vuk8691/E+ via Getty Images

Sometimes, patience is required when it comes to investing. From time to time, you will come across a great company but at a price that doesn’t quite make sense. Instead of paying that premium, sometimes the best option is to wait for shares to decline in price and/or for its fundamental condition to improve enough to warrant a purchase. One company that has been on my radar that’s getting close to that point, but isn’t quite there yet, is SiteOne Landscape Supply (NYSE:SITE). This entity, which operates as one of the largest national wholesale distributors of landscape supplies in the US, has experienced some pain from a share price perspective even as the fundamental health of the company continues to improve. Long term, I fully expect that the firm will continue to create value for its shareholders. And I believe that the overall risk to investors who are in it for the long run is quite limited. But for those of a value orientation who want to buy a company that is drastically underpriced, shares are not there quite yet.

Surveying SiteOne Landscape Supply

Back on April 23rd of this year, I wrote an article detailing the investment worthiness of SiteOne Landscape Supply. I recognized, in that article, that the company had done well to grow its operations over the prior few years. I said that this trend should continue for the foreseeable future, but I also recognized that shares of the company were trading at fairly lofty levels, suggesting to me that it was more or less fairly valued. So despite the robust fundamental condition of the enterprise and its continued growth, I ended up rating it a ‘hold’, reflecting my belief that it would generate returns that more or less would match the broader market for the foreseeable future. It seems as though I was a little too optimistic when making this call. You see, while the S&P 500 has generated a loss of 4.4%, shares of SiteOne Landscape Supply have generated a loss of 10.8%.

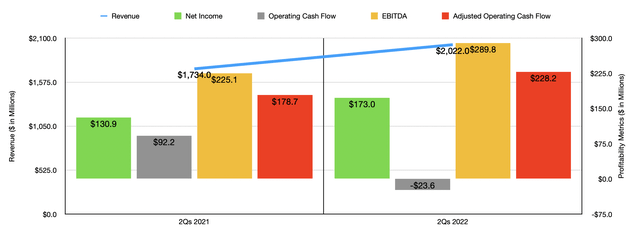

Author – SEC EDGAR Data

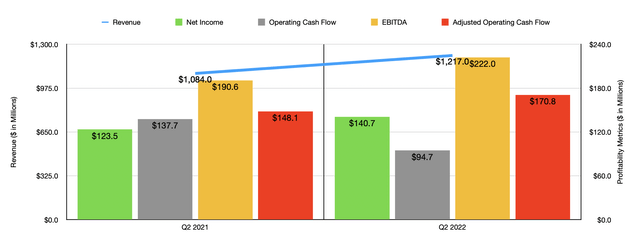

Although this is bad, it’s worth noting that this return disparity had nothing to do with the fundamental condition of the enterprise. If anything, the company is doing quite well on that front. To see what I mean, we need only look at financial results covering the first two quarters of the company’s 2022 fiscal year. When I last wrote about the firm, we only had data covering through the end of its 2021 fiscal year. Total revenue for the first half of the year came in at $2.02 billion. That represents an increase of 16.6% over the $1.73 billion generated the same time one year earlier. The bulk of this increase in revenue, according to management, related to the company’s decision and ability to push inflation-oriented costs onto its customers. But there were other factors at play as well. Organic daily sales increased by 12% for the company for the aforementioned reason, some of which was offset by a slight but unspecified decrease in volume. The firm also benefited from some acquisitions that management had made, accounting for $88.3 million, or 5%, of the company’s top line growth. So far in 2022, the firm has made 13 different acquisitions. It is true that growth was slightly slower in the second quarter of the year, but it was still impressive nonetheless, with revenue of $1.22 billion coming in 12.3% above the $1.08 billion generated one year earlier.

When it comes to profitability, the picture has looked very similar to what the picture looked like for revenue. Net income in the first half of the year came in strong at $173 million. That’s 32.2% above the $130.9 million generated one year earlier. For the most part, other profitability metrics followed suit. Yes, operating cash flow did decline from $92.2 million to negative $23.6 million. But if we were to adjust for changes in working capital, it would have risen from $178.7 million to $228.2 million. Meanwhile, EBITDA for the company also increased, climbing from $225.1 million to $289.8 million. An identical trend can be seen for the second quarter of the year. For instance, net income rose by 13.9% from $123.5 million to $140.7 million. Operating cash flow dropped from $137.7 million down to $94.7 million, while the adjusted figure for this rose from $148.1 million to $170.8 million. And finally, EBITDA also improved, rising from $190.6 million to $222 million.

Author – SEC EDGAR Data

Although the slowdown that took place in the second quarter of the year might have investors worried, my opinion is that any concern on this front is more or less unwarranted. That’s because, in its second quarter earnings release, management announced that EBITDA for the 2022 fiscal year should come in at between $440 million and $460 million. In addition to being, at the midpoint, 8.4% above the $415.1 million generated in 2021, it’s also above the prior expected range of between $430 million and $450 million. No guidance was given when it came to other profitability metrics. But if we assume that they should increase at the same rate that EBITDA is forecasted to, then we should anticipate net income of $258.4 million and adjusted operating cash flow of $370.9 million.

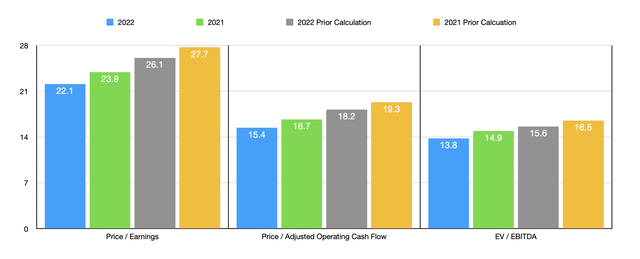

Author – SEC EDGAR Data

Using this data, I was able to value the company. On a forward basis, the price-to-earnings multiple of the firm is 22.1. That’s down from the 23.9 reading that we get using data from 2021. The price to adjusted operating cash flow multiple should be 15.4. That stacks up favorably against the 16.7 reading that we get when using data from last year. And the EV to EBITDA multiple of the company should be 13.8. That compares to the 14.9 that we get if we were to use data from last year. It’s also worth noting, as is shown above in the chart, that this pricing is far more attractive than when I last wrote about the company. As part of my analysis, I also compared the firm to five similar companies. On a price-to-earnings basis, these companies ranged from a low of 6.6 to a high of 23.6. In this scenario, four of the five businesses were cheaper than SiteOne Landscape Supply. Using the price to operating cash flow approach, the range was between 8 and 271.5. In this scenario, only one of the companies was cheaper than our prospect. And when it comes to the EV to EBITDA approach, the range was between 5.2 and 10.8, with our target being the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| SiteOne Landscape Supply | 22.1 | 15.4 | 13.8 |

| Core & Main (CNM) | 23.6 | 271.5 | 9.7 |

| MSC Industrial Direct (MSM) | 14.9 | 20.4 | 10.8 |

| Univar Solutions (UNVR) | 7.7 | 21.2 | 6.3 |

| WESCO International (WCC) | 12.0 | 101.4 | 9.4 |

| GMS (GMS) | 6.6 | 8.0 | 5.2 |

Takeaway

What data we have today suggests to me that SiteOne Landscape Supply continues to grow at a nice clip. Although the company is a bit pricey compared to similar players, it is getting cheaper and it’s nearing that point where it might warrant an upgrade. This is especially true if the firm continues to generate strong cash flow. But for now, I do still think that the company makes for a solid ‘hold’.

Be the first to comment