AJ_Watt

REITs continue to be a favourite exposure of ours in the current environment, and the iShares Core U.S. REIT ETF (NYSEARCA:USRT) fits the bill reasonably well with specialty exposures. Statistically, REITs perform well in turbulent markets, and lease terms are going to be able to outpace inflation and interest rates over the longer term. However, we note a couple of risks in self-storage, and update our view on rates given recent jobs and CPI data in the US, which although strong, indicate rates will have to be hiked a good deal higher to stop propagating inflation. Rates are stinging these property values now, although the rents are still very strong and capable of growing. Overall, while the yield is a little thin at 2.5%, we continue to look quite favourably on REITs.

Update on Economic View

The new results show some pretty interesting dynamics. Rates have grown as everyone knows, and so has unemployment finally after remaining at very low levels for a month after the initial dramatic 75 bps hike. The issue is that unemployment isn’t growing because people are losing jobs. Jobs continue to be added at rates ahead of expectations. Unemployment is rising because more people are joining the search for jobs from the pool of unmeasured, discouraged, or perhaps indolent, unemployed people who’ve been enjoying stimulus money and taking an extended vacation after recent resignation waves. And with the return of Phillips Curve logic, the core inflation still inches upward, with headline figures only coming off highs due to depreciation in energy prices. Ultimately, this means rates are going to have to keep increasing a while in our opinion. While the return of some workers to the workforce will do something to push productive capacity, which hopefully helps inflation a bit, it’s still too high where continued rate hikes will be needed.

REITs

REITs have lease terms with build in step-ups annually so that long-term leases aren’t subject to too much duration risk. With rising inflation and rates, this is important, and protects the economic value of REIT cash flows. Still, on the financing side the markets are less buoyant, and we are seeing declines in real estate values even for specialty real estate like self-storage and warehouses. Warehouses are especially surprising because logistic constraints have been a pervasive market theme, but financing conditions matter for markets where leverage is an important return lever for investors.

We also have additional concerns on the demand-side for self-storage REITs. While not a dramatic effect, we fear that there has been some pull-forward demand that is going to be digested soon as a result of COVID-19 and internal migration with work from home. With a lot of moving, and also a pull-forward in mortality due to COVID-19 accelerating death among the elderly, self-storage has been in demand, but we believe that self-storage businesses may observe that these impulses to demand are going to be a bit temporary, as other industries have experienced.

USRT Breakdown

How does this effect USRT? About 10% of the portfolio is exposed to self-storage REITs. This is not an irrelevant allocation, but of course it is not too dire from a cash flow perspective. But with an earnings yield at only slightly higher than 5% and a yield at 2.5% there isn’t too much margin for safety.

Besides that, exposures look reasonably good.

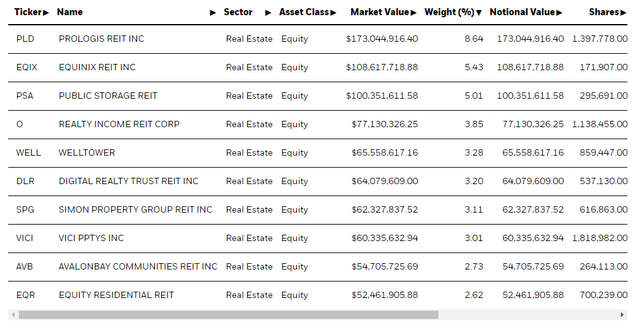

Holdings (iShares.com)

Prologis (PLD) is at the head of the holdings list with a 9% allocation, and this covers some of the warehouse exposure that we mentioned. Below that is Equinix (EQIX) at 5.4%. We like Equinix because of demand side economics, but it does benefit from having as easy access to financing as possible to accelerate its value proposition on the demand-side. That of course is being affected by the higher rate environment. Otherwise we see some staffed care exposures, that are overall pretty good, although COVID-19 was and probably will continue to be an intermittent problem for how those facilities run and for their utilisation. This risk should not be ignored, and staffed care facilities account for about 5% of the portfolio. We see self-storage REITs, and of course some multi-family REITs as well. Multi-family is a highly resilient category, and with work-from home persisting in some capacity, benefits secularly from a shift of workspace needs from the office to the home environment. There is even a 3% exposure to regional gaming REITs, and advantaged category, even with mobility and COVID-19 risks still swirling around.

Conclusions

Statistically, REITs perform well both in market downturns and in their recovery, and specialty REITs have additional reasons to stay resilient. USRT covers good markets, and is a diversified portfolio that contains a lot of stable exposures like multi-family. It also has more iffy stuff. We think self-storage could disappoint a little, and staffed care isn’t the most ideal, despite demographic appeal of an ageing population. So when you see a yield at 2.5% for USRT you wonder if you might do better elsewhere. In the end, we think that investors can opt for specific REITs just as well as for REIT ETFs. REITs are already portfolios and are well diversified. Also investors can investigate the debt situation better, and aim for smaller debt loads if solvency or rate hikes concern them a lot on the income side. On a portfolio basis you diversify this away, but there are no ETF level statistics that show you a blended leverage across the portfolio, which would be useful. We will pass on USRT, but remain optimistic about REITs in general.

Be the first to comment