winhorse

A 66% drop in just over a year for a company like adidas (OTCQX:ADDDF) is something that is certainly puzzling. Since it has been listed, there has never been such a steep slump, not even during the great financial crisis of 2008. In this article, I will highlight the causes of this collapse, the future prospects, and calculate its fair value to understand whether or not we are close to the bottom.

What ails adidas’ profitability

According to the latest quarterly report, the main aspects that are affecting adidas’ profitability are multiple, and all are related to the consequences entailed by the pandemic and the war.

War, inflation and interest rates

After Russia declared war on Ukraine, most Western companies decided to stop selling in Russia, including adidas. This decision cost the company €100 million less in Q2 2022, but since revenues for the entire quarter reached €5.59 billion, this is not that big of a problem. What is relevant, however, are the consequences the war is having in terms of rising energy costs. adidas is a company that operates worldwide, but the EMEA region is the most important one being responsible for 37% of total revenues. Recent energy price increases in Europe due to the decision to stop sourcing Russian gas are causing serious problems for both European businesses and households. European businesses have seen their operating costs skyrocket as the cost of energy is no longer the same, European households have to pay bills that have tripled since last year, thus reducing their willingness to purchase discretionary goods. As if that were not enough, the rising cost of energy is driving the general level of inflation in Europe higher and higher, further reducing the margins of European companies. All these phenomena just mentioned are already manifesting themselves in adidas’ income statement.

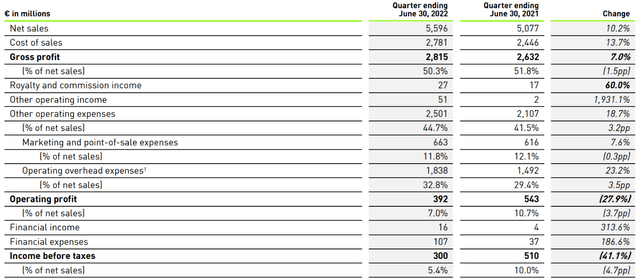

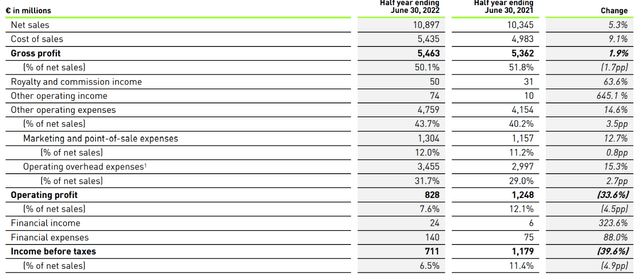

In the latest quarterly report, we can see that revenues increased by 10.20% compared to Q2 2021, but the cost of sales increased by 13.70%, more than revenues. Gross margin remains high and above 50%, but there was a deterioration of 1.5 percentage points. However, the gross margin does not take into account operating costs, the main issue related to adidas’ problems. The operating income margin, which includes the aforementioned operating costs, plummeted 3.70%, an important figure since the industry in which adidas operates does not have such high operating margins. Driving this sharp increase in operating costs was mainly the increase in operating overhead expenses, a cost aggregate that includes rent and utilities costs. These costs increased by 23.20 %. Overall, the current macroeconomic environment resulted in a 27.90% reduction in operating income compared to Q2 2021, bringing it to €392 million.

Extending the comparison on a six-month basis, the increase in operating overhead expenses is 15.30%, which is less marked than the comparison on a quarterly basis. This difference highlights how Q2 2022 suffered more than Q1 2022 in terms of operating overhead increase as a result of general inflation driven by energy prices. When this inflationary spiral ends I consider it very likely that adidas will be able to breathe again, but until then the situation may remain difficult. Personally, I expect disappointing results in the next two quarters as well since the inflation problem is far from over, especially in Europe where the cost of energy is the main component. Moreover, assuming inflation was overcome through a rapid increase in interest rates, access to credit will be more difficult and will discourage consumers from buying discretionary goods such as those sold by adidas. Buying the new adidas Yeezy for €300 may not be considered a necessity purchase, which is why consumers might consider postponing their purchase during this historical period. We are not currently in a severe recession, but with the steady rise in interest rates and weak economic growth, we may be in the future. Investing in adidas means investing in a pro-cyclical business.

Gross margin struggling

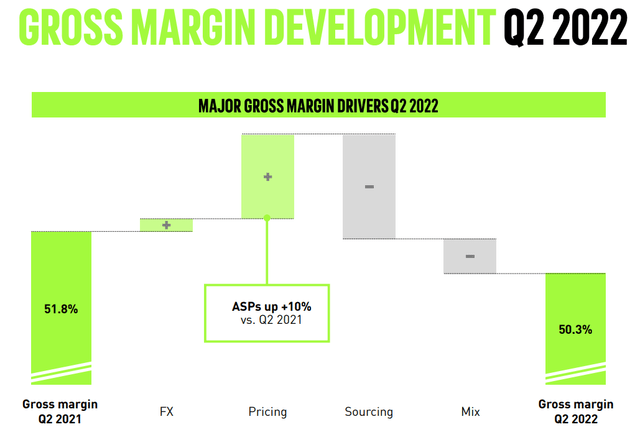

Previously we noted how the gross margin has decreased by 1.50% compared to Q2 2021, however, there has been no in-depth discussion on the causes of this reduction. In this section, I will elaborate on the additional issues facing adidas that precede operating costs in the financial statements.

This well-done graph was published in the latest quarterly presentation and clarifies what is impacting gross profit the most. There are positive components such as exchange rate and pricing, and negative components such as sourcing and mix (mainly the reduction in revenue from China). Let’s go through them individually.

Exchange rate

adidas is a company headquartered in Germany, and its financial statements are denominated in euros. As is well known, the euro has depreciated sharply against many major international currencies in recent months, especially the dollar. The result is that a weaker euro results in a positive exchange rate effect, and this favors foreign sales.

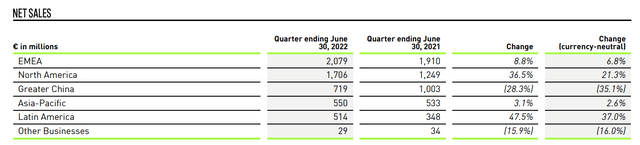

As can be seen, revenue growth would have been lower if we had considered a neutral exchange rate. This is currently positively affecting adidas’ profitability, but if the trend were to reverse there would be an additional problem to deal with. Nike, for example, is currently in the opposite situation.

Pricing

Pricing is another component that positively impacted revenues, preventing a gross margin meltdown. The average selling price (ASPs) increased by 10% compared to Q2 2021, manifesting adidas’ ability to pass on to customers some of the increase in operating costs due to inflation. A 10% increase was not enough to avoid a reduction in gross margin, but it certainly helped. Looking ahead, it is difficult to predict how far adidas will raise the prices of its sportswear, partly because wage increases often cannot support cost-of-living increases in this 2022. Much will depend on the level of inflation in the coming months, but I trust adidas’ leadership and to pass some of the future cost increases on to consumers.

Sourcing

Although to date we are getting used to living with Covid-19, supply chain issues persist and continue to adversely affect companies’ profitability. Due to last year’s lockdowns in Vietnam, revenue growth was reduced by about 200 million in Q2 2022. In the guidance for the second half of 2022, the company did not express positivity on the resolution of this problem; therefore, its negative effects are likely to extend over the entire fiscal year 2022.

Mix (revenues from China)

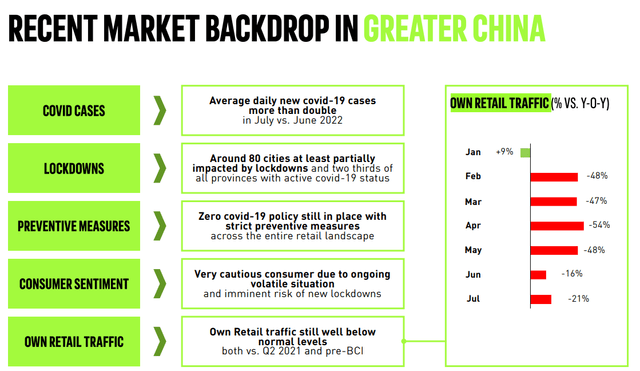

China continues with its tactical lockdowns as soon as Covid-19 cases increase slightly, which only creates imbalances from an economic perspective.

As we can see from this slide released by adidas, there are still many problems related to Covid-19 in China. Anti-Covid policies are still very restrictive, which is why adidas’ sales are struggling to take off. The company is performing worse than expected and it is unlikely that anything will change unless China’s attitude to combat the virus changes. Sales in China went from €1 billion in Q2 2021 to the current €719 million in Q2 2022, a significant decrease of 28.30%. Considering a neutral exchange rate, the decrease even reaches 35.10%. The weight of revenues from China compared to total revenues has dropped significantly in only 1 year: in Q2 2021 it was 19.7%, in Q2 2022 12.80%. The company does not expect anything to change in the second half of 2022.

Finally, the company estimates a gross margin of 48% in the second half of 2022 and 49% for the whole of 2022.

Is adidas undervalued?

Based on previous considerations, the collapse of adidas after all has been justified. The company has lower operating margins as it is unable to reduce operating costs due to high inflation; supply chain problems persist; and the China segment is going through a slow recovery due to lockdowns. It is certainly not one of the best times for adidas but I would like to point out that all these problems seem to be temporary in duration, and in a long-term perspective (10-15 years) they may not have that much of an impact. I believe, or at least hope, that high inflation driven by energy prices will not last forever, as will supply chain slowdowns and COVID-19. If we look at adidas from this perspective, the 66% drop could be a reason to buy a leading sportswear company in Europe at a discount. As a first aspect of this valuation, let’s see if the price multiples show traits of undervaluation.

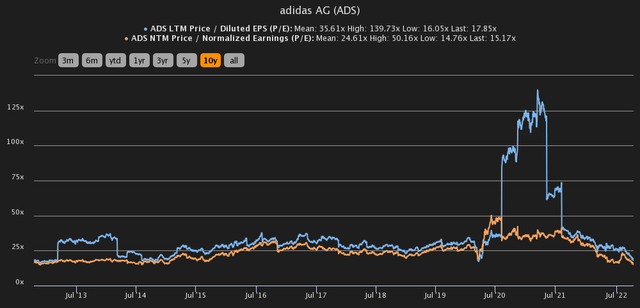

Both the P/E over the past 12 months and the expected P/E over the next 12 months have reached levels far below the historical average. The LTM P/E is 17.85x while the historical average is 35.61x; the NTM P/E is 15.17x while the historical average is 24.61x. Analyzed individually these are not low multiples considering that adidas is not a high-growth company, but compared to historical values we are in an undervalued situation. However, if we look at the multiples before 2016, it is interesting to note that the current multiples are in line with those values. It is hard to say a priori whether current values denote an undervaluation or a return to past multiples after years of euphoria.

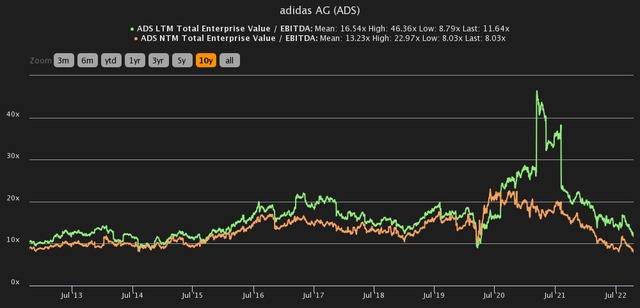

Analyzing other multiples such as EV/EBITDA the result does not change. Looking at values from 2016 onward adidas seems to be undervalued, but if we extend the time frame we are in line with past values. It is difficult to make a judgment from the analysis of multiples, as there are both signs of undervaluation and fair valuation. Therefore, to get a clearer overall picture I will go on to create a discounted cash flow, so as to obtain a fair value by discounting future cash flows. This model will be constructed as follows:

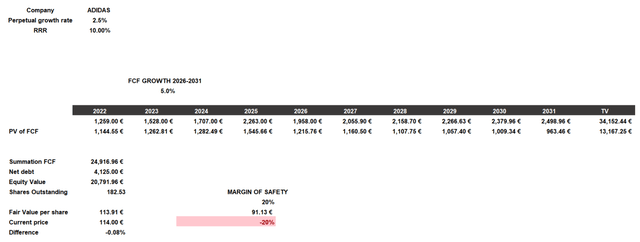

- Required rate of return (RRR) will be 10%, slightly above the historical annual average of the S&P500. adidas has a beta of 0.97, so we can consider it an investment in line with market risk, which is why I have not entered a higher RRR.

- The free cash flows entered from 2022 to 2026 are TIKR Terminal analysts’ estimates. From 2026 onward, I considered a 5% growth rate. The perpetual growth rate will be 2.50%.

- Shares outstanding and net debt were taken from TIKR Terminal.

According to my assumptions, adidas’ fair value is €113.91, so the company is fairly valued by the market. Reconnecting to the multiples analysis done earlier, it would seem that this company is back to trading at pre-2016 values and may not be that undervalued. All in all, I don’t think it is wrong to start building a position now since under these assumptions it should provide a 10% return per year, but I would prefer to adopt a margin of safety of at least 20% and wait for the €90 per share. I think there could potentially still be room for further decline, as I do not expect the macroeconomic environment to change much in the last months of 2022.

Be the first to comment