nicolas_

Omeros (NASDAQ:OMER) had a rough go over the last two years after the FDA accepted the company’s BLA filing for narsoplimab for HSCT-TMA back in January of last year. The FDA set narsoplimab’s PDUFA for October of 2021, but the FDA delayed the PDUFA… and ultimately issued a CRL. As a result, OMER’s share price plummeted from around $20 per share to $2 per share in roughly 16 months. Meanwhile, I was waiting for an opportunity to establish a speculative position in OMER for a profitable trade, but the negative headlines prevented me from pulling the trigger. So, OMER remained a “Bio Boom” candidate for my Seeking Alpha Marketplace Service, Compounding Healthcare. Then, the market decided to sell off for six months and put small-cap healthcare tickers under pressure, which pushed OMER into the oversold territory and de-risked the investment. Using my valuation models and some technical analysis, I determined OMER was worthy of speculative investment at around $3.50 per share and would be undervalued at $1.88 per share. Those targets were hit and I am now celebrating a successful trade after OMER rocketed through my sell targets leaving me with a “house money” position.

Now, I must determine what I am going to do with these remaining shares after a fruitful multi-bagger trade. Has OMER’s long-term outlook improved? What is the Bull Thesis? Should I look to book additional profits? Should look to reload if the share price drops back to my buy targets?

First, I will discuss why I started a position in OMER, and why decided to go “house money”. Furthermore, I intend to ascertain the company’s current status and long-term outlook to determine if I should. In addition, I will discuss some of the risks as well as my current plan for my OMER position going forward.

Max Doom Into Bio Boom

As I mentioned in my introduction, Omeros experienced a tough losing streak regarding narsoplimab’s BLA for HSCT-TMA. The PDUFA delay and the subsequent CRL crumpled OMER’s share price… then, the market sell-off melted OMER down to under $2 per share. At that time, OMER was trading at a market cap of less than $150M, which is about the amount of cash on hand.

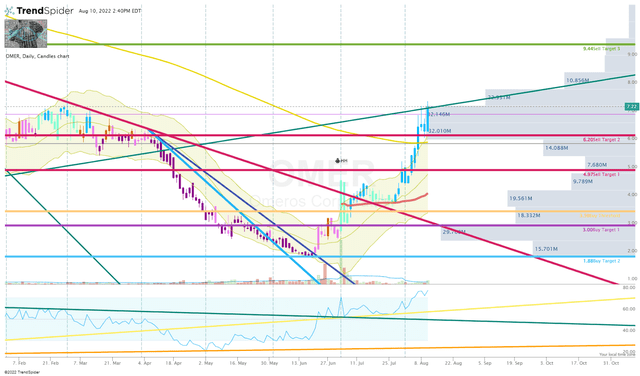

OMER Daily Chart (Trendspider)

OMER Daily Chart Enhanced View (Trendspider)

This extreme level of selling provided an opportunity to take advantage of the discounted valuation with the potential of a mean reversion trade. It is important to note, that narsoplimab is in multiple late-stage clinical trials and still may possibly be approved for HSCT-TMA. Indeed, it is reasonable to see a solid sell-off following a CRL but to cut the ticker’s share price by 90% when the company still has multiple balls still left in play made OMER a prime candidate for the Compounding Healthcare’ Bio Boom Portfolio.

The Compounding Healthcare Bio Boom candidates must be able to provide a near-term trade opportunity with a superior risk-reward profile. This unlocks the ability to quickly book some profits and de-risk the investment to hold for a long-term investment prospect. OMER presented the opportunity to buy the ticker in an oversold condition and at a discounted valuation. Yet, the company’s long-term bull thesis appeared to be intact. Essentially, OMER was a near-perfect Bio Boom candidate under $2 per share.

Thankfully, OMER acted like a Bio Boom ticker and was able was snapback off the 52-week lows and blasted through my Sell Target 1 and Sell Target 2 to transition into a “house money” status. Now, my original investment value has been removed from the market, thus, de-risking my remaining shares to allow Omeros time to execute on their objectives.

Developing A Long-Term Outlook

For me, OMER was an ideal Bio Boom ticker because it presented a great trade opportunity that had long-term prospects, but we will need another level of sophistication to determine if OMER will stay in the Bio Boom Portfolio, or will the ticker be mothballed until it provides another opportunity. Essentially, is OMER worthy of a long-term investment?

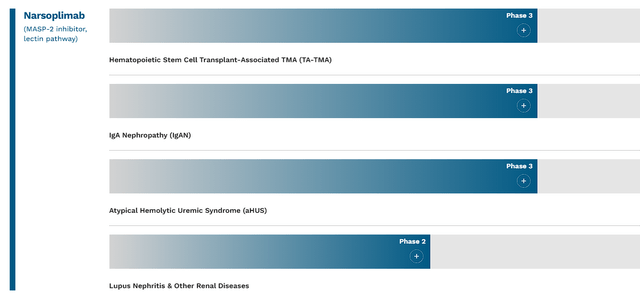

In order for the ticker to remain in the Bio Boom Portfolio, it either has to offer multi-bagger upside potential, or the ticker has to be a great trading vessel that can generate several trades over the course of about five years. For Omeros, I would point to the numerous catalysts that could trigger some trading prospects, while also unlocking some pending intrinsic value. Most of these catalysts come from the company’s flagship candidate, narsoplimab, their leading MASP-2 inhibitor candidate for TA-TMA, IgA Nephropathy, aHUS, Lupus Nephritis & Other Renal Diseases, and even COVID-19.

Narsoplimab Pipeline Programs (Omeros)

The stem cell transplant-associated thrombotic microangiopathy “TA-TMA” indication was CRL’d by the FDA. However, the company is not giving up on this indication and had a Type A post-action meeting with the FDA in the first quarter. Following the meeting, the company decided to file a dispute resolution request in June, which will permit the company to appeal the decision made to the Office of New Drugs “OND”. The company has met with the OND and they are now currently awaiting a decision, which the company expects this month (August). Obviously, approval would have a dramatic impact on the company’s outlook and should bolster the share price.

Moreover, narsoplimab has the potential to treat acute severe COVID-19 as well as for long COVID. The company believes that the lectin pathway is a point of attack in both acute COVID and long COVID. Despite our progress in the COVID-19 vaccine and therapeutics, people are still dying from COVID-19 and millions of people are still dealing with long COVID. Therefore, there is still a huge demand for COVID-19 therapeutics.

The company is also evaluating narsoplimab for the treatment of IgA nephropathy, which is in a Phase III study and has a scheduled read-out by the middle of next year.

In addition to narsoplimab, Omeros has several other pipeline assets that could be supplementary value drivers in the future. The company’s second MASP-2 program, OMS1029, is a long-acting second-gen MASP-2 antibody that is in Phase I clinical trials. The company expects OMS1029 to be “complementary to narsoplimab”. Omeros is also working on small molecule MASP-2 inhibitors as well as oral MASP-2 inhibitors.

OMS906 is the company’s MASP-3 inhibitor for Paroxysmal Nocturnal Hemoglobinuria “PNH”. OMS906 has the FDA’s orphan drug designation for PNH. The company expects to present Phase I trial results at a major Congress later this year. Moreover, the company is looking to evaluate OMS906 against C3 glomerulopathy.

The company also has OMS527, their PDE7 inhibitor asset for addictive disorders. The company is looking for “third-party funding to continue development.” Emory University testing PDE7 inhibitors to improve L-DOPA-induced dyskinesias and should see the dyskinesia data early next year. Obviously, having a product that could work for addictive disorders as well as Parkinson’s would be a valuable asset with blockbuster potential.

Into the bargain, the company made a deal with Rayner Surgical for the ophthalmic drug, OMIDRIA. This was a “strategic divestiture” that included an upfront payment of $125M with an extra $200M in commercial milestone payments along with royalties on net sales of OMIDRIA. Altogether, Omeros stated that “the transaction is valued in excess of $1 billion.”

Considering the points above, I would Omeros has plenty of potential catalysts and drivers that could dramatically change the company’s long-term outlook.

My long-term thesis will center on OMIDRIA providing Omeros with significant cash flow from royalties to help offset expenses until they can get narsoplimab across the finish line. Then they can turn their focus to developing their MASP-2, and MASP-3 inhibitor franchise and become a leader in the alternative complement pathway.

So, there is some justification for holding some OMER shares beyond a simple mean reversion trade.

Downside Risks

On the other hand, Omeros has a few downside risks that investors need to consider when managing their position. Firstly, the company needs to get narsoplimab through the FDA in at least one indication. Obviously, approval of the TA-TMA indication would be ideal and could improve the sentiment around the rest of narsoplimab’s programs. However, it is possible that OND’s decision does not favor Omeros, and the company is stuck running another clinical trial or possibly abandoning the indication. Clearly, that would have a negative impact on the drug’s prospects and hurt the company’s near-term outlook.

Another concern is the company’s cash position, which was at $122.6M at the end of Q2. The company saw a $19.7M drop in their cash position from the first quarter to the second quarter, so it appears as if finances are not an immediate threat. Still, the company is burning cash at this point in time and is still a threat to shareholder value until the company is able to report sustainable profits.

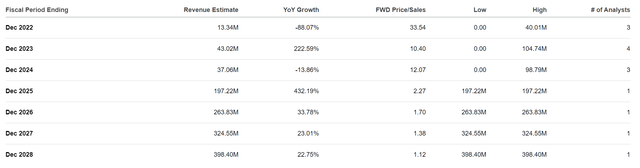

OMER Annual Revenue Estimates (Seeking Alpha)

Looking at the Street’s revenue estimates, it looks as if analysts are not expecting Omeros to clear $100M until 2025. Considering Omeros had -$155.2M in operating income last year, it looks as if the company is several years away from breaking even. Therefore, the cash burn could lead to the company taking on debt or dilutive financing.

Considering these risks, I have assigned OMER a conviction level of 2 out of 5.

My Plan

Now that my OMER position is de-risked, I need to figure out how I am going to manage this position going forward. On one hand, I am happy to have booked some profits and would be content with simply putting OMER in the back of the sock-drawer for the next few years to allow the company to maximize shareholder value. On the other hand, OMER could become an excellent trading vessel over the next several years as the company continues to move narsoplimab through its clinical trials and develop their other pipeline programs.

If narsoplimab is approved for HSCT, OMER would not only have an improved long-term outlook, but the ticker would also be in play for years to come as other narsoplimab indications move closer to the finish line to potentially expand its label. Therefore, my plan is to hold onto my remaining shares for the foreseeable future. What is more, I am willing to re-accumulate a position just in case the market wants to roll over and take OMER with it. Therefore, I am going to set some buy orders around my current buy targets. If those buy orders are filled, I will immediately reset my sell orders with the intention of booking profits and regaining a “house money” position. I expect to maintain this strategy as long as Omeros is reporting a negative EPS in order to limit my downside risk.

If Omeros is able to report a positive annual EPS, I will consider graduating OMER from my speculative Bio Boom Portfolio and transition it to my “Bioreactor” growth portfolio.

Be the first to comment