Michael Vi

San Diego, CA based Sempra Energy (NYSE:SRE) serves more than 40 million customers – primarily in California, Texas, and Mexico – through its electric utility, electric transmission lines (300,000 miles worth), and LNG assets. The company’s recent Q3 earnings report – released on November 3rd – was a beat and a raise. Since then, Sempra has made two big announcements that flush out the development of its proposed Port Arthur LNG project, which appears to be very close to achieving Phase 1 FID (final investment decision), which I suspect will likely come early in Q1 next year. Meantime, the company is seeing significant interest in Phase 2 of the Port Arthur project as well. That being the case, LNG is likely to become the primary growth thesis for SRE going forward.

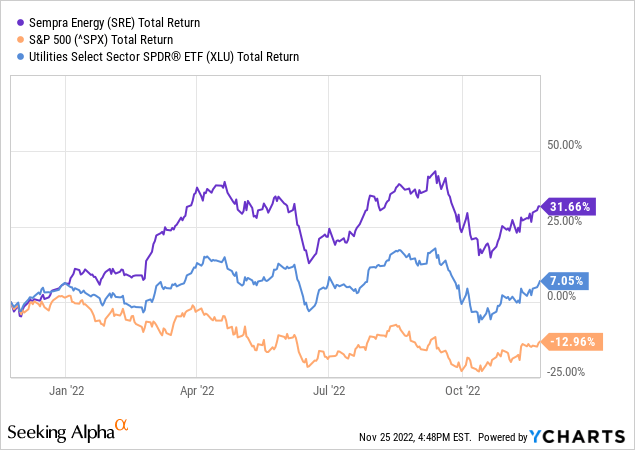

Sempra’s stock has bucked the bear-market trend and is up 30%+ over the past year, vastly outperforming both the S&P 500 and the SPDR Utility Sector ETF (XLU):

Investment Thesis

Sempra operates three primary growth platforms: California, Texas, and Sempra Infrastructure (which includes Mexico). Prior to recent LNG developments (more detail below), Sempra’s regulated utility operations in California and Texas were the primary growth catalysts. That is because Sempra is well-positioned for the clean-energy transition, and should generally be a beneficiary of the Biden administration’s ability to get both the bi-partisan Infrastructure Act passed and the IRA (or what I refer to as the “Clean Energy Act”) passed through Congress. These acts have appropriated tens of billions of dollars for investment into EV-charging stations, upgraded utility grid and electric power infrastructure, and for clean-tech renewable solar and wind electric power generation capacity.

However, going forward, LNG is going to be SRE’s primary growth catalyst in my opinion. But before we delve into that, let’s take a brief look at the company’s most recent earnings report.

Earnings

Sempra’s Q3 EPS report was issued the first week of November, and it was a strong performance. Highlights included:

- Non-GAAP earnings of $1.97/share was a $0.19 beat.

- Q3 revenue of $3.62 billion (+20.3% yoy) beat by $260 million.

- Sempra increased the midpoint of full-year FY22 adjusted earnings guidance to $8.85/share from the previous $8.40/share and above the consensus (at that time) of $8.66/share.

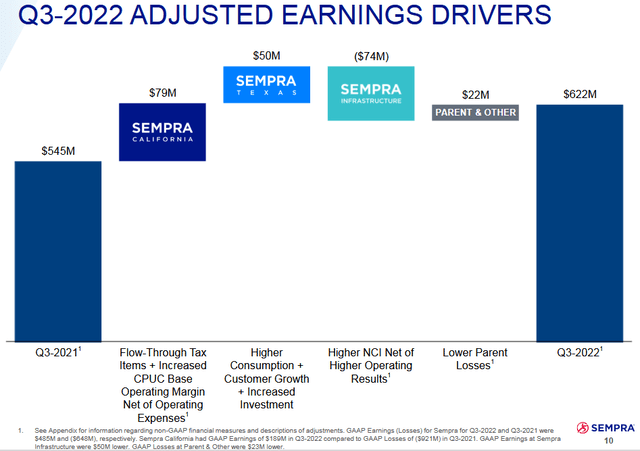

As the slide below shows (taken from the Q3 Presentation), the excellent quarter was due to strong yoy performance at Sempra California (primarily SDG&E and SoCal Gas) and Sempra Texas, offset by lower results from Sempra Infrastructure:

LNG

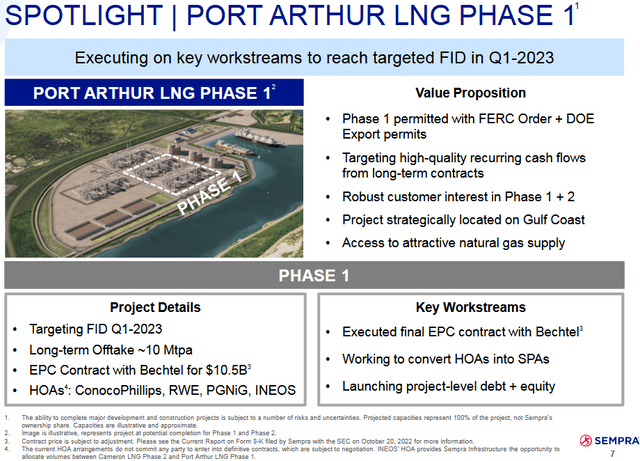

As mentioned earlier, since the Q3 report, Sempra has announced two big deals with respect to advancing its proposed Port Arthur, TX LNG project, which is shown below:

As you can see from the slide, Phase 1 of the Port Arthur project has already been permitted by FERC and the DOE and is expected to export 10 mega-tons of LNG per year.

On November 15, Sempra Infrastructure (“SI”) announced a heads of agreement (“HOA”) with Williams (WMB) for the offtake of LNG and development of associated natural gas pipeline projects. Specifically, the HOA aims to finalize two 20-year long-term sale & purchase agreements (“SPA”) for ~3 million tonnes per annum (Mtpa) of LNG – in aggregate – from the Port Arthur LNG project and Cameron LNG Phase 2 – both of which are currently in the developmental stage.

The HOA also anticipates forming a strategic joint-venture between the two companies to own, expand, and operate the existing 2.35 Bcf/d Cameron Interstate Pipeline that is expected to deliver natural gas to Cameron LNG Phase 2 as well as the proposed Port Arthur Pipeline Louisiana Connector that is expected to deliver natural gas to the Port Arthur LNG facility.

A week after that announcement, SI announced an even bigger offtake agreement with ConocoPhillips (COP) – a 20-year, 5 Mtpa of LNG from Port Arthur Phase 1. I say a “bigger”, because the two companies also entered into an equity deal whereby ConocoPhillips will acquire 30% of the equity in Port Arthur LNG, Phase 1, as well as a natural gas supply management agreement whereby COP will manage the feedgas supply requirements for Phase 1. This is natural considering COP has built-up one of the largest natural gas marketing businesses in the United States, as well as the fact that it also obviously has significant natural gas production in the Eagle Ford and Permian Basins, both of which already supply natural gas to the Texas Gulf Coast. That being the case, Port Arthur LNG is likely to be very competitive on a cost-basis with any LNG facility on the planet.

Meantime, with respect to Cameron LNG, note that Justin Bird, SI CEO, made these comments on the Q3 conference call:

Let me start at Cameron LNG, where operations for Phase 1 are going very well, with production levels exceeding expectations. In addition, both the proposed Phase 2 expansion project and related debottlenecking activities of the existing 3 trains are moving along as planned.

and with respect to Port Arthur, Phase 2:

So remember, we’ve got 3,000 acres of frontage on the waterway there (i.e. Port Arthur), roughly 3 miles of access to water. Also, what’s very attractive to customers is the potential scale … You’ll recall that this has the opportunity to be up to 8 trains. And if you ever got that far, and obviously, that’s well into the future, it would be the largest export project in the Western Hemisphere. So it really has the ability to scale quite nicely. And to your point, Bechtel probably has the best reputation for delivering projects on time and on budget … They have spent a significant amount of time on this site, and that’s been a real big linchpin and get us confident in our FID opportunity for Phase I, which we’ll talk about, hopefully, in Q1, but it also is a real competitive advantage for Phase 2.

As a result of the excellent progress to date with both of these new LNG prospects, LNG is likely to be the primary growth driver for Sempra Energy going forward. That said, investors should consider that over the past year, SI has sold (non-controlling…) stakes of 20% to KKR, and 10% to Abu Dhabi.

Valuation

The chart below shows some current valuation metrics of Sempra compared to that of the broad utility sector as represented by the SPDR Utilities Sector ETF, XLU, the broad S&P 500, and its new partner ConocoPhillips:

| P/E | Forward P/E | Yield | |

| SRE | 22.9x | 18.6x | 2.81% |

| XLU | 7.1x | N/A | 3.04% |

| S&P 500 | 21.0x | N/A | 1.62% |

| COP | 9.1x | 8.9x | 3.6%* |

* yield calculated off of both (base+variable) dividends.

As you can see, SRE is currently trading with a P/E significantly above that of the XLU ETF and even above that of the S&P 500. That being the case, it appears to me that much of the good news regarding Sempra’s pivot to LNG has already been priced into the stock this year. At today’s close (Friday, Nov. 25th) of $163 and change, the stock looks fully valued to me.

Summary & Conclusion

Sempra has pivoted toward a prioritization of LNG. The recent large-scale agreements with Williams and ConocoPhillips increase the certainty that SI will reach a final investment decision for the proposed Port Arthur Phase 1 in Q2 FY23, likely early in the quarter in my opinion. While all this is good news for Sempra shareholders, it appears to already be well-priced into the stock.

On the other hand, a stock like ConocoPhillips appears to be the best way to play Sempra’s emerging LNG plans (and LNG in general). While I realize that COP doesn’t have the relatively stable cash-flow profile of a utility company like Sempra, it is trading at less than half the earnings multiple and is delivering significantly more income for its investors. In addition, with COP’s marketing arm being in charge of so much natural gas feedstock for Sempra’s LNG plants, it’s probably safe for investors to think that COP will, in general and going forward, very likely receive higher realized pricing for its natural gas production in the Eagle Ford and Permian that it otherwise would have. I would also guess that the Port Arthur LNG project will very likely license COP’s proprietary LNG technology (the Optimized Cascade Process) – that I previously wrote about in this Seeking Alpha article – and which is being used in most of the LNG facilities currently in operation on the planet.

Meantime, note that COP already has a significant global LNG footprint. See my Seeking Alpha article ConocoPhillips Shift Focus To LNG, which was written in July – months before the Sempra agreements were announced.

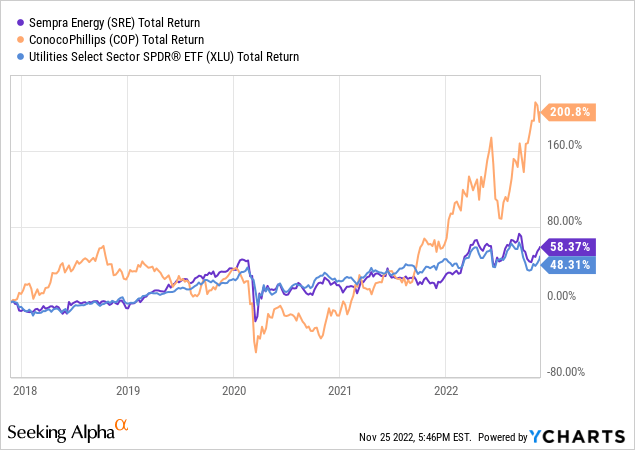

I’ll end with a 5-year total returns chart of SRE, COP, and the XLU. And yes, before you leave a comment, I do know that COP is not a utility company. The comparison is simply in reference to my previous comment on perhaps a better way to play SRE’s LNG prospects going forward.

Be the first to comment