Feng Li

While screening for cheap oil and gas companies, I came across China Petroleum & Chemical Corporation (NYSE:SNP). With 2021 revenues of RMB 2.7 trillion (US$400 billion), its scale is comparable to Exxon Mobil Corporation (XOM) and yet its enterprise value is only $122 billion, a fraction of XOM’s. Is it ‘deeply undervalued’, as some analysts claim, or is there more to the story?

I believe Sinopec is cheap for a reason, as the company is controlled by the Chinese government and may not have investors’ best interests in mind. There’s a delisting overhang from the SEC’s HFCAA rule. Sinopec could also run afoul of U.S. sanctions on Iran and Russia. Investors are better served looking for value in other jurisdictions such as Europe.

Sinopec Is An Integrated O&G Giant

China Petroleum & Chemical Corporation (“Sinopec”), along with China National Petroleum Corporation (“CNPC”) and China National Offshore Oil Corporation (“CNOOC”) are the big 3 of the Chinese oil and gas industry.

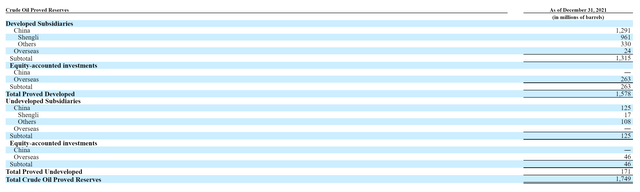

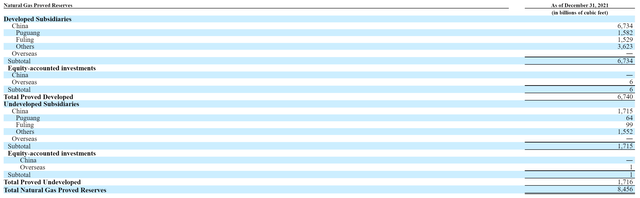

Sinopec’s primary operating activities consist of the exploration and development of oil and gas reserves and the operation of petrochemical facilities. As of December 31, 2021, Sinopec had proved oil and gas reserves of 2.8 billion BOE, split between oil reserves of 1.4 billion barrels, and gas reserves of 8.4 trillion cubic feet. Figure 1 and 2 from the company’s 20F report summarizes Sinopec’s oil and gas reserves respectively.

Figure 1 – Sinopec proved oil reserves (Sinopec 2021 20F report) Figure 2 – Sinopec proved gas reserves (Sinopec 2021 20F report)

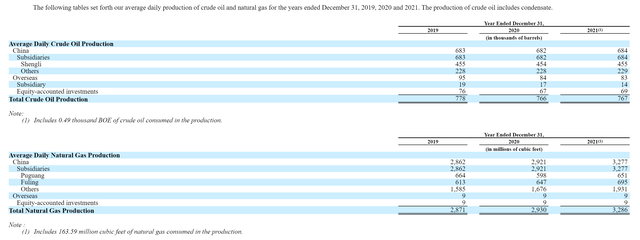

In 2021, Sinopec produced 273 million barrels of oil and 1.1 Tcf of natural gas. Figure 3 summarizes Sinopec’s daily production rates of 780k boed oil and 2.9 bcf natural gas.

Figure 3 – Sinopec daily production rate (Sinopec 2021 20F report)

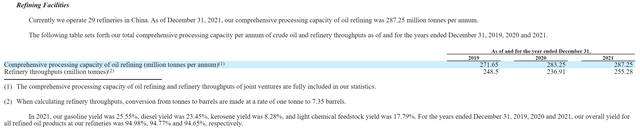

In addition to a large upstream production base, Sinopec also has extensive downstream refining and petrochemical operations. In 2021, Sinopec had total refining capacity of 287 million tons of oil per annum, or 5.8 million boed. For context, Marathon Petroleum (MPC), the largest refiner in America, only has refining capacity of 2.9 million boed.

Figure 4 – Sinopec refining capacity (Sinopec 2021 20F report)

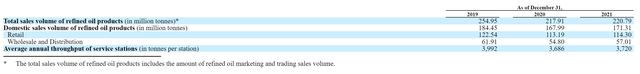

In 2021, Sinopec sold 220 million tons of refined oil products, including 114 million tons sold through its more than 30,700 Sinopec-branded service stations (Figure 5). Refined oil revenues in 2021 were RMB 1,535 billion (US$ 227 billion), or 56% of the company’s revenues.

Figure 5 – Sinopec Refined product sales (Sinopec 2021 20F report)

Finally, Sinopec has a large petrochemical business, with capacity to produce 13.5 million tons of ethylene, 11.9 million tons of propylene, and a host of other petrochemicals worth a combined RMB 425 billion ($63 billion, 15.5% of total revenues) in 2021. For context, Dow Inc. (DOW), one of the largest chemical companies in the world, had 2021 revenues of $55 billion.

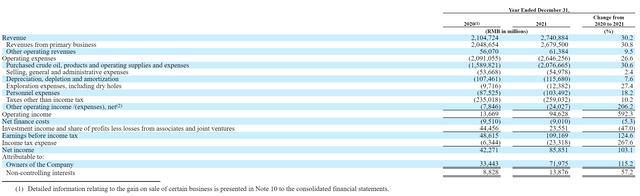

Despite Large Revenues, Margins Are Razor Thin

Despite being one of the largest integrated oil and gas companies in the world, Sinopec has very low margins. Figure 6 shows its operations summary in 2020 and 2021. In 2021, Sinopec generated RMB 86 billion in net income on revenues of RMB 2,740 billion, or 3.1%. For context, Exxon Mobil generated $23 billion in net income on $279 billion in revenues in 2021, or 8.2%. Dow generated $6.3 billion in net income on $55 billion in revenues or 11.4%. Marathon generated $11 billion in net income on $120 billion in revenue or 9.1%.

Figure 6 – Sinopec operations summary (Sinopec 2021 20F report)

What Could Be Going On?

Investors in Sinopec must understand that 69% of the shares of Sinopec are owned by Sinopec Group Company, essentially an arm of the Chinese government. As a national oil company, shareholders’ interest and the government’s interest may not always align.

Price Control May Limit Margins

For example, as detailed in one of the business risks in the 20F:

In addition, while we try to adjust the sale prices of our products to reflect international crude oil price fluctuations, our ability to pass on the increased cost resulting from crude oil price increases to our customers may be limited, and is dependent on international and domestic market conditions as well as the PRC government’s price control policies over refined oil products. For instance, the PRC government could exercise price control over refined oil products when international crude oil prices experience a sustained rise or become significantly volatile. As a result, our results of operations and financial condition may be subject to material risks resulted from the fluctuation of prices of crude oil, refined oil products and petrochemical products.

As gasoline price is a key component to inflation and a key input to downstream industries such as transportation and manufacturing, the PRC government may want to soften the impact of rapidly rising energy prices by exercising price control covertly through Sinopec. The result is that refining margins for Sinopec could be lower than they otherwise would be under a free market system.

Sinopec Could Be An Employment Agency Of The PRC Government

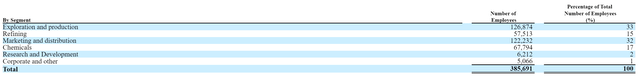

Furthermore, Sinopec, is one of the largest employers in China, employing 385,000 employees as of December 31, 2021, as shown in Figure 7. As with national champions in other developing countries (i.e. Petrobras in Brasil), the company could be tasked with maintaining employment levels to manage the unemployment rate in China.

Figure 7 – Sinopec employees (Sinopec 2021 20F report)

For example, according to the Canadian jobs bank, there were approximately 12,000 service station attendant jobs in 2018 while there are approximately 12,000 service stations in the country. This works out to 1 attendant job per station. This makes sense anecdotally, as we usually see only 1 cashier per service station, because many of the functions are automated or self-served.

However, for Sinopec, we see that the company employed 122k people in the marketing and distribution segment, or roughly 4 employees per each of the 30,700 service stations.

Also, Dow Inc. has 36k employees supporting its $55 billion in revenues, while Sinopec has 68k employees in its chemicals division. Similarly, Marathon Petroleum has 18k employees for 2.9 million boed of refining capacity, while Sinopec has 58k employees for 5.8 million boed refining capacity. Exxon Mobil employed 68k people to produce 2.3 million boed versus the 127k employees in Sinopec’s E&P segment.

In all business lines, it appears Sinopec is carrying a much higher employee load than a similar sized business in a free-market system.

Other Risks To Consider

Aside from the potential conflict of interest between investors and the PRC government, there are other major risks that investors should consider before accumulating Sinopec shares.

Possible Delisting

One of the biggest overhangs on Chinese ADRs in recent years is the possible delisting of the shares due to The Holding Foreign Companies Accountable Act (“HFCAA“).

The HFCAA was enacted in December 2020 and states that the SEC has the authority to prohibit shares or ADRs from trading if the company has been audited by an accounting firm that has not been subject to an inspection by the Public Company Accounting Oversight Board (“PCAOB”) for three consecutive years beginning in 2021. Furthermore, in June 2021, the U.S. Senate passed an act to accelerate the HFCAA to 2 years instead of 3.

Sinopec was conclusively identified by the SEC as of May 26, 2022, and hence is subject to delisting with the above timelines. If the shares are delisted, investors in the NYSE-listed ADRs may not be able to sell their shares, or may have to convert their shares to the H-shares listed in Hong Kong.

Sinopec May Run Afoul Of US Sanctions

Sinopec imports almost 90% of its crude oil from overseas markets, chiefly the Middle East and Russia. Due to the sanctions imposed by the U.S. on countries such as Iran, Syria, and Russia, Sinopec may run afoul of these sanctions and find its business activities negatively impacted, including being shut out of international payment systems.

Furthermore, with increased political friction between the U.S. and China, Sinopec itself may be sanctioned by the U.S. government at a future date.

Poor Risk Control

Finally, as a sprawling emerging market conglomerate, Sinopec suffers from the risk employees committing financial crimes using company resources. For example, Sinopec’s shares plunged in 2018 following a string of large losses in its trading unit on rumors that two executives were suspended after making improper trades.

Valuation

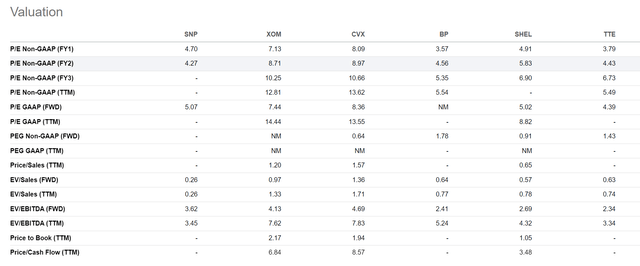

After reviewing the key risks, we come to Sinopec’s valuation. With an enterprise value of $122 billion, Sinopec is trading at a 5.8x LTM P/E. On a forward basis, it trades at 4.7x 2022 P/E and 4.3x 2023 P/E. While the absolute valuations are attractive, they are not out of line with the peer group of international integrated energy companies (Figure 8)

Figure 8 – Sinopec valuation comps (Seeking Alpha)

In particular, while US-based comps such as XOM and CVX are valued at roughly twice the valuation multiple of Sinopec, we can see that European energy companies such as BP, Shell, and Total, have similar, if not cheaper valuations.

I believe investors may be better served by looking for value in European energy companies, as they do not suffer from the same level of idiosyncratic risks that Sinopec has.

Conclusion

In Summary, while Sinopec may screen very cheap on dividend yield and earnings, investors can find European energy companies such as BP and Total that have similar rock-bottom valuations without the idiosyncratic risks. I believe Sinopec is cheap for a reason, as the company is controlled by the Chinese government and may not have investors’ best interests in mind. Furthermore, there’s a large overhang of possible U.S. delisting in two years. Finally, Sinopec runs a serious risk of running afoul of U.S. sanctions on Iran and Russia that may jeopardize its business.

Be the first to comment