Lisa-Blue

One of the biggest losers on Tuesday happens to be crypto platform Coinbase (NASDAQ:COIN). Shares of the company were down more than 10%, falling below $50 a share for the first time in a number of months. The reason for this fall is due to a major problem in the crypto space, one that if not worked out quickly could send Coinbase to new lows in the coming weeks.

In recent days, there have been concerns about the health of Alameda Research, which is Sam Bankman-Fried’s (“SBF”) investment firm. At the same time, there were worries that cryptocurrency exchange FTX, which SBF heads, was having problems. Fellow firm Binance (BNB-USD) announced that it was selling its holdings of the FTX token (FTT-USD), as it feared what was going on at FTX, which caused the token to start declining.

As the chart below shows, the decline was a bit gradual, but things really picked up on Monday night when the token fell below $20. On Tuesday morning, there were issues with FTX’s withdrawal process, sending the token even sharply lower. A little after 1PM Eastern, the FTX token fell into the single digits, meaning it had lost more than half of its value in a matter of hours.

FTX Token 5-Day (Yahoo! Finance)

As the panic spread around FTX, it seemingly took down all of the cryptocurrency space. Bitcoin (BTC-USD), which was over $21,000 in recent days, fell below $19,000. While rumors that Binance would buy FTX caused a brief relief rally, selling quickly resumed across the board. Shares of Coinbase, which had jumped to more than $58.40 at their day’s high, dropped back quickly and were testing $50 again in early afternoon trading.

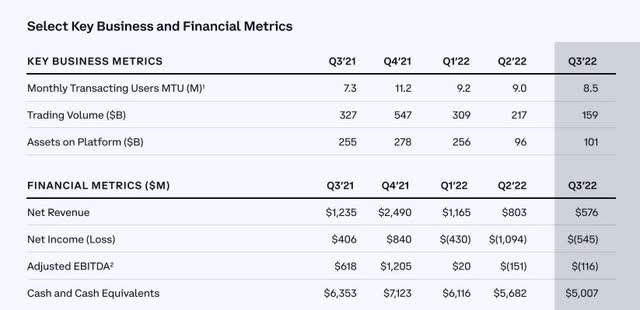

I bring up the idea of Coinbase falling further because it was just last week when the company announced its Q3 results. The company reported a sizable revenue miss, with total revenues down almost 55% over the prior year period. With the entire crypto space falling significantly from its highs, the company reported significant declines in trading volumes and assets as seen below. The company also swung from a $400 million profit in the year ago period to a more than half a billion dollar loss.

Coinbase Q3 Key Numbers (Company Shareholder Letter)

Management mentioned in the shareholder letter than October trading volumes were down from July levels, so Q4 is already off to a slow start. The company said it was preparing for a potential multi-year down period in this space, and it still had more than $5 billion in cash. However, I’m worried that if this FTX contagion spreads, and perhaps Bitcoin drops to say $15,000 or lower, Coinbase’s results will be a lot worse than previously expected.

Going into Tuesday, the average price target on the street was more than $81, implying significant upside from current levels. However, that figure was down about $10 since the Q3 report, and well off its more than $500 high after Coinbase started trading publicly. It would not surprise me to see more price targets cut in the coming weeks if we don’t see a crypto rebound quickly.

In the end, investors in Coinbase should be quite worried with what’s going on with FTX currently. As the FTX token has plunged to the single digits, the entire crypto space is dropping quickly. Coinbase already announced a terrible set of results last week, and the stock is only about $10 from a new 52-week low. If this FTX contagion isn’t resolved soon, it would not surprise me if Coinbase shares fell to a new low as a crypto winter could be about to set in.

Be the first to comment