LukaTDB/E+ via Getty Images

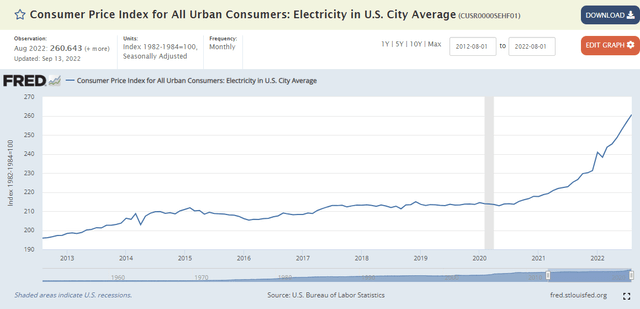

Electricity prices are climbing rapidly across the nation as natural gas, often the marginal fuel type for power generation, has more than doubled in the last few years. Though off the highs of 2022, $7 Henry Hub prices are a far cry from cheap levels seen during much of the last decade. Many utilities that properly manage risk can profit from higher retail prices, but it’s tricky as there are often higher input costs too.

One firm, based in the PJM power market, has upside growth prospects but comes at a high price. Is it worth it? Let’s dive in.

CPI: Electricity Prices Soar in 2022

According to Bank of America Global Research, PPL Corporation (NYSE:PPL) operates regulated electric and gas assets in Kentucky, Pennsylvania, and Rhode Island. The Pennsylvania segment operates as a transmission and distribution business. The company’s Kentucky segment, named Louisville Kentucky Electric, consists of two companies: Louisville Gas and Electric, and Kentucky Utilities. Louisville Gas and Electric focuses on regulated generation, transmission, distribution, and sale of electricity and natural gas in Kentucky.

The firm has upside potential due to its fossil fuel generation assets. It used to be that this was a major downside risk, but with ongoing retirements across the nation, particularly in PPL’s footprint, those power plants left standing are poised to be very profitable given elevated electricity prices. Moreover, PPL is seen as an Inflation Reduction Act beneficiary. Downside risks are around regulatory and capital market conditions, potential natural disasters, and unfavorable tax rate changes. There’s also uncertainty around how PPL’s Rhode Island assets integration goes.

The Pennsylvania-based $20.9 billion market cap Electric Utility industry company within the Utilities sector trades at a very high 28.5 trailing 12-month price-to-earnings ratio and pays a respectable 3.2% dividend yield, according to The Wall Street Journal.

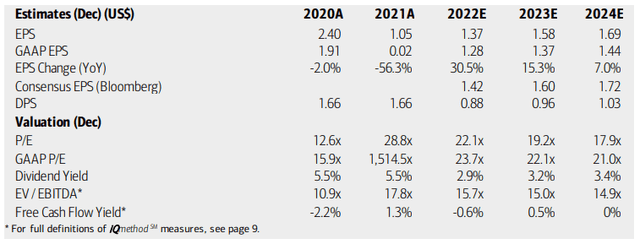

On valuation, BofA analysts see strong EPS upside through 2024, which may come as a surprise for a ‘boring old utility’ company. Bloomberg is even more sanguine on shares. More ammo for the bulls – the dividend is expected to increase handsomely over the next two years. Free cash flow yield, though, is weak and its EV/EBITDA ratio is high. Overall, investors are paying up for growth and relative safety in PPL.

PPL Earnings, Valuation, and Dividend Forecasts

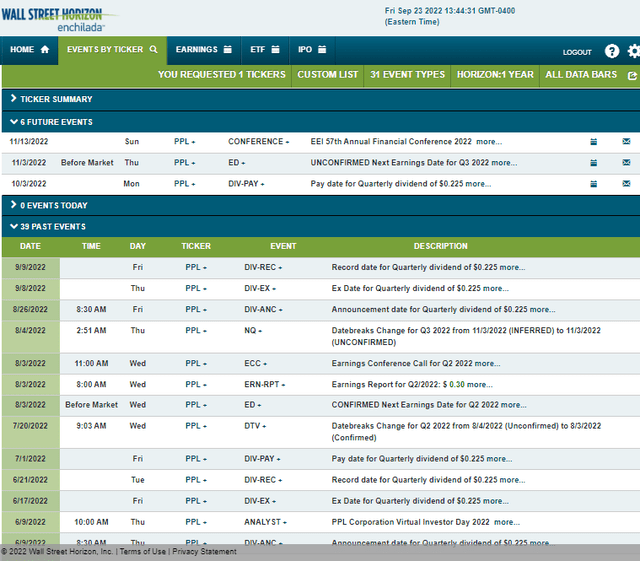

Looking ahead, corporate data provider Wall Street Horizon shows an unconfirmed Q3 earnings date of Thursday, November 3 before market open after a dividend payable date on Monday, October 3. Shortly after the earnings release, the management team is expected to present at the EEI 57th Annual Financial Conference 2022.

Corporate Event Calendar

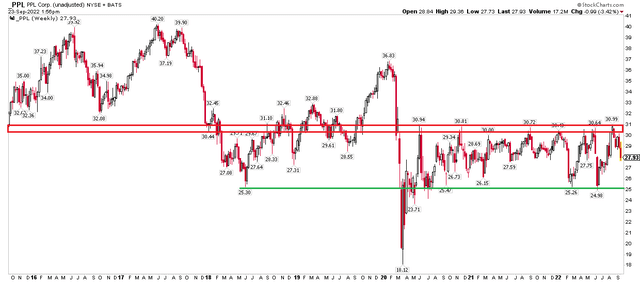

The Technical Take

With a lofty valuation, but relative strength over the last year, what does the chart say about PPL? It’s about as straightforward as it gets. There’s a clear trading range between $25 and the low $30s. I think the play here is to buy on the dip into the mid-$20s, with a stop under $24.

On the upside, a breakout above $31 would be bullish and portend a measured move price objective of about $37 – which is the pre-pandemic high. These are some of the key price levels to monitor.

PPL: Shares Rangeboud, Buy the Dip

The Bottom Line

PPL is a hold here as the valuation is high, but its growth outlook appears to be improving. With a defined trading range, it’s hard to get too excited, but with market turmoil unfolding, there should be continued relative strength in this Utilities stock should volatility persist.

Be the first to comment