Stockfoo/iStock Editorial via Getty Images

In my preview of Skyworks’ (NASDAQ:SWKS) earnings report from last Thursday, I was intent on understanding two things. First, how much “broad market” revenue is the company seeing (and is it growing), and second, is it being impacted by the widely reported component inventory adjustments at customers? The first question was answered on the call but it brought more questions than answers, but did clarify a few things for me in terms of how it reports this number. The second was the more interesting takeaway, as it provided insight into why the company appeared insulated from the adjustments while serving two major smartphone customers. Both of these gave me clarity on the bull thesis for Skyworks, and when combined with the relative valuation to peers and customers, its shares prove to have far less risk at this juncture.

Aligning Skyworks’ Position Relative To Apple

The title of my earnings preview article assumed there was an either-or scenario when it came to being unaffected by the inventory adjustments happening at major customers like Samsung (OTCPK:SSNLF)(OTCPK:SSNNF) and Apple (AAPL). Either Skyworks would have enough diversification not to have any one customer impact its overall revenue, or it would be too concentrated with its largest customer and feel the full force of the supply chain inventory accordingly.

I used management’s term “broad market” revenue as a proxy for revenue not related to smartphones since most of the inventory correction was happening with handsets, as seen by Qualcomm (QCOM), Micron (MU), and others. With 36% of revenue claimed under this banner, it left 64% for smartphones. But what I had assumed in that number – which, in hindsight, I did without sufficient evidence – was its largest customer, Apple, would not land in this “other” market category.

However, I failed to (sufficiently) recognize Skyworks provides components beyond its iPhone products. Broad market, beyond just industrial, networking, and IoT (internet of things), also includes iPads, iMacs, and AirPods, as inferred by management’s commentary on its FQ4 earnings call. This means Apple’s overall revenue contribution to Skyworks also likely holds a significant part (perhaps not a majority) of the broad market revenue.

This is important due to Skyworks’ reliance on Apple as a majority revenue contributor. Since Apple was likely drawing down its inventory so as not to be holding an unduly amount in a recessionary-prone time, I went into earnings thinking diversification away from smartphones also meant away from Apple’s inventory restrategizing.

Aligning Apple’s Position Relative To Skyworks

As it turns out, I was right, but for the wrong reasons.

Skyworks did turn out to have avoided a majority of Apple’s inventory adjustments but not because the component maker avoided iPhones. Instead, the avoidance of inventory drawdowns was actually due to Apple’s poor mix strategy going into the launch season.

You might say, “Well, that’s quite a leap.”

But follow the train of thought, using a few key statements from Skyworks’ management on its earnings call and what we see in the market.

Apple went into the season knowing the retail customer was pulling back – it’s well documented across the economy. Surely, it thought, its clients would shoot for the lesser models to save cash. Naturally, plenty of folks will get the high-end model and nothing less, but the train of thought likely erred on the side of having enough stock of less expensive models to cater to the economic environment.

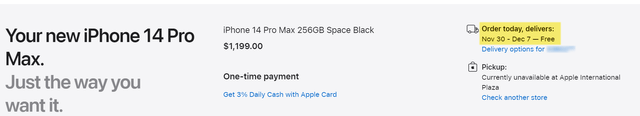

However, it appears Apple overshot the low-end models and didn’t produce enough high-end models as demand for high-end models has ship times out 4-5 weeks. Every Pro configuration is the same delivery window regardless of color or storage.

Apple iPhone 14 Pro Max Order Page 11/5/22 (apple.com)

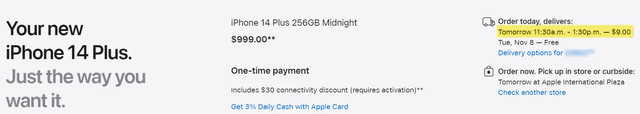

There are pretty legitimate reports of Apple reducing orders for the Plus models. And this makes sense, as I can get a Plus model delivered with two-hour delivery. All this says is Apple ordered too many Plus models, and now it can’t sell them.

Apple iPhone 14 Plus Order Page 11/5/22 (apple.com)

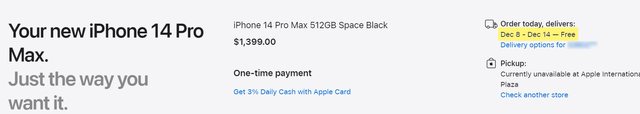

Then Sunday night, to make Apple’s woes worse, China’s COVID lockdown policies are hampering its assembly of Pro models. So not only did Apple not ramp up enough high-end models, but now it’s struggling to get the output it ordered. This has pushed out delivery times by another week.

Apple iPhone 14 Pro Max Order Page 11/6/22 (apple.com)

Since Skyworks has at least four sockets in the 14 Pro Max, it’s got quite a bit of content in the latest high-end iPhone. Therefore, if the high-end is struggling to keep up supply while low-end inventory is being drawn down, demand for Skyworks’ components remains robust. But don’t take my word for it; management also strutted a bit during the call:

So our largest customer in the September quarter was approximately 63% of our business… new products that translated into a 30% sequential growth or a 14% year-over-year growth. I know, there is always a lot of question about is Skyworks gaining content or not. While those numbers clearly illustrate that we had a major uplift in content in the new products that have been launched by our large customer.

– Kris Sennesael, CFO, FQ4 ’22 Earnings Call Q&A

And this is how the company managed to have a decent revenue guide of $1.325B – not great, as it was still below the consensus of $1.5B, but respectable in this environment. As management noted, there was obviously softness in Android, particularly with Samsung, causing most of the slowdown sequentially.

However, [Samsung] is also not immune to some of the softness on the global demand, including some of the European markets. And so, that — it’s very well documented as well there. There is some inventory overhang at that customer and that’s definitely having an impact on our December guide.

– Kris Sennesael, FQ4 ’22 Earnings Call Q&A

This isn’t terrible because of Skyworks’s position with Apple and Apple’s need to continue ramping up iPhone 14 Pro inventory; there will be continued strong demand on this end. However, some might think the COVID constraint in China will slow component orders. Orders for parts will continue to roll in as the eventual resumption of full capacity output will then have enough parts to produce the orders demanded. The COVID restrictions aren’t in place long enough to change supply chain orders on a whim.

To put a finer point on the subject, the company’s derisking with China smartphones isn’t going to be any lower than the December quarter. This means the market’s pricing of the stock – which I’ll get to in a second – is more knee-jerk than rational when one considers Skyworks’ isn’t vulnerable to further issues with China. These are some of the cascading effects we’re getting with inventory corrections, so the two (China and inventory drawdowns) tie together in the end. But the key is, it’s an only-can-go-up-from-here story.

…December for China is definitely the low point. It can’t get much lower than that. The question is, when does it switch back on? Is it in March? We expect some of it to start in March or the following quarter. But, again, in December, it’s completely derisked. It can’t get much lower than that.

– Kris Sennesael, FQ4 ’22 Earnings Call Q&A

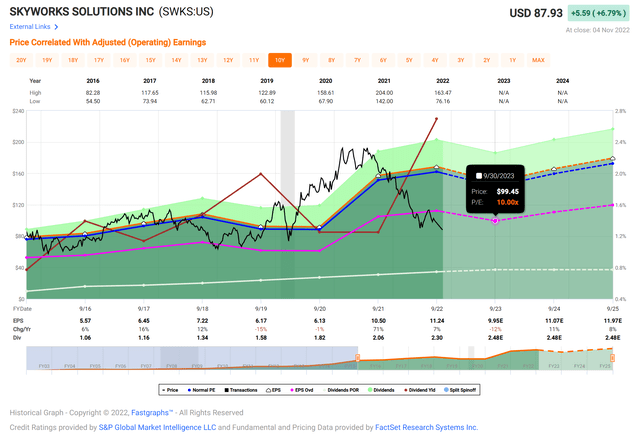

Valuation Below Historical Lows

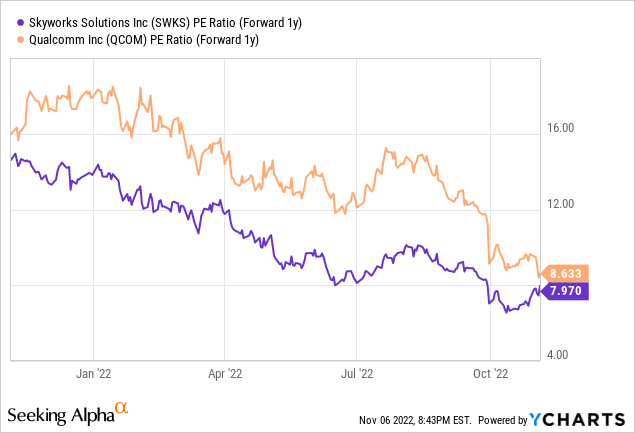

Skyworks’ valuation is as low as peers like Qualcomm, who are seeing an outsized negative impact on its relationship with smartphones. Skyworks is taking advantage of being a “single customer revenue center” that needs its components in the worst way.

There’s a reason Qualcomm has a premium (I use that word loosely in this economic environment) valuation in forward earnings, as it’s larger and has more diversity. But Skyworks’ advantage is being able to ride on the side of bypassing inventory reductions and adding more content wins. Furthermore, the risk in Skyworks is far reduced as its forward P/E ratio is well below any of its track record. We’re bordering on the 2008 financial crisis, where its P/E dropped to 5.5.

Even with the revisions for negative earnings for FY23, the stock is still far under its lowest historical valuation. At just ten times earnings, fair value is near $100. Can earnings revisions drop further? Sure, that’s not out of the question at all. But the difference is the low valuation the stock already trades at while it sees December as a bottom for its Chinese revenue and really the entire inventory drawdown situation.

A Pretty Good Position

Skyworks has been put in a unique position, some by its own doing of having significant content in a top-tier smartphone, and some by its customer constraining itself without needing to draw down its flagship model’s inventory. This means Skyworks can skirt many current inventory adjustments while pushing demand into the current and next quarters. With a historically low valuation, while expecting only a negative growth period to last a short while (six months or less), the stock has a serious floor compared to peers.

Be the first to comment