Dougal Waters/DigitalVision via Getty Images

Main Thesis & Background

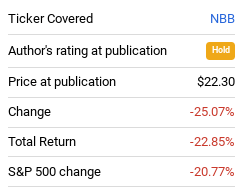

The purpose of this article is to evaluate the Nuveen Taxable Municipal Income Fund (NYSE:NBB) as an investment option at its current market price. This fund is run by Nuveen and its primary objective is “current income through investments in taxable municipal securities.” Despite having a favorable long-term view of munis (both taxable and tax-exempt), I turned cautious on the sector when 2022 got underway. There were multiple reasons for this which I discussed in my January review and, in hindsight, I was right to be cautious. However, in reality I should have been more bearish than neutral, as funds like NBB have been rocked pretty hard year-to-date:

Fund Performance (Seeking Alpha)

Simply put, this is very poor performance. Even when we consider the income stream, NBB is heavily in the red for the year. Worse, equities have been hit just as hard, which means that munis have not provided the buffer or hedge that one would hope.

While there is not much good that can be said for the performance the first half of the year, the bright side is it has opened up a buying opportunity in my view. While I would stress not to get too bullish here because inflation and rising interest rates are going to keep pressuring fixed-income as a whole going forward. However, valuations across the muni space are very attractive, and credit quality in the underlying securities is strong. Thus, I am upgrading my rating on NBB to “buy”, and I will explain why in more detail below.

Valuation Is Quite Attractive

A primary focus point for me when I consider NBB, or any CEF for that matter, is valuation. As my readers know, I prefer funds at discounts, and I will rarely pay above a 5% premium for the “privilege” of owning a fund. I don’t care what the fund is – who is managing it, what the income stream is, or how strong my outlook is for the sector. If a fund is too expensive, I pass and find a better opportunity.

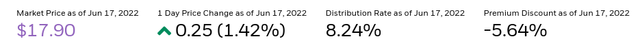

With this in mind, it should be easy to figure out why NBB has my interest at the moment. The fund’s discount to NAV is nearing 8%, which is cheap for most of the CEF universe and is below the 52-week average valuation for this option (the average is a discount of 1%):

Fund Valuation (Nuveen)

This is fairly straightforward. NBB looks cheap, and it is in terms of its historical trading range and in relation to its peers. The primary peer for this fund is the BlackRock Taxable Municipal Bond Trust (BBN), so a quick comparison is usually warranted before buying either one. At this juncture, NBB has a discount advantage of around 2%:

While this is not the most complicated exercise, it is important. NBB is cheap in isolation, and is cheaper than its primary rival for inflows. This makes the fund seem like a buy in my view.

Should We Be Avoiding Leverage? Not Necessarily

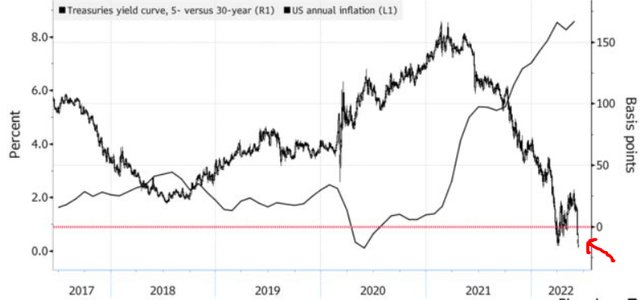

Another important aspect for NBB, and for most muni CEFs, is the fund’s use of leverage. This is something that has undoubtedly been on the minds of investors these days, with leveraged funds getting punished along with most risk-on investment approaches. The reasoning is two-fold. One, a leveraged fund is inherently more risky, and the reality is that in this climate investors are fading risk. Two, while leverage is often an advantageous tool for a CEF, it becomes less so in an environment where the yield curve is flattening, and especially when it is inverting.

This is an important concept because the basis thought would be that as interest rates rise, the income CEFs can earn increases. This is true to a point, but it assumes that longer-dated securities are offering more in yield than shorter-dated ones. If that is indeed the case, the fund’s income can rise in a rising rate environment to more than offset the costs of leverage (which is also rising concurrently). However, with an inverted yield curve short-term borrowing expenses can rise faster than the income stream from those long-term securities. So, leveraged products (CEFs or otherwise) are specifically at risk when we see the yield curve invert, which has indeed been happening throughout 2022, including very recently:

Yield Curve (5 yr versus 30 yr) (Bloomberg)

With this backdrop, perhaps it makes sense to avoid leverage then – right?

The answer to this is more complex than that. For one, it depends on each investor’s individual circumstances. If one is not comfortable taking on the extra risk of leverage, than now probably is not the time to start. This is a very volatile market and amplifying a position through leverage is not appropriate if one cannot handle the swings or is already too over-exposed to the market – whether through equities, munis, or any other sector).

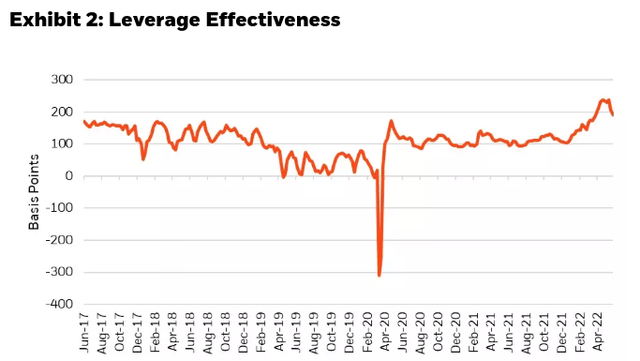

That being said, for those who can withstand a little more volatility, I would note that using leverage can still be beneficial in this market. The yield curve is bouncing between inversion and not, and there is certainly a chance it could widen in the months ahead (which is beneficial for leveraged CEFs). Importantly, while the yield curve is inverting from time to time, which is a worrisome trend, it is still a normalized curve the majority of the trading days. With respect for muni CEFs, there is still a “yield pickup” opportunity in this space. This means that leverage can still be positively effective, despite the market’s overreaction to the downside recently:

Leverage Effectiveness for Muni CEFs (BlackRock)

My thought is that NBB is not disadvantaged for having leverage. Is it a riskier play, and one that may bring some enhanced ups and downs in the near future? Absolutely – and this is a key risk readers need to consider when deciding if buying now is right for them. However, it is helpful to understand that leverage is still advantageous in this environment, for now. NBB may not be the right move for everyone, but its use of leverage is not the reason why.

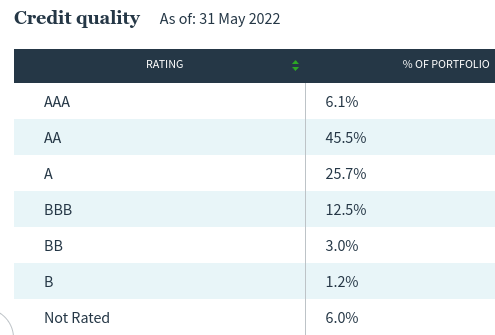

Quality Of The Holdings Provides Comfort

Another important reason supporting a buy rating on NBB is the quality of the underlying assets. This fund holds roughly 90% of its assets in investment-grade munis, which I view positively:

NBB’s Holdings Credit Ratings (Nuveen)

This is key to understanding why I feel the fund’s sell-off is simply too much, too fast. These are quality bonds, and the 20% + drop is just not warranted since I still see low levels of defaults for this sector in 2022 (and beyond).

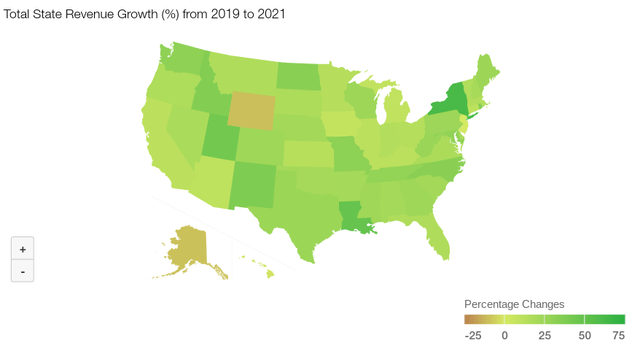

The reason behind this outlook has more to do than just the listed credit ratings. States (and local governments) are actually in fairly strong financial position across the board. Despite a challenging consumer climate and rising interest rates, state governments have managed to be very resilient post-pandemic. Federal aid was significant, and tax collections actually improved as consumers continued to spend and the labor market remained strong, keeping payroll and income taxes high. For perspective, consider that state revenue growth was very strong across the board, with few exceptions:

State Revenue Growth (Treasury Department)

The takeaway is that states know the means to make good on their debt obligations. While elevated inflation levels and rising interest rates can certainly pressure the valuation of muni securities, investors should not be worried too much about asset quality. Given how hard munis have sold off, it seems like positions now are worth the risk.

Low Supply Is A Tailwind

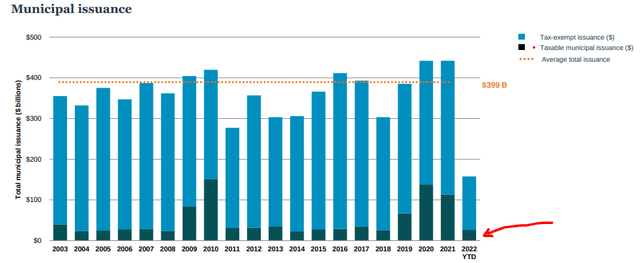

My final point for NBB looks at the taxable muni sector more broadly. This is a smaller sub-sector of the overall muni market, but grew in importance post-2019 tax reform which limited the ability of issuers to refinance tax-exempt securities and remain tax-exempt. As a result, to lock in lower interest rates issuers saw their tax-exempt bonds be reissued as taxable. This made the sector more relevant, and it correspondingly grew in size.

Of course, the taxable sector still remains relatively small compared to the broader muni market. Further, given the differentiation of the sector, demand kept prices elevated. The good news on this front is that while prices have been depressed due to macro-elements, on the micro-level prices look well supported. This is because supply has been moderate, and appears like it will end the year with less supply coming on to the market than in the past two years, as shown below:

The conclusion I draw here is the supply dynamic is favorable for prices. While there are other reasons why prices have been on the decline, this is not a market that is over-supplied. From a longer term perspective, this is bullish.

Bottom-line

My thesis here is municipals look attractive at current valuations, and that includes NBB in particular. The fund has a sharp discount to NAV and the taxable muni sector appears under-supplied relative to prior years. Further, the fund offers an attractive income stream, as the distribution has stayed constant while the market price has been hammered. This has led to a yield just under 8%, which is simply silly for investment grade bonds. Historically speaking, past periods of disruption in the muni market have been profitable entry points for investors, and I see little evidence to suggest this won’t be a similar result. With high yields and a stable fiscal backdrop, funds like NBB may not be this cheap for long, so I would encourage readers to give this idea some consideration at this time.

Be the first to comment