Sundry Photography

Lam Research (NASDAQ:LRCX) is a TechStockPro favorite in the semi-cap. The stock dropped almost 38% YTD, and we believe the memory weakness has finally been priced in. We were previously worried about LRCX’s exposure to memory markets, specifically NAND demand; now, we are more constructive as we believe the weakness has been recognized and priced in. We’ve already seen LRCX’s 1Q23 sales beat expectations, growing 9.5% Q/Q to $5.07B. We believe the LRCX stock has hit its inflection point and expect the stock to rebound from here now that the company has cut its wafer fabrication equipment (WFE) spending outlook for 2023. We recommend investors buy the stock.

Memory weakness priced in

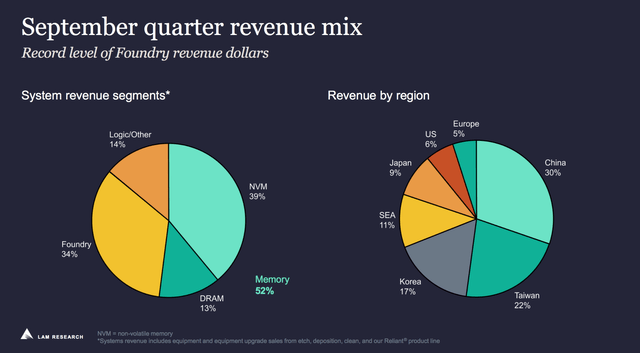

LRCX operates within the semiconductor equipment industry of etching and deposition with significant exposure to memory markets. We attribute the stock’s YTD pullback to a major weakness in memory demand. The sluggish smartphone and PC demand has led to fragile memory demand for DRAM and NAND flash chip vendors. As a result, we expect memory weakness has significantly affected LRCX’s revenue and others in the semiconductor space. US memory chip maker Micron (MU) highlighted the weakness in the memory market, with revenue dropping to $6.64B in 4Q22 compared to $8.27B a quarter prior. The same can be said for SK Hynix, the Korean memory chip maker, which has suffered softening demand for memory chips amid the worsening macroeconomic environment. Like the competition, LRCX relies heavily on its memory segment, accounting for 52% of its total revenue, as outlined in the following graph.

We believe the weakening memory markets hit LRCX as the company relies heavily on NAND demand, which is used in smartphones and PCs. Hence, when global smartphone shipments declined 9.7% Y/Y in 3Q22, and PC sales fell 19.5% in 3Q22, LRCX felt a weakness in NAND demand. We’re more constructive on LRCX now because we believe the worst of the memory weakness has been priced into the stock.

Cutting WFE outlook for 2023

Our bullish sentiment on LRCX is also based on the company’s cut in WFE outlook for 2023 by 20% compared to 2022. We expect the correction will reflect the lower industry demand and allow supply-demand dynamics to balance. We expect LRCX’s cut for its WFE outlook will reduce the blow of any downside risks for the stock going forward. LRCX operates in the WFE industry, forecasted to grow at a CAGR of 7.9% between 2022-2027. In the longer term, we like LRCX’s position within the semi-space as the semiconductor equipment provided through LRCX will advance future NAND generations and future-generation DRAM.

LRCX is not without risks. We expect LRCX’s greatest downside risk to be the US export regulations on Chinese memory IDMs. Nevertheless, we believe the impact of US export regulations to be offset by the LRCX’s cut in WFE demand outlooks for 2023.

Valuation

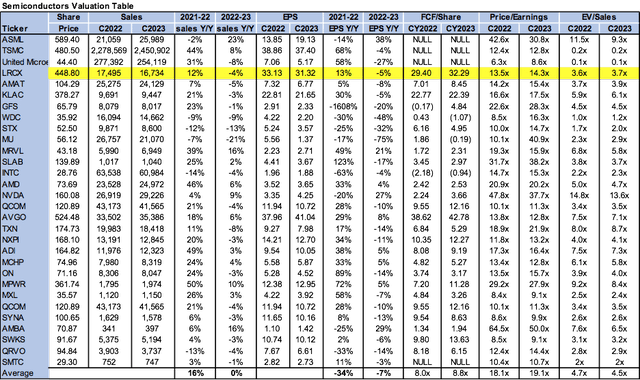

LRCX is relatively cheap. On a P/E basis, the stock is trading at 14.3x C2023 EPS $31.32 compared to the peer group average of 19.1x. In addition, the stock is trading at 3.7x on EV/C2023 Sales versus the peer group average of 4.5x. We believe LRCX’s exposure to memory weakness is priced into the stock and recommend investors buy the pullback.

The following table outlines LRCX’s valuation compared to the peer group.

Word on Wall Street

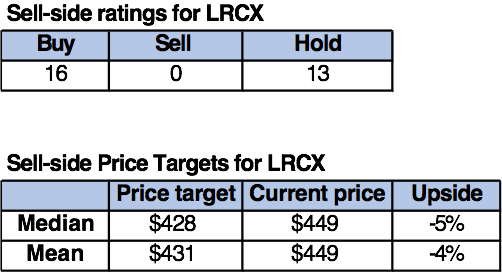

Wall Street is buy-rated on LRCX. Of the 29 analysts covering the stock, 16 are buy-rated, and 13 are hold-rated. The stock is currently trading at $449 per share. The median price target is $428, and the mean at $431, with a negative upside of 4-5%.

The following table outlines the sell-side ratings on LRCX.

TechStockPros

What to do with the stock:

We expect that LRCX stock has bottomed, and the memory weakness has been priced in. Hence, we recommend investors buy the pullback. Still, we believe LRCX will be under pressure due to US export regulations and macroeconomic headwinds. We’re constructive on LRCX as we believe the company is adapting to the market demand with its cut of WFE outlooks for 2023. We expect this will make the stock more resilient as it enters 2023. We believe the worst days are behind the company. We like LRCX’s position within the semi-cap industry in the long run and believe the stock pullback creates an attractive entry point to invest in the stock at a discount.

Be the first to comment