Olemedia

Standard Lithium Ltd. (NYSE:SLI) has, in my view, many signs about an incoming increase in production, and the CEO recently executed some options. The technical report prepared by engineers also indicates an increase in production from 2023 to 2027. Using production figures obtained by SLI, and incorporating the recent increase in the price of lithium, my discounted cash flow (“DCF”) analysis resulted in a higher fair price than the current market price. Even considering the risks and the lack of cash to pay 100% of the necessary capital expenditures, SLI is a stock to follow very carefully.

Standard Lithium

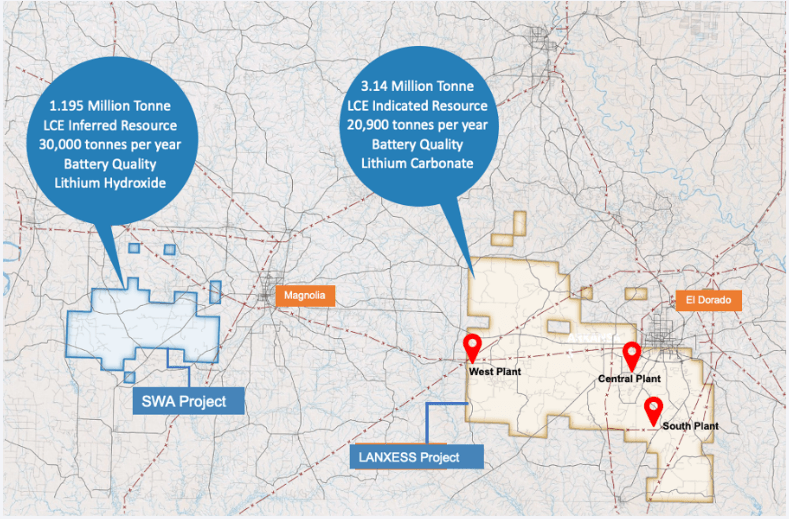

Standard Lithium is a lithium development company that already has a Direct Lithium Extraction demonstration plant facility in southern Arkansas using LiSTR technology.

I believe that now is the right time to assess the company for two reasons. First, the most recent news clearly indicates that production could accelerate in the coming months. Management recently hired a company to run a FEED/DFS study.

The Company completed a competitive FEED/DFS selection process and is pleased to award the contract to OPD LLC, a Koch-owned business based in Katy, Texas. The FEED/DFS study and subsequent EPC contract are focused on the first commercial lithium project being developed by Standard Lithium. Source: Press Release

Standard Lithium also continues to add personnel reporting project delivery expertise, which is, in my view, another indication to be optimistic about future production.

The Company recently added key personnel to the executive and management team in newly created positions to expand project delivery expertise in support of its commercial scale developments. Source: Standard Lithium Corporate Update Standard Lithium Ltd.

With the previous information in mind, I wonder whether the most recent execution of options by the CEO and CFO means that revenue growth is coming. I believe that the following information is worth noting:

The Company also announces that Robert Mintak, Chief Executive Officer of the Company, Dr. Andy Robinson, President of the Company, and Kara Norman, Chief Financial Officer of the Company, have exercised a total of 1,400,000 incentive stock options. Source: Standard Lithium Corporate Update Standard Lithium Ltd.

The Company May Soon Need More Cash To Finance Capex and Opex

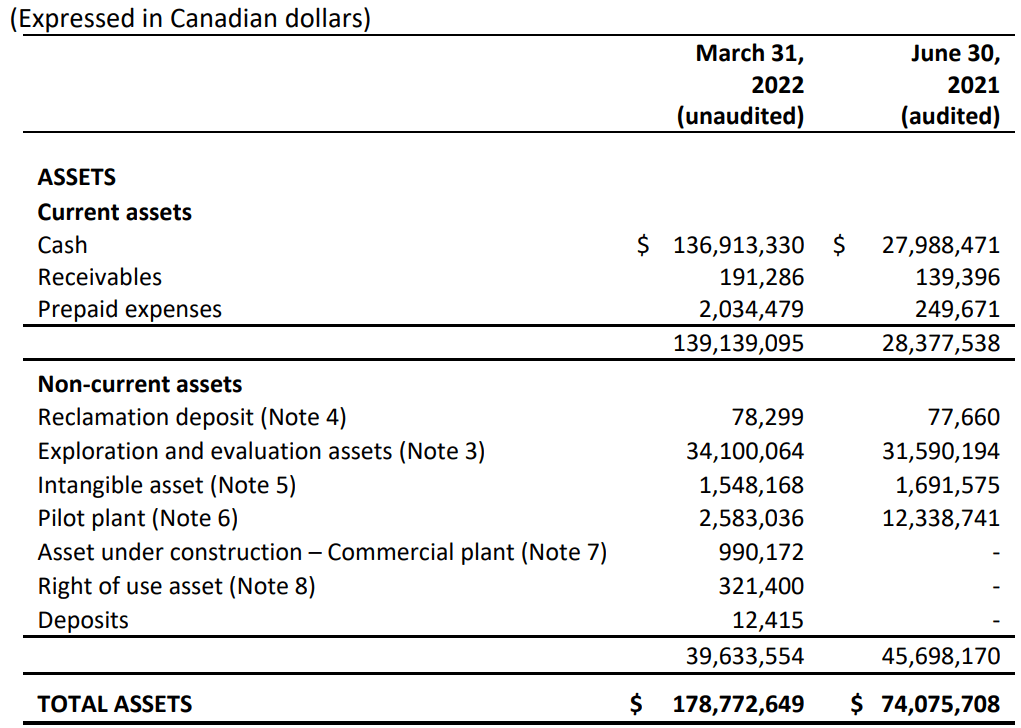

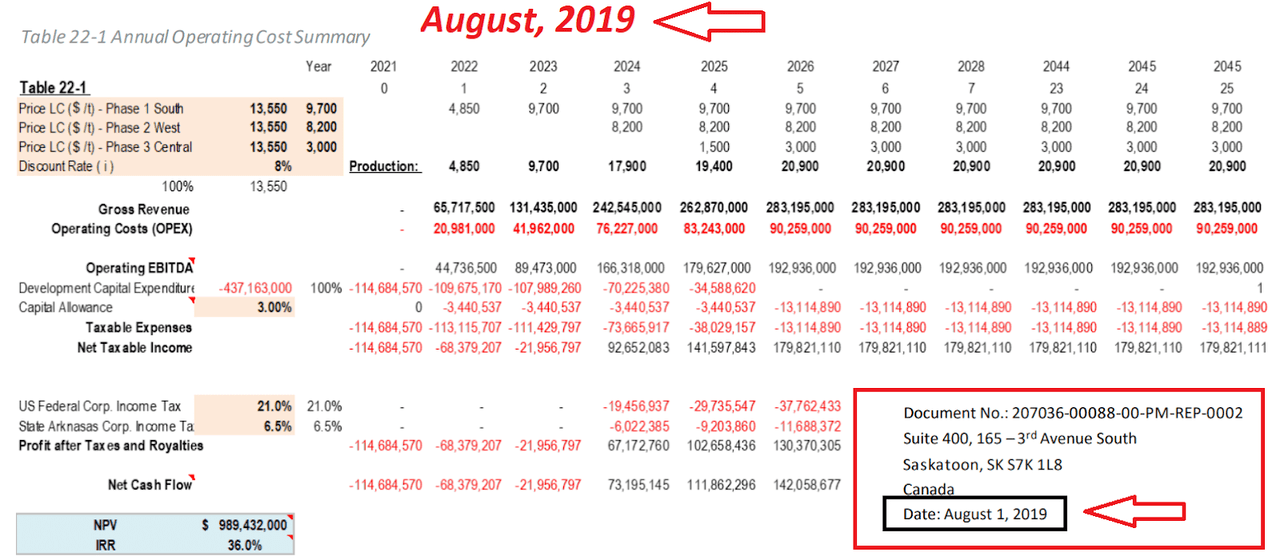

As of March 31, 2022, the company reported $136 million in cash, exploration and evaluation assets worth $34 million, and total assets worth $178 million. The total amount of liabilities appears very small, which is appealing. However, management will have to raise much more money in order to pay future opex and capex.

10-Q

As shown in the image below, I don’t really see debt outstanding, which appears quite beneficial. In my view, management may talk to banks in order to obtain debt financing.

10-Q

The Flagship Project Could Make The Stock Price Trend North

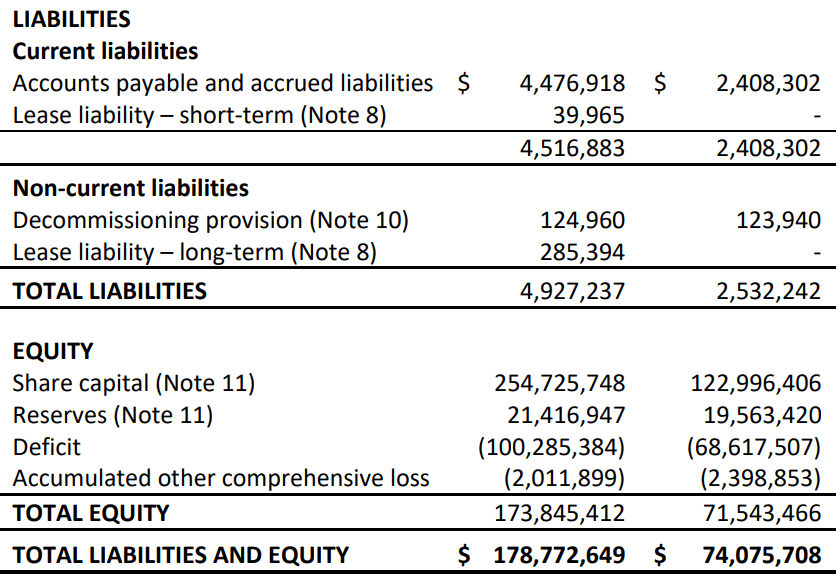

According to documents developed by management, the flagship project is expected to last for 20-25 years and would require a total capex of $437 million. It means that Standard Lithium would run operations until around 2045.

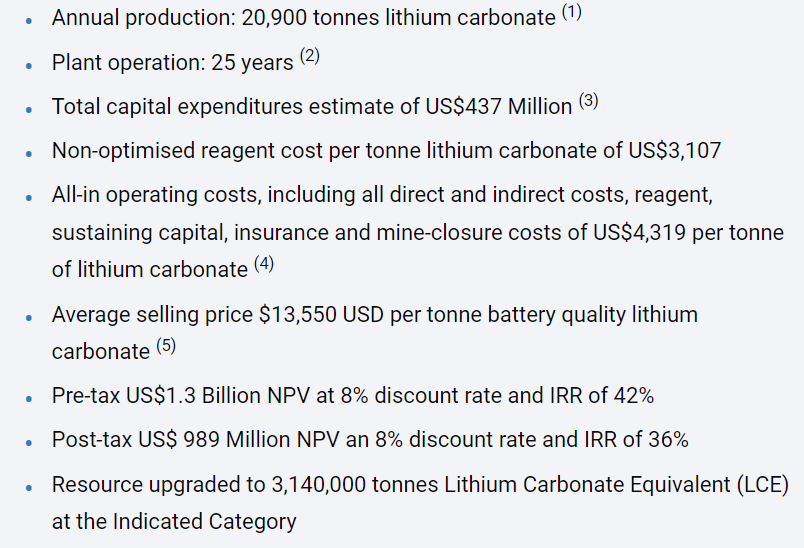

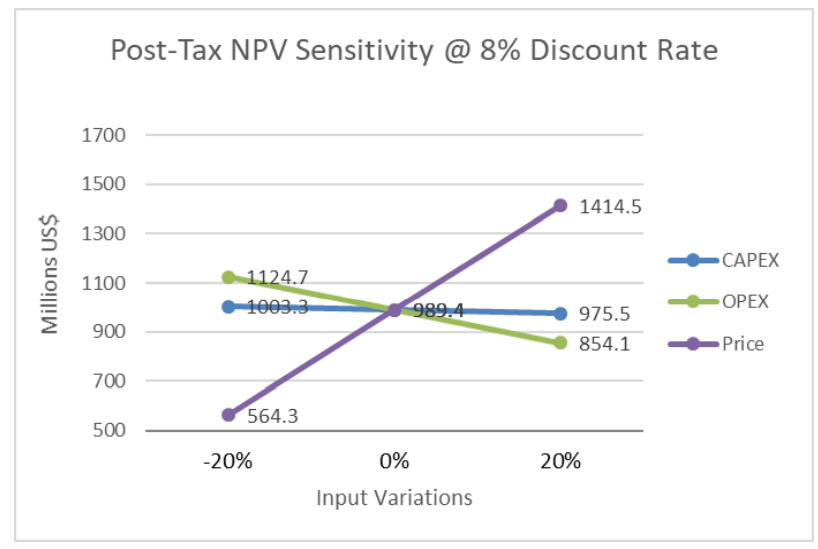

Management offered an economic assessment a few years ago. So, the recent increase in the price of lithium was not included in the company’s reports. Assuming an average selling price of $13.55k per ton and a discount of 8%, the NPV would stand at close to $989 million, and the IRR would be 36%.

Company’s Website

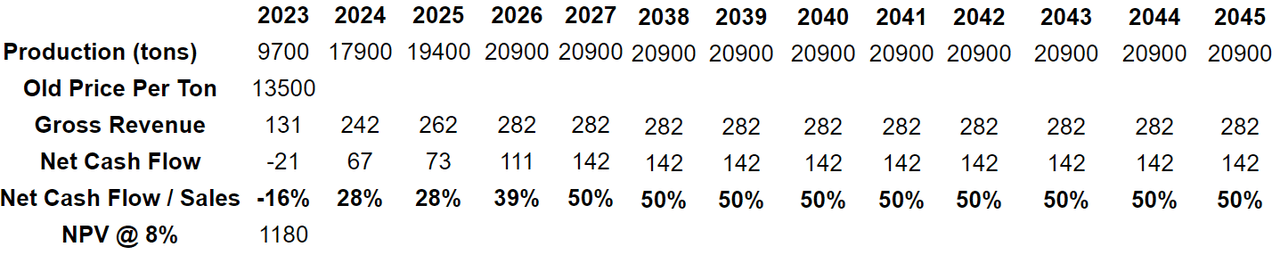

I found the financial model used to obtain the net present value for the project and obtained certain financial statistics. It helped me understand how it would affect an increase in the price of lithium. Keep in mind that the price increased to up to 40k per ton.

PEA

The company’s sensitivity analysis didn’t even consider that the price of lithium could increase that much. The maximum increase in the price of lithium expected was not more than 20%.

PEA

Using the assessment of Standard Lithium, the net cash flow/sales would grow from 28% to close to 50%. I believe that an increase in the price of lithium would lead to a better cash flow margin. However, I wanted to remain conservative. Perhaps, inflation or salary increases decrease the company’s profitability.

Author’s Work

The Battery-grade Lithium Carbonate EXW China price closed at $41,925 per tonne at year-end, an increase of 485.8% year over year. Source: Lithium costs up in 2021, continuing to surge in 2022 | S&P Global Market Intelligence

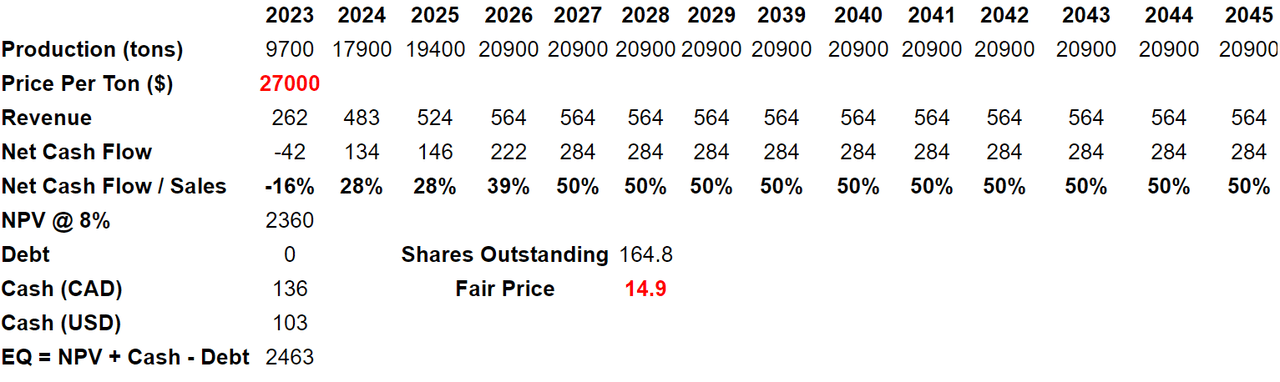

If we assume 20.9k tons of production from 2026 to 2045 and a price per ton of 27k, at 8% the net present value would stand at $2.36 billion. If we sum the cash in hand of $103 million or CAD136 million, the equity would be close to $2.4 billion. Finally, the implied price would be $14.9 per share.

Author’s Work

My Bearish Case Scenario Would Include Lower Production Than Expected, An Increase In The Cost Of Equity, And Equity Dilution

Among the worst nightmare of management, I believe that there is a significant decrease in the expected production. According to the company’s documents, management reports 3.14 million tonne LCE indicated resource, which would mean 20.9k tonnes per year. If management does not find that level of resources in the future, production would be significantly lower. As a result, as soon as equity analysts notice, I believe that free cash flow expectations would decline, which may drive down the stock price.

Company’s Website

If net cash flow estimates decline, in my view, the cost of equity would most likely increase. As a result, I believe that using a cost of capital larger than 8% would make a lot of sense. With respect to the price per tonne, I decided to use a price of $27k per tonne, which is sufficiently low and conservative. Right now, the price stands at more than 40k per tonne.

In my view, Standard Lithium will most likely raise more capital to finance future capital expenditures efforts and opex. As a result, the owners of the company’s stock warrants may sell or convert their convertible securities, which may lead to further equity dilution. In the worst-case scenario, an increase in the share count could lead to a decline in the stock price. Let’s note that I assumed, in this scenario, a share count of 200 million, which is significantly higher than the current number of shares outstanding.

On February 16, 2018, the Company closed a brokered private placement and issued 10,312,821 units of the company at a price of $2.10 per Unit, for gross proceeds of $21,656,924. Each Unit consists of one Share and one-half of one Share purchase warrant (each whole warrant, a Unit Warrant. Each Unit Warrant was exercisable to acquire one Share at an exercise price of $2.60 for a period of two years. The Company paid finder’s fees of $2,165,692 in cash, issued 309,384 Shares and granted 721,897 compensation options which were exercisable for one Unit until February 16, 2020 at an exercise price of $2.10. Source: Annual Report

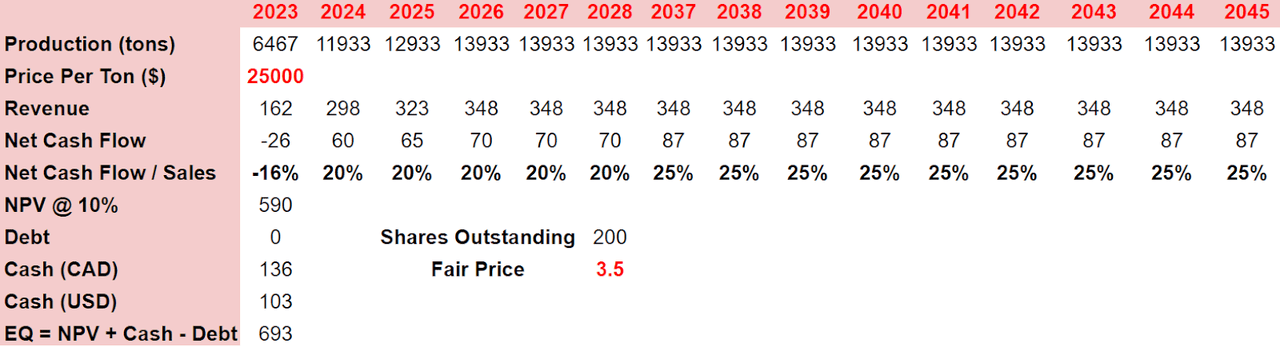

Under very traumatic events, I assumed that Standard Lithium would finally find two-thirds of the total production expected. I also included a discount of 10% and reduced the expected net cash flow/sales margin significantly. From 2024 to 2028, the company would report gross revenue close to $325 million and $375 million, with net cash flow/sales around 20%. Besides, from 2039 to 2045, future gross revenue would stand at around $375 million, and the fair price would be $3.5 per share.

Author’s Work

Risks Include Lack Of Financing, Failed Geological Model, And New Regulatory Models

The company noted very clearly, in one of its documents, that lack of financing could happen. In my view, without due financing, we can be sure that production will likely be lower than expected. The free cash flow expectations would most likely decline, which would lower the stock price.

There can be no assurance that debt or equity financing, or cash generated by operations will be available or sufficient to meet these requirements or for other corporate purposes or, if debt or equity financing is available, that it will be on terms acceptable to the Company. Moreover, future activities may require the Company to alter its capitalization significantly. Source: Annual Report

Besides, Standard Lithium reported that mineral deposits may not be commercially viable due to changes in the commodity prices. The size of the company’s deposit and geological properties could also damage the company’s free cash flow margin. Finally, changes in environmental regulations may lead to higher costs and may push the project’s net cash flow down.

The Company’s business strategy depends in large part on developing the Arkansas Lithium Project into a commercially viable mine. Whether a mineral deposit will be commercially viable depends on numerous factors, including: 1) the particular attributes of the deposit, such as size, grade and proximity to infrastructure; 2) commodity prices, which are highly volatile; and 3) government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of Mineral Resources and Mineral Reserves, environmental protection and capital and operating cost requirements. Source: Annual Report

Conclusion

Considering documents delivered by management, recent news, and trading activity of the CEO, in my view, production could accelerate soon. In my opinion, the economic report about the company’s flagship project is a bit outdated. Assuming that future production is accurate, and using a price of 27k per ton, I obtained a valuation significantly higher than the current stock price. There are risks, and Standard Lithium is a bit speculative because I don’t believe that management has all the cash in hand necessary to pay the expected capex. With that, in my view and given the reports about the reserves, the stock price is too low.

Be the first to comment