Shunyu Fan/E+ via Getty Images

Investment thesis

Peak Bancorp Inc. (OTCPK:IDFB), is the holding company for Idaho First Bank (OTCPK:IDFB), is a state-chartered community bank headquartered in McCall, Idaho. Today, it has a portfolio of approximately 10,000 customers, all located within the Idaho state. In February 2022, BAWAG AG (BAWAGF), an Austrian bank focused on Western Europe and the USA market, announced acquisition of Peak Bancorp Inc, for a total amount of US 65 million, or USD 12.05 per share. At the moment of writing this article, Peak Bancorp shares are trading at USD 11.15.

Reason for acquisition

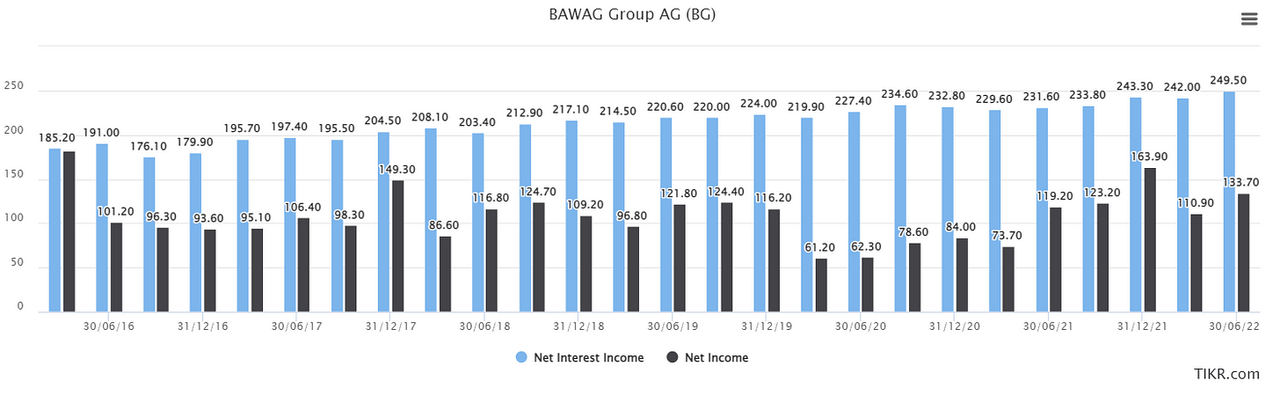

BAWAG currently lends in the US using cross-border loans and, since the start of the 2022, through their US representative office in California. Having a physical presence and a banking license in the US would enable them to start issuing retail loans (not feasible possible through a representative office), but also to collect the deposits from their customers and, thus, obtain other more flexible forms of financing. BAWAG has more than enough money to execute this acquisition. Purchase price of USD 65 million, is roughly earned by BAWAG as net interest income in roughly 24 calendar days, or as net income in 45 days.

Quarterly Financials in Millions of Euro from 31/03/16 to 30/06/22 (TIKR)

IDFB is not a systematically important bank, BAWAG has adequate know-how and is being monitored by an EU regulatory body minimizing the risk of mismanagement of the IDFB. In addition, marginal risk taken for BAWAG is minimal, and it will not influence current operations of the whole Group in a negative way. There is no reason, other than BAWAG backing out or some politically driven issues, that could stop the acquisition.

Idaho First Bank history

Idaho First Bank was founded in 2005 in McCall Idaho, a small resort town with a population of around 2000 people. Over time, they expanded their branch network, and today they service roughly 10.000 clients through seven branches (the last one being opened in June 2022, after an acquisition announcement).

Development history (Idaho First Bank website)

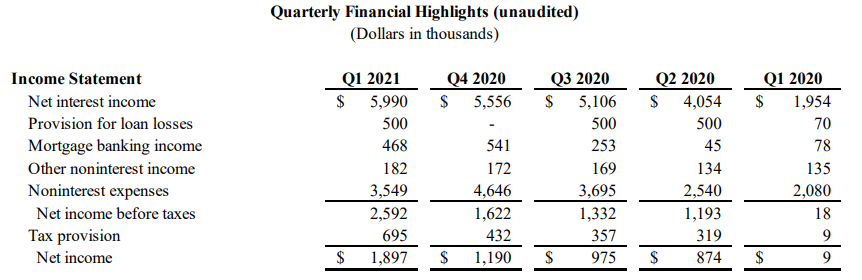

Their portfolio mostly consists of commercial and retail real estate lending, with the majority of loans issued in McCall and Boise, Idaho.

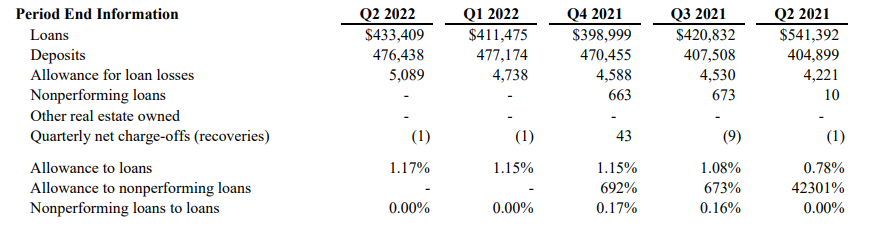

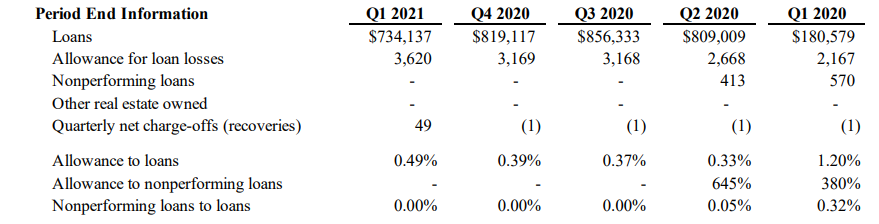

With the start of the 2020 crisis, IDFB participated in the Paycheck Protection Program, by drawing USD 500m on a Paycheck Protection Program Liquidity Facility. At the time, this was almost 2.5 times their existing loan book. Loans originated through PPP had a low funding cost, coupled with low interest income. Maximum interest of 1% could be charged to the clients, with additional 1 to 5% fee charged to US Small Business Administration (SBA). Since these loans had initial maturity of up to 5 years (either through forgiveness or repayment), portfolio size should return to the pure bank operational levels until the end of 2022. As of Q2 2022, only 8 million of PPP loans remain on book. Growth observable between Q1 2020 and Q2 2022 was mostly due to 9.5 million capital raise in June 2020, and underwriting of 105 million between Q1 and Q2 2022. Banks are leverage machines. IDFB used the PPP net income from the past 2 years to expand. As a rule of thumb, I always assume that a bank should be able to convert 1 dollar of its equity, or reinvested net income, into 8-10 dollars of interest-bearing assets in the next reporting period. IDFB did perform accordingly.

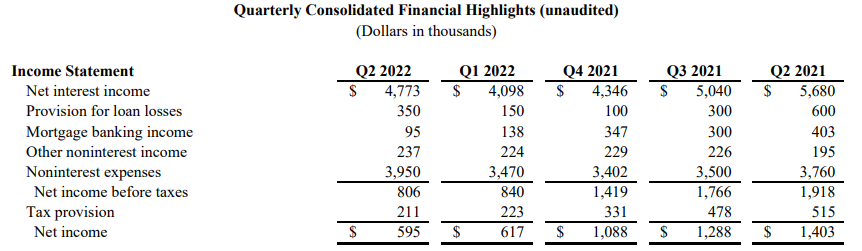

Loan portfolio development (IDFB quarterly reports) Loan portfolio development (IDFB quarterly reports)

As seen in the following extracts from the income statement, we can expect net income to stabilize close to USD 2.5 million per year, giving BAWAG a ~3.8% after-tax yield on their investment in a conservative state assuming no growth.

Results development (IDFB quarterly reports) Results development (IDFB quarterly reports)

As for the portfolio structure, it’s stable and growing (excluding PPP loans), and as we will see, similar to BAWAG’s US portfolio.

Portfolio structure (IDFB annual reports)

BAWAG history

BAWAG is the fourth-largest bank in Austria, and one of the most efficient banks in the wider region when measured through their cost income and ROE ratios. For the past decade and more it is going through massive corporate culture change from once typical state-owned bank to more American style corporation focused on the shareholder value creation.

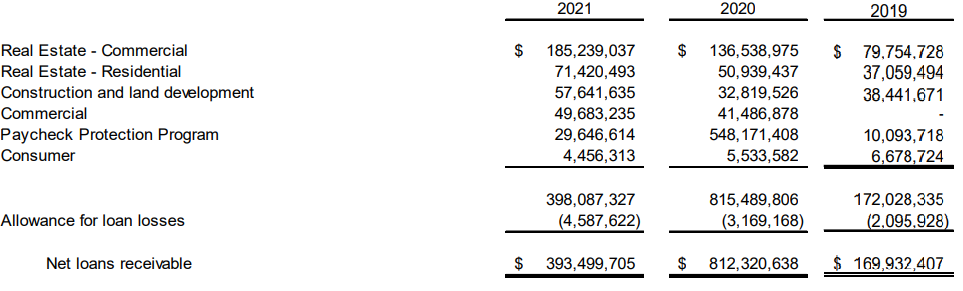

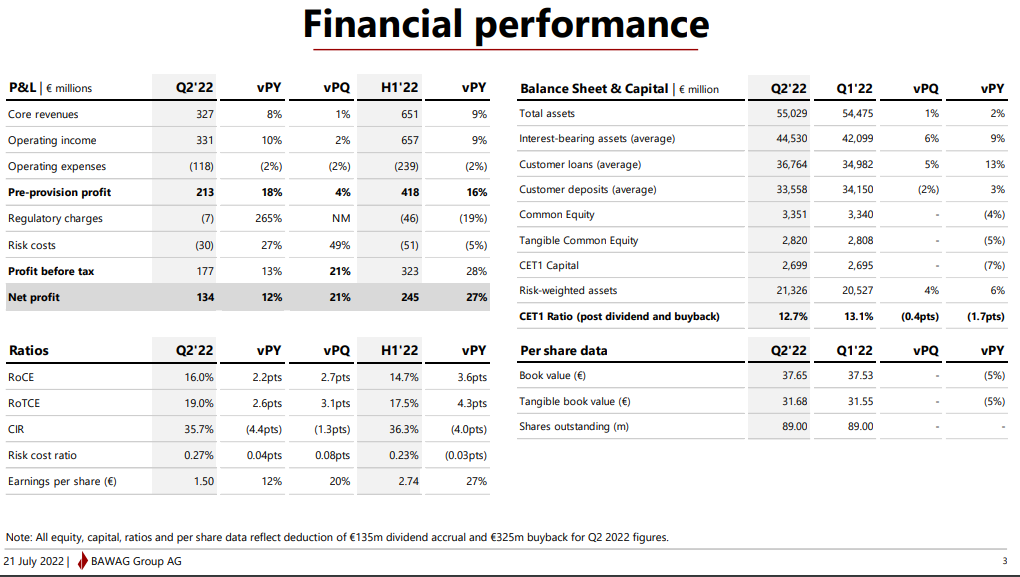

Overview of results (BAWAG Q2 results presentation)

Its loan portfolio is roughly 55 times larger than that of IDFB, and it has accumulated EUR 460 million in dividend accruals and buybacks for year 2022 in the first 6 months (purchase price for IDFB being USD 65 million).

BAWAG in itself is an interesting bank. For full disclosure, I do own it. Unlike many banks in Austria, it focuses on Western Europe and the USA and has minimal exposure towards Eastern Europe.

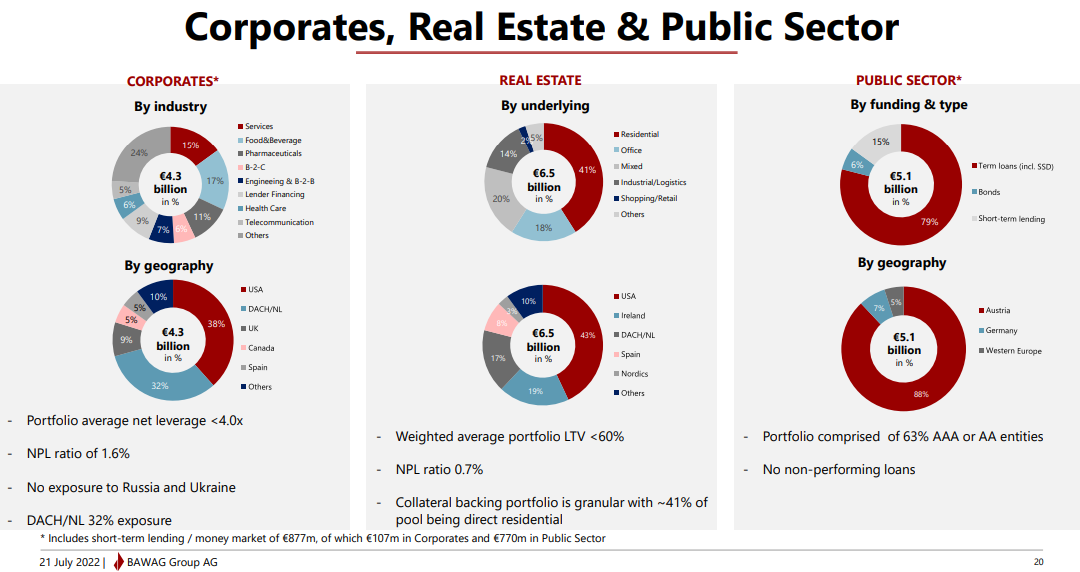

Portfolio structure (BAWAG Q2 results presentation)

Apart from lending, part of its income comes from growing fee income from local trading platform and their investment portfolio.

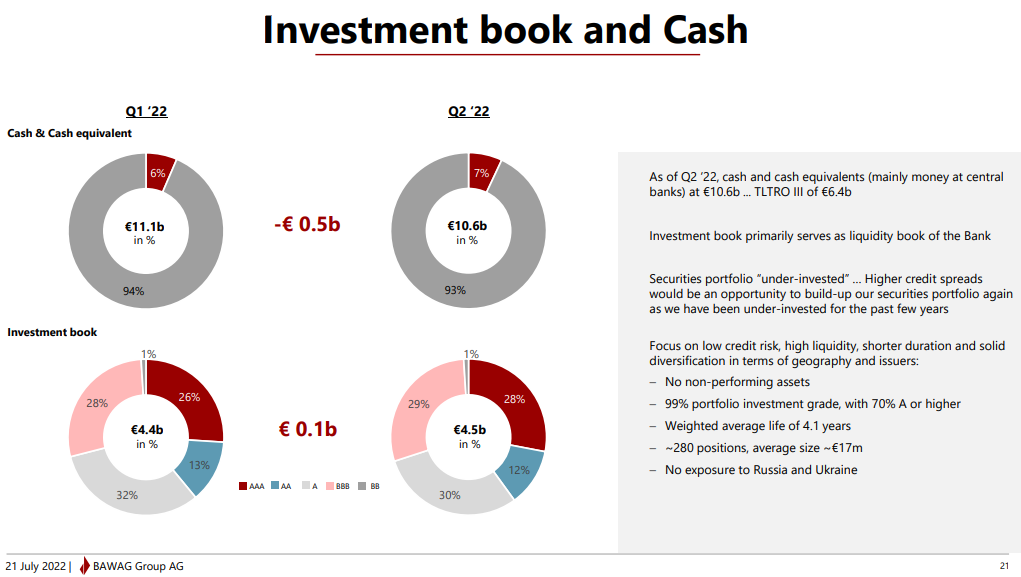

Investment book structure (BAWAG Q2 results presentation)

It is conservative in its underwriting and is true to its philosophy that it won’t underwrite risky loans for the sake of portfolio growth. But, I will return to BAWAG some other time in a separate analysis (let me know if you are interested).

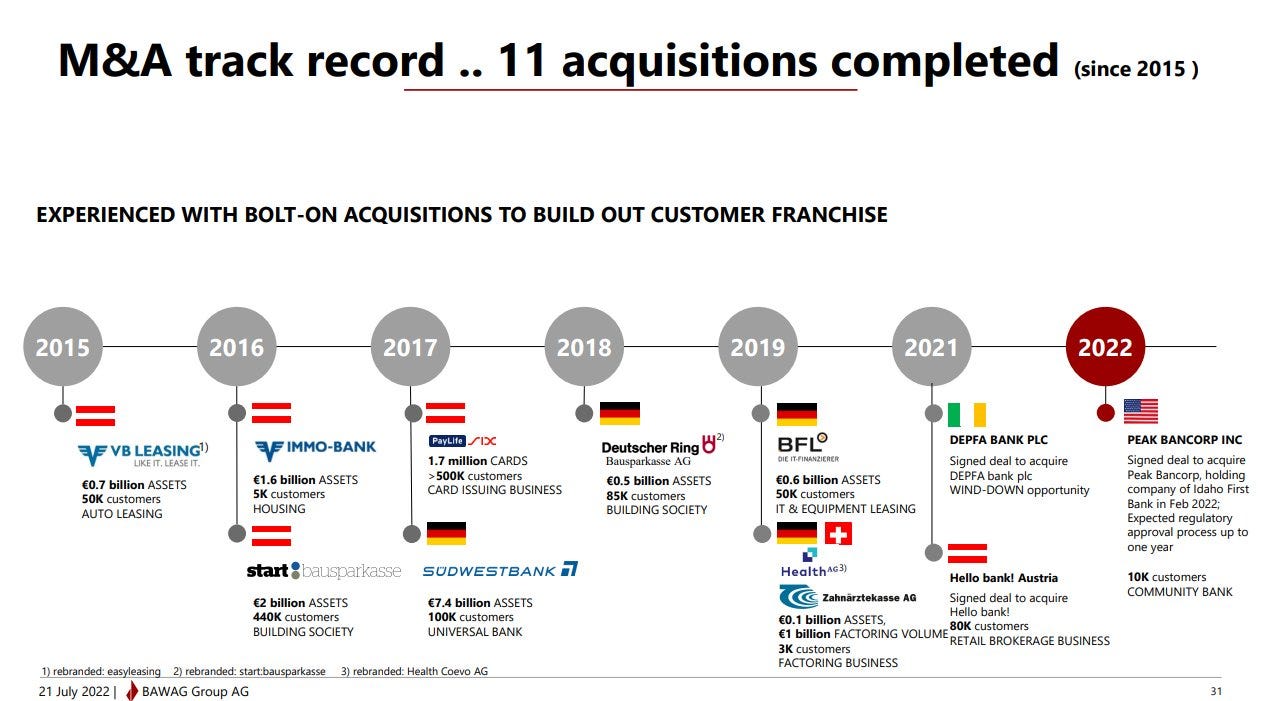

In addition, it now has a good track record in small and successfully integrated acquisitions.

Acquisition history (Investment book structure)

Updates on acquisition

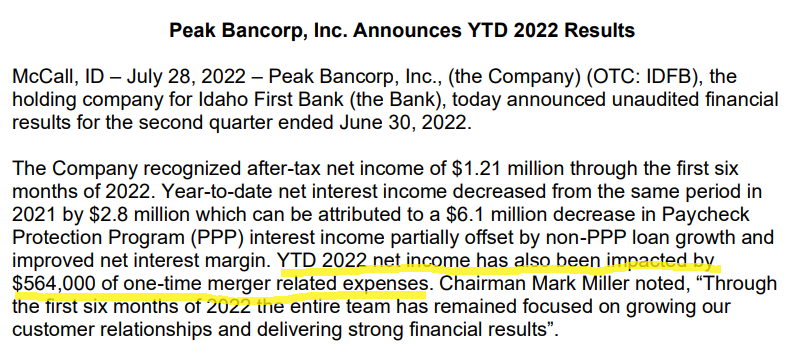

In their latest quarterly results, IDFB booked USD 564 thousand as one-time merger-related expenses, without providing further details on this cost item (have in mind, quarterly results are published in a 2-page document).

Acquisition update (Idaho First Bank June 2022 Results)

Further, on 29th August 2022, BAWAG confirmed to San Francisco Fed, deciding body on the acquisition, that it will hold the minority stake in Marlette Holdings, Inc., which it indirectly acquired through Peak Bancorp. This adds little new information, but it shows that the process is ongoing.

In addition, Investor Relations in BAWAG confirmed on several occasions that the acquisition should be finalized within a year from announcement (by February 2023).

Additionally, going through San Francisco Fed board meeting minutes for the past 2 and a half years, I failed to find any rejected acquisition attempt.

Why does it exist

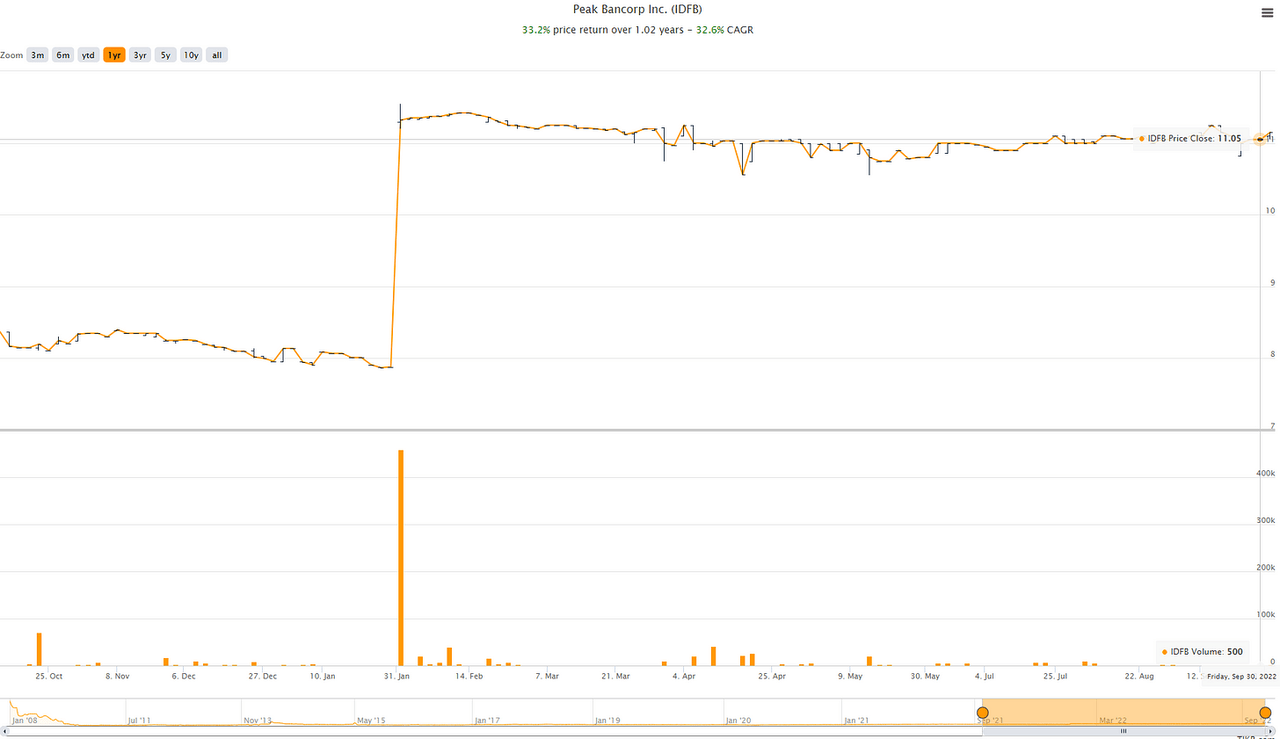

Shares of IDFB are highly illiquid. It took almost 3 days for my order on 500 shares to be executed.

Price development (TIKR)

Also, after initial increase in price after acquisition announcement, when some 460,000 (close to 10% of float) shares exchanged hands, equity prices collapsed worldwide. If you were holding the shares slightly before then and had other investment prospects, would you keep them?

In addition, several lawsuits have been started claiming that the acquisition price is below fair value of the IDFB. However, if anything, BAWAG overplayed in my opinion. But they had other motivation than just organically growing IDFB itself.

Expected return

I acquired shares of Peak Bancorp at USD 11.05, using leverage since dollar investments requiring me to convert EUR to USD and then back, are a risk for me with current EUR/USD FX levels and volatility. On total capital used, I thus secured the ROIC 6.5% after capital gains tax. In case of the deal falling, I would expect the price to drop to the level of 1.2 of book value (some 30% lower than current price). However, in my view, this is now an unlikely outcome.

There are factors that I can only assess in a limited way:

-

Geopolitical risk is beyond my assessment capabilities.

-

Wild Euro Dollar rate fluctuations might force both sides to reconsider the deal (BAWAG most likely), but most likely the deal will be financed with dollar cash reserves.

-

Fed decisions of any kind can be driven by other motivations I have not considered or cannot comprehend.

-

Maybe I am missing something.

Summary

I am certain that the deal will go through. However, I have my biases and most of them come from the fact that I believe that BAWAG is a good investment and my trust in their management. The promised return by this deal going through, compounded on an annual level, is more than I would normally ask from my investment, however, I used the opportunity that presented itself. Hopefully, it works out.

Be the first to comment