Sjo/iStock Unreleased via Getty Images

It goes without saying that the pandemic outbreak has severely restricted the whole aviation industry. It is not the first time that we’re talking about travel recovery, just a few months ago here at the Lab, we anticipated that this summer could finally be the one where we see the V-shape recovery from pre-COVID-19 levels. After two years of frustrated expectations due to restrictions on air flights, airlines are increasingly confident for the summer. Having said that, for the whole year, there are uncertainties linked to the war in Ukraine and to the increase in fuel price.

With the capital increase finished, Air France-KLM (AFRAF; AFLYY) is poised to cope with strong travel demand. The proceeds will mainly be used to repay a French state aid package and reduce related financial costs and other debts obtained during the crisis triggered by COVID-19, also to strengthen the group’s financial position and to increase strategic flexibility. This was a widely anticipated move as part of its efforts to gain shareholder support to look beyond the COVID-19 pandemic and invest in recovery travel. With travelers, affected by airport delays in recent weeks, hoping that the global tourism industry can address the staff shortage, the company CEO said that they “have hired 300 pilots, 300 mechanics … we have taken that risk. Our planes are ready to take off“.

Looking at the capital increase details, 1,928 million of new shares were issued at a subscription price of €1.17 per share. At first sight, the size of the recapitalisation was impressive, because it was equal to 80% of the market capitalisation of Air France-KLM just before the announcement with a 73% discount compared to the previous day’s closing price. In reality, the discount was standard, taking into account the market context and the issue size. The discount comes in at around 40%, if we take into account the value of the shares once the preferential subscription right, equal to €2,345, has been removed. This discount is also consistent with the latest operations carried out in the sector. For example, Lufthansa carried out a capital increase with a discount of 39.3% last autumn and in the case of Easyjet it was 35.8% last September. The new shareholder structure will be as follows: the French state, with 28.6%, and the Dutch state as owner of 9.3%, who participated pro rata in the capital increase. The maritime transport group Cma-Cgm entered the capital with 9% with an investment of €400 million betting on growing demand for cargo on airplanes in the midst of challenges from supply chain bottlenecks. China Eastern Airlines and Delta Air Lines will only partially follow the recapitalisation and their shares were diluted from 9.6% to 4.7% and from 5.8% to 2.9%, respectively.

Conclusion

In the Q4 results we saw an impact by the Omicron variant that took airlines by surprise as they were just gaining momentum. During the Q1, China and Japan were severely affected by lockdowns that were partially offset by positive performances in Southeast Asia and India. Also the Russian invasion of Ukraine was not doing the company any favours. Having analysed other companies, our internal team believes that the transformation program is not producing any relevant results. Despite strong performances thanks to the cargo business, we have decided to initiate the coverage with a neutral rating, as we did for Deutsche Lufthansa, continuing to prefer other players in the sector namely: Ryanair as an airline operator and Deutsche Post as a logistics operator. (Here below you can see Mare Evidence Lab’s previous publications)

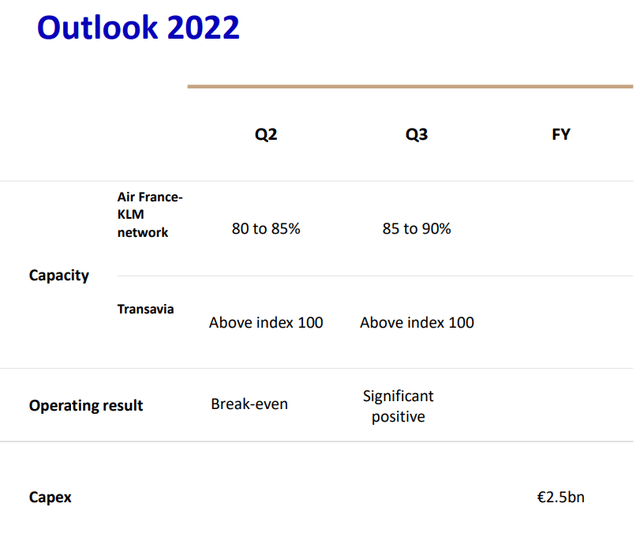

Air France-KLM Guidance

Source: Air France-KLM Q1 Results

The major risks that could impact Air France-KLM’s stock price includes:

- Higher cash burn due to fuel costs and labour inflation;

- Macroeconomic events;

- Worsening conditions from the current health crisis;

- Higher competition.

Previous coverage in the travel and leisure industry:

- Deutsche Post: Strong Results And A New Buy In Our List

- Expedia: U.S. Exposure And Travel Recovery Will Play In Its Favour

- easyJet: Short Turbulences, Long Upside

- Ryanair: Our Bet On Travel Recovery

.

Be the first to comment