Justin Sullivan

Thesis

Since AT&T (NYSE:T) spun off Warner Bros. Discovery, many investors have taken a keen interest in T stock. The markets excitement is mainly driven as a function of perceived valuation: Down nearly 40% from December 2021 highs and trading at a P/E of about x7, the stock appears to be a bargain. I do not agree. Personally, I argue AT&T is priced very efficiently as investors should consider the company’s valuation in relation to growth and leverage. Moreover, a residual earnings framework, anchored on analyst consensus EPS calculates a fair implied share price for AT&T of $22.35/share. With only 20% upside, investors can focus on better opportunities.

About AT&T

As measured by revenues, AT&T is the world’s largest telecommunication company and the third largest provider of telephone services in the US. The company claims to reach more than 255 million people and further highlights to operate the most reliable 5G network in the US, as well as being #1 rated in customer satisfaction for fiber. With the advent of 5G, which the company deems the most ‘transformative wireless technology yet’ with huge potential to ‘spark innovation in everything from transportation to entertainment’ the company has initiated strategic decisions to re-focus fully on data and communication infrastructure. AT&T estimates that by 2025, the US will consume 5 times as much data as the country did in 2021.

As a world leader in communications and technology, we’re beginning to unlock the promise of 5G to redefine how you engage with media and entertainment. 5G will ultimately change how you live, work and play, and will help businesses increase efficiency, empower workers and drive innovation in ways we can only imagine

Accordingly, the company sold its media assets including Vrio, Warner Media and DirecTV. Spinning out the media business was the right strategic move, in my opinion. Investors should consider that if AT&T would have kept its interest, the company would have needed to invest heavily in content production and streaming development. This would have taken too many resources that can be more efficiently allocated to 5G investments. Moreover, reflecting on the observation that Warner Bros. Discovery shares are down almost 50% since the deal has closed indicates that AT&T sold out its stake at a favourable valuation.

Fundamentals Imply Fair Valuation

In Q2 2022, AT&T generated total revenues of $29.6 billion, versus $35.7 billion in Q2 2021. The -17.1% year over year negative growth, however, was mainly driven by the Warner Bros. sale. Net income for the June quarter was $5.5 billion (18.6% margin), up by about 7% year over year.

If investors assume that $5.5 billion per quarter is sustainable, AT&T would effectively trade at a P/E below x7 (reference $150 billion market cap). This is a bargain multiple. But the analysis is oversimplified. Investors should consider that AT&T has about $154.8 billion of net-debt, which must be amortized by the company’s operations. Accordingly investors should apply an unlevered multiple, e.g., EV/EBIT. AT&T’s enterprise value as of August 10th is $321.7 billion and the company’s TTM EBIT is about $22.64 billion. Thus, I calculate a EV/EBIT multiple of almost x14. Is this a bargain? I do not think so.

Moreover, investors should consider that AT&T is expected, according to analyst consensus forecasts, to generate little to no growth for the next three years (Source: Bloomberg Terminal as of 15 August 2022). And as a consequence, there is little upside for the x14 EV/EBIT multiple to improve.

Residual Earnings Valuation

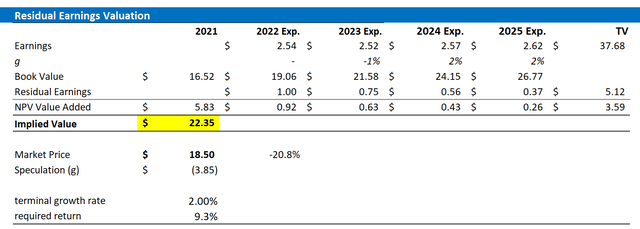

Let us now look at the valuation. What could be a fair per-share value for AT&T’ stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on AT&T’s cost of equity at 9.3%.

- To derive AT&T’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply a 2 percentage points to reflect growth in line with nominal GDP growth.

Based on the above assumptions, my calculation returns a base-case target price for AT&T of $22.35/share, implying material upside of almost 35%.

Analyst Consensus EPS; Author’s Calculations

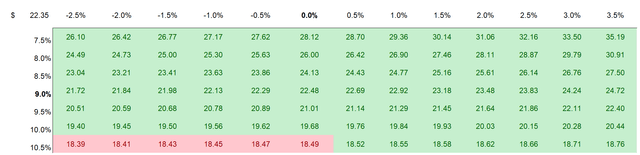

I understand that investors might have different assumptions with regards to AT&T’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculations

Conclusion

AT&T is trading at a P/E of less than x7. But don’t let this multiple fool you. It is a trap. Investors should consider that AT&T has more than 100% net-debt as a percentage of market capitalization. Accordingly, AT&T’s true valuation as a function of earnings (EV/EBIT) is almost x14. Moreover, the company is expected to generate little to no growth, which would help the multiple to improve. In my opinion, this is not how a bargain opportunity looks like. Also, if investors consider AT&T’s 5-year EV/EBIT trading multiple, T stock is valued only 5% below the historical average-which is a non-noteworthy deviation. Personally, I see T stock fairly valued at $22.35/share. I anchor my argument on a residual earnings model with EPS expectations based on analyst consensus estimates. AT&T is a Hold.

Be the first to comment