Bet_Noire

Even the most dedicated passive investors have caught themselves looking at ETFs like the ProShares S&P 500 Dividend Aristocrats ETF (BATS:NOBL). Dividends feel good and dividend growth strategies are tempting. More than that, thoughts about inflation and the future are worrying.

The story surrounding NOBL is compelling. The underlying holdings are a handful of recession-resistant stocks. They’re blue chips with a history of profitability, a proven track record of good money management, and a mission to reward their shareholders through growing dividends. Many of these firms are sought after by the world’s premier value investors. And, even if we can’t pick the winners like they can, we can at least buy a basket of all these stocks through NOBL.

Usually these stories are too good to be true. There are no investments that provide inflation protection and growth unless a lot of luck is involved. In this case, though, I think NOBL comes close. I don’t think NOBL is the only or even the best ETF for coming trying times, but I do like NOBL for what it is. I think it has good odds to survive this bear market if you’re willing to stay the course.

The Bull Case for NOBL

Equities in general tend to be a poor investment when inflation is running high. The falling value of currency drives up nominal operating costs, which puts a dent in net profit margins. This is especially an issue for growth stocks, which tend to be less profitable, that now find it more difficult to borrow money in light of rising interest rates. If any equities are going to stand a chance against inflation, it will be those firms that are already profitable and don’t need to drive up their operating expenses to remain profitable.

It just so happens that dividend-paying firms with a history of increasing their dividends are these right kinds of equities. Consistent dividend-payers, logically, will tend to be those firms that have no need to reinvest their profits back into their operations. As a recent article from Fidelity Viewpoints agrees:

When inflation has been high, the stocks that have increased their dividends the most have outperformed the overall market.

Fidelity’s director of quantitative market strategy, Denise Chisholm, gives a similar take.

Based on history, if high inflation is here to stay, I believe dividend growth stocks look likely to outperform.

Fidelity closes out their article with a list of Fidelity funds (of course) and then some other recommendations. And, in their list of suggested ETFs, guess which non-Fidelity ETF shows up: NOBL.

What Is NOBL?

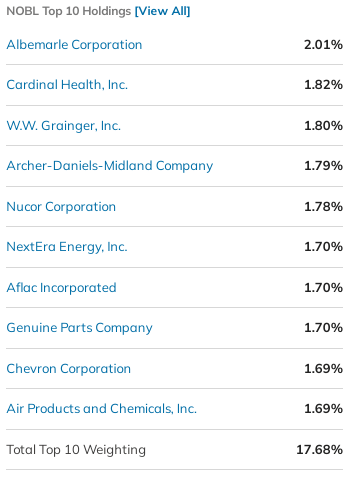

NOBL is an equal-weight index ETF that tracks the S&P 500 Dividend Aristocrats index. As such, NOBL invests in 65 companies from the S&P 500 that have a 25-year track record of increasing their dividends, and NOBL diversifies across them by holding them in equal dollar amounts. Currently, the top 10 holdings are the usual suspects for dividend growth strategies.

NOBL’s top 10 holdings are name-brand firms and are roughly equally weighted. (ETF.com)

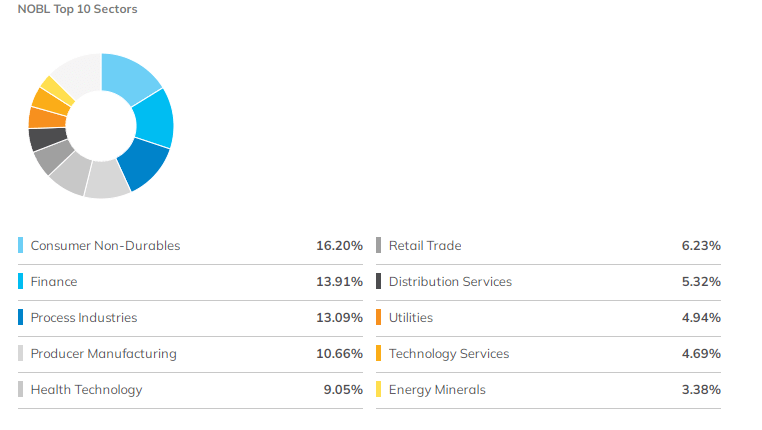

The 65 companies are well spread across a variety of market sectors. NOBL’s sector diversification is good, as is its concentration of its top 10 holdings due to being an equal-weight fund.

NOBL’s sector diversification is acceptable. (ETF.com)

There are some drawbacks, though. To start, NOBL has an expense ratio of 0.35%. That’s pretty high for an index ETF that trades US large caps, but it’s still lower than the 0.45% average of comparable ETFs. One big advantage of NOBL is that ProShares handles rebalancing for you, but whether that’s worth the 0.35% fee is arguable.

Also, NOBL’s dividend yield isn’t great, but it isn’t terrible either. At 2.0%, it does beat the S&P 500’s 1.5%. The majority of dividends are qualified, though, which is a positive. From a portfolio management perspective, possibly the main criticisms of this fund are: 1) that there are only 65 holdings; and 2) that stock selection was chosen based on a metric as arbitrary as dividend growth consistency.

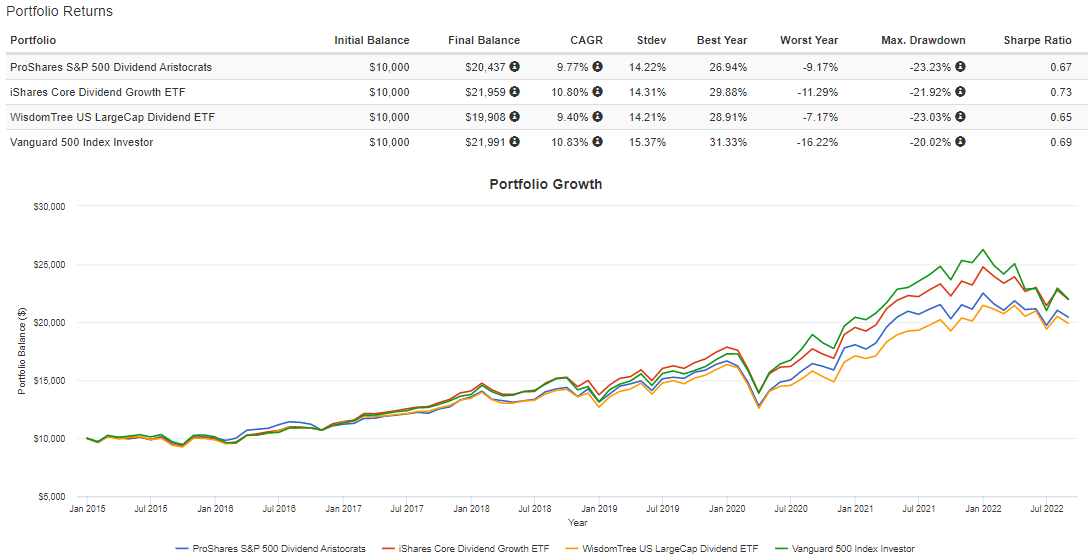

NOBL appears to be oriented towards investors who are looking for blue chip stocks that pay reliable and growing dividends while capturing market beta. That’s a tall order, and it doesn’t always happen. To illustrate this, backtested returns for NOBL since inception, the S&P 500, and two related dividend ETFs are shown below. The related dividend ETFs are the iShares Core Dividend Growth ETF (DGRO) and the WisdomTree US Large Cap Dividend Fund (DLN).

NOBL is able to keep up with the S&P 500, but it is far from the only dividend fund that can do this. (Portfolio Visualizer)

Indeed, NOBL has closely tracked the S&P 500 since the fund’s inception. On a risk-adjusted basis, the two are very similar. The majority of the underperformance is probably explained by large cap tech growth having a wonderful past decade, while NOBL, whose holdings are not typical large cap tech growth names, did not participate so much in that bull run. Though, I don’t see much of a compelling reason to choose NOBL over DGRO or DLN, at least from a total return perspective.

Factor Regression

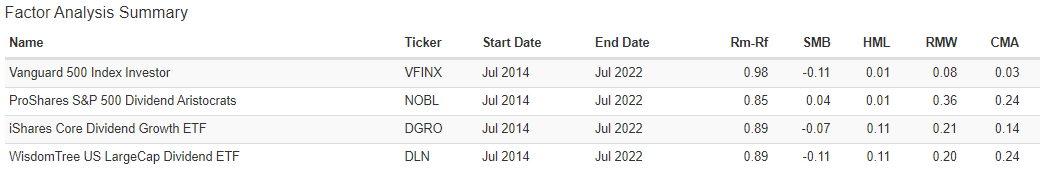

Having a fundamentals-based thesis for our investments is important, but it is similarly important to be quantitative. As such, we turn to factors. We can support many of the above observations with a Fama-French factor regression. A table with 5-factor regressions for each of the four funds is shown below.

Fama-French 5-factor regression outputs for four funds. (Portfolio Visualizer)

As we can see, NOBL’s dividend-paying stocks tend to be those that are both profitable and invest conservatively. It’s interesting to note that NOBL has almost no value tilt. It could be an artifact of the regression, or this is perhaps because everyone knows that dividend aristocrats are reputable firms. To me, this is a big argument against NOBL. If investors are buying dividend aristocrats solely because they’re dividend aristocrats, then dividend aristocrats as a whole become overvalued. They aren’t cheap because everyone knows that they don’t deserve to be cheap. We should be looking for opportunities among undervalued stocks instead of accepting overpriced shares.

Still, factor exposure looks good and comparable to the other two dividend ETFs that outperformed NOBL over the last few years. We might attribute this to luck, particularly uncompensated sector risk given that the other two funds hold tech stocks like Apple (AAPL). Generally, we understand NOBL’s low beta because NOBL holds many low beta stocks. Low beta stocks tend to have risk-adjusted returns in excess of the market in the long run, which is good. Importantly, we are not intentionally selecting low beta stocks and are instead selecting stocks that happen to have low betas. This was one of the problems I had with the Invesco S&P 500 High Dividend Low Volatility ETF (SPHD), which I wrote about here.

Predicting NOBL’s Future Returns

We have an inflationary environment ahead of us, so we need to understand how NOBL fares in inflationary landscapes. Since we know NOBL’s risk factor exposure, we can simulate its past returns, before its inception date, and use these simulated results to tell us what the future holds. A naïve expected return calculation using factor loadings and premiums yields a number around 0.9% over the market, which is already very good, but this does not account for inflation.

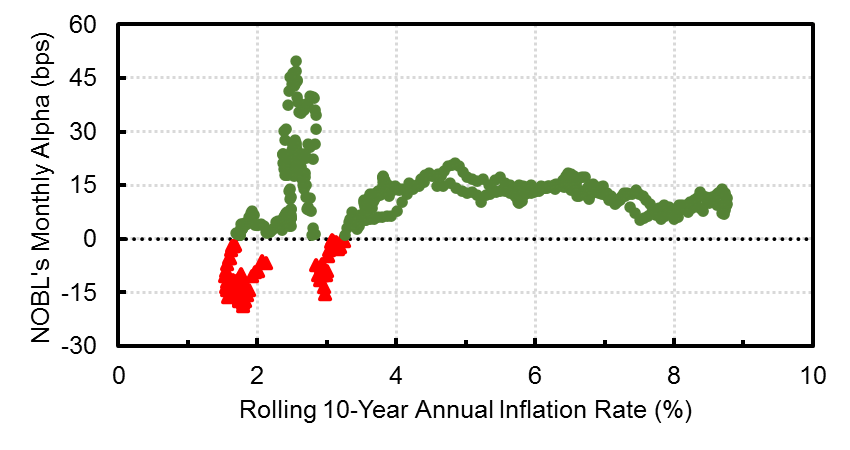

I downloaded monthly Fama-French 5-factor premiums for US markets from Ken French’s data library and annual US inflation rates (calculated monthly) from multpl. For the period starting July 1963 and ending May 2022, I plotted rolling 10-year inflation rates against a simulated portfolio that shares the same factor exposure as NOBL from 2014 to 2022. From this “simulated NOBL”, I subtracted the market’s return to calculate “NOBL’s Monthly Alpha” over the market.

We should note that NOBL, like everything else in the market, has time-varying factor exposure. This means that any backtesting we do is purely hypothetical. We can still attempt the backtest regardless, as shown in the plot below.

Simulated NOBL’s backtested performance against inflation from 1963 to 2022 over rolling 10-year periods. (FM Research)

Of these rolling 10-year periods, NOBL-like factor exposure has delivered returns in excess of the market nearly 87% of the time. In other words, simulated NOBL has beaten the US market more often than the US market has beaten T-bills, which has only happened 80% of the time. Moreover, simulated returns have been especially consistent during decades of inflation. This is to be expected given periods of low inflation, like the last decade, tend to favor growth stocks and market beta.

If NOBL’s factor exposure remains similar over the coming decade – which is in no way guaranteed – and if inflation persists – which is also in no way guaranteed – then we can expect NOBL to outperform the broader US market by anywhere between 6-15 basis points per month. This translates to 0.7-1.8% over the market each year. For rolling 10-year periods with annual inflation of at least 4%, NOBL’s outperformance is on average 13 basis points per month, corresponding to 1.6% annually. Indeed, we can expect NOBL to generate total returns in excess of the market if the Fed doesn’t have this situation under control.

Should You Buy NOBL?

I find NOBL to be a solid play against inflation, yet I do not own NOBL in my own portfolio for two reasons. 1) I’m not looking for dividends, and 2) I think there are better total return investments in inflationary environments. Small cap value funds like the Avantis US Small Cap Value ETF (AVUV), which I do own in my portfolio and have written about here, have higher expected returns in exchange for taking on more risk. I’m willing to bear this risk. It is important to note that even with NOBL, you are taking on extra risk in pursuit of excess returns.

ProShares knows that investors love ETFs like NOBL, so they charge somewhat high fees for their service. It’s very unfortunate to have your returns vacuumed away like this, but I don’t think that the fee is enough reason to avoid this fund. NOBL is a well-managed product, but it is not the only well-managed product out there. Still, I like the perceived safety in focusing on dividend aristocrats. NOBL would be my clear favorite over DGRO or DLN, if only its fees were lower.

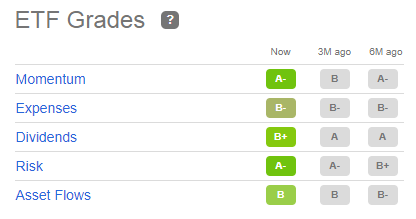

Seeking Alpha’s Quant gives a Buy rating with 4.36/5. The only major complaint I have with NOBL is that it commands such a high fee for doing next to nothing. Quant somewhat agrees.

Quant agrees that NOBL is a good buy at the moment. (Seeking Alpha)

Whether inflation is here to stay or going away is anyone’s guess. The inflation situation is not enough of a reason to avoid staying the course with your equity investments, but your investments need to be able to stand a chance under any macroeconomic regime. I can see message boards all over the internet recommending NOBL over the next 10 years. It could be sensible to hop on NOBL before it explodes in popularity.

Be the first to comment