Francesco Scatena/iStock via Getty Images

We’ve previously discussed Allkem (OTCPK:OROCF) as a lithium pure play we are particularly bullish about. Subsequently, we have observed continued strength in raw lithium prices and steady progress of expansion plans, which supports our continued conviction in the investment.

Furthermore, we have seen the fruition of predicted volatility in the stock price, and as it is now currently trading below levels when we initially made our buy call, we feel now is an opportune time to increase exposure.

Revisiting Fundamentals

When we initiated coverage in August 2022, the ASX-listed stock was trading at around a P/E multiple of 18x (A$14). At time of publication of this article, the stock is trading closer to A$13. As an entity that releases financials semi-annually there has been no earnings update in between, and therefore on a trailing basis, headline P/E has decreased proportionally to 16.5x. In the meantime, the company has published its quarterly production update for Q1, as well as conducted its AGM, and we were able to garner some useful information from these forums.

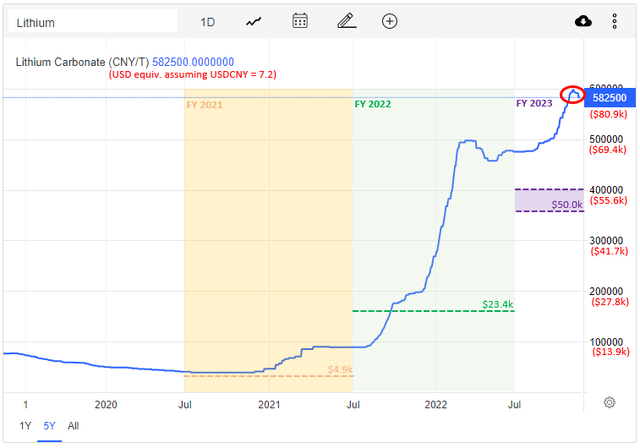

There were a few positive factors we initially highlighted which helped us derive an implied valuation closer to P/E of 6x. The first was Realised Sales Price. This has been trending upwards, with average realised price improving from US$23.4k/tonne for full year 2021, to US$43.2k for Q1 22, and guided by management to reach US$50k/tonne for Q2. With lithium carbonate spot currently trading above US$80k/tonne, we maintain our forecast that average sales price of US$50k/tonne can be sustained for the entire financial year.

Since we last published research, lithium carbonate spot price has continued trending upwards. The purple zone represents the realised sales prices we think Allkem will achieve in FY 2023. Also, note the pause in the last few weeks (red circle) – we think this is the probable explain of recent disproportionate stock price movement. (tradingeconomics.com)

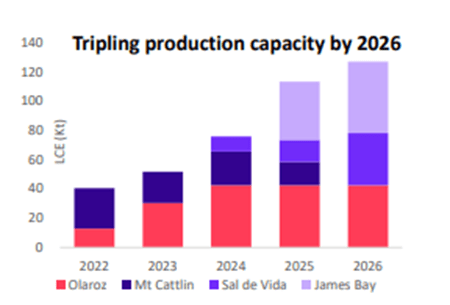

The other factor was an expected tripling of Production Output by 2026. That view was recently reaffirmed by management, although the production update articulated some setbacks that the company experienced in the quarter.

Allkem’s plans to triple production by 2026 actually doesn’t assume any contribution from Mt Cattlin (company presentation)

Full-year guidance at its Mt Cattlin operations was confirmed at the downwardly revised levels of 140-150kt, owing to labour shortages and a change in mining contracting companies. However, we recall that Mt Cattlin is shown as at end-of-life by 2026 in presentation materials, and was assumed not to be contributing to the company’s medium-term growth. Furthermore, recent resource drilling updates give hope that more reserves may actually be available at the site, and therefore we see upside potential that hasn’t been factored in. We will know more when management provides more details H1 2023.

Separately, supply chain related issues explained a delay in first production from Olaroz Stage 2 by 6 months to mid-2023, and also an overrun of capex budget by 12%. Although 93% complete, with Stage 2 slated to provide a substantial production volume boost, the delay has understandable repercussions for the current financial year’s performance, but less uncertainty further out. Also, factoring in higher costs to get the project over the line, breakeven is still expected around US$17k/t.

Stock Price Action

The 27% YTD appreciation in the stock price is paltry considering the meteoric rise of lithium carbonate spot price in the same timeframe, and the fact that Allkem’s production continues to increase. Also, the large spikes down in price recently are unjustified in our view. (Interactive Brokers)

Nevertheless, we’ve noticed that the stock has moved erratically and inconsistently in 2022 despite the increasingly positive outlook for the company. Initially we attributed this to general negative sentiment from macroeconomic uncertainties. Having watched more observantly of late we refine this view further.

Firstly, lithium producers are broadly considered growth prospects, in anticipation of the unleashing of exceptional performance as the green transition makes progress and specifically EVs become increasingly mainstream. This helps explain the 18x P/E multiple at which Allkem trades at, which is higher than producers of more traditional natural resources.

The sector as a whole though is littered with companies that are yet to generate revenues. Of the ones which are currently producing, examples such as Pilbara Minerals (OTCPK:PILBF) trades at 25x, and Albemarle (ALB) at 22x. We think although the stock is naturally caught up in the speculative ebb-and-flow that often accompany growth industries, unlike many of its competitors Allkem generates positive cash flow generation and earnings, has a more certain and shorter-dated path to further growth, and at a lower multiple than peers perhaps shouldn’t be treated as a growth stock.

Growth stocks have fared poorly this year, with the underperformance attributed to higher interest rates increasing the discount factor applied to longer-duration investments. In this environment we think it’s understandable that there is gravitational pull acting on the stock price of lithium producers.

However, considering the general correlation between interest rates and inflation, inflation and commodity prices, and in Allkem’s case commodity prices and profits, we see Allkem’s performance to be more resilient than the market is giving it credit for. The 27% gains the stock price has seen in 2022 is paltry, considering we expect realised sale price to increase by at least 100% in FY 2023.

This negative sentiment has bared its sharp teeth of late, when all lithium producers were unexpectedly pummelled a few times this month (November 2022). The first instance, Allkem shares got hit by over 10%, merely on rumours. The share price was coincidentally tanking while the AGM was taking place, leaving these slightly bemusing closing remarks from management:

Thanks, everyone, for your attendance, and thanks for being shareholders of the company. And I hope that you stay as shareholders in continuing to enjoy the benefits of an increased share price. Unfortunately, not today for some reason, we’re trying to find out why. Down 12% when I last looked. What to do… …well, the whole sector is down. I’m trying to find out the cause, it’s unusual. (Martin Perez de Solay, CEO)

Another significant drop of 9% on the day of preparing this article, perhaps on account of spot prices ‘weakness’ around US$80k/t, has returned the stock price back to A$13. These are levels last seen in August, and a price point we definitely deem attractive.

Final Thoughts

Of course, the first signs of a plateauing of spot price could signal the start of a prolonged downtrend. But with the positive basis between spot and realised prices still so wide and acting with a lag, the certainty that Allkem will further ramp up production, and unjustified negative sentiment from speculative corners of the market weighing on the stock price, we instead feel that now is a timely opportunity for a long-term investor to add to their portfolio. We also sense that volatility could persist until mid-2023, and would advocate finding ways of freeing up capital to top-up further if the stock price becomes increasingly favourable.

We will continue to keep an eye out for a break-down of spot price from its current US$80k/t levels, as in the wider picture concerns about inflation and recession could exert continued downward pressure, as it has with most investments of late. We would however expect prices to stabilize imminently at elevated levels.

Instead, unless the fundamental supply-demand dynamics for lithium as a critical material for the green transition materially changes, we think it is unlikely our sentiment for lithium producers in general, and Allkem in particular, will waver.

(AUDUSD=0.67 assumed in analysis)

(Reporting currency of Allkem is USD, however we reference ASX-listed AKE in our analysis which is quoted in AUD)

Be the first to comment