M Company stressed at its most recent quarterly results briefing that “we really believe the three businesses that make up that New 3M company will be strong, well positioned for success in their markets.” This appears to send a signal that the other three business segments for MMM are unlikely to be separated. I think this might be because there is a certain level of vertical integration within 3M Company’s businesses, which makes a complete separation of the company’s various segments challenging.

It is understandable that most investors will seek out pure-play or single-business companies if they wish to bet on a specific investment theme. For listed conglomerates such as 3M Company, the key source of long-term value creation is really capital allocation, or more specifically the re-allocation of capital from lower-return businesses to higher-return businesses via value-accretive corporate transactions. Apart from the proposed spin-off of the healthcare business, I don’t see other substantial corporate restructuring levers for 3M Company, which dims its appeal as a long-term investment candidate.

Is MMM Stock A Buy, Sell, or Hold?

MMM stock is rated as a Hold. On the positive side of things, 3M Company is now valued by the market at a new 10-year historical trough consensus forward next twelve months’ P/E multiple of 11.5 times, and there are potential re-rating catalysts. On the negative side of things, there is limited room for substantial portfolio restructuring and capital re-allocation in the long run, making MMM a less attractive investment choice. My mixed view of MMM’s shares implies that a Hold rating is appropriate.

Be the first to comment