Wolterk/iStock Editorial via Getty Images

As companies grow, one thing that they all have in common is the need for various products and services to make their lives easier and their operations more efficient. It should stand to reason then that, over time, companies would develop to provide these offerings. One such firm that has a special focus on human resource software and services is Paychex (NASDAQ:PAYX). Over the past few years, financial performance at the company has been generally positive. Although its cash flows have been lumpy, revenue has grown at a nice clip. Long term, the company will likely only grow larger. But all things considered, shares of the business don’t look particularly cheap. Although the company may appeal to growth-oriented investors, it is priced at a level that should make it a ‘hold’ as opposed to a ‘buy’ prospect at this time for everybody else.

Paychex – A business for your business

Today, Paychex describes itself as a human resource software and services company. To be more specific, the company provides a number of technologies and services aimed at making the operation of your business easier. Examples include offering human resources functions, providing payroll functions, keeping track of benefits, and providing insurance services for small and medium-sized companies.

When discussing its various solutions, the company claims to bring together payroll and HCM software that allows clients the option of doing payroll online using with their technology platform, but also offering the ability to outsource the payroll function to their specialists or using a combination of the two methods. From there, the company’s payroll technologies are then integrated with the firm’s HCM software modules if a customer so desires it.

For those who don’t know, the company’s HCM technology is an SaaS platform known as Paychex Flex that helps clients to manage the employee lifecycle ranging all the way from the recruiting process to retirement. The system uses a cloud-based platform and clients can select which aspects of it they need as add-on services as they grow their own businesses.

On top of all of this, the company also offers comprehensive human resources outsourcing through its own ASO, or administrative services organization, as well as PEO solutions. The former of these offers businesses a combined package that includes payroll, employer compliance features, human resources activities and employee benefits administration, risk management outsourcing, and other related features. Meanwhile, the PEO solutions portion of the business involves their own licensed subsidiaries to provide those same kind of functions. The only difference here is that, under the PEO solutions side of the equation, the company serves as a Co employer of their client’s employees and, as a result, shares in both the risks and rewards of workers’ compensation insurance and health insurance offerings.

The company also provides insurance solutions through a subsidiary called Paychex Insurance Agency. As you might have guessed, this unit of the business provides insurance from various carriers to the employees of companies that it works with. These insurance policies range from cyber security protection to automotive insurance to health and benefit insurance and more.

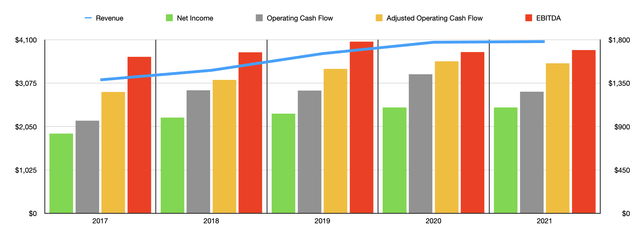

Author – SEC EDGAR Data

Over the past five years, management has done well to grow the company’s top line. Revenue has increased from $3.15 billion to $4.06 billion. What’s more, management expects that growth to continue this year, with revenue likely to expand by between 12% and 13%. At the midpoint, this would imply revenue for 2022 of $4.56 billion. This is actually higher than the growth rate the company has experienced on its top line in at least the prior five years. And so far, the company is well on its way to that goal. That’s because, in the first nine months of its 2022 fiscal year, the business reported revenue of $3.47 billion. That represents an increase of 14.5% over the $3.03 billion the company reported one year earlier.

When it comes to its bottom line, the picture has been a little more volatile. Between 2017 and 2019, net profits at the company increased from $826.3 million to $1.03 billion. Profits then inched up to $1.10 billion in 2020 and flatlined at that level in 2021. Given all that transpired because of the COVID-19 pandemic, this leveling off, which matches the near leveling off of revenue, should not be all that surprising. But when it comes to other profitability metrics, the results have been less impressive. Between 2017 and 2020, operating cash flow with the company rose consistently, climbing from $960.4 million to $1.44 billion. But then, in 2021, cash flow dropped to $1.26 billion. Even if we adjust for changes in working capital, after seeing the metric rise from $1.26 billion in 2017 to $1.58 billion in 2020, the metric then inched lower to $1.56 billion last year. The only profitability metric that has consistently risen year after year has been EBITDA. This metric grew from $1.62 billion in 2017 to $1.69 billion in 2021.

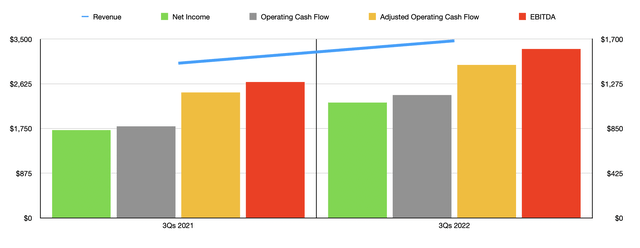

Author – SEC EDGAR Data

When it comes to the 2022 fiscal year, the company has seen a resurgence in profitability growth. Net income in the first nine months of its 2022 fiscal year totaled $1.10 billion. That represents an increase of 25.9% over the $834.5 million the company reported one year earlier. Operating cash flow with the company grew from $870.6 million to $1.17 billion, while the adjusted equivalent of this grew from $1.19 billion to $1.46 billion. Over the same window of time, EBITDA at the business expanded from $1.29 billion to $1.61 billion. When it comes to the 2022 fiscal year, management has said that EBITDA, at the midpoint, should come in at about $2.03 billion. The company also expects earnings per share to rise by between 22.5% and 23%. Given the number of shares outstanding for the company at this time, this would translate to net profits of $1.33 billion. No guidance was given when it came to operating cash flow. But if we assume the same growth rate for it as what we should see with EBITDA, then the adjusted figure should come in at about $1.87 billion.

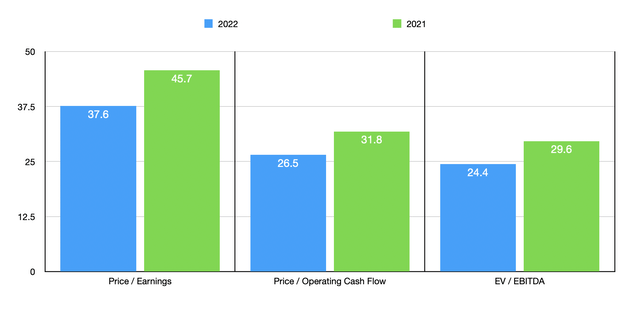

Author – SEC EDGAR Data

Given this data, we can now price the business. On a price-to-earnings basis, using the company’s 2021 results, we end up with a multiple of 45.7. This drops to 37.6 if we rely on 2022 estimates. The price to adjusted operating cash flow multiple would drop from 31.8 to 26.5 over the same window of time. And the EV to EBITDA multiple for the company would drop from 29.6 to 24.4. I then decided to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 36.9 to a high of 438.4. Only one of the five companies was cheaper than Paychex. Using the price to operating cash flow approach, the range was from 13.3 to 79.8. In this case, three of the five companies were cheaper than our prospect. Meanwhile, using the EV to EBITDA approach, the range was from 15.8 to 249.5. And in this scenario, four of the five companies were cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Paychex | 37.6 | 26.5 | 24.4 |

| Global Payments (GPN) | 42.5 | 14.7 | 16.2 |

| Fidelity National Information Services (FIS) | 152.3 | 13.3 | 16.2 |

| Fiserv (FISV) | 51.9 | 17.2 | 15.8 |

| Block (SQ) | 438.4 | 79.8 | 249.5 |

| Automatic Data Processing (ADP) | 36.9 | 32.4 | 24.1 |

Takeaway

All things considered at this time, Paychex strikes me as a company that is performing well and that will likely continue to do so for the foreseeable future. Long term, I have no doubt that the business would generate attractive value for its investors. Growth investors will likely enjoy this prospect because of the returns it can offer. But on the whole, I don’t like how pricey the stock is. This is especially true when looking at it through the lens of the price to earnings multiple. But even when we look at the cash flow multiple, the company is far from cheap. Of course, I would not say that shares are overvalued either. Frankly, given how rapidly the company now looks set to grow and the strong cash flow margins it generates, I would make the case that it probably is fairly valued right now.

Be the first to comment