Spencer Platt/Getty Images News

Tencent Music Entertainment Group (NYSE:TME), the largest online music entertainment platform in China, has seen an extraordinarily weak share price performance over the last year as it transitions away from social entertainment amid heightened live streaming regulation. That said, the stock is oversold, in my view – excluding its listed stakes in Spotify (SPOT), UMG (OTCPK:UMGNF), and Warner Music (WMG) along with its net cash position, TME stock trades at a deeply discounted ~7x P/E despite a net cash balance sheet and a growing long-term earnings stream. TME management seems to agree – the company has already deployed ~ $553m of buybacks in 2021 out of its $1bn authorization and could ramp things up further given the YTD stock price decline. Crucially, TME is also set for a secondary listing in Hong Kong, having fulfilled the HKEX secondary listing requirements for companies with weighted voting rights (>HK$10bn market cap and >HK$1bn of sales in 2021). As a secondary listing will allow ADRs to be converted into Hong Kong shares in the event of a US delisting, I expect confirmation of an HK listing to catalyze a re-rating in the coming months.

|

Valuation |

||

|

$ m |

||

|

TME 100% |

9,072 |

|

|

– Spotify 2.5% |

765 |

|

|

– UMG 1% |

491 |

|

|

– WMG 0.8% |

156 |

|

|

– Net Cash (2021) |

2,745 |

|

|

= Core TME Market Cap |

4,915 |

|

|

Core TME 2021 Adj P/E |

7.2x |

|

Source: Market Data (4th April 2022), TME Disclosures, Author

Massive Online Music TAM Opportunity Drives TME’s Growth Potential

As a music-based entertainment platform (rather than a pure-play music streaming service company a la Spotify), TME offers investors exposure to a massive user base of >620m online music mobile monthly active users (MAUs) and >200m social entertainment MAUs. Thus, TME’s runway in China is far greater than that of purely music streaming companies like Spotify. In essence, TME is a monopoly – it dwarfs its only other competitor in China, NetEase Cloud Music, whose customer base is focused on smaller niche groups. The TME moat stretches beyond its rich music library, given its close ties with parent company Tencent as well as its cross-shareholdings with the leading labels and Spotify, paving the way for deeper collaboration opportunities going forward.

Fundamentally, the Chinese customer base is growing, not only in numbers but also in its disposable income and willingness to pay for music content. This rings particularly true among the younger generation – gone are the days when pirate music streaming was the go-to place for music in China, with most people now opting for music streaming services with licensed music content. In line with this trend, TME’s online music paying ratio has risen to 12.4% last quarter (from 2.9% in 2017), led by a net addition of ~5m users QoQ. In total, subscription revenue remains the bright spot for TME at RMB2bn in 4Q21 (+23% YoY) on strong paying user growth and a stabilizing ARPU. With music licensing costs guided to move lower as TME continues to build scale, the online music segment is on track to achieve operating profit breakeven by year-end.

Social Entertainment Segment Hits a Speedbump

In contrast with the fast-growing online music segment, the social entertainment business is going through a challenging phase – revenue suffered its second consecutive quarterly decline at -15.2% YoY, reaching RMB4.7bn in 4Q21. The weakness was led by a decline in paying users to 9m (-17% YoY), as user engagement worsened alongside a contraction in live streaming MAUs. While the YoY decline was partly attributable to an unfavorable base effect, decreased monetization efficiency of the virtual gifting model following tightened regulations is the key concern, along with macro-led headwinds for open-screen advertising. While revenue will likely come under pressure in the coming quarters, management is exercising discipline by cutting back on content and marketing spend to keep margins in line with 2021 levels. While additional revenue contribution from QQ Music live streaming could provide some offset, regulatory adjustments and competition from short video platforms mean a single-digit decline is probably fair for TME’s social entertainment revenue outlook post-2022.

Long Term Initiatives Present Optionality; De-Risks the Investment Case

To its credit, TME management is mitigating the live streaming slowdown by investing in innovative product features on social karaoke application, WeSing, as well as new initiatives across long-form audio and streaming, virtual interactive products, and international expansion. TME is also ramping up its original content production efforts, with no.1 hits such as “Lonely City” in the “Chinese Ancient Style” category driving ~1bn streams in 4Q21 alone. Its independent musician network is also on the rise – Tencent Musician Platform has reached ~300k as of its latest quarter, paving the way for more live performances in the years ahead. The key mid-term opportunity, in my view, lies in long-form audio (LFA), where MAU has already exceeded 150m (+63% YoY). Assuming this trajectory continues, TME looks set to hit breakeven at the gross margin level in 2022 despite still figuring out ways to expand monetization and control content costs. Given TME’s backing from Tencent and its net cash balance sheet, I also see ample synergies and expansion opportunities from partnerships or external M&A (e.g., the recent acquisition of M&E Mobile, which operates Japan’s leading karaoke app Pokekara). Finally, a potential secondary listing on the Hong Kong Stock Exchange is in the works, likely through a direct listing (i.e., no offering of new shares) – if successful, a Hong Kong listing should insure against a potential US delisting scenario and thus, ensure continued access to the capital markets going forward.

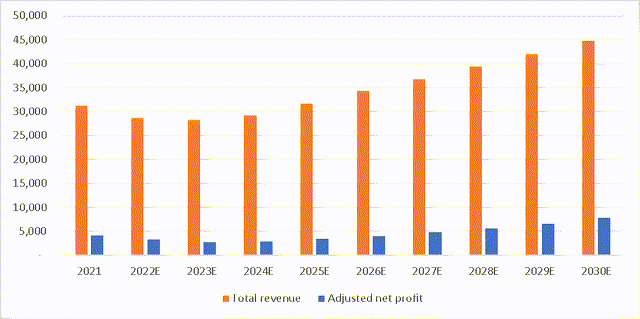

Online Music Entertainment Monopoly Trading at a Deeply Discounted Valuation

TME’s latest quarter outlined all the fundamental challenges it continues to face, as music net adds are guided to slow to a 3.5-4m/quarter pace in 2022 (vs. 5m in 2021) amid competition and regulatory headwinds. That said, context is essential – this is still a business with a wide moat and a healthy earnings stream, so the current valuation is puzzling, in my view. Excluding its listed stakes (Spotify, UMG, and WMG) and the net cash balance, TME stock trades at a discounted ~7x adj. P/E despite still being on track for earnings growth post-two-year transition in social entertainment. With management actively repurchasing stock and a potential secondary listing in the works (TME already meets HKEX requirements), TME is not short of re-ratings catalysts.

Source: TME Disclosures, Author

Be the first to comment