ZU_09

Overview

Energy Transfer (NYSE:ET) and MPLX LP (NYSE:MPLX) are two of the most successful pipeline companies in the USA.

With operations spanning North America, ET and MPLX generate large amounts of revenue and cash flow and pay out significant distributions.

In this article, I will compare the two’s potential based on their 2022 second quarter results to see which one is the best investment for 2025.

ET is a much larger company than MPLX

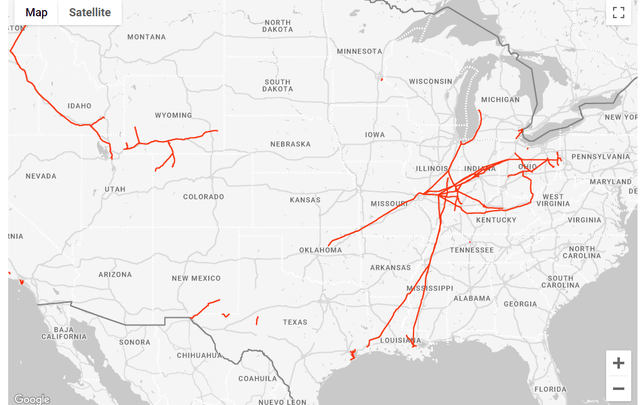

As the map below shows, ET (110,000+ miles) has an enormous pipeline footprint. The difference in size is most obvious when you look at total assets. ET has $135 billion in assets (net of depreciation) and MPLX has $55 billion.

The mileage has changed somewhat due to acquisitions and dispositions by ET since last July. ET sold its 51% interest in ET Canada for about $270 million in March. More importantly, ET acquired Enable Pipeline for stock in December 2021.

Energy Transfer

MPLX on the other hand is much smaller, with most of its pipelines in the eastern US.

Financial metrics

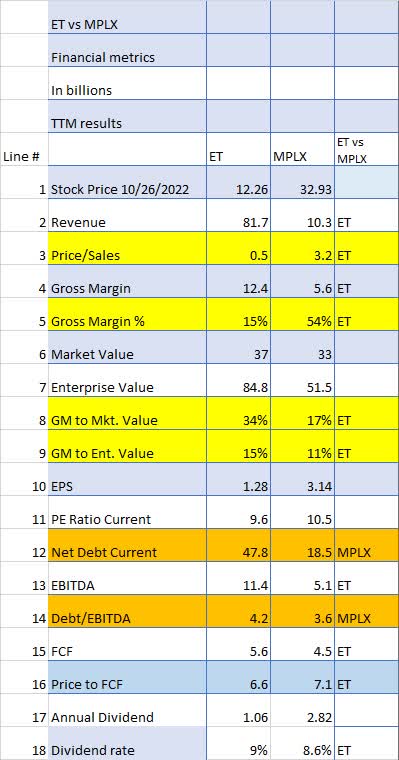

When we look at the financial metrics comparing the two companies on a TTM (Trailing Twelve Month) basis, several metrics jump out indicating how underpriced ET is versus MPLX.

Seeking Alpha and author

Looking at the yellow outlined items, we can see that ET’s price-to-sales ratio (line 3) is 1/3 of MPLX’s, and ET’s gross margins based upon Market Value and Enterprise Value (Lines 8 and 9) are much higher than MPLX’s, and it is indicating that either ET is underpriced or MPLX is overpriced relative to each other.

However, MPLX’s more conservative approach to debt shows an advantage relative to ET’s net debt (Line 12) and the debt to EBITDA ratio (line 14).

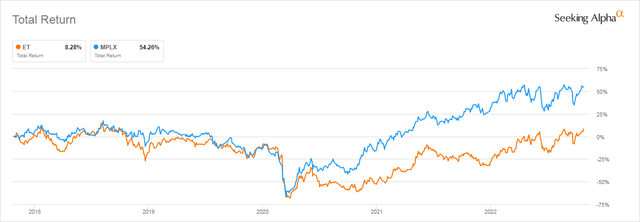

Looking over a longer period of five years, MPLX’s 54% total return, which includes distributions, is much better than ET’s at 8%.

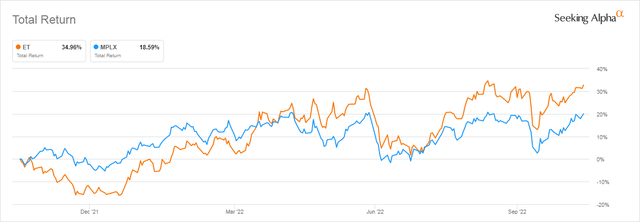

However, on a shorter 1-year basis ET is far ahead, 39% to MPLX’s 19%.

Generally speaking, ET’s financial metrics are better than MPLX’s.

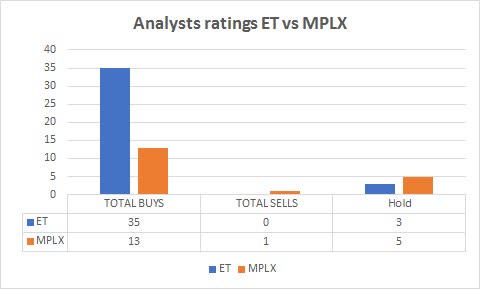

Analysts’ ratings show both companies are well-liked by the investment community

Both Seeking Alpha writers and Wall Street analysts appear to really like these two stocks. The total of 48 Buy recommendations and only 1 Sell indicate that most analysts think these two stocks have a bright future ahead of them.

Seeking Alpha and author

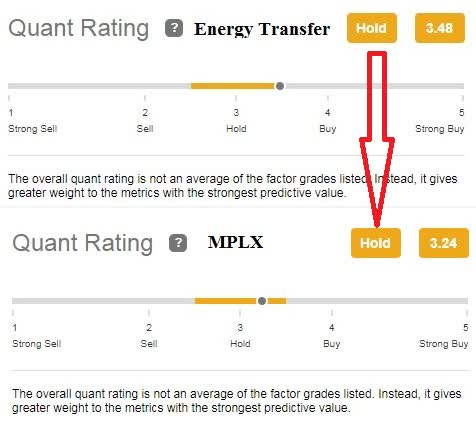

Interestingly enough, quants are not nearly as excited as the analysts, with a very modest “Hold” call for both stocks.

Seeking Alpha and author

Do the quants know something that the rest of us do not?

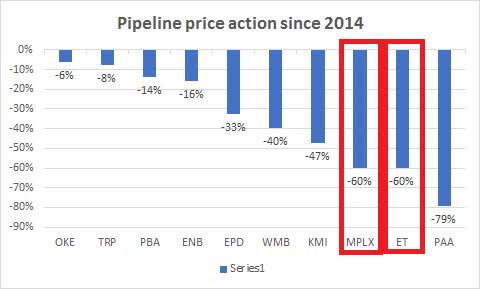

Historical price trends continue to be negative for both companies

If we look at the prices for midstream companies from 2014 to the present, we can see a decidedly downward trend.

Author

Note that carnage is universal, and even a conservative stalwart like MPLX has seen a crushing decrease in the share price of 60%, exactly the same as ET.

The following chart compares the total return for ET versus MPLX since September 15, 2014. It shows that over that extended time period when both stock’s share prices dropped significantly, MPLX returned a very modest profit of 2% to investors if you include the dividends. One would have to question whether less than a 2% return was worthy of an investment in MPLX 2014.

Over a much shorter period of time, one year, ET actually outperforms MPLX on a total return basis (36% to 19%) perhaps signifying the beginning of a turnaround for ET.

ET’s revenue is growing faster than MPLX’s

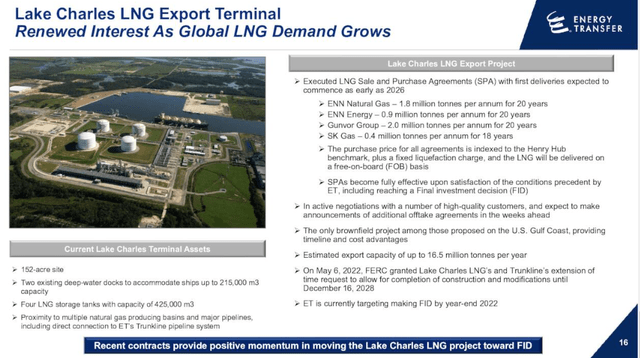

ET has expanded its operations with both the Enable acquisition and its expansion into the LNG market. Management has spent a lot of time recently talking about establishing an LNG export terminal in Lake Charles, LA. Just recently, it added Shell to its list of long-term LNG contracts. Shell signed up for 20 years.

CEO Tom Long:

As we previously stated, we expect to finance a significant portion of the capital cost of this project by means sale of equity in the project to infrastructure funds and possibly to one or more industry participants in conjunction with LNG offtake agreements.

Energy Transfer

Having an LNG facility will not just generate revenue and cash flow from the export of LNG but will provide new markets for ET’s existing facilities.

Upon completion of the LNG project, we expect to realize significant incremental cash flows from transportation of natural gas on our trunk line pipeline system and other energy transfer pipelines upstream from Lake Charles.

Source for above quotes: Q2 Earnings Results.

Because of the ever-increasing need for LNG around the world, this effort sounds extremely promising for the years ahead. Offloading the vast majority of the investment risk to third parties is exactly the right business approach.

And Lake Charles doesn’t have to be ETs last LNG facility either.

Conclusion

Pipelines are not the market’s favorite pick right now and likely won’t be in the future either. ESG and negative political headwinds will plague the market for the foreseeable future.

But that doesn’t mean that there is no potential in any MLPs. In ET’s case, the price is low enough that if it just gets back to the MLP median value on a P/E ratio and FCF (Free Cash Flow) basis, it could have a significant upside to at least $15 and maybe $20 if the LNG terminal gets built.

In the meantime, there is little doubt that ET management’s near-term goal is to restore the distribution to its previous $1.22 per share, which at the current price would result in a 10% distribution. Personally, I think the $1.22 dividend will be reached next quarter, especially since ET just raised the dividend again on October 25th. MPLX also has a nice distribution yield of 8.6% and has increased its distribution every year since 2013.

MPLX has also begun a share buyback campaign, but since June 2020, it has only amounted to 4.4% of shares outstanding, a rather slow rollout.

ET is a Buy as a turnaround candidate with an extremely high distribution yield and the potential for large capital gains by 2025.

MPLX is a hold.

Be the first to comment