VioletaStoimenova

During these tough market conditions and uncertain times, some companies that are fundamentally attractive and even attractively priced are being hit by investor pessimism in a way they normally shouldn’t be. A great example of this can be seen by looking at Korn Ferry (NYSE:KFY), a global consulting firm that helps companies when it comes to issues of organizational strategy, professional development, employee search, and more. The company also provides digital solutions that helped to generate insight and actionable recommendations for its clients. Recently, shares of the company have taken a beating. This has come even as financial performance achieved by the company has been robust. Even if we ignore how cheap shares might be looking on a forward basis and focus only on data covering results from prior fiscal years, the firm is still quite attractive from a cash flow perspective. So although shares have not been moving in the direction that some who are bullish on the company might like, I do still think the firm is appealing enough to warrant some upside potential worthy of a ‘buy’ rating.

Two different stories

Back in early May of this year, I wrote an article that took a rather bullish stance on Korn Ferry. In that article, I talked about the pain the company experienced because of the COVID-19 pandemic. But I also detailed how, since then, management had done well to generate strong upside from a revenue and profitability perspective. I ultimately said that current pricing for the company made shares look cheap, but that a return to weaker results would imply that shares might be more or less fairly valued. At the end of the day, I felt as though this created a favorable risk-to-reward opportunity for investors to the extent that I felt comfortable rating the business a ‘buy’. Since then, the market has gone on a wild ride, dropping by 9%. But clearly, Korn Ferry has experienced even more pain, dropping by 21.9% over the same window of time.

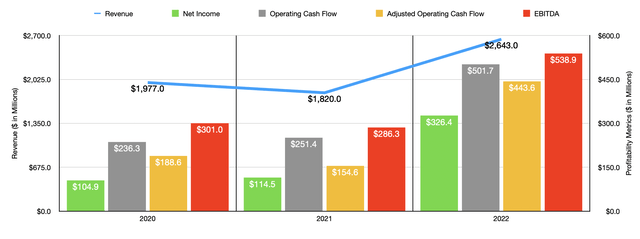

This extreme performance disparity might, at first glance, make it seem as though the fundamental performance of the company was awful as well. But that is not the case at all. For starters, let’s talk about how the company finished its 2022 fiscal year. You see, when I last wrote about the company, we only had data covering through the third quarter of 2022. For 2022 as a whole, revenue came in strong at $2.64 billion. That represents a 45.2% increase over the $1.82 billion reported for the 2021 fiscal year and it compares favorably to the $1.98 billion seen during the 2020 fiscal year.

In a company like this, there are a number of working parts and they each contributed in their own way to this improvement. What’s worth noting, however, is that some of the strongest upside for the company involved the Fee Revenue portion of the business, with sales having risen by 45.1% because of new business driven by the increased relevance of the company’s solutions and because of the acquisition of various firms. In terms of specific segments, the highest percentage increase came from the RPO & Professional Search portion of the enterprise, with revenue there skyrocketing by 87% because of higher fee revenue because of a 21% increase in weighted average fees billed per engagement under the Professional Search category. Some of the improvement for the company also came from two different acquisitions the company made.

Profits for the company also came in strong. Net income of $326.4 million dwarfed the $114.5 million reported for the 2021 fiscal year. Operating cash flow nearly doubled from $251.4 million to $501.7 million. On an adjusted basis, it rose to $443.6 million from the $154.6 million reported for the 2021 fiscal year. And finally, we also have EBITDA. According to the figures, this came in at $538.9 million. To put this in perspective, one year earlier, it had totaled $286.3 million.

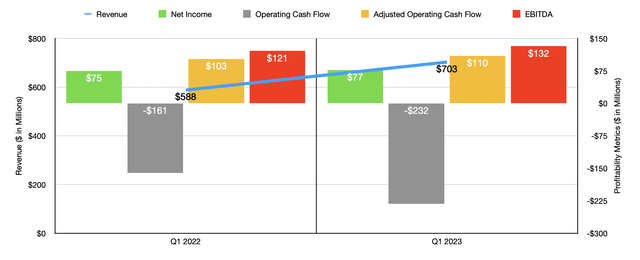

Strength for the company has continued into the 2023 fiscal year. Driven by robust demand and higher pricing for its offerings, Korn Ferry saw revenue in the first quarter of the fiscal year total $703.1 million. This compares to the $588.1 million reported one year earlier. This brought with it surprisingly mixed bottom line results. For instance, net income rose only modestly from $74.8 million to $77.2 million. Operating cash flow actually worsened, declining from negative $160.5 million to negative $231.9 million. Though if we adjust for changes in working capital, the metric would have increased slightly from $102.6 million to $109.8 million. Meanwhile, EBITDA for the company increased from $121.3 million to $132.2 million.

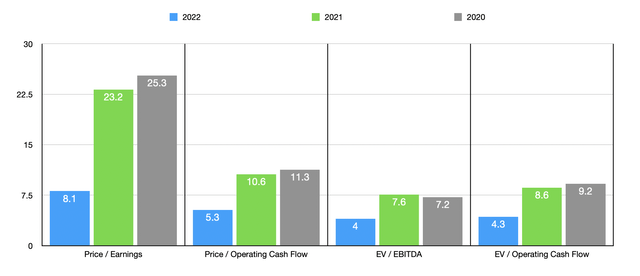

Given how early it is in the 2023 fiscal year and considering that we don’t have any real guidance from management for what the rest of the year will look like, I decided to instead value the company based on what it achieved in 2022. So even if recent mixed, but generally positive performance does not continue, we have some idea as to what the company might be priced at. The price to earnings multiple of the business, for instance, should come in at 8.1. The price to operating cash flow multiple should be 5.3, while the EV to EBITDA multiple of the firm is even lower at 4. The reason why the EV to EBITDA multiple of the company is as low as it is stems from the fact that the company has cash in excess of debt of $500.8 million. For instance, if we were to value the company using the EV to operating cash flow approach, the multiple would drop from 5.3 to 4.3.

As you can see in the chart above, shares do get a bit more expensive if we assume that financial performance reverts back to what we saw in 2021 or in 2020. But even in that case, thanks to the substantial decline in share price the company experienced recently, the business might have some nice upside even if fundamentals deteriorate to some degree. As part of my analysis, I also compared the enterprise to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 8.7 to a high of 29.3. Using the price to operating cash flow approach would give me a range between 7.9 and 14.9. And using the EV to EBITDA approach, the range would be from 5.6 to 16. In all three cases, Korn Ferry was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Korn Ferry | 8.1 | 5.3 | 4.0 |

| Insperity (NSP) | 29.3 | 14.9 | 16.0 |

| ManpowerGroup (MAN) | 8.7 | 7.9 | 5.6 |

| Kforce (KFRC) | 14.4 | 11.6 | 10.3 |

| TriNet Group (TNET) | 13.0 | 9.2 | 7.7 |

| Robert Half International (RHI) | 11.9 | 12.1 | 7.3 |

Takeaway

At this point in time, I recognize that the market is very skittish. This is especially true of a company like Korn Ferry that could suffer from a reduction in demand for the search for labor and tightening budgets that might cause companies to spend less on consulting and other related activities. Having said that, shares do look cheap on both an absolute basis and relative to similar firms. So long as business does not deteriorate tremendously, Korn Ferry should offer some nice upside potential moving forward. And as the economy eventually recovers, that upside could become quite significant. Because of that, I’ve decided to keep my ‘buy’ rating on the company for now. And in the event that shares get even cheaper, I might even consider increasing that to a ‘strong buy’.

Be the first to comment