Kriangsak Koopattanakij

Published on the Value Lab 12/8/22

We covered Udemy (NASDAQ:UDMY) a little less than a year ago, and at the time it had competitors with a better profile. That has since changed. Udemy has executed very well, and it performs in the important parts of its business. As a platform business the economics are good and the dynamics are winner-take all. We think Udemy could get into a position where its economics could suddenly see marked improvement. Yes, the company does burn cash at the moment, and it must for competitive reasons, but it is getting rather cheap. We think it’s a buy.

Main Developments in Q2

The Q2 results have come out and some of what you might have expected has played out. Consumer segment is in YoY decline, which is not a surprise coming off the ideal pandemic environment. Growth there was going to be mostly unsustainable, but having grown the platform, even if it isn’t continuing now, was of benefit given Udemy’s position as a platform company. With more consumer customers than in past years, there is more opportunity for instructors. More instructors offering courses, more competition and better quality courses that could eventually be chosen for their business segment, where Udemy promotes and sells courses in different areas to companies who use them as part of their onboarding and training.

That business segment is what matters ultimately. The revenues are highly recurring and the economics of selling to business customers are better. Udemy is achieving better growth with larger clients, 79% YoY with >$100k ARR customers and 60% with customers >$1 million. That’s really great progress in penetrating larger markets. It shows in the marketing costs which have increased by over 30%, with overall revenue increasing by 21%. Hosting costs have gone up, and so have other costs associated with COGS, which has also risen more than 21% to crimp margins a bit.

But who cares, because now business actually accounts for half of the company’s revenue, with over 70% growth in both ARR and revenues. It’s fantastic performance thanks to some major contract wins, one in particular with a professional services firm. By being the platform through which instructors try to get in with corporate clients, the relationship of course being brokered fully by Udemy, the industry structure they’ve forged for themselves is really excellent.

In the meantime, Coursera (COUR) has seen a fall off in its growth rates due to its greater exposure to consumer through its universities link. Its exposure to enterprise is quite a bit less than Udemy’s is now. They have similar gross margins though, but with better recurring revenue opportunities in enterprise and great execution, ahead of Coursera, in land and expand, they are ahead in a market that has winner-take-all dynamics, where instructors especially will preferentially attach to the more prolific and potentially profitable platform, thus increasing the quality of courses on that platform.

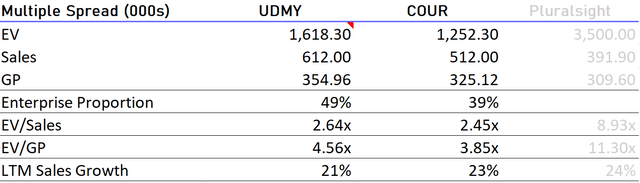

From a valuation point of view, UDMY has acquired a slight premium of 10-20% over COUR which is entirely justified. UDMY’s growth is higher quality given the enterprise prevalence. Although we must admit the university connections that Coursera has does make its currently slowing down consumer segment better than Udemy’s.

Comps (VTS)

Conclusions

This isn’t a stock without risks. It burns cash, and quite a lot of it, and will have to do so to stay ahead of the game. It is essential, and it shows in the marketing cost bloat. We think this is a very worthwhile investment. And what’s more is they can likely sustain about five years of this at the current clip with current cash piles, so the recent VC discount will not come to bite them and they are not hamstrung at a critical moment. Ideally they’ll grow their spend, in which case the cash burn will decimate cash balances probably a bit sooner, maybe in 2.5 years if they’re aggressive.

The bigger issue is actually the macroeconomic environment, to which the company is not immune. Slowdowns in hiring could come even though we still have quite a lot of corporate optimism. We are seeing layoffs already. While some of this might just be trimming fat, the decline in consumer confidence will come home to roost with enterprise tech players, now including Udemy.

Still, the marketing costs are almost all of their operating expenses. A 30% or higher EBIT margin is doable. At current multiples, that would convert to a theoretical 9x EV/EBIT multiple, which is low considering the growth rates, of course ignoring the cash burn that will happen before they decide to focus on bottom line. There are those demand side economics to love as well, although it could be called a ‘race to burn’ given that it does share markets with a pretty symmetric competitor in Coursera. It’s hard to call a bottom, and we won’t have money in this, but who knows, because in our book this might be a high conviction, fallen angel buy right now.

Be the first to comment