Duncan_Andison/iStock via Getty Images

Company Snapshot

Clover Health Investments, Corp. (NASDAQ:CLOV) is a relatively new healthcare technology company (founded in 2014) with a particular focus on offering Medicare Advantage Plans for senior citizens in America (currently available in 209 counties across 9 American states).

CLOV reports under two divisions- a) Insurance and b) Non-insurance. Through its insurance segment, it offers Medicare-eligible US senior citizens with Preferred Provider Organization (PPO) and Health Maintenance Organization (HMO) plans. The non-insurance segment is a more recent establishment (started in April 2021), where CLOV provides its proprietary software as a fee-for-service offering via the Centers for Medicare & Medicaid Services’ (CMS) Direct Contracting model. These services are presently offered in 8 states across the US.

Currently, whilst the company is seeking to gain an edge in the Medicare Advantage space, it also has long-term ambitions to cover other areas of Medicare, and eventually also transition to Medicaid and commercial insurance.

Clover Health – What’s To Like?

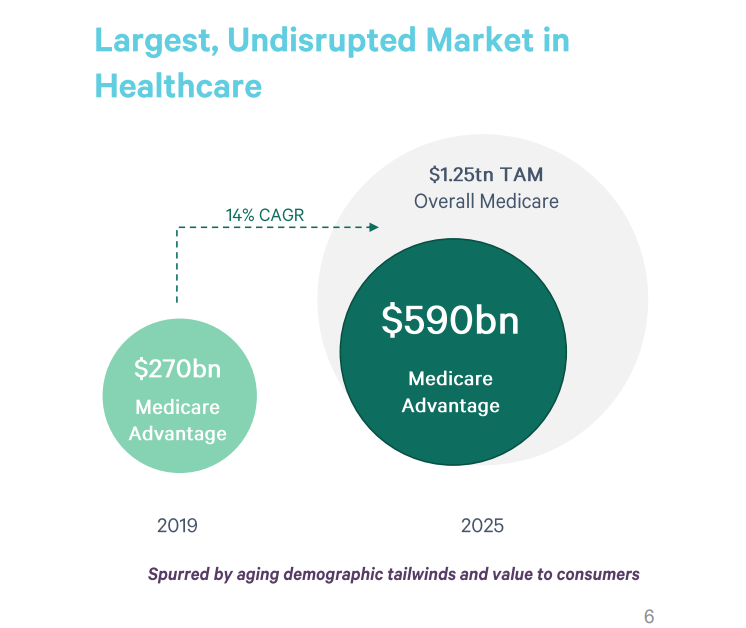

Firstly, the opportunity staring at CLOV, and other incumbents in the broad Medicare universe is huge, as the country is aging at a very rapid pace; over the next four decades, the number of Americans aged 65 and over, will almost double to 95 million, even as their share in the total population hits 23% from current levels of over 16%! Besides, over the medium term, within the broad Medicare universe (potentially a $1.25trillion market by 2025), the Medicare Advantage segment is expected to witness much faster growth of 14% CAGR (between 2019-2025) hitting $590bn in total expenditure, even as the Original Medicare segment grows at a much slower pace of only 4% CAGR.

Clover Deep Dive Presentation

Being part of an attractive market of this sort isn’t enough, as your offering needs to have a niche or an edge relative to its peers.

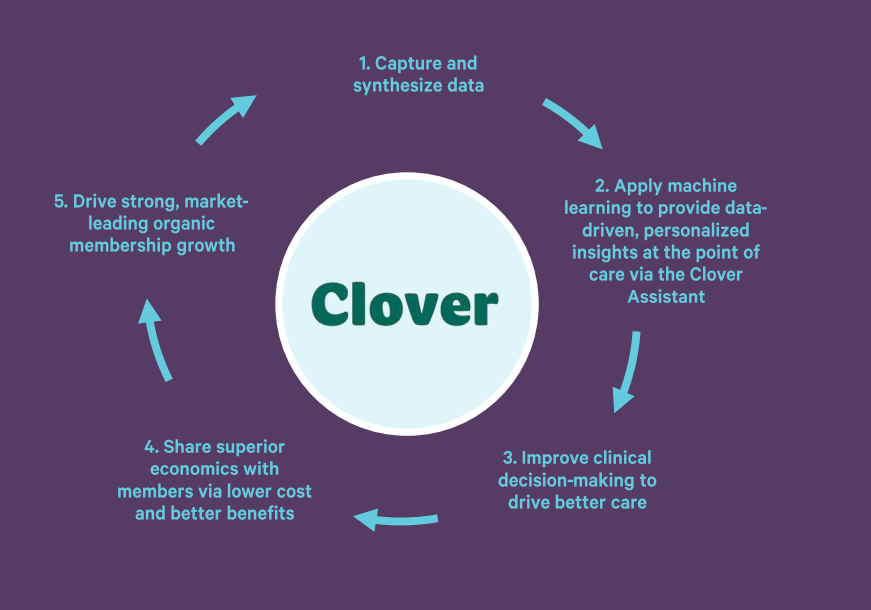

Well, at the heart of the Clover story is this proprietary software called ‘Clover Assistant’ that helps physicians decode and treat patients better. Health insurance providers are innately set up to procure dollops of data via different avenues, but rather than using the data to, say, enhancing the billing function, or the customer service function, Clover directs this towards empowering physicians. So far, the data-driven ‘Clover Assistant’ has enabled physicians to identify even more new conditions per member, per year, and make more accurate diagnoses of health conditions. Physicians then come back and add their two cents, which only enhances the product even more.

The underlying goal of Clover is to engender a more preemptive process in the health ecosystem where you can get ahead of the problem before it snowballs into a terrain where the total cost of care becomes overly prohibitive. According to the company, MA members who were diagnosed by Clover-assisted physicians had MCRs (total medical claims as a function of premiums earned) that were 10% lower than non-clover-assisted physicians.

Clover Deep Dive Presentation

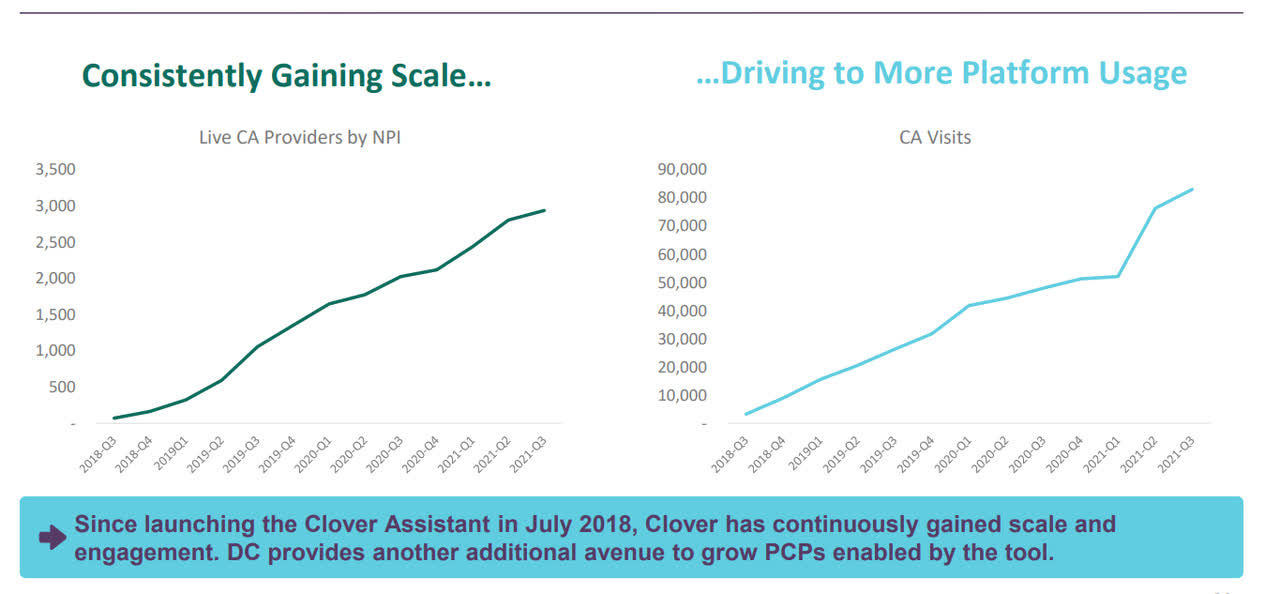

On paper, with economic value of this sort, you can see why a platform like this could gain strong traction. As things stand, the % of MA members that see Clover Assisted physicians is less than 50%, but the company’s long-term goal is to get this to 70%.

Nov 2021 Investor Presentation

Over time, there’s also potential for this to become more mainstream and be leveraged and monetized as SaaS opportunities with other external entities.

I also think that structurally, Clover is also well-positioned to build scale and bring through stronger operating leverage over time as this is principally a technology-driven healthcare model, quite unlike the traditional brick-and-mortar models of other peers.

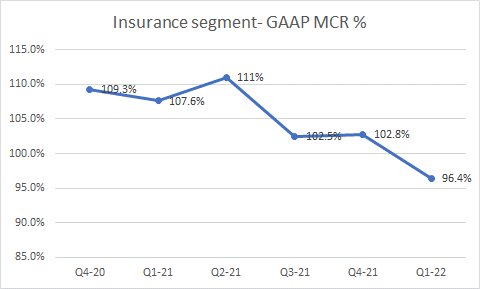

I’m also quite enthused to discover that some recent operating metrics have been trending rather well. Take for instance the insurance segment’s GAAP MCR. Admittedly by general insurance standards, this number is quite high, but notice how it has been trending lower sequentially with the most recent Q1 number coming in sharply lower by 640bps.

Earnings transcripts

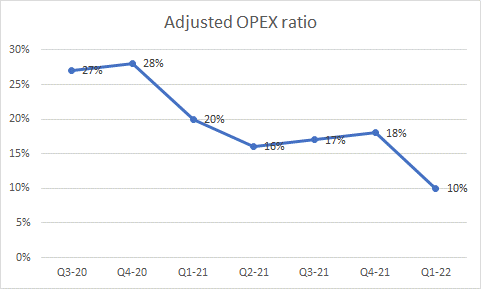

Clover is also doing very well to limit its adjusted operating expenses (excluding stock-based compensation) as a function of revenue. Despite facing front-loaded broker commission payments of $10m in Q1, they were able to limit that figure to $84m, which represented only 10% of total revenue. The good thing is that these expenses are unlikely to be repeated in Q2 and Q3.

Earnings transcripts

Clover has also been beefing up its C-suite exec team this year, which should help bring more credibility to this story. They recently hired the ex-CFO of Sortera Health-Scott Leffler to become their new CFO. Leffler was instrumental in leading Sortera through its IPO and getting it to the $1bn sales landmark.

The tech side of Clover too has gotten a lot stronger with the co-founder and President – Andrew Toy, also now getting a CTO under him – Conrad Wai. Wai has solid product development leadership experience at Google and Yahoo, and was most recently involved with Hinge Health.

Crucially, Clover has also appointed Aric Sharp as Head of Value-based care for Clover. Sharp has a competent track record in healthcare transformation projects (notably at Integris Health) and is also the Chair-elect of the American Medical Group Association; I’d imagine he would play a key role in driving deeper ‘Clover Assistant’ adoption amongst physician networks across the country; this could also provide the non-insurance segment with a useful fillip.

What Are Some Of The Risks Associated With The Clover Story?

Even though CLOV has long-term ambitions to gain wider adoption across the US, it still has a long way to go; as things stand, whilst it offers its services across 9 states, CLOV remains heavily exposed to the State of New Jersey; just for some perspective, at the end of last year, over 90% of its Medicare Advantage members came from this state, whilst 34% of its DCE beneficiaries were aligned to providers based in this state alone.

Whilst it is commendable from a socialistic perspective, note that Clover also tends to be more forthcoming towards the underserved and low-income sections of the populace, which have been traditionally neglected by the more established peers due to underwriting concerns. (Clover believes that its focus on successful patient outcomes over financial risk, will pay off in the long term).

In addition to that, Clover also incentivizes physicians who use ‘Clover Assistant’ at approximately twice the average Medicare reimbursement fee rate (for primary visits). I wouldn’t want to cast aspersions here, as I’m not a stakeholder in this ecosystem, but if this fee were to be curtailed and brought in line with the industry average, would the adoption rate of the software still be as strong as it is now? I’m sure if you were to ask Clover they’d answer in the affirmative, but you’d have to run an independent physician group survey to get an honest answer to that question.

Clover also hasn’t made money so far, and Seeking Alpha estimates suggest that it will continue to bleed for the next three years, with an expected negative EPS figure of -0.4 in FY24.

For now (the next 12 months), Clover appears to have adequate liquid assets of $563m ($274m of cash, $212 of short-term investments, and $77m of AFS securities) to support its growth ambitions. But, for a young company at this stage of its lifecycle, it is inevitable that dilution risk will likely be a recurring facet that shareholders of CLOV will have to contend with.

Closing Thoughts – Is CLOV Stock A Buy, Sell, or Hold?

As covered in the previous section, the Clover Health story is not without its flaws, but at this price point, I don’t believe you can dismiss it, particularly considering the valuations and the growth potential on offer.

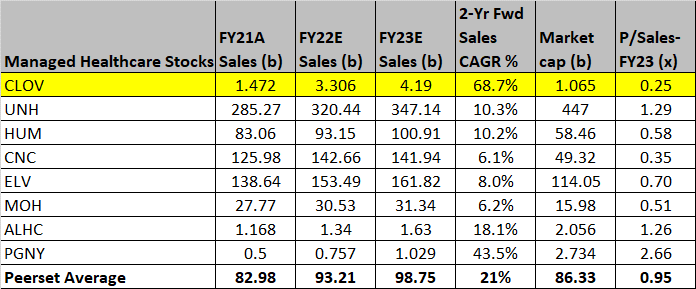

To make my case, I’ve compared CLOV to 8 other managed healthcare peers of different sizes. According to consensus estimates, over the next two years, CLOV is poised to deliver the strongest revenue growth numbers which will likely be more than 3x the peer set average; yet still, the company only trades at a market cap of a little over $1bn, implying a lowly price to sales (based on FY23 numbers) of just 0.25x; this is almost 4x lower than the peerset average of 0.95x.

YCharts, Seeking Alpha

The price action on the technical charts too offers some encouraging signs, as it appears that the stock “may” have formed a bottom. Firstly, note that compared to the start of the year, the range of the stock has collapsed, even as the 14-day- ATR indicator has collapsed over time. At the start of the year, the intraday range was around 0.35c, now it is at almost half those levels. It doesn’t always play out that way, but volatility contraction of this sort typically precedes one-way moves in the stock. Given that we’ve witnessed a triple bottom pattern play out at the $1.95-2 levels, the probability would likely tilt to an up-trending move, potentially to the upper boundary of the wedge pattern at around the $3.3 levels.

Heightened bearish sentiment too appears to have dimmed; a year ago, the percent of shares outstanding that were short was above 10%; now it is closer to 6%. Besides, the CLOV stock’s entry into the Russell 3000 index a couple of days back could also titillate the institutional investor community that constructs various products and funds based on that index.

Investing

To conclude, the CLOV stock can be pursued by investors with aggressive risk appetite.

Be the first to comment