Godji10

But youth smiles without any reason. It is one of its chiefest charms.”― Oscar Wilde

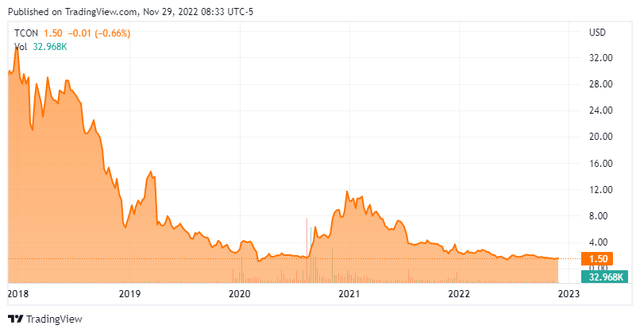

Today, we circle back on TRACON Pharmaceuticals (NASDAQ:TCON) since our last article on this small developmental name in the first quarter of 2021. This ‘off the radar’ microcap name has received no coverage here on Seeking Alpha since our last piece on it. The company recently came up in comments from a Biotech Forum member. Therefore, we are circling back on this name. An analysis follows below.

Seeking Alpha

Company Overview:

TRACON Pharmaceuticals is a San Diego based clinical stage biopharmaceutical company that is focused on the development and commercialization of therapeutics for cancer. The stock currently trades for $1.50 a share and sports an approximate market capitalization of $35 million.

March Company Presentation

The company has several assets in development. The most important and advanced is a compound called Envafolimab, which TRACON has the rights to develop and commercialize in sarcoma and multiple other indications in North America.

March Company Presentation

TRACON licensed Envafolimab from 3D Medicines and Jiangsu Alphamab Biopharmaceuticals in return for royalties on any commercialized sales.

March Company Presentation

This candidate is a novel, single-domain PD-L1 antibody that is administered by subcutaneous injection without the need for an adjuvant. This candidate being studied in combination with gemcitabine and oxaliplatin in a Phase 3 registration trial in biliary tract cancer.

March Company Presentation

Dosing is also underway in a pivotal Phase 2 trial ‘ENVASARC’ targeting sarcoma in the US sponsored by TRACON. Envafolimab has been accepted for priority review by the Chinese National Medical Products Administration for the treatment of MSI-H cancer patients.

March Company Presentation

Late in the third quarter, Envafolimab garnered fast track designation from the FDA for the development of envafolimab for patients with locally advanced, unresectable, or metastatic undifferentiated pleomorphic sarcoma [UPS] and myxofibrosarcoma (MFS) who have progressed on one or two prior lines of chemotherapy.

March Company Presentation

TRACON Pharmaceuticals has several other compounds in earlier stage development. However, the company’s near and medium-term direction will be determined by the success or failure of the development of Envafolimab.

In August, the FDA approved the company’s IND application for the initiation of a Phase 1/2 clinical trial of their CTLA-4 antibody YH001 in combination with envafolimab and doxorubicin for the treatment of sarcoma patients, including patients who have not received prior therapy.

March Company Presentation

Analyst Commentary & Balance Sheet:

So far in November, JonesTrading ($5 price target), H.C. Wainwright ($12 price target) and Maxim Group ($8 price target) have all reissued Buy/Outperform ratings on TRACON Pharmaceuticals.

Only about one percent of the outstanding float of TCON is currently held short. The CEO and one beneficial owner have made several small insider purchases so far in the fourth quarter, totaling less than $100,000 in aggregate. The company ended the third quarter with approximately $17 million worth of cash and marketable securities on its balance sheet. Late in the third quarter, management announced that it entered into a $35 million non-dilutive long-term debt facility with Runway Growth Finance Corp., with $10 million funded at closing. This extended the Company’s cash runway to mid-2023.

March Company Presentation

Management boasts a development model that emphasizes capital efficiency, in-housing its clinical operations as well as regulatory and database aspects of its business; thus, eliminating the need for costly contract research organizations. This is a key reason the company’s R&D and SG&A costs totaled only $6.4 million in the third quarter.

Verdict:

When we last visited TCON, the stock had recently quadrupled to over $9.00 a share. The advice then was not to chase that rally for myriad reasons. One key one was to remind readers that TRACON’s former lead compound, endoglin antibody TRC105, flunked three mid-to-late-stage trials in brain cancer (2017), renal cell carcinoma (2018), and angiosarcoma (2019). TRACON also discontinued development of a compound called DE-122 for wet age-related macular degeneration in March 2020.

The company has been public for nearly a decade now, and still hasn’t got a drug candidate across the FDA approval finish line. In addition, TRACON is going to have to raise additional funding either by a dilutive capital raise and/or via convertible debt or some other sort of credit facility. Given current funds on hand, this is likely to happen in the near-term future.

March Company Presentation

Envafolimab could have some important advantages over currently approved PD-L1 inhibitors. Envafolimab has Orphan Drug status for sarcoma and management believes it could eventually see $300 million in peak annual sales if approved for this indication. Interim results from the Phase 2 ENVASARC study should be out in December. However, in a best case scenario, Envafolimab will not be launched until 2025.

Given the uncertain nature of the current market, the company’s past record of developmental failures and upcoming funding needs, I am going to pass on any investment recommendation around TRACON Pharmaceuticals at this time. However, as Envafolimab moves closer to commercialization, this is a story we may revisit late in 2023 or in 2024.

March Company Presentation

It should be noted that TRACON has ongoing arbitration around various agreements with I-Mab Biopharma. The company is seeking to recover over $200 million in damages. Management expects a decision in the first quarter of 2023 around this litigation. Obviously, if TRACON wins, this would be a windfall for the company and shareholders. However, given the current market cap the stock is currently trading at would imply the market is putting a low probability of a positive outcome to this effort.

March Company Presentation

By the time you’re thirty, your worst enemy is yourself.”― Chuck Palahniuk

Be the first to comment