ipopba/iStock via Getty Images

All things fade and quickly turn to myth.”― Marcus Aurelius, Meditations

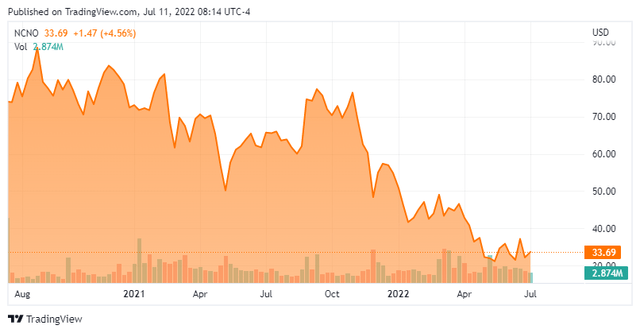

Today, we put nCino, Inc. (NASDAQ:NCNO) in the spotlight for the first time. Despite impressive revenue growth, the stock is deep in ‘Busted IPO‘ territory, as the market has pummeled non-profitable concerns so far here in 2022. Can the shares turnaround? An analysis follows below.

Company Overview:

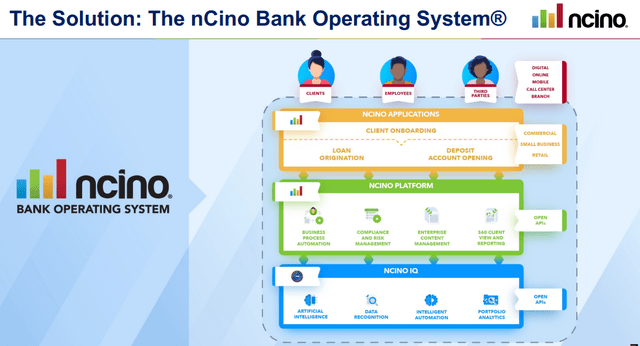

nCino, Inc. is headquartered in Wilmington, NC. This mid cap company provides cloud-based software applications to financial institutions such as enterprise banks, regional banks, community banks, credit unions, new market entrants, and independent mortgage banks as well as global financial institutions. Most of the of the company’s revenues come from a subscription as a service {SAAS} model. The company’s capabilities cover client onboarding and acquisition, loan and mortgage servicing, reporting, compliance, as well as related analytics. nCino’s platform allows its customers which includes the likes of Wells Fargo to become more efficient, streamline their operations and to remain compliant.

The stock currently trades just under $34.00 a share and sports an approximate market capitalization of $3.7 billion. The company’s fiscal year ends on January 31st.

First Quarter Results:

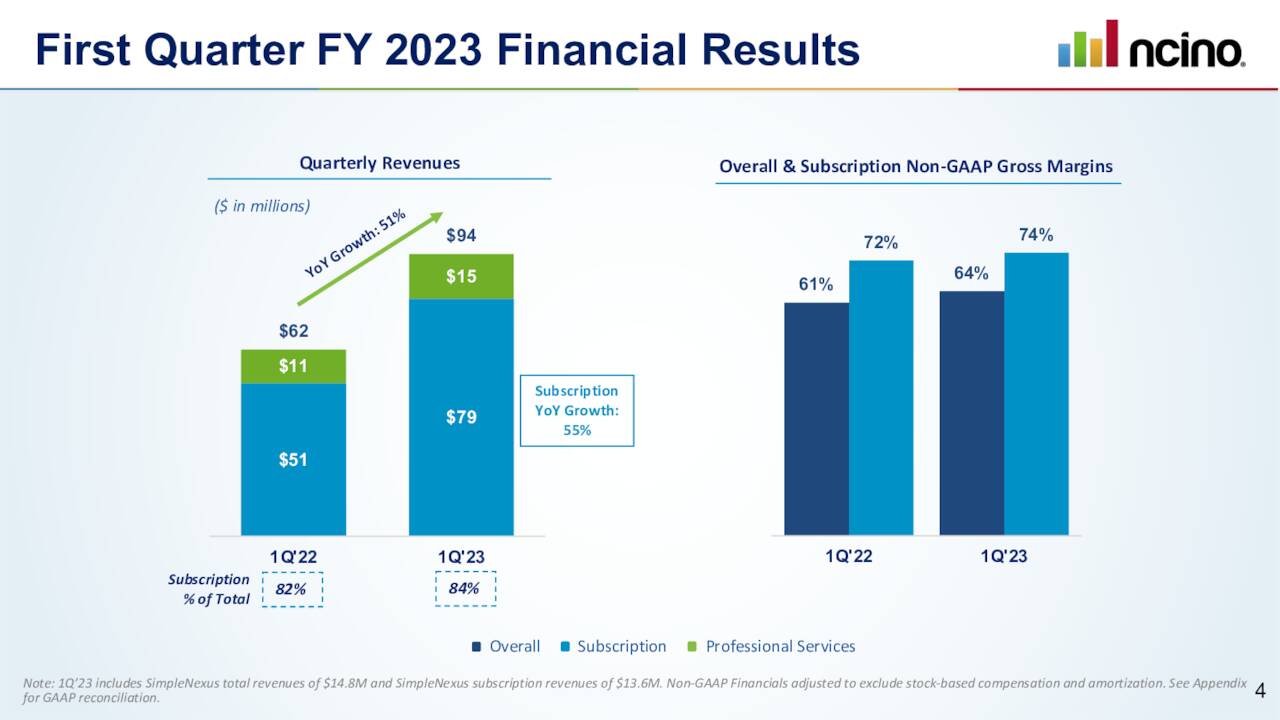

On June 1st, nCino reported first quarter numbers. The company posted a non-GAAP loss of six cents a share and revenues rose 51% from the same period a year ago to $94.2 million. Both top and bottom line numbers slightly exceeded expectations.

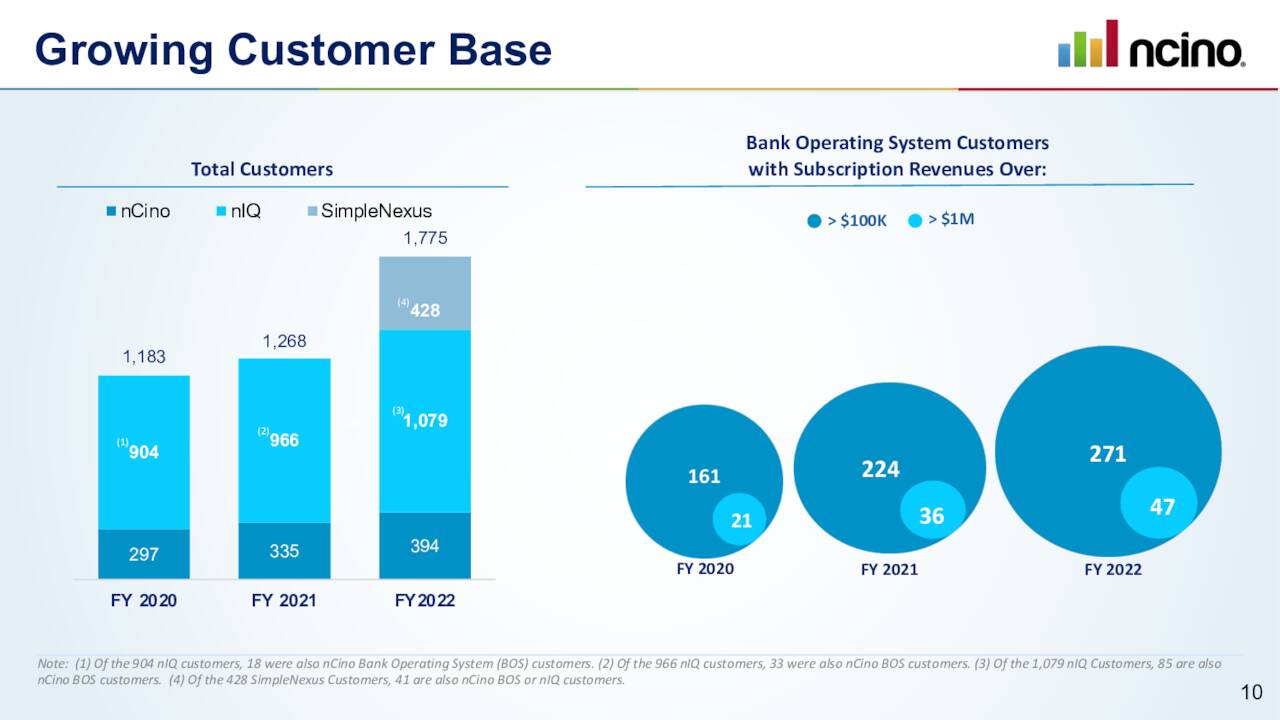

June Company Presentation

Subscription revenue rose 55% from 1Q2022 to $78.2 million. The company saw 29% organic revenue growth from this segment while the rest came with the acquisition of SimpleNexus. nCino purchased this company late in 2021 for $240 million in cash and ~13.2M shares of nCino common stock. Total Remaining Performance Obligation or RPO was just over $905 million, an increase of 48% compared to the first quarter of fiscal 2022. Organic growth was 38% from this segment during the quarter.

June Company Presentation

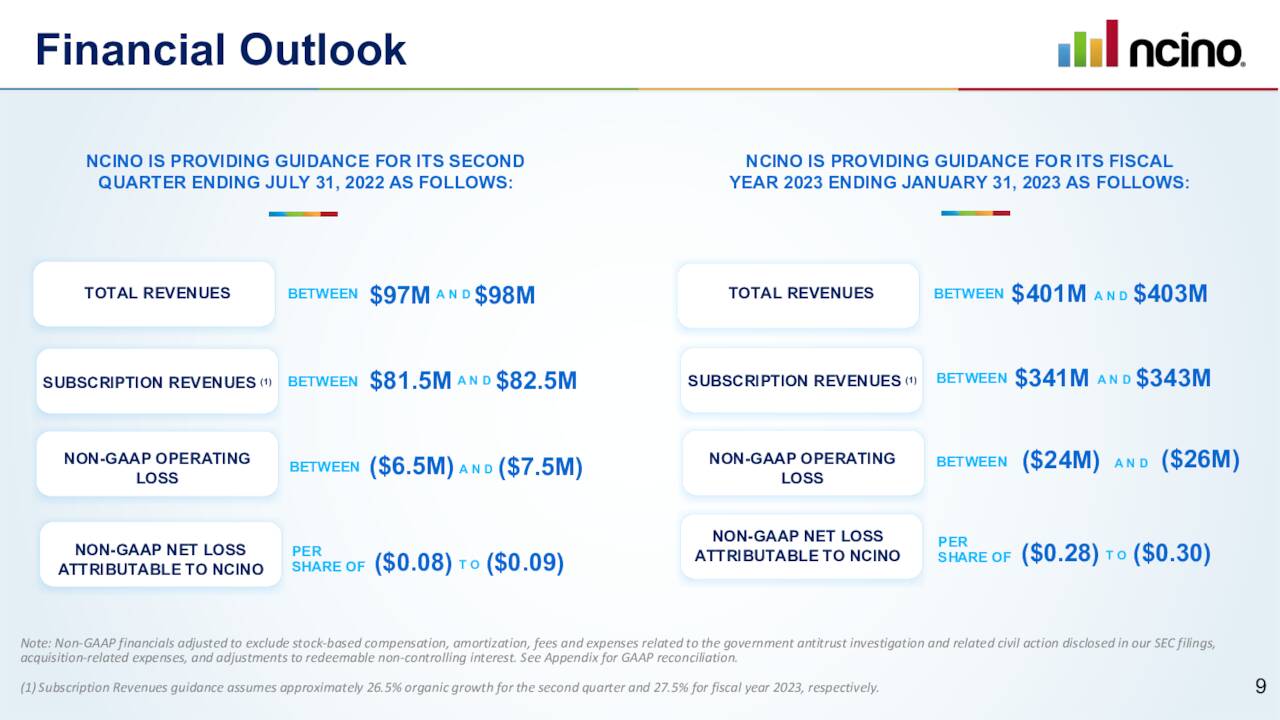

Leadership provided the following guidance for this fiscal year (FY2023).

- Total revenues between $401 million and $403 million.

- Subscription revenues between $341 and $343 million.

- Non-GAAP operating loss between ($24) million and ($26) million.

June Company Presenatation

Analyst Commentary & Balance Sheet:

Since first quarter earnings posted, both Robert W. Baird ($43 price target) and Barclays ($39 price target) have reiterated Hold ratings on the stock. Six analyst firms including Needham and Morgan Stanley have reissued Buy or Outperform ratings on NCNO. Four of these had downward price target revisions. Price targets proffered ranged from $40 to $70 a share.

Insiders don’t seem to signaling that shares are close to a bottom. Numerous insiders have been frequent and consistent sellers of the shares throughout 2022, selling more than $6 million worth of stock in aggregate in June alone. Just over 10% of the outstanding float of the shares are currently short.

The company ended the first quarter with cash and marketable securities of just over $84 million after posting a non-GAAP net loss of $6.1 million for the quarter. The GAAP net loss came in at $30.7 million for the quarter.

Verdict:

The current analyst consensus has the company losing nearly 30 cents a share in FY2023 even as revenues rise more than 45% to a tad over $400 million. Next year, analysts see the company breaking even as revenue growth slows to just over 25% in FY2024.

Despite the recent pullback in the shares, the stock still trades at just north of nine times forward sales. While that is a sharp pullback from its price to sales valuation from a year ago, it hardly seems a bargain given the company is unlikely to produce a profit until FY2025. The market environment hasn’t been kind to profitless concerns in 2022, even those with impressive sales growth. I could also see nCino possibly doing a capital raise over the next year. Until the market dynamic changes, we are passing on any investment recommendation around nCino, Inc at this time.

No man is crushed by misfortune unless he has first been deceived by prosperity”― Seneca

Be the first to comment