anusorn nakdee

Atlas Salt (OTCQB:REMRF) is very unique, but before I get to that, I want to provide some information on the industry as it is not a focus area for the majority of investors. However, the sector is a big deal and very lucrative.

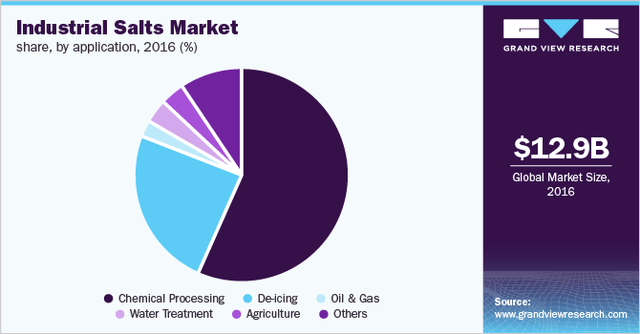

According to statista.com, the worldwide market for salt production was valued at over 29 billion U.S. dollars in 2021, with 290 million metric tons of salt produced that year. Most people think of salt as something on the table or for cooking, but one of the most important and largest use is as a deicer. Road salt keeps our highways and sidewalks much safer in the winter months. According to research conducted in Wisconsin, the application of salt for snow melting is estimated to reduce accidents by 88% in the U.S. A lot is also used as feedstock for chemical industries. Highway deicing forms the major market for industrial salt in North America and Europe, while chemical processing is more dominant in other countries.

A leading North American manufacturer of minerals and salt, Compass Minerals (CMP) reported an increase in highway anti-icing product sales of approximately 4.8 million tonnes during the fiscal 2022 second quarter. I want to talk a bit about Compass because I have known the company for a long time, as I once lived not that far away from their major salt mine and visited the site 20 years ago or more. There is also a very important tie between Compass and Atlas Salt. Compass is the leading salt producer in North America and the U.K. Their Goderich Ontario salt mine is the largest and most productive in North America. Compass’s production capacity is approx. 16.2 million tons and about half of this, 8.0 million tons, is from Goderich Ontario.

An important tie to Atlas Salt to Compass is the Mine General Manager at Goderich from 1995-2011 joined Atlas Salt as President & Director, Rowland Howe. He is a Chartered Engineer with an impressive background in the salt industry. He was with North American Salt since the beginning that later became Compass and went public in 2003. As Mine General Manager at Goderich in Ontario, he led the expansion of the operation to the largest and most productive salt mine in North America. Following this, he was Director of Strategic Projects for Compass Minerals through 2016. He is currently President of the Goderich Port Management Corporation.

Atlas Salt – The Great Atlantic Salt Project

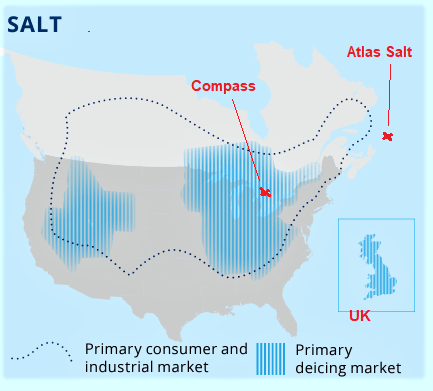

Compass Minerals estimates the consumption of highway deicing salt in North America at about 39 million tons/year in an average winter. The consumer and industrial market is approximately 10 million tons/year. This graphic below is from Compass Minerals. I highlight the two companies in relation to the market. Compass is also in the UK, that’s why it is shown. Compass has great access in the middle area via the Great Lakes. Atlas will have very good sea access to all of Eastern Canada and Eastern U.S.

Compass Minerals

What is more important, is the supply to the Eastern U.S. that comes from South America and the Middle East, that is far more expensive to ship compared to what Atlas could do. Currently, around 8 million tonnes per year are shipped from these distant sources into the Eastern US and Canada. According to the Atlas Salt presentation, about 1.5 to 2.5 million tonnes per year from Egypt, 1 million from Morocco, and 5 to 7 million from Chile. There have been no new mines in North America in the last 20 years, so Atlas Salt can fill a void here and with much cheaper transportation costs.

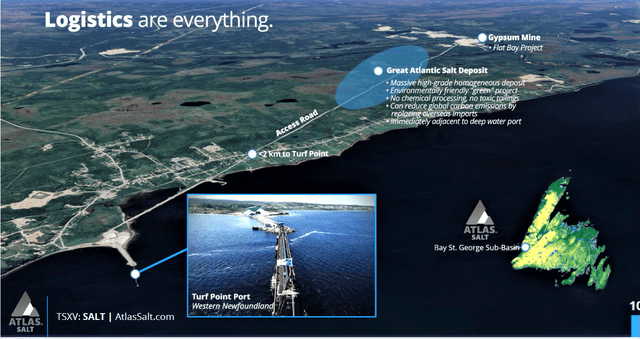

I will use a few graphics from the Atlas presentation. Location and logistics make a difference. The mine will only be a few kilometres from the seaport. There is inexpensive hydropower in Newfoundland, Canada, and Atlas can implement inexpensive and efficient mine access via a declined ramp.

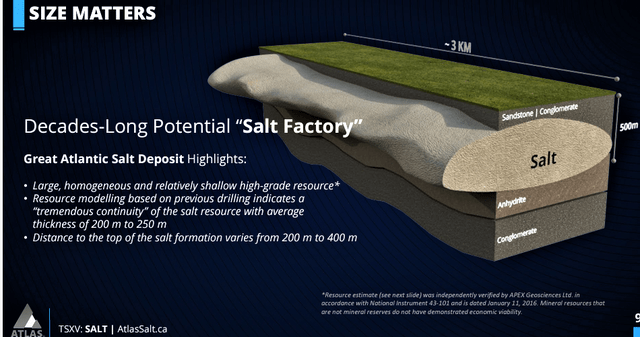

Size and grade are also important. The full extent of the deposit is not known yet, but so far drilling has indicated it is very large at about 3 kilometres in length and close to the surface. Deicing salt is a very specific salt that requires a minimum 95% grade. Atlas Salt has an inferred resource of 880 million tonnes at a 96.9% NaCI grade with a 95% cut-off. Therefore, it can be shipped at its current grade for deicing.

Salt mining is very simple. What is most important to understand is there is no risk with grade, metallurgy, strip ratios, processing and mining methods like mining other metals or materials. A processing plant is not required, you simply scoop material out of the deposit with a salt processor and ship to the port. It is more like a salt factory than a mine. This graphic illustrates the expected mine plan. The feasibility report could come out at any time now and will provide much more detail.

Financials

Last financials at June 30, 2022 show C$7.9 million in cash and no long-term debt. The company should have ample funding to get this project to a construction decision with the feasibility study almost complete.

Valuation and Risk

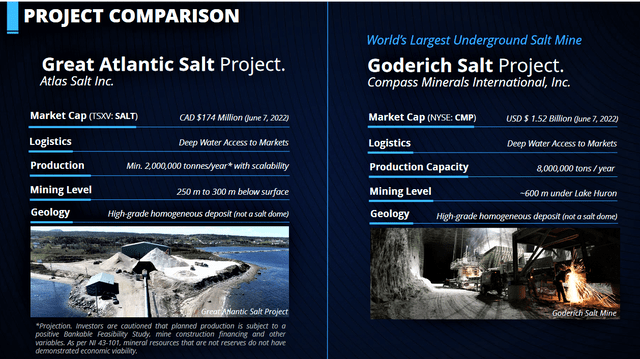

This is so rare; there are no developing salt projects in a public company to compare to. The closest comparison would be the closest Canadian mine in Goderich that Compass owns. Here is a snapshot from the Atlas Salt presentation.

Today, at $38, Compass has a market cap of $1.62 billion and that is after a considerable correction in this bear market. About half of Compass’s capacity is from the Goderich mine, and it really is the gold standard of salt mines, so is probably worth more than half the valuation. We could estimate $1 billion for the value of the Goderich mine.

At current prices and 87.6 million shares out, Atlas Salt is valued at about US$130 million. A significant part of this valuation is their Triple Point Resources holdings, further detail below. There is plenty of room for the value to rise as the project advances, and the feasibility study will go a long way in helping that. I do not foresee any problems or risks with the feasibility.

There is a strong market for good salt mines. There have been over $5 billion in acquisitions in the industry over the past few years. For example, in April 2020, Stone Canyon Industries bought out The Kissner Group that controls the Detroit Salt Company for $2 billion. Mark Demetree of Stone Canyon appears to be reshaping the North American salt industry and is probably not done. In fact, in April 2021, he won U.S. Antitrust approval to buy Morton Salt in a $3.2 billion deal. Whether Stone Canyon or not, it would not surprise me if Atlas is bought out within the next 2 years at multiples of the current share price.

This does not have all the risks of a mining project because it is such a simple process to simply grind the salt and ship, but all projects carry some risk of getting a permit to build. However, the project is located in a mining and development-friendly jurisdiction and is in high demand. When Prime Minister Justin Trudeau met with German Chancellor Olaf Scholz about hydrogen on August 22, 2022, they met at Stephenville NFLD right where Atlas Salt is located. Atlas Salt also spun out one of its assets, a salt dome to Triple Point Resources in the same location. A salt dome is important to a hydrogen project.

I don’t see much risk that would stop this project from permitting and production.

Conclusion

Yours truly did a Zoom interview with Rowland Howe in August, where you can learn more about him and Atlas Salt.

What makes this rare and unique are a number of things:

-

First off, it is extremely rare to find a salt mine development project leveraged 100% to a public company. I am aware of none in the past 10 years, and it is likely longer than that.

-

It is a massive salt deposit near a major coastal port in NFLD with access to Eastern North America and a very high grade of 96.9% NaCI, using 95% cut-off.

-

The total resources are massive that vary in thickness between 200 and 250 meters. It could have a mine life of over 100 years.

-

These salt projects generate huge cash flow and profits but very seldom does one ever come to market in a public company.

-

Atlas Salt is run by one of the premier salt experts in the industry.

-

A very good buying opportunity with the stock off -65% from its recent high.

Near-term catalysts will be released of the feasibility study and public listing of Triple Point Resources. Atlas Salt owns 51.2 million shares of Triple Point, and their valuation will have a significant effect on Atlas Salt’s share price. Most of the trading volume occurs on the Canadian TSXV under the symbol (TSXV:SALT:CA) so I will use the C$ based stock chart. The stock has come down to strong support and the recent downtrend has been broken. The stock probably got ahead of itself, and the record date for their spin out of their salt dome to Triple Point Resources was also a factor. That record date was September 21, and I note the high volume around that time frame. That probably washed out sellers, leading to the recent bottom.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which ran through November 7.

Be the first to comment