35007/E+ via Getty Images

Investment Thesis

According to rumors circulating this week, California-based life sciences researcher and clinical diagnostics product supplier Bio-Rad (NYSE:BIO) is in talks with Netherlands-based molecular research and clinical testing specialist Qiagen (NYSE:QGEN) over a potential merger.

At the time of writing, Bio-Rad’s market cap is $11.6bn, and its share price is $390 – down 45% across the past five months, and up 75% over the past five years, while Qiagen’s market cap is presently $9.8bn and its share price $43, down 17% across the past 12 months, and up 24% over the past five years.

Qiagen’s revenues in 2019, 2020, and 2021 were $1.53bn, $1.87bn, and $2.25bn, while Bio-Rad’s revenues in the same years were $2.3bn, $2.55bn, and $2.9bn. Qiagen’s operating income across the three years was $288m, $538m, and $658m, whilst Bio-Rad’s was $230m, $411m, and $554m.

On the face of it, the marriage of two companies with a price to sales ratio of <5x, generating revenues in the multi-billions, and driving operating profit margins of ~20% in Bio-Rad’s case, and 29% in Qiagen’s seems logical, especially when we consider that the main competitive threat to both companies in their markets comes from much larger organizations.

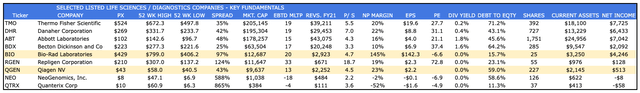

Bio-Rad and Qiagen compete against the likes of Thermo Fisher (TMO), Danaher Corporation (DHR), Abbott Laboratories (ABT), and Becton, Dickinson (BDX), which are in a different league in terms of revenue generation and financial resources, as we can see in the table below.

Investment fundamentals of leading Life Sciences / Diagnostics companies. (my table)

Source: my table using data from TradingView. Google Finance.

Back in 2019, Thermo Fisher was rumored to be considering acquiring Qiagen, which helped drag the smaller companies’ share price out of a dangerous slump, to $27. I covered Qiagen in a post for Seeking Alpha at the time, giving the company a “BUY” recommendation, and shares went on to reach a high of $57 on strong revenue growth and profitability, before slumping in 2022.

Bio-Rad stock has also been on a downtrend, however Bio-Rad’s valuation is bizarrely dictated by the value of a ~37% holding of ordinary shares and ~28% holding of preference shares of a Germany-based technology supplier to the biotechnology, pharmaceutical, chemical and food and beverage industries Sartorius.

As we can see in the table above, Bio-Rad recorded an extraordinary Earnings Per Share (“EPS”) figure of $142.3 in 2021, which is down to the company realizing a $4.9bn windfall as Sartorius’ share price surged in value from $171, to $500 in 2021, reaching an all-time high of $778 in September 2021.

In 2019, 2020 and 2021, Bio-Rad recorded gains of $2bn, $4.5bn, and $4.9bn attributed to the change in fair market value of Sartorius shares, but in 2022, Sartorius stock has fallen to a price of ~$300, and Bio-Rad has recorded a loss of $5.9bn. GAAP diluted income per share in 1H22 is a staggering ($143.88)!

Whether this quirk affects the prospects of a merger between Bio-Rad and Qiagen is questionable, but it’s nonetheless useful to know about in order to understand the true economics of the company.

The question shareholders in either company, or those considering an investment in either company need to answer is whether a merger is in their best interests or otherwise?

While you can argue that the merger of two relatively successful companies could create an even more successful one, that can take on more established incumbents, in fact my belief is that it would be more likely to stifle innovation in the sector.

A merger seems unnecessary to me, and based on the flawed logic that two competing companies of similar size are better off working together. The Life Sciences sector may need M&A to stimulate growth and innovation, but both Qiagen and Bio-Rad would be much better off deploying their substantial resources of making bolt-on acquisitions of smaller companies, in my view.

Qiagen Overview

In its 2021 10K submission, Qiagen breaks down its business as follows:

We provide more than 500 core consumable products (sample and assay kits), instruments and automation systems, and bioinformatics solutions for analysis and interpretation.

These products comprise two main categories: Consumables and related revenues accounted for between 86% and 89% of total net sales during the last three years and includes sample and assay kits, bioinformatics solutions, royalties, co-development milestone payments and services, while instruments includes related services and contracts and accounted for between 11% and 14% of total net sales during the same time period.

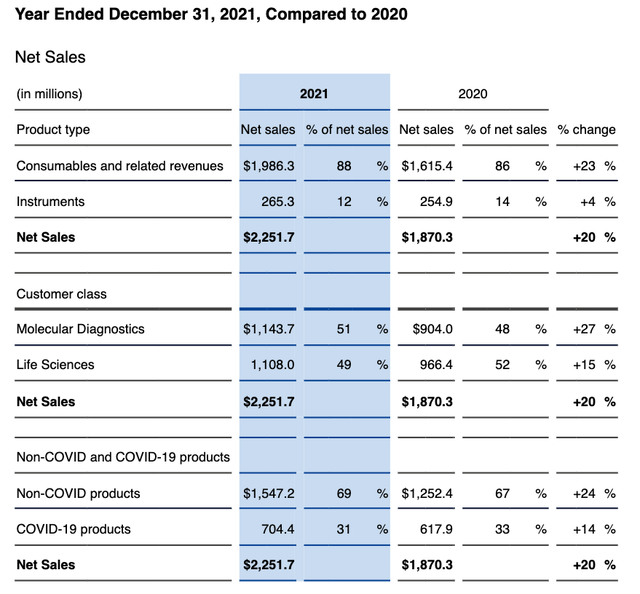

Qiagen also provides a helpful revenue breakdown table as follows:

Qiagen sales breakdown 2021 vs 2020. (10K submission)

Source: 10K submission.

As we can see, ~31% of Qiagen’s revenues in 2021 – $704m – were derived from COVID related products, and that figure has declined significantly in 2022 as the requirement for intensive testing has receded.

In Q222 COVID related revenues were $92m vs. $160m in Q221, but non-COVID revenues increased from $408m in Q221, to $423m, offsetting some of the losses. For FY22, Qiagen is guiding for total revenues of ~$2.2bn, more or less matching 2021, and EPS of ~$2.3, vs. $2.65 in 2021. An impressive performance overall, if achieved, which suggests to me that the company’s shares have been a little oversold in 2022, after a surge in 2021 based largely on additional COVID revenues generated.

Additionally, Qiagen reported a very healthy cash position of $706m, and current assets of $2.15bn as of Q222. In most respects, then, we can call Qiagen a healthy company by almost any measure – revenue generation, profitability, and even growth, if we ignore the one-off impact of the pandemic and the loss of additional testing revenues.

Bio-Rad Overview

According to Bio-Rad’s 10k Submission, the company sells “more than 12,000 products and services to a diverse customer base comprised of scientific research, healthcare, education and government organizations worldwide.”

The company does not break down sales of its products and services, but divides them into two separate divisions, Life Science and Clinical Diagnostics, and makes the bulk of its sales – 61% – internationally, and the remainder within the US.

Like Qiagen, Bio-Rad is relatively flush with cash, reporting current assets of $3.25bn as of Q222, although the company does have $1.12bn of long term debt, and $1.6bn of deferred income taxes.

While net income has been off the scale thanks to the Sartorius holding in recent years, income from operations has also been growing steadily, as mentioned in my intro. According to the company’s investor day presentation, gross margins have increased from 56.1% in 2017, to 57.3% in 2021, SG&A has decreased over the same period from 37.3% of total revenues, to 28.6%, and R&D investment has increased from $207m, to $259m.

The same presentation also illustrates just how diverse the company’s product suite is, from droplet digital PCR, to protein purification, to cell biology, to biopharma production, within Life Sciences, to Quality Controls and Informatics, Immunohematology and transfusion medicine, and autoimmune, diabetes and infectious disease monitoring with Clinical Diagnostics.

Despite this, however, in Q222 Bio-Rad reported revenues of $691m, down 4% vs. the $716m earned in Q221. In this instance, COVID revenues – which declined from $69m to $33m year-on-year, cannot be blamed for the underperformance. Life Science segment sales were $322m – down 4% – and Clinical Diagnostics sales $368m – down 3.3% year-on-year. Net income from operations also fell, from $125m, to $120m, and we know, GAAP net income was ($4.3bn) thanks to the decline in Sartorius’ share price.

For FY22, Bio-Rad management says it “anticipates non-GAAP currency-neutral revenue growth,” and affirms its “operating margin expectation of approximately 19.0 percent.”

As with Qiagen, although revenue growth is likely to be flat in 2022, and the Sartorius holding worth a few billion less (unless the company’s share price embarks on another bull run) than in 2021, it’s hard to argue that Bio-Rad is not a healthy, profitable, high margin company with opportunities to grow in multiple markets that have high barriers to entry. The company has even set aside nearly $300m for share repurchases, according to its Q22 earnings press release. One flat year – as the global economy finds its feet again after a global pandemic – is no reason to start panicking.

Would A Merger Make Sense For Either Company?

Looking at the nine Life Sciences / Diagnostics companies in the table in my intro, we can see that the combined market caps of Bio-Rad and Qiagen – ~$22.3bn would pull the company clear of rival Repligen, but leave it still some way short of matching up to Becton Dickinson, and nowhere near the scale of the three largest incumbents, Thermo Fisher, Danaher and Abbott.

What, then, would be the purpose of a merger for either company?

In truth, I find it hard to gauge precisely what the logic of such a merger would be. It’s possible there would be cost synergies, although neither company is unprofitable at the present time and mega-mergers are complex processes that have the potential to destabilise existing businesses and damage margins.

A combined Bio-Rad / Qiagen theoretically may be able to take command of certain markets, although each company sells thousands of products, rather than several major ones, so it is unclear (to me) what benefit a monopolistic partnership can extract from hundreds of niche markets.

Both companies are cash rich and capable of completing their own strategic M&A without needing the extra fire power a merger would bring, in my view. If a merger were to be completed, then I could see a combined entity attempting further M&A – a buyout of Repligen, perhaps, to create a company large enough to challenge Becton or even Abbott / Thermo, or perhaps a merger with Illumina, to give the entity an edge in the gene sequencing market – a market that could grow big enough to exceed any other within the diagnostics / life sciences.

These types of deals would require years of work however and it’s worth noting that Qiagen shareholders rejected the overtures of Thermo Fisher back in 2020 – why would they be any more amenable to a merger with Bio-Rad – a smaller company that brings less to the table?

To answer my own question, then, I’m not sure I see why a merger would make sense. The life sciences industry may be crying out for more M&A activity to stimulate growth and inject some positivity into a market that’s suffering in the face of inflationary and interest rate concerns, but merging Bio-Rad and Qiagen is almost certainly not the answer to that dilemma, as neither company would realise a sufficiently tangible benefit.

What Happens Next?

Although it has been widely reported that these two companies have been discussing a merger, neither company’s management has been doing much to stimulate such a rumor so far as I can see.

Both companies have been happy to divulge long-term growth plans in presentations and earnings calls. I already have mentioned Bio-Rad’s detailed investor day presentation, while Qiagen is pursuing “five pillars of growth,” namely sample technologies, Quantiferon (immune response and human ID and forensics), QIAstat-DX and NeuMoDx (infectious disease testing) and PCR technologies.

If anything, if the two companies were to merge, the lack of competition in the market may de-stimulate growth and innovation – neither company appears to need anything that the other possesses, but both companies are laser focused on achieving certain developmental goals and have the funds to do so.

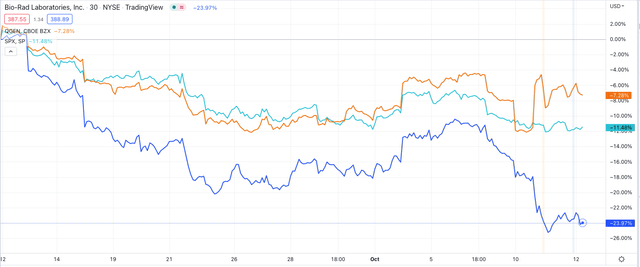

Bio-Rad and Qiagen share prices versus the S&P 500 – past month. (TradingView)

As we can see above, rumors of a merger have not benefited the share price of either company, although Bio-Rad’s may have fallen as a result. There are very few details of what the terms of any merger would be – if there have been lengthy discussions about a deal between the two parties, as is claimed in some quarters, they have been kept very secret on both sides, it seems.

If something were to happen, the rumors suggest that it would be in a matter of weeks, although the deal itself might take six months to a year to complete and it would have to be ratified by authorities on both sides of the Atlantic, although both the Federal Trade Commission and European Commission may raise objections on anti-competitive grounds, which could take many months to resolve.

Conclusion – Merger Between Bio-Rad and Qiagen Feels Like A No-Score Draw Of Little Benefit To Investors.

As mentioned in my intro, the share prices of both Qiagen and Bio-Rad have been in decline in 2022, but that in itself is not a reason for a merger. Qiagen’s revenues have fallen as COVID-related revenues have fallen, while Bio-Rad’s share price has been damaged by the decline in value of its Sartorius holding. Both situations are temporary, not terminal

While an acquisition of a smaller company by a bigger one tends to drive the share price of the former skywards while the latter declines, in the case of Qiagen and Bio-Rad, the companies are of equal size, so who benefits?

Neither, in my view, because neither company has something the other desperately needs. As stated, both companies are profitable, cash rich, and while they may not grow revenues in 2022, may well do so in 2023, and have not usually struggled to do so in the past.

One advantage of a merger would be to bring a US and European-based company together to give the combined entity a global presence, although in a globalized world, it’s questionable if this is necessary – both companies sell large quantities of their goods in both regions already.

To summarize my thesis, I do not see that it’s logical for Bio-Rad and Qiagen to merge simply because they are of similar size and operating in the same fields. If it was logical to merge on that basis, we might see Moderna (MRNA) merge with BioNTech (BNTX) to create one MRNA pioneer, or Organon (OGN) and Viatris (VTRS) merge to create a larger generic / biologics drug maker, or CRISPR Therapeutics (CRSP) and Illumina (ILMN) merge to create a CRISPR giant.

These types of deals would be anti-competitive, unnecessary, cumbersome and fail to create a company capable of challenging major market incumbents. As such, I can’t really see the logic of a Bio-Rad / Qiagen merger, and since it may make the life sciences / diagnostics sectors more static and less innovative, I cannot see a merger benefit either company’s share price either.

If I were either company, I would want to stimulate market growth and innovation by making a strategic acquisition or two, but I would be looking at smaller companies, and I would encourage investors looking to benefit from M&A activity at a premium to traded share prices to look at these smaller niche companies, rather than hope two similar companies join forces apparently more due to inertia than logic.

Be the first to comment