Teamjackson/iStock Editorial via Getty Images

In my last article about Amazon.com, Inc. (NASDAQ:AMZN) in March 2022, I asked the question if Amazon is finally a buy (at that point, the stock was trading for $142). In my conclusion I wrote:

I am rather neutral on Amazon right now and I think it is possible that the support level will hold, and the stock might move higher again. However, I don’t know if Amazon can set new all-time highs in the foreseeable future. And I also don’t think that Amazon is a bargain right now or a great investment. The company is without any doubt a great business and will be able to grow with a high pace for several years to come – but at current valuation multiples, it has to be.

We now know the support level did not hold and the stock declined to the next support level around $100 (back then it was about $2,000 in the not split-adjusted chart). In the meantime, Amazon stock already bounced back to the previous support level around $145 and then declined again – and the last quarterly earnings really accelerated that decline and pushed the stock down to only $90.

Quarterly Results

At a first glance, the result doesn’t seem so bad, and one won’t necessary expect a 20% decline that followed in the days since earnings were reported on October 27, 2022. While the company beat on earnings per share expectations, it missed revenue expectations, but only by $370 million. This seems neglectable when considering total net sales of $127,101 million in Q3/22. Compared to the same quarter last year ($110,812 million in net sales), the top line increased 14.7% year-over-year. While net product sales increased from $54,876 million to $59,340 million (resulting in 8.1% year-over-year growth), net service sales increased from $55,936 million to $67,761 million (resulting in 21.1% growth).

But while the top line increased, operating income declined 48.0% YoY from $4,852 million in Q3/21 to $2,525 million in Q3/22. And diluted earnings per share also declined from $0.31 in the same quarter last year to $0.28 this quarter.

The biggest disappointment for investors was probably the company’s guidance for the fourth quarter. Amazon is expecting net sales to be between $140.0 billion and $148.0 billion, reflecting only between 2% and 8% growth compared to Q4/22 (the guidance anticipates an unfavorable impact from foreign exchange rates of 460 basis point). Operating income is expected to be between $0 and $4.0 billion, compared to $3.5 billion in the same quarter last year. And any growth rate below 7% would be the lowest quarterly growth rate for a long time (probably the lowest growth rate ever).

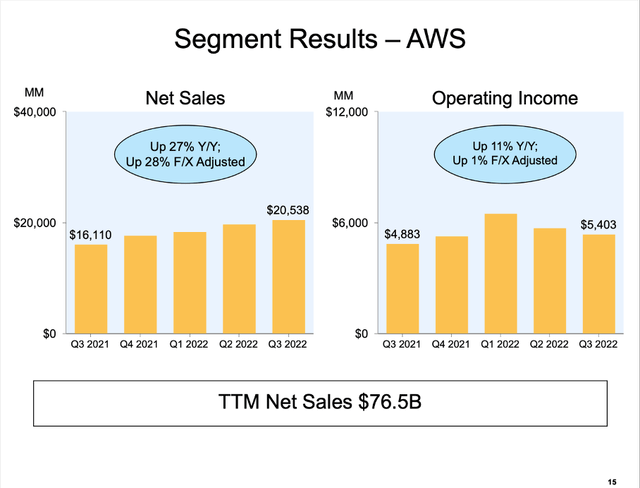

AWS: Cash Cow

When looking at the different segments, the picture is quite similar as in the last few quarters and years. Amazon Web Services, which was already launched in 2002, continues to be the cash cow for Amazon, and it is the segment which is generating almost all the operating income. In the third quarter of fiscal 2022, AWS generated $20,538 million in net sales. Compared to the same quarter last year, this resulted in 27% year-over-year growth (28% in FX adjusted numbers). Operating income in Q3/22 was $5,403 million, resulting in 11% year-over-year growth.

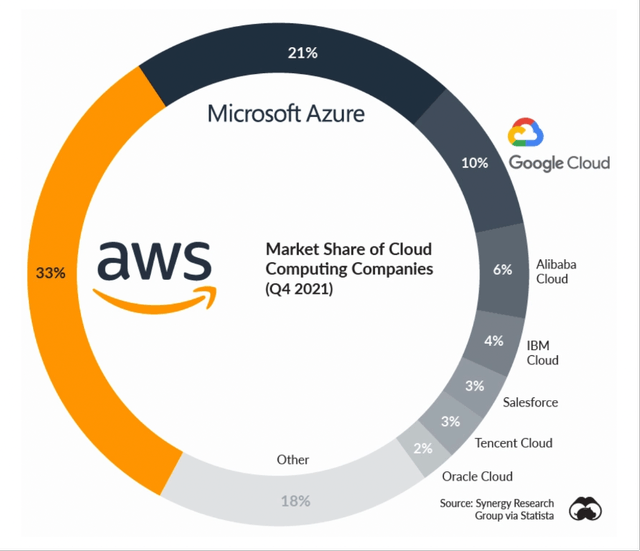

And as we can see in the chart below, Amazon is the clear market leader in a fast-growing market. In Q4/21, Amazon AWS had a market share of 33% and was clearly ahead of its two main competitors – Microsoft (MSFT) with Microsoft Azure and Alphabet (GOOG, GOOGL) with Google Cloud.

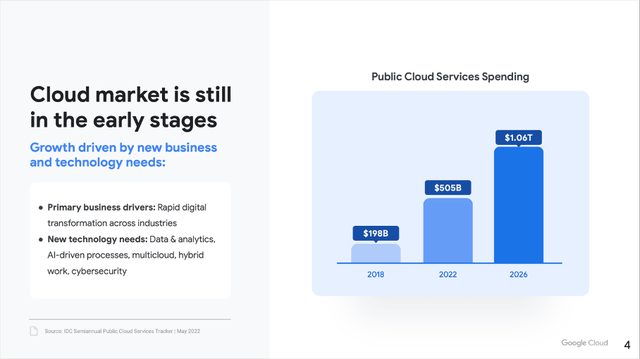

In my previous article about Alphabet, I already mentioned the fast-growing cloud market. Alphabet stated in a recent presentation that the cloud market is still in its early stage. According to this presentation, the public cloud services spendings are expected to double between 2022 and 2026, and not only Alphabet will profit from this trend but Amazon as well.

And this is backed up by several different studies (see here and here) and forecasts that also expect high growth rates for the cloud business in the years to come.

Retail: Struggling

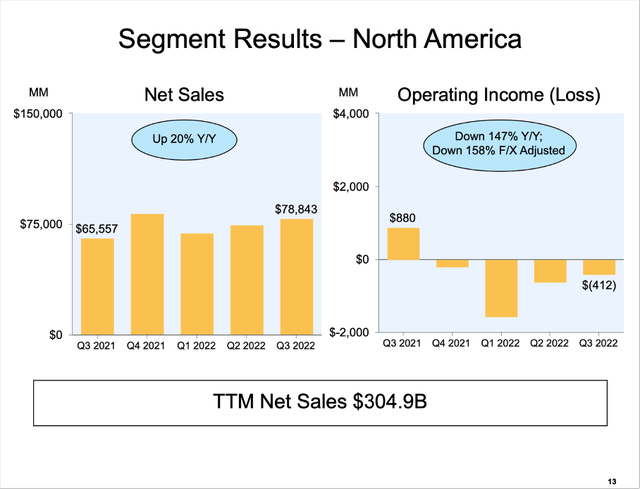

While AWS is continuing to grow at a high pace and is very profitable for Amazon, the retail business of Amazon – which is responsible for the biggest part of revenue – seems to struggle once again. The North America segment could still grow the top line at a solid pace, with increased revenue 20% year-over-year, from $65,557 million in the same quarter last year to $78,743 million this quarter. But while the segment could generate an operating profit of $880 million in the same quarter last year, it is now reporting an operating loss of $142 million.

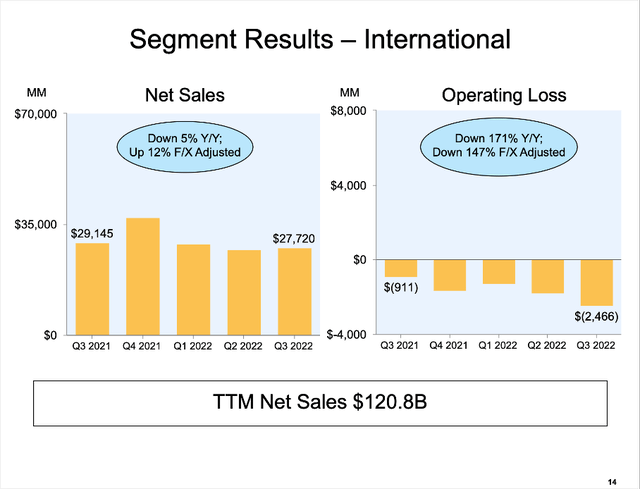

And not only its North America segment was unprofitable this quarter. Its international segment was also unprofitable once again and reported an operating loss of $2,466 million (compared to an operating loss of $911 million in the same quarter last year). Additionally, the segment also had to report declining sales. Compared to $29,145 million in Q3/21, sales in Q3/22 were only $27,720 resulting in 5% year-over-year decline. However, this was in large parts due to currency effects – FX adjusted, sales increased 12% year-over-year.

So, to be honest, results are not so bad. Both segments are not profitable (we will get to this later) but the mediocre top line results are also due to the strong dollar which affected Amazon’s business – like it affected many other U.S. businesses.

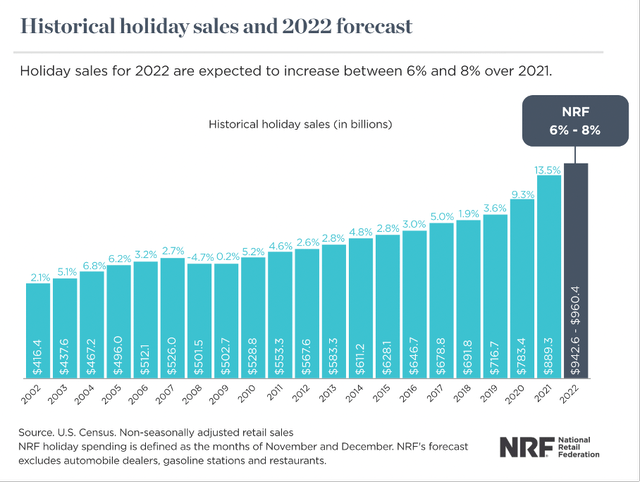

And when looking at the expectations for the holiday sales, analysts and the NRF, the National Retail Federation, are quite optimistic. For the months of November and December 2022, holiday sales are expected to be between $942.6 million and $960.4 million– resulting in 6% to 8% year-over-year growth, which is quite an optimistic forecast. Compared to the last two years (with growth rates of 9.3% in 2020 and 13.5% in 2021), this seems moderate.

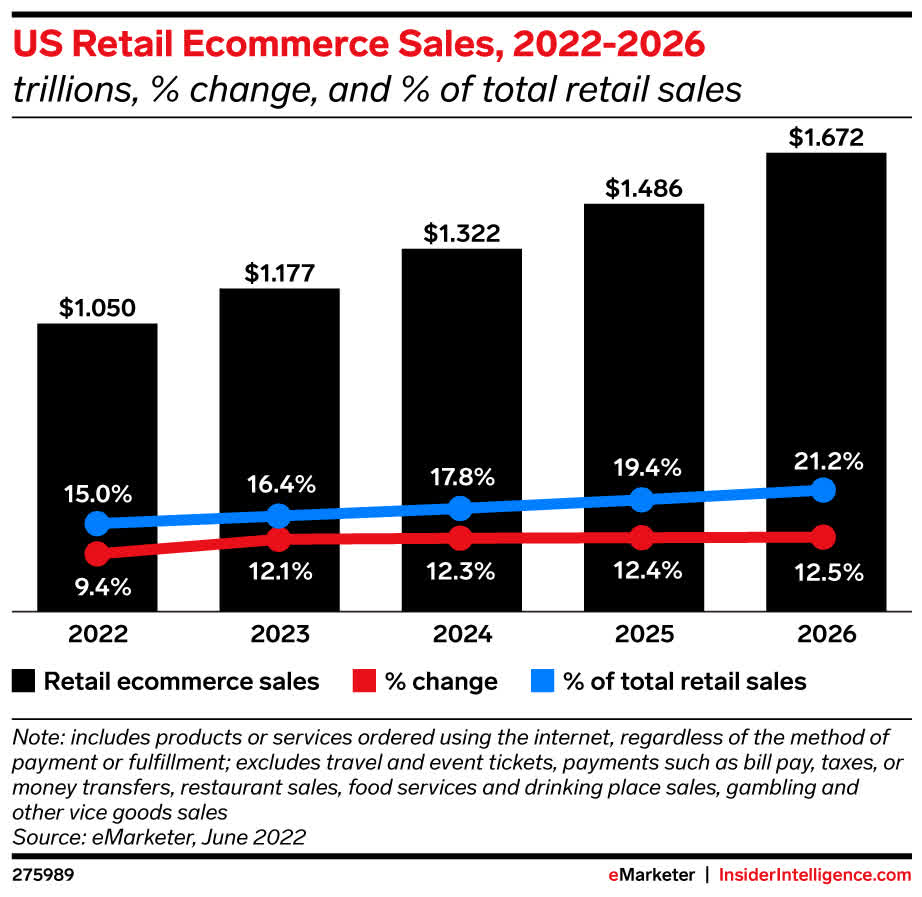

And when looking at longer timeframes, growth expectations are also high – not only for the holiday sales. While retail sales are expected to grow only with a CAGR of 3.70% between 2021 and 2026 (according to Statista), ecommerce sales are expected to grow with a much higher pace (and Amazon is generating most of its sales online). For the years from 2023 till 2026, analysts are expecting ecommerce sales to grow about 12% annually.

eMarketer // InsiderIntelligence

Now we must question if these growth expectations are realistic – especially as we are seeing strong signs for the economy crumbling and not only in the United States of America. Aside from the stock market declining about 20% (which is an early warning indicator), the yield curve inverted recently (one of the best warning signs for a recession) and disposable income per capita is also declining for several months in a row now.

In a recession, we usually see spendings decline and here we must take a closer look at Amazon’s revenue streams. About 16% stem from AWS (see section above), and companies might cut back on spendings here – although these are fundamental services for a business. An additional 7% of revenue is stemming from subscription services, and due to switching costs we can be confident to see numbers be at least stable (many people rely on Amazon Prime for free shipping as well as the video and music content).

But about 42% of revenue stems from online stores, and about 23% stems from third-party sellers. And in both cases, we must assume consumers spending is less, which could lead to declining revenue for Amazon (or at least lower growth rates). An additional 8% of revenue is stemming from advertising and these are classical examples for businesses to cut spendings.

All in all, we should be rather cautious about Amazon’s top line growth in the next few quarters. And we should even think about the possibility of declining revenue in some quarters – depending on how extreme the recession gets.

Investing in the future

And while declining revenue (or slower growth rates) could be an issue in the coming quarters, the bottom-line results already are a reason for concern right now. Since the fourth quarter of fiscal 2021, free cash flow is negative again (when looking at the TTM numbers). And while Amazon has done a pretty good job of convincing investors to focus on top line growth and ignore profitability (something Meta Platforms (META) is failing horrible right now), investors also seem to be concerned about Amazon as well.

And I must be honest: I am also a bit irritated that Amazon, a business which is almost 30 years old and one of the major corporations in the world, is failing once again to be profitable. On the other hand, it is good to invest in the future, and we should be confident these investments will pay off.

We will especially focus on the operating expenses, as these amounts will mostly driver future growth – they include sales, marketing, research, and development. And while Amazon spent about 35% of its revenue on operating expenses in the years 2019 till 2021, it spent over 40% in the last four quarters. And when comparing Amazon to other retail companies, the difference is huge. Walmart (WMT), Target (TGT), and Kroger (KR), for example, are spending about 20% of revenue on operating expenses (Target is spending a little more than the other two). Amazon is spending twice as much of its revenue, and when this spending pays off, Amazon will probably profit in the future by higher growth rates and higher sales.

|

Total Operating Expenses % of revenue |

2019 |

2021 |

2021 |

TTM |

|---|---|---|---|---|

|

Amazon |

35.81% |

33.64% |

36.74% |

40.46% |

|

Walmart |

20.59% |

20.01% |

20.57% |

20.54% |

|

Target |

23.71% |

22.21% |

20.73% |

20.79% |

|

Kroger |

20.59% |

21.59% |

20.03% |

19.24% |

Of course, the long-term goal should be to spend only as much as necessary and cut cost of revenue as well as operating expenses as this will increase profitability. In case of Amazon, we can see that the company was able to lower its costs of revenue (as percentage of revenue) constantly during the last decade, while operating expenses increased over time.

But if Amazon can lower its operating expenses over time – and therefore increase operating margin it can be extremely profitable. And it doesn’t even have to lower its operating expenses to 20% of revenue like Walmart or Target – 30% to 35% is enough to multiply its operating income.

Intrinsic Value Calculation

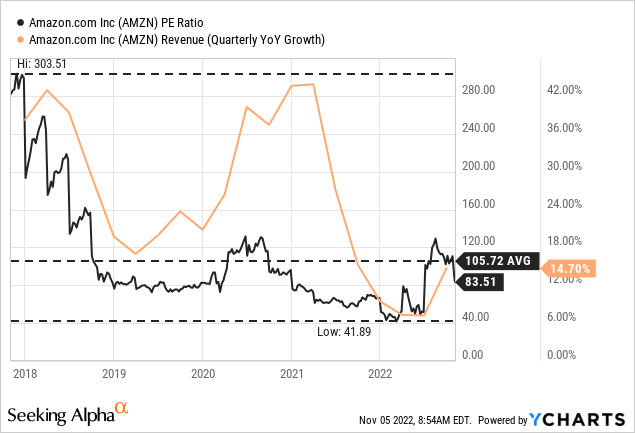

And these increased spendings led to Amazon trading for extremely high valuation multiples once again. As free cash flow is negative, we can’t calculate a reasonable P/FCF ratio at this point. The P/E ratio however is 83 right now and although this is below the 5-year average (which is 105), we can’t really argue that a P/E ratio of almost 100 is cheap in any way. Such a high P/E ratio is even difficult to justify with high growth rates.

However, it can be justified – at least in parts – by extraordinary high operating expenses, which might not only result in higher revenue growth but also in higher operating income once the high expenditures are reduced again. If we assume only about 35% of revenue spent as operating expenses in addition to 57% of revenue for costs of revenue, we will get an operating margin around 8% and an operating income of $40,000 right now. This would result in earnings per share around $3.50 in my opinion (considering taxes and interest expenses) and Amazon would therefore trade for a P/E ratio of 26.

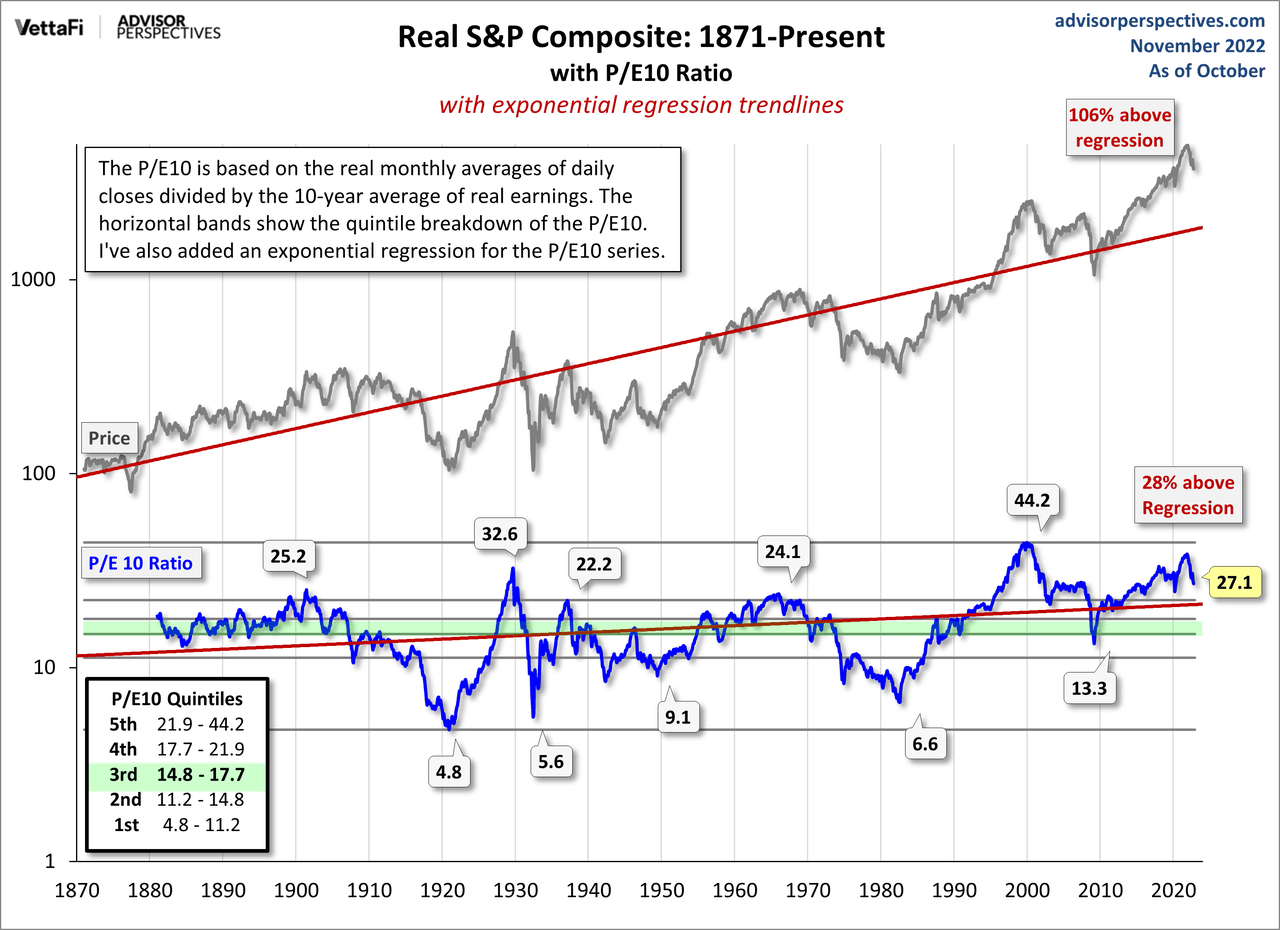

This is a much more reasonable P/E ratio, but still a bit high in current market conditions – and we are calculating with hypothetical assumptions. I have mentioned several times that we must probably adapt to a new reality of lower P/E ratios and lower CAPE ratios. We got so used to these extremely high valuation multiples for several years now that we assume they are the norm. But the last few years have been an extreme outlier – stocks are not trading for a CAPE ratio of 30.

Advisor Perspectives

Usually, I offer an intrinsic value by using a discount cash flow calculation. For such a calculation we must make several assumptions and in case of Amazon it is extremely difficult to make these assumptions as the company is lacking consistency. We could assume operating margin to improve again in the coming quarters and Amazon still growing its top line in the mid-to-high teens and we get an extremely undervalued stock. But we could also argue that growth rates will slow down, the recession will hit Amazon hard, and profitability will decline even further in a challenging macroeconomic environment and the stock remains overvalued.

Technical Picture

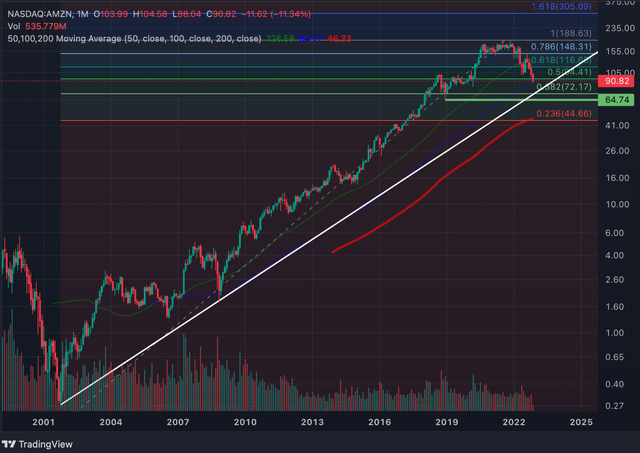

Instead of trying to calculate an intrinsic value for the stock I will rather focus on the chart and the sentiment surrounding stocks – especially high-growth companies (which are close to being unprofitable).

I already started writing parts of this article about two weeks ago before earnings were reported. At that point I theorized that the stock could go up to $145 again. But I didn’t consider that scenario to be very realistic. Instead, I rather assumed the stock to decline to $100 again. And while I expected the stock to break below $100 at some point in the next few months, I didn’t think it would happen so quickly.

When looking at the chart, we can identify two strong support levels for Amazon. And a first reasonable mid-term target for the stock over the next few months is between $65 and $72. At that level we find not only the 38% Fibonacci retracement level of the last upward wave, but also the lows of the late 2018 correction. Additionally, we have a long-term trendline connecting the lows of the Dotcom bubble crash and the Great Financial Crisis. At $65, we are already looking at a 65% decline, but I don’t want to bet on Amazon already finding its cyclical bottom there.

A next potential support level would be around $45 where we find the 23% Fibonacci retracement as well as the 200-months moving average. And especially the latter is often the target for stocks in steep corrections. At that point we are looking at a 76% decline, which might seem extreme right now but is possible. And I would also not be surprised if Amazon goes even lower – depending on how the next recession and bear market play out.

Conclusion

Amazon is not extremely expensive anymore. However, I don’t see Amazon as the extreme bargain many other contributors are seeing (when scrolling through the articles, I only see bullish and extremely bullish views about Amazon).

I avoided Amazon as an investment for a long time, as I considered the stock as being just too expensive. Now, Amazon is certainly getting to price regions where the stock is starting to get interesting, but I won’t pull the trigger yet, as Amazon is still above the cycle bottom in my opinion. Investors have not priced in what is about to come for the economy as well as the stock market. And when comparing Amazon to other big tech companies – like Alphabet or Meta Platforms – the stock is still trading for rather high valuation multiples making it vulnerable to downside risk. I personally will get interested in Amazon when it is trading for $65 to $70.

Be the first to comment