Sundry Photography

Thesis

Enphase Energy’s (NASDAQ:ENPH) FQ3 earnings release demonstrated that the market had anticipated another robust report card from CEO Badri Kothandaraman and his team as ENPH surged towards its November highs.

However, the recent momentum surge also seems to have stalled, worsened by yesterday’s risk-off selling as the market could have anticipated a red wave in the mid-term elections. Still, we don’t expect California (Enphase’s most critical US region) to be impacted. Therefore, the risk-off positioning that affected solar stocks broadly should not be detrimental to ENPH’s business structurally.

Despite that, we postulate that Enphase’s growth rates could peak in FY22. Even Kothandaraman suggested that Enphase is unlikely to repeat its growth rates over the past two years, given tougher comps. Notwithstanding, he remains optimistic that Enphase could still deliver “very healthy high double-digit growth from 2022 to 2023.” However, management has yet to provide guidance for 2023.

Moreover, even the bullish Street analysts don’t expect Enphase to repeat its tremendous growth in FY23. With ENPH priced at an NTM normalized P/E of 53.4x, we observe a significant growth premium embedded. Hence, it’s incumbent on management to deliver robust guidance for 2023 to keep ENPH’s upward momentum going.

However, we continue to glean significant trouble in ENPH’s price action at the current levels, indicating that the market is not convinced of re-rating ENPH much higher from here.

Maintain Sell.

Enphase Is Leveraging The Energy Crisis

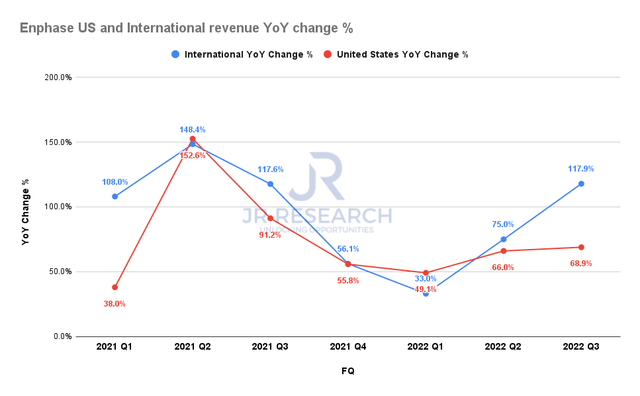

Enphase Revenue by region change % (Company filings)

Enphase has managed to capitalize on the energy crisis that was worsened by the Russia-Ukraine conflict. Consequently, its ex-US revenue increased by 118% YoY, mainly driven by Europe, which saw its revenue increase by 136%.

US revenue (71% share of Q3 revenue) has also remained robust after bottoming out in FQ1. Hence, Enphase has continued to execute remarkably well, as seen in its stock price appreciation in 2022, as ENPH defied the tech bear market. Accordingly, ENPH delivered a YTD total return of 54.39% (Vs. 10Y mean of 55.9%), benefiting investors who concentrated their portfolio in ENPH.

Management is confident that the structural drivers remain intact, driven by the energy crisis, as demand remains robust. Therefore, the company has yet to observe any material weakness in demand that suggests it could be impacted significantly by the coming recession.

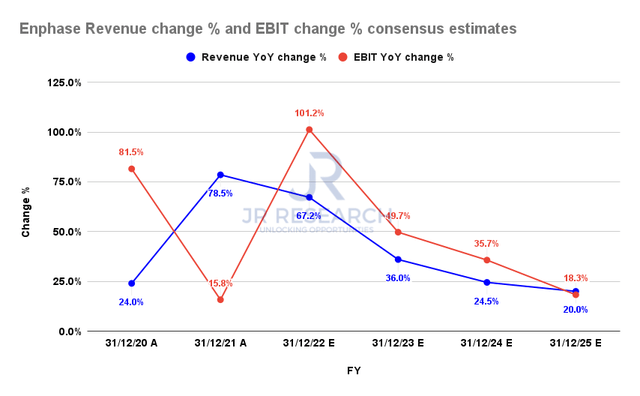

Enphase Revenue change % and EBIT change % consensus estimates (S&P Cap IQ)

However, even bullish Wall Street analysts are not confident that the company could repeat its significant growth rates over the past two years. Nevertheless, there’s little question that Enphase operates in a market where massive structural tailwinds are lifting its business.

However, early investors have already made the easy money, as seen in its 10Y CAGR. For ENPH to sustain such performances moving forward would require a gargantuan effort that we think investors who hop on board at the current levels are asking for too much. Therefore, new investors are urged not to extrapolate ENPH’s past performance if growth is expected to normalize.

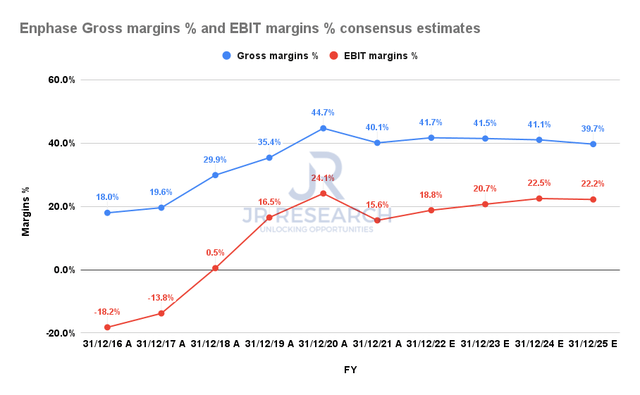

Enphase Gross margins % and EBIT margins % consensus estimates (S&P Cap IQ)

Accordingly, Enphase’s gross margins are projected to normalize moving ahead. Still, the company’s technological advances could deliver superior cost-per-watt improvements, helping to drive operating leverage. Kothandaraman accentuated:

So lots of optimization [is] possible. Name of the game is to keep the footprint the same, not bloated. Size is important for us, and I think we can get the cost structure under control. And if we are able to pack in 480 watts AC punch into [a] similar number of components, similar cost structure, then we directly get the cost-benefit there in terms of cost per watt. That’s our thinking. (Enphase FQ3’22 earnings call)

Given Enphase’s remarkable performance driving robust profitability, we believe the market remains confident in its execution. Furthermore, the 30% tax credits (through the end of 2032) from the Inflation Reduction Act would be instrumental in localizing its supply chain, potentially benefiting its cost-optimization efforts.

Is ENPH Stock A Buy, Sell, Or Hold?

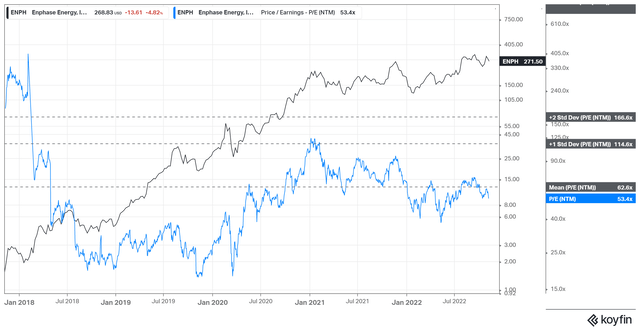

ENPH NTM EBITDA multiples valuation trend (koyfin)

ENPH last traded at an NTM P/E of 53.4x. Note that the market had already de-rated ENPH even though it continued to surge toward new highs in 2022. Therefore, we postulate that the market has reflected the potential for decelerating growth moving ahead.

Moreover, ENPH’s valuation remains well ahead of its solar peers, as represented in the Solar ETF (TAN), in which ENPH is the leading constituent. TAN’s forward P/E of 14.7x is also well below ENPH’s current valuation.

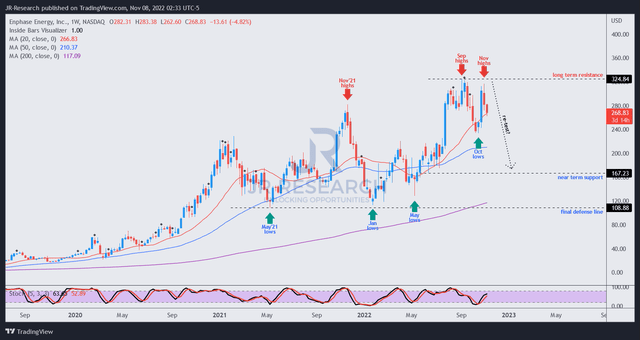

ENPH price chart (weekly) (TradingView)

Also, ENPH has continued to experience significant selling pressure at its November highs, in line with its September highs.

Our analysis suggests that the market has “refused” to re-rate ENPH markedly higher, as its growth rates are expected to normalize. Coupled with a significant valuation premium, ENPH’s price action doesn’t augur well for investors who refuse to take some exposure off at the current levels.

Maintain Sell.

Be the first to comment