imaginima

DMC Global (NASDAQ:BOOM) just released strong Q2 earnings last Friday, and I recommend readers hold the stock given the favorable macro environment.

US oil rig count is still ~40% lower than pre-pandemic levels, although the oil price is at record high and the US recently became an oil net exporter. DMC’s DynaEnergetic has 20% market share as a perforating system manufacturer, whose product is necessary for oil drilling projects. Its exceptionally strong Q2 earnings supports the statements above. DMC also owns Arcadia and Nobleclad, both of which are solid market leaders and are very unlikely to interrupt the oil call option.

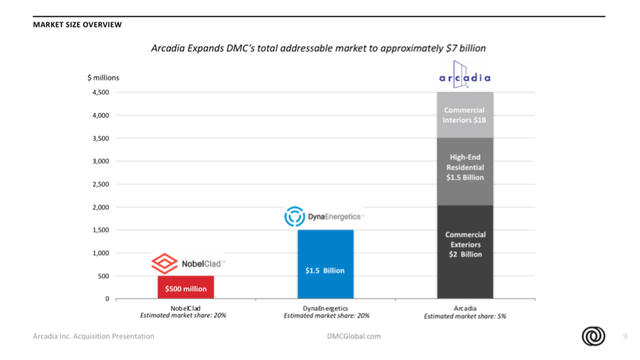

I believe DMC Global has decent upside (170% in bull case) due to a large exposure to oil, solid market share, diversified operation, and a current acquisition (Arcadia) that can support future earnings. The chart below shows DMC Global’s segments and their respective market share/TAM.

Market share of DMC Global’s subsidiaries (Investor presentation)

DynaEnergetic

DynaEnergetic designs, manufactures, markets and sells perforating systems and associated hardware for the global oil and gas industry. According to 2021 10k, “a perforating system, which contains a series of specialized explosive shaped charges, is used to punch holes through the casing and cement liner of the well and into the geologic formation surrounding the well bore.” Perforating guns and charges are necessary for well drilling projects. DynaEnergetic has ~20% of market share of its ~$1.5 billion TAM, per investor presentation. It accounts for 78% of DMC’s net sales.

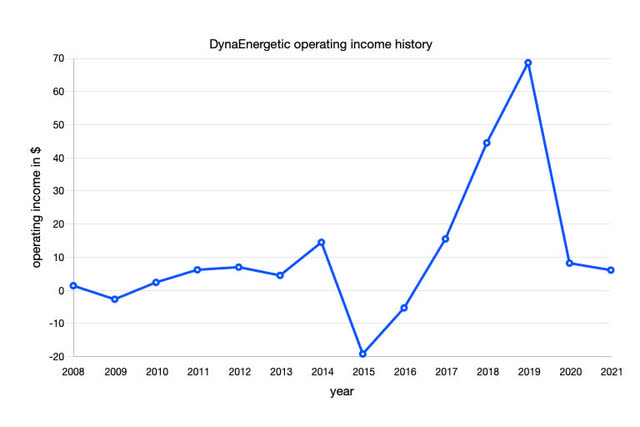

DynaEnergetic was acquired in November 2007 for $~96 million (per 8k). Its segment operating income (chart below) grew from $1.4 million in 2008 to $14.5 million in 2014, then plunged to ($19.2 million) due to oil crash (oil at $40s), and then surged to $69 million in 2019 before dropping to ~ $6 million in 2021 due to pandemic.

DynaEnergetic operating income history (10k archives)

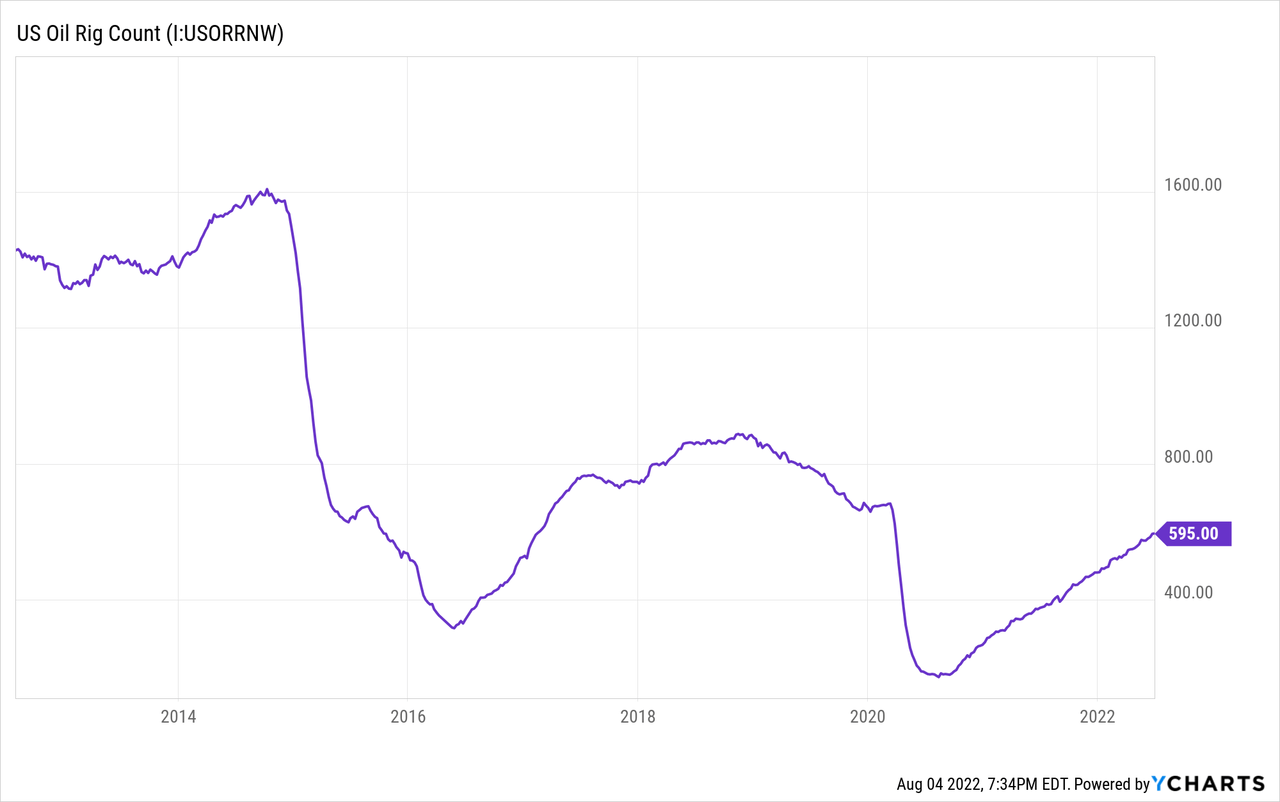

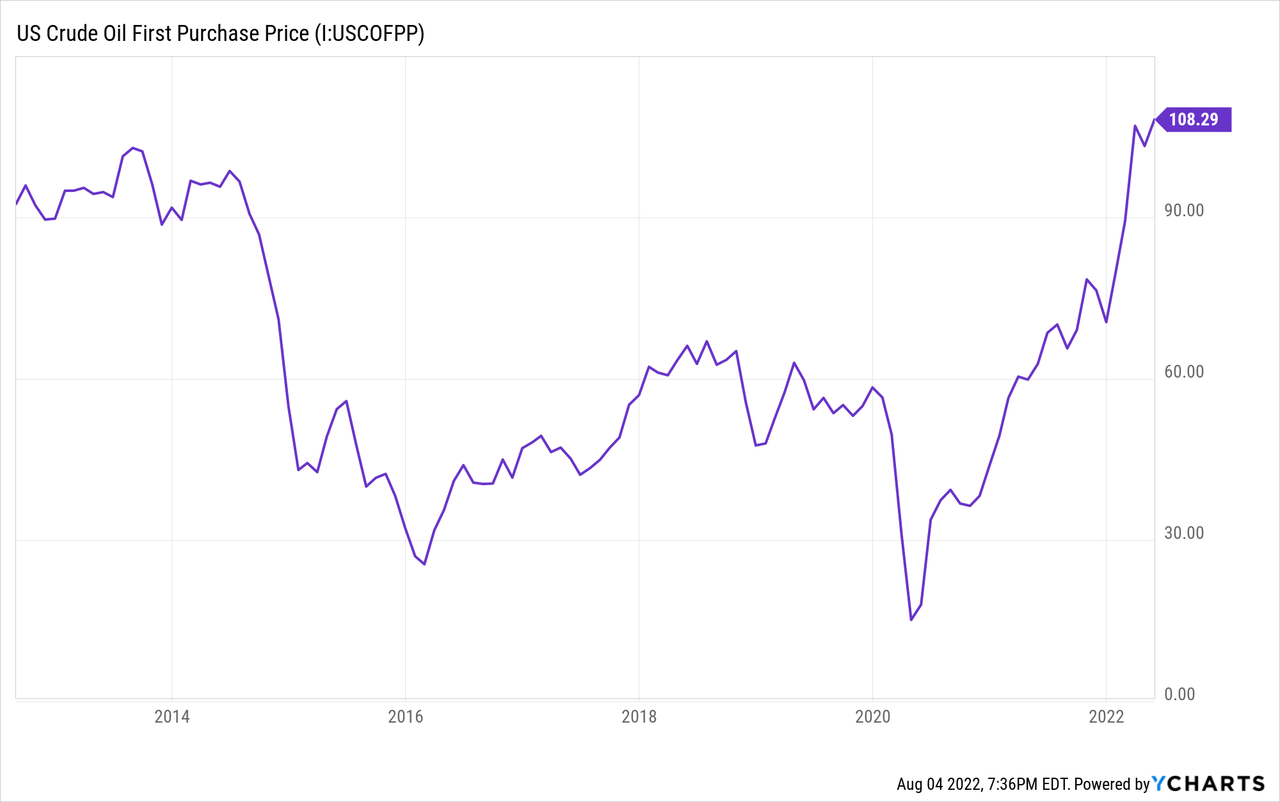

While we can see an upward trend from DynaEnergetic’s long term historical earnings, the current macro environment also creates tailwinds. From the charts below, we can clearly see that US oil rig count is at record low while oil price is at record high. In the current environment (Russia-Ukraine war, under-investment in oil field during the past decade, US recently became an oil net exporter, etc), it’s reasonable to assume oil price is staying at a high level and oil rig count would at least go back to 2019 level, which requires ~50% growth. DynaEnergetic’s perforating system is necessary to oil drilling projects, which makes it a great call option on rising oil. In 2019, DynaEnergetic generated $68.7 million in operating income. It’s reasonable to expect that DynaEnergetic’s profitability is going back to 2019 level as more oil drilling projects roll out. I used US rig count because the US is DynaEnergetic’s primary market, accounting for 76% of its total revenue per last 10Q.

From the chart below we can see that oil price is significantly higher than the 2019 level.

According to the last 10Q, DynaEnergetic’s sales of $67,517 in 2Q22 increased 60% compared to 2Q21 due to “improved oil and gas demand, which led to higher North American drilling and well completions, and increased demand and improved pricing for DynaEnergetic’s DS perforating systems”. DynaEnergetic’s international sales also improved, increasing 42% compared to 2Q21. I think this is a strong support to my analysis above, and indicates further upside since the oil rig count is still significantly lower than 2019 levels.

Arcadia

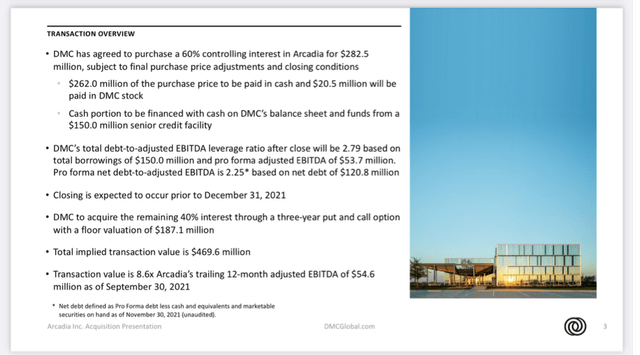

DMC Global acquired 60% controlling interest in Arcadia in December 2021 for $282.5 million. DMC Global also has the option and intention to acquire the rest of the company for $187.1 million, implying a total transaction value of $496.6 million.

According to the 2021 10k:

Arcadia is a leading supplier of architectural building products, which include exterior and interior framing systems for low and mid-rise commercial buildings, windows, curtain walls, interior partitions, and highly engineered windows and doors for the high-end residential market.

The commercial exterior business accounts for 73% of the net sales of Arcadia, which has 10% market share in western and southwestern addressable market (5% market share in TAM). Arcadia is a very good business with 35% gross margin, 22% EBITDA margin and very low depreciation expense (~$1.5 million; capital light). From 2010 to 2020, its sales grew from $71mm to $246mm (13% CAGR) and its EBITDA grew from $7mm to $51mm (23% CAGR). Its pro-forma net income is ~50 million, and it experienced minimal effect during the pandemic (net income only dropped to the high 40s, despite a slowdown of house building projects). I think the price the management paid ($470mm) is adequate (9.5x PE for a growing capital light market leader in a low interest rate environment) and again demonstrated their decent capital allocation ability.

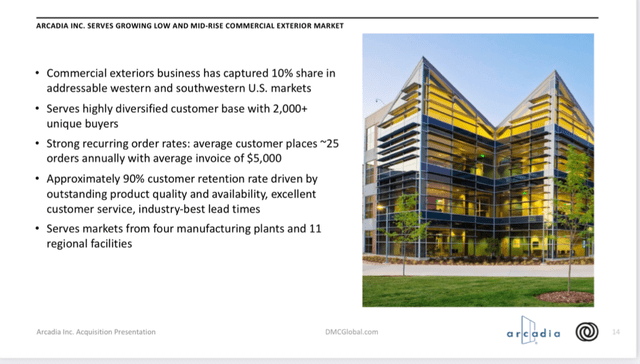

I expect Arcadia to turn out to be even more successful of an investment than DynaEnergetic. Note that all the numbers above are inclusive of minority interest, which the management has the option and intention to acquire. As of today, DMC only has 60% controlling interest in Arcadia, so we expect Arcadia would add $50 million*60%=$30 million to DMC’s bottom line per annum before the company acquires the minority interest. The slide below shows Arcadia’s market position and competitive advantages.

Arcadia’s competitive advantages (Investor presentation)

Nobleclad

Nobleclad manufactures clad metal plates, which can be used in industries such as oil and gas, petroleum and chemicals, alternative energy, shipbuilding, etc, for construction of large industrial processing equipment that is subject to high pressures and temperatures and/or corrosive processes. Nobleclad used to be the largest segment of DMC, but it has been experiencing secular market decline. Nevertheless, it’s still a capital light business with 16% EBITDA margin and 20% market share that is able to generate ~$9.8 million operating income. In the valuation I will assume zero growth of Nobleclad from 2021 level for the sake of conservatism, although this segment also has exposure to oil drilling activities.

Balance sheet

DMC Global has a strong balance sheet despite recent acquisitions. It has ~$120 million net long term debt against ~$53.7 million pro-forma annualized EBITDA, which gives us a decent 2.25x Net debt/EBITDA ratio. The debts mature in 2026, which is amortizable at 10% of principle per year with a balloon payment, with a interest rate of SOFR rate + applicable margin(1.5%-3%).The picture below is the management’s presentation of balance sheet outlook post Arcadia acquisition. Everything is clear and I see no liquidity concerns in the foreseeable future.

Balance sheet outlook post acquisition (investor day)

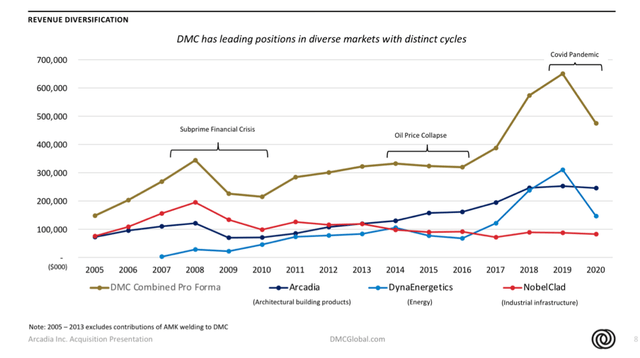

Through the Arcadia acquisition, DMC Global successfully further diversified its operation while maintaining adequate leverage. The chart below shows long term growth trends of DMC’s segments, from which we can clearly see that DMC Global has a strong growth history despite slight cynicality. Now with the favorable macro environment, DMC Global stock appears even more attractive.

DMC’s diversified operation (investor presentation)

Valuation

Bull case: The oil call option works out, and DynaEnergetic generates $94.5 million EBITDA (2019 level). Arcadia and Nobleclad’s EBITDA remains at pro-forma level ($30 million and $13 million respectively). Corporate overhead remains at pro forma $10 million. TEV/EBITDA multiple remains at 10x (2019 level). I think there is a decent chance for the bull case to work out given DynaEnergetic’s past organic growth and favorable macro environment (increasing oil drilling activities in the US).

TEV= 10 * (94.5+30+13-10) = $1.275 billion

Market cap= $1.275 billion – $120 million = $1.155 billion

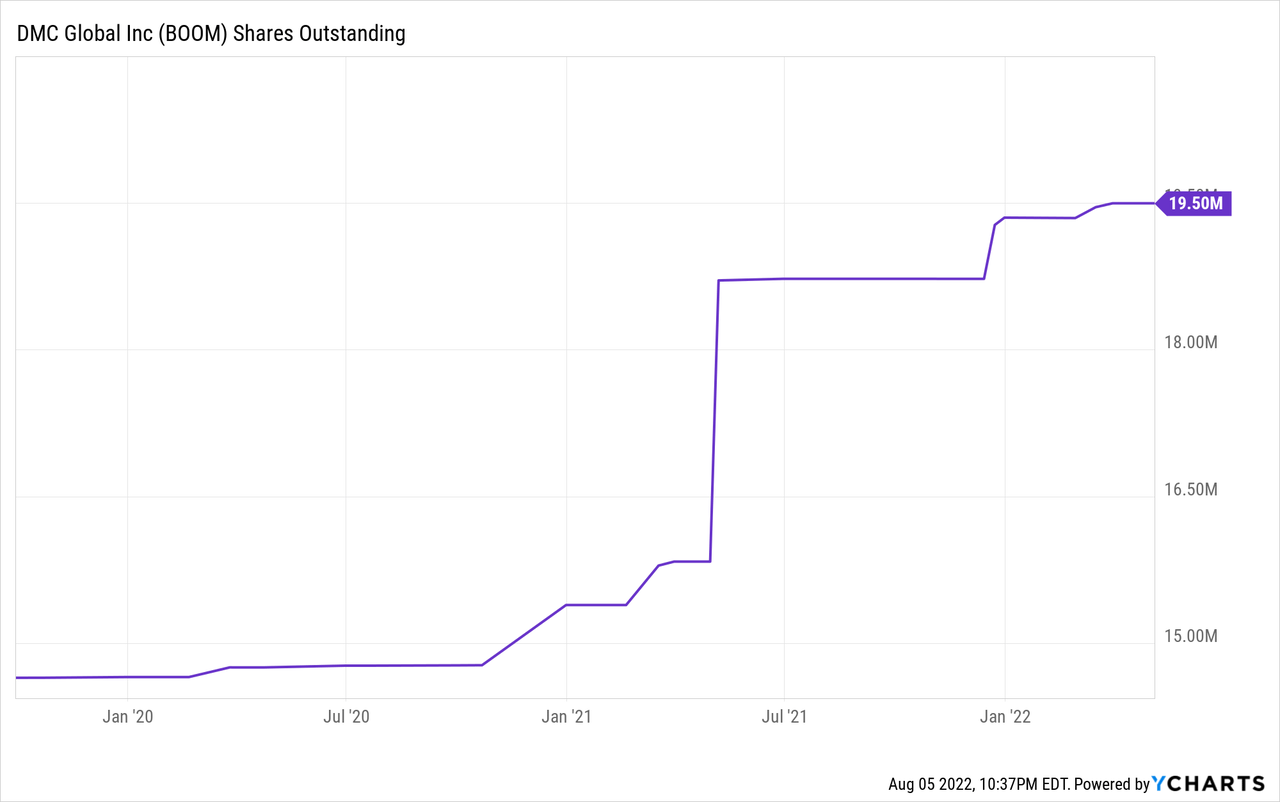

Share price= $1.155 billion/19.5 million= $59, indicating ~170% gain

Base case: the oil call option works out but DynaEnergetic generates only $58 million EBITDA (2018 level). Arcadia and Nobleclad’s EBITDA and corporate overhead remains at pro forma level. I believe the base case is the most likely scenario that could happen, because the expected earnings factors in minor interruptions such as remaining pandemic effects, slowing US economy, etc.

TEV=10*(58+30+13-10)= $910 million

Market cap= $910 million-$120 million= $790 million

Share price= $790 million/19.5 million= $40.5, indicating ~80% gain.

Bear case: The oil call option doesn’t work out, DynaEnergetic generates $16 million EBITDA (2020&2021 level). Arcadia and Nobleclad’s EBITDA and corporate overhead remains at pro forma level. I think the bear case is unlikely to happen because oil price is at multi-year high right now (backed with decades of under-investment and Russia-Ukraine war), and the effects the pandemic posed on oil industry during 2020&2021 will inevitably fade away.

TEV= 10*(16+30+13-10)=$490 million

Market cap=$490 million -$120 million= $370 million

Share price=$370 million/19.5 million= $19, indicating ~ 13% loss.

Conclusion

DMC Global has stellar assets and a strong balance sheet. It’s a great call option on the current macro environment with limited downside. The management has demonstrated their ability to allocate capital, which could even magnify the potential upside. I recommend holding on to DMC Global stock until the US oil rig count reaches 2019 level or oil price drops below $80.

Be the first to comment