Drew Angerer

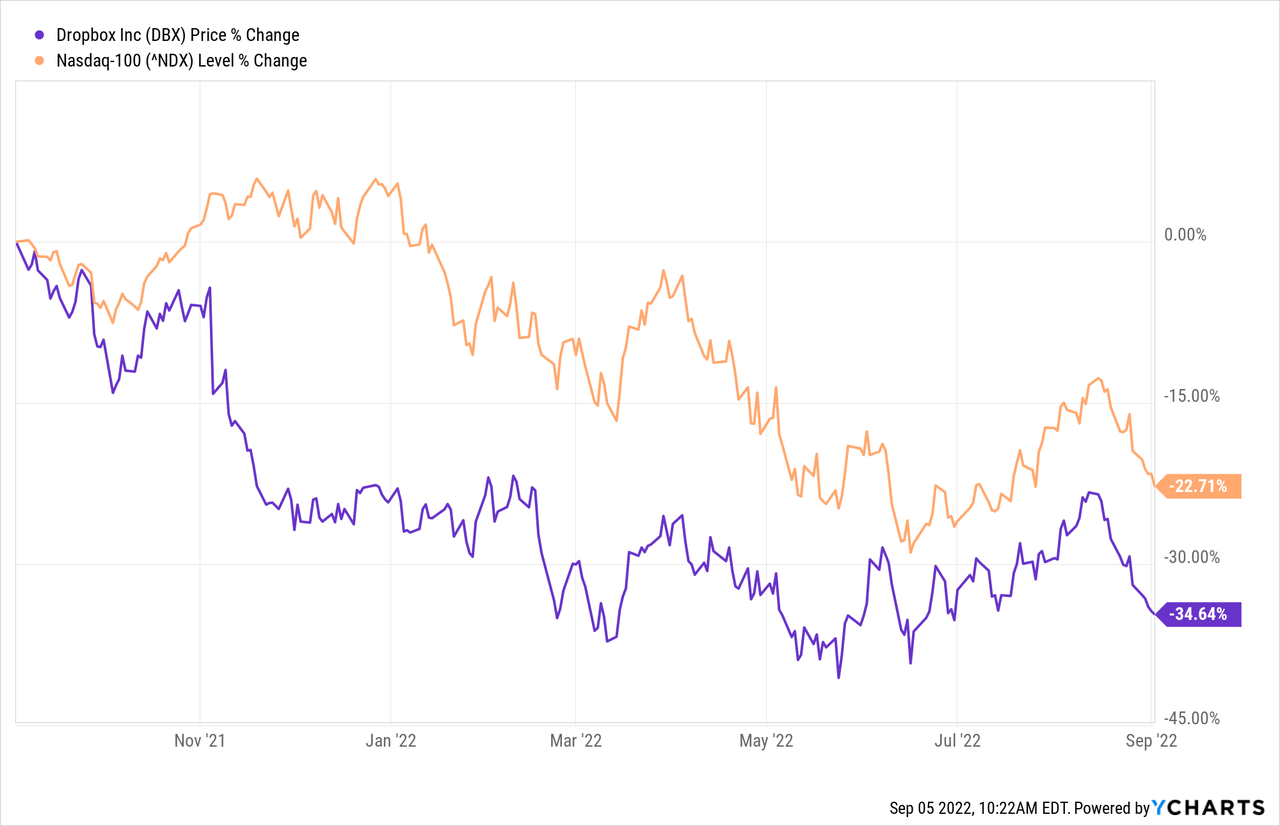

Dropbox (NASDAQ:DBX) stock has underperformed the broader tech-market over the last year, which may come as a surprise since Dropbox generates robust free cash flow, which should favor the stock in times of interest hikes and market rotation towards value stocks. However, while the advanced profitability is undoubtedly appealing, growth has slowed down significantly and is expected to decelerate even more in H2 2022. When I first initiated my a rating for Dropbox stock in September 2021, I spoke of a hybrid relationship between growth and value, which is now heavily skewed towards the value aspect of the argument.

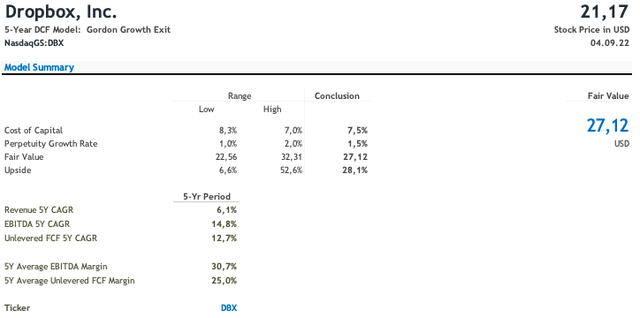

I remain bullish on the stock mainly due to Dropbox’s ability to generate free cash flow and smart value realization on the side of management in the form of share buybacks and M&A. However, I lower my rating from “strong buy” to “buy,” primarily because of weaker-than-expected revenue growth that is well below the industry average. I now expect Dropbox to be fairly valued at $27.12, with an upside of 28.1% in the base case.

On August 4th, 2022, Dropbox released quarterly results for its second quarter, which ended June 30th. Dropbox’s Q2 results were a preview of what is to come with both revenue and Free Cash Flow growth decelerating from the previous year. In summary, revenue came in at $572.7 million, an increase of 7.7% YoY compared to 13.5% growth in Q2 2021. Free Cash Flow for Q2 came in at $205.9 million, compared to $216.0 million the year before, a decrease of ~$ 10 million YoY. Standalone, these results would offer little positives for Dropbox stock. However, the results were significantly impacted by currency headwinds and lost revenue in Russia. Adjusted for these results, revenue growth would have been 8.8%. So, in conclusion, revenue is decelerating, but not as fast as suggested in the first place.

Is Dropbox a value stock?

When speaking of a value stock in this context, I refer to a stock with low-digit growth prospects but operates profitable, and its intrinsic value based on Free Cash Flow suggests that its share price is undervalued. In the past, my main value proposition for the company evolved around the thesis that Dropbox would remain at a growth rate above 10% for at least the next 2-3 years, which at the time to me appeared realistic as revenue had just grown 13.5%. I expected that growing segments like e-Signature in the form of HelloSign and document analytics with DocSend would smoothen out the expected deceleration in Dropbox’s core cloud product. It is fair to say that my expectations in this regard have been wrong. While the amount of new paying users has remained relatively stable over the observed timeframe at around 300 thousand added quarter-over-quarter, average revenue per user (ARPU) has fallen from $134.78 in Q4 2021 to $133.34, which helps explain the recent decline in revenue growth. The reasons for the decline in ARPU are probably manifold. Management mentioned in its Q2 earnings call that higher adoption of the family plan and subsequently lower margins would drive this decline. While logical and most certainly influencing the mentioned decline in ARPU, I assume that increased competitive pressure also plays a part in this, with more services being bundled and margins decreasing.

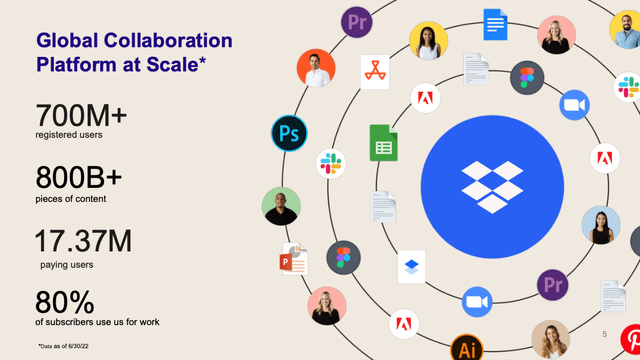

Dropbox Overview (Dropbox Investor Presentation)

Competition

The lingering threat of the three big competitors, namely Google (GOOG) (GOOGL), Microsoft (MSFT), and Apple (AAPL) itself, poses an argument against investing in Dropbox since competition poses the single biggest threat in terms of growth and survivability for the company for the next 5-10 years. While the prospects of an acquisition have emerged recently, personally, besides Adobe (ADBE) or Oracle (ORCL), I do not see a feasible acquisition case. Unlike Slack, which Salesforce (CRM) acquired in 2021, Apple, Microsoft, and Google would all make an appealing acquisition case if they had not already offered their services. Consequently, Dropbox will have to differentiate itself because, in terms of marketing budgets and the product range, they stand no chance against the likes of Microsoft. On a more positive note, they are on a decent track to achieve just that, as, despite my earlier comments on the new products not yet being able to buffer decelerating demand in the core product, HelloSign and DocSend have shown tremendous growth, as reiterated by CEO Drew Housten in the Q2 earnings call.

With all that in mind, I find the argument of competitive destruction by the big three so far unsupported in that competition has been around for five years, and Dropbox has remained among the market leaders. Further, while I expect Dropbox to lose market share in the private cloud market over the next five years, overall market growth is forecasted to grow by 17.9% p.a. As such, the percentage of the overall market may decrease relatively but grow absolutely.

Valuation

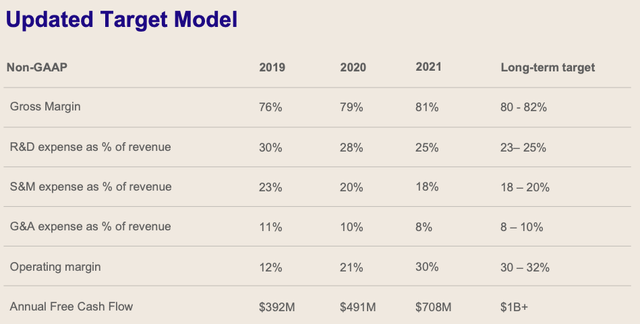

While the growth prospects appear limited, I believe the stock has been hit harder than what is justifiable, with the stock trading at a forward P/E multiple of just 13.84. In the Q2 Earnings Call, management has once more reiterated its 2024 target model of generating $1 billion in Free Cash Flow, which, based on current market capitalization, would have the stock trading at an 8x Cash Flow multiple. For reference, the average Free Cash Flow multiple for software companies is 25x, and Microsoft trades at 75x its Free Cash Flow.

For my valuation, I have been relatively conservative in my calculation of the cost of capital at 7.5%, primarily due to a higher risk-free rate and an increased risk premium based on the abovementioned risks. In terms of revenue, I have Dropbox growing at 6.1% p.a. and maintaining an operating margin of 30-32% over the duration, reaching 31.5% for the terminal value calculation. My estimate of 1.5% for the perpetuity growth rate in the base case stems from the assumption that after 2026 growth will slow even further. As such, a lower-than-usual perpetuity growth rate of 1.5% is, in my opinion, justified.

Based on these assumptions, I get a fair value of $27.12 and an upside of 28.1% in the base case, with the fair value range between $22.56 and $32.31, respectively, for the low-end and the high-end of the spectrum.

Dropbox DCF Model (Author Source)

Risks

The main risk for Dropbox is the competitive environment surrounding the business. This topic was briefly discussed already, but in this section, I want to bring it up again to elaborate on the implications if Dropbox cannot compete effectively. If Dropbox cannot compete effectively, this would severely affect the company’s value, resulting in an even faster revenue decline. However, with relatively high lock-in costs, an immediate revenue plunge seems very unlikely. Also, as outlined above, Dropbox has competed effectively over the last couple of years, and there are no signs of that changing soon. Another risk that emerges as a result of the competitive environment in which Dropbox operates is the potential of a pricing war, which would seriously decrease the prospects of Dropbox’s profitability. Although there is some potential for increasing pricing competition, I do not see this aspect as challenging Dropbox’s ability to operate in the long term. My input figures for 2025 and beyond rest on the assumption that products like HelloSign and DocSend continue to grow and steady revenue growth at approximately 6%. Thus far, both products have surpassed expectations. However, for my valuation to come to fruition, product offerings like HelloSign would have to grow continuously and, even more essential, bring in money over the long term. Failure to do so would significantly impact my input numbers from 2025 and, as such, the terminal value, which makes up ~75% of today’s fair value.

Conclusion

At the current valuation, trading at an absurd forward P/E of just 13.84, Dropbox stock makes a compelling value play. However, the valuation brought forward significantly relies on the company’s ability to maintain revenue growth at 6-7% p.a. for at least the next five years and continuous margin improvement, which remains to be seen. Therefore, any potential or existing investor should closely monitor these growth trends.

Be the first to comment