Nelosa/iStock via Getty Images

From Dusk Till Dawn

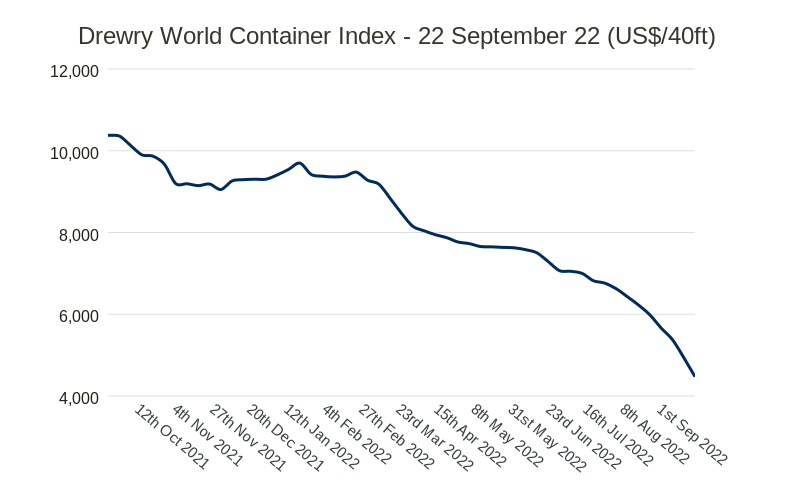

Less than nine months ago, container rates (and, therefore, stocks) were still running super-hot, with a 40-foot container still fetching nearly $10k.

At the time, we wrote that “KEN stock price goes where ZIM stock price goes, and currently, there seem to be very little (dark/stormy) clouds in ZIM’s bright skies.”

Container rates maintained high levels for another 3 months, but then Russia invaded Ukraine and changed the container landscape almost overnight.

With the world economy slowing rapidly, and global trade taking a step back, a clear path toward lower container rates was formed.

Drewry

Not only have container rates been more than halved (since the peak, a year ago), but it seems like there’s no end to the ongoing decline.

As per Drewry, who is publishing the World Container Index (emphases ours):

The composite index decreased by 10% this week, the 30th consecutive weekly decrease, and has dropped by 57% when compared with the same week last year.

The latest Drewry WCI composite index of $4,472 per 40-foot container is now 57% below the peak of $10,377 reached in September 2021, but it remains 21% higher than the 5-year average of $3,704.

The average composite index for the year-to-date is $7,692 per 40ft container, which is $3,988 higher than the five-year average.

Drewry

From Boom To Bust

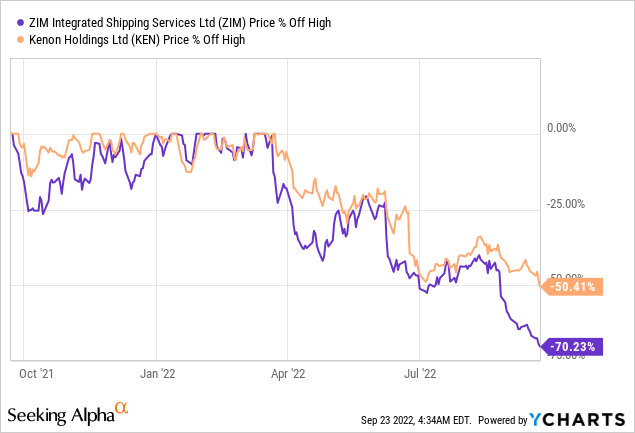

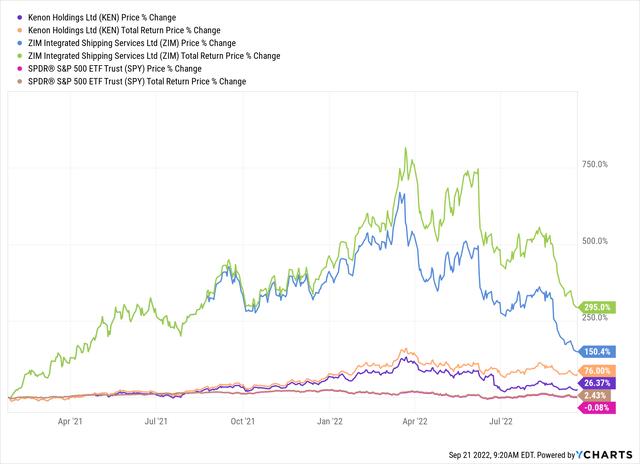

Stock prices of both ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) and Kenon Holdings Ltd. (NYSE:KEN) kept climbing until the end of Q1/2022. However, they have performed roughly in line with – and even worse than – container rates ever since.

At the time of writing, ZIM has lost over 70% of its value (price-wise only), and KEN more than halved.

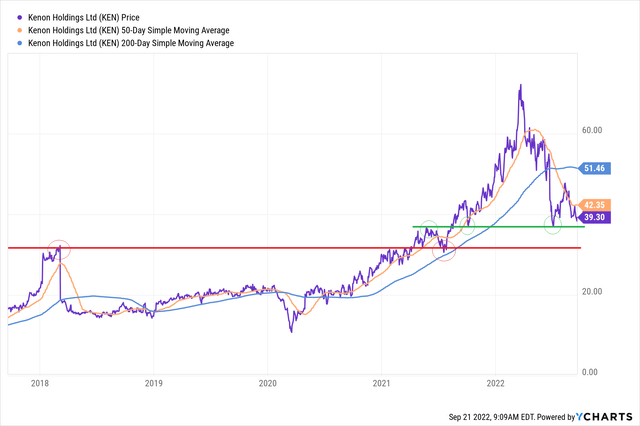

YCharts

It’s important to note that even in light of these massive drawdowns these two stocks are still faring much better than the market.

If we look at how the two stocks have performed compared to the SPDR S&P 500 ETF (SPY) since early 2021 (when ZIM went public), the level of outperformance is still significant (especially when it comes to ZIM).

Being a “Container Contrarian”

The questions shareholders of ZIM and KEN are asking these days are:

1) How low can container rates move down, consequently how low the stock prices of ZIM and KEN may trade?

2) Is there hope for a recovery in container rates that would allow for KEN and ZIM stock prices to reverse the current (declining) course?

In this article, we will try to answer these two questions and explain why we remain buyers of these stocks even at a time when it feels like everybody is only looking to sell.

Let’s look closer at the two sentences we emphasized at the bottom of the Drewry quote (above):

- “remains 21% higher than the 5-year average.”

It seems like everybody is focused on rates being down 57% from their peak, while completely ignoring that they’re still significantly higher than the historical norm. Putting it differently, container ship operators are still making more money these days than they have in 2020, 2019, 2018, 2017, and a few years before that, too.

Bloomberg

It’s beyond our grasp why most everybody is focused on the glass being half-empty (off peak) rather on the glass being half-full (historical perspective)!?

- “The average composite index for the year-to-date is $7,692 per 40ft container, which is $3,988 higher than the five-year average.“

If you ask yourself how good 2022 (still) is for container ship operators, keep in mind that the average rate they have seen in 2022 is ~108% higher than the average rate they have seen in recent years, surely since KEN went public (early 2015).

Sure, we’re way off-peak.

Sure, the year ended in Q1/2022 was nothing like we’ve ever seen and it’s unlikely to be as good in the foreseeable future.

But can we sell a stock just because its best-ever year is behind us!? I mean, since when do we value a stock solely based on its peak performance and not on an ongoing basis!? That’s, in my book, quite ridiculous!

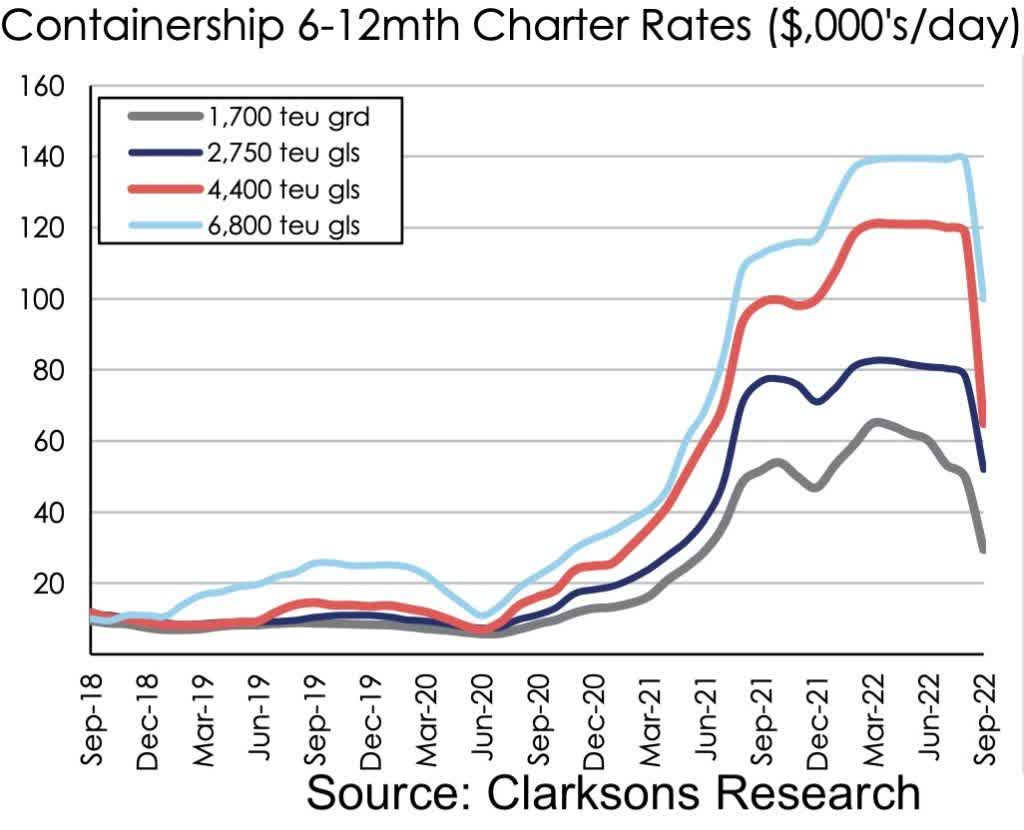

Clarksons

At this point, it’s clear that ZIM, KEN, and all other container-related stocks for that matter are trading solely based on short-term economic/recession fears with complete disconnection from long-term fundamentals.

Let’s take a closer look at each of the stocks and see why we believe they’re both “Strong BUYs” at this point in time for those who look beyond the next 12 months.

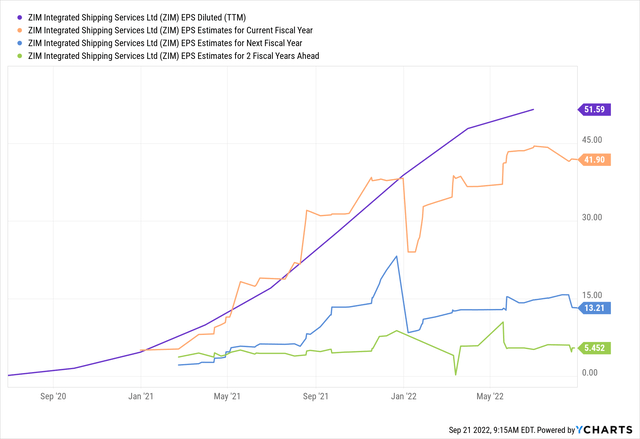

ZIM

At $26.38 (closing price on Sep. 22), even if ZIM earns “only” $5/year, this is still a ~5.3x multiple, and if the company pays 50% of it as dividend, the yield would still be ~9.5%.

The company still makes very decent cash flows, but most of all – people forget that just as the cycle ended a few months ago, a new one may start in 1-2-3 years.

Then what? ZIM would be worth $80 again just as it was worth 6 months ago?

The only reason to dump ZIM is if someone believes in: 1) deep, long, recession (unlikely, taking into consideration modern central banks’ policies); 2) lower container rates for longer (possible, but not probable – it’s unlikely for rates to move significantly below long-term average when supply-chain is still an issue); and 3) a new cycle is many years away (i.e., not 1-2-3).

Even if I assign probabilities of 30%, 40%, and 50% (more generous than we believe they truly deserve) to each of the above scenarios, respectively, the combined probability (for them all to happen, at the same time) would be only 6% = 30%X40%X50%; let’s make it a 10% probability for the sake of being (even more) conservative.

Selling a stock with a “doomsday” multiple of 5.3x and a dividend yield of 9.5% for something that has a 10% probability? That’s plain dumb.

KEN

As for Kenon, there are four important points we wish to make:

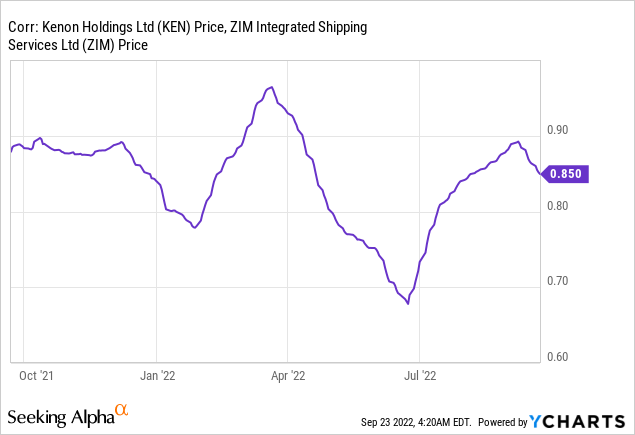

1) Indeed, there’s a high correlation between KEN and ZIM, and so it’s very much true that KEN goes where ZIM goes.

YCharts

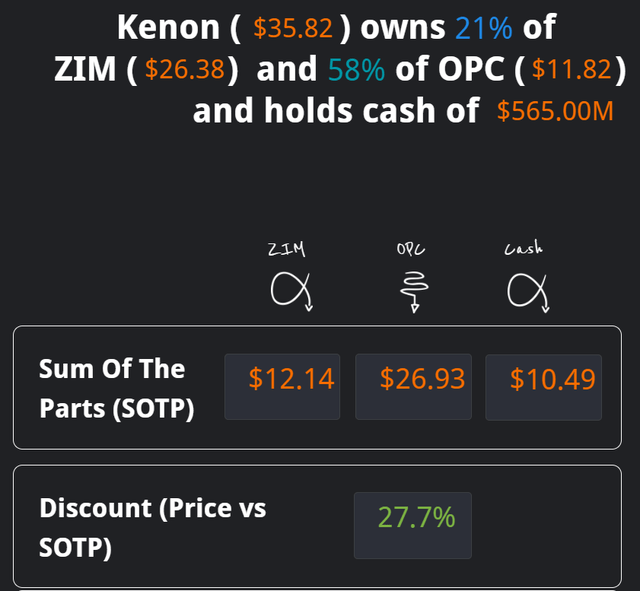

Nevertheless, if you look at the three main parts that make the valuation of KEN – ZIM, OPC Energy (“OPC”; more details hereinafter) and cash – ZIM accounts for less than 1/4 (see below chart).

How come?

- KEN has reduced its holding percentage in ZIM this year.

- OPC is way more significant for KEN than ZIM (and OPC is performing way better than ZIM this year).

- KEN keeps a lot of cash in its balance sheet (thanks to the dividends from ZIM) and it’s unclear yet what they’ll do with it (dividends to investors or a new big investment/holding?).

In more simple words, the impact of ZIM on KEN is smaller than it was, and surely smaller than many people assume.

Kenon today is more an energy play than a containership play!

2) Based on a “Sum of the Parts” (“SOTP”) analysis, the discount to the company’s holdings is now approaching the 30% mark, which historically marks a buying opportunity.

The below chart was prepared by @DerekCheung (who is updating the chart periodically) and can be viewed through his dashboard.

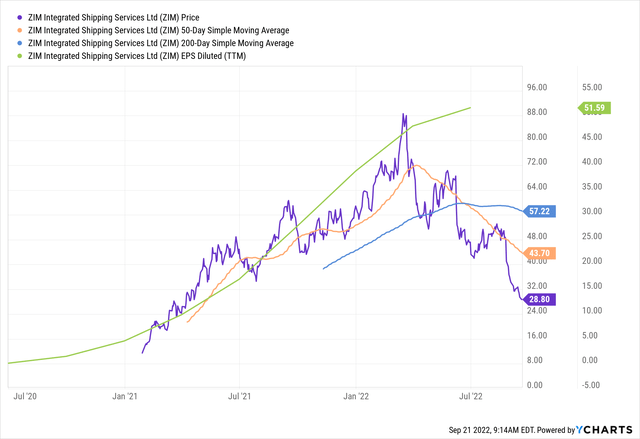

3) Technically speaking, KEN is now trading right at its (first, green) support line.

If this first line of defense breaks down, the next one is the red line at the low 30s. This isn’t a big downside, compared to the upside potential if and when things stabilized.

4) The most important point to make about KEN is its holding in OPC.

First and foremost, you can see how strong this holding is by looking at the below chart which is the complete opposite to ZIM’s chart.

Even more important than that, the prospects for the company’s growth and earnings are very bright.

The OPC subsidiary announced last week that it will build a natural gas power plant designed to capture climate-changing carbon in West Virginia.

Here are a couple of points mentioned by Giora Almogy, CEO of OPC, in an interview that he gave (in Hebrew) this week:

- “We will double our production capacity in Israel next year.”

- The Inflation Reduction Act of 2022 “gives us certainty for 10 years. We will receive $85 in cash for every ton of carbon dioxide that will be buried in the ground.”

- “The third quarter is usually stronger because of the electricity consumption in the summer. The electricity tariff in Israel has increased by 13% and in addition to that the gas prices in recent months, at least in the US, are very high and they greatly affect our results there. As electricity and gas prices rise, we can ultimately earn more.”

Valuation & Risks

When we refer to the valuation of ZIM and KEN, it’s crucial to keep in mind that both companies (especially ZIM) are distributing a lot of their free cash flows as dividends to shareholders. As such, the price targets for these companies must be adjusted for the big sums that they’re distributing.

At the moment, our price target for ZIM is $55 and for KEN is $70, reflecting a double potential for each of those, though not necessarily for the same reasons.

In the case of ZIM, we assume a long-term profitability of $5-$6 and we’re using a multiple of 10x = $55 at midpoint.

In the case of KEN, we actually believe that OPC would be the bigger driver for price appreciation, especially if energy prices remain as high (or even higher) than they are these days.

In both cases, cycles play a major role, so container rates and/or energy prices are having a huge impact on the results, thus valuations.

For the sake of this article, we set the PTs with a 24-month view, but again – these prices may need to adjust depending on how big future distributions are.

If future distributions would be “normal” (<8% on an annual basis), we see no reason to adjust, but if they would be out of the ordinary (>20%), as the past year was – this will need to be taken into consideration.

The main risks for ZIM are:

- Lower (for longer) container rates

- Deep recession that will lead to lower (freight) volumes

- China growing a lot less than its historical pace

- Supply-chain disruptions/Port congestions disappearing completely

- Change of control, if Kenon decides to sell its controlling stake (A move which is very difficult to make as it requires a pre-consent by the government of Israel)

The main risks for KEN are:

- All of the above (risks of ZIM = risks for KEN)

- Lower energy prices

- Change in policies supporting green/renewable energy

- No dividends coming from ZIM, draining one of the main liquidity sources that allows KEN to keep investing in OPC and/or in other/new projects

Container Contrarian

In light of where container rates are trading and how the global economy is looking, I guess that we can be viewed as “Container Contrarians.”

Things are likely to remain difficult (economically) over the next 12 months, at the very minimum. However, we must keep in mind that:

- Historically, stocks start recovering before the economy does.

- The sooner things get worse – the earlier the Fed would start backing off (from being hawkish).

The first headline of this article reads “From Dusk Till Dawn,” and we believe that it won’t be as long as many investors currently think before a new dawn will be upon container rates, subsequently container/related stocks.

KEN isn’t only the stock symbol of Kenon Holdings but it also means “Yes” in Hebrew.

We say “Yes” to KEN.

We say “Yes” to ZIM.

We know that stock prices of container-related companies aren’t going to rise straight away.

We know that container rates aren’t going to recover for (at least) a few more months.

But we also know that investing isn’t about today’ next week, or next month. You sow the seeds before the winter and you reap the fruits in the summer.

We’re sowing the seeds of love today, wiping the tears, and overcoming the fears.

Be the first to comment