ApisitWilaijit/iStock via Getty Images

The problem with a company like Rollins (NYSE:ROL) is that it has it all. The economics are great and it’s a founder-run business. In PE, this would make the ideal minority shareholding barring the price. For an LBO, it would work wonders too thanks to the security of the cash flows. Inflation might be the stock’s biggest problem, a severe recession might not be enough to dent it either. The price is impervious to meaningful declines so far, and we fear that it will never be the bargain we need it to be since we don’t invest on historical price strength, so despite an expectation that it’ll stay solid in a recession, an extended multiple means that in our rightfully dogmatic value investor way it’s a pass.

Quick Comment on Rollins’ Q1 Results

The quarter was a bit incomparable due to a sale of Clark Pest Control, but adjusting for that we see than on top of solid revenue growth, some modicum of EBITDA growth was achieved. Pest control materials have become substantially more expensive, and a non-negligible 0.7% of the operating margin is being lost to growing fuel prices.

or the first quarter, we are presenting adjusted EBITDA for comparison purposes due to the impact of our gain on sale of several of our Clark properties of $31 million in Q1 of last year. First quarter EBITDA 2022 was $117.8 million or 4.2% over 2021 adjusted EBITDA of $113 million.

Relatively aggressive pricing to outpace inflation was attempted, but the company appeared to indicate that it is careful not to get undercut by competitors. Moreover, the dynamics of pricing can be a little unsystematic especially on the commercial side representing about 35% of revenue, but does allow for some discretion and value capture. Moreover, the end-markets for commercial should be more robust these days as reopening takes effect among catering and leisure customers. Altogether, pricing is keeping pace but not outdoing inflation, and profit growth has slowed as opposed to previous crises.

Recession Resistance

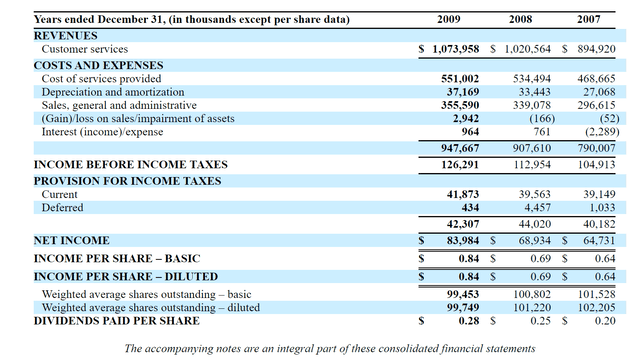

Despite exposure to homes, there is no exposure to the housing market. In the financial crisis, results grew steadily throughout despite the massive income collapse and the massive collapse in housing.

Performance During the Great Recession (SEC.gov)

That’s not the biggest surprise, since if there are termites or pests in your house, you either will very much want to or very much need to get rid of them. Rate increases, still relatively modest, and the worst case scenario of an unemployment spiral happening to instigate a recession, will still probably not be enough to stop Rollins, possibly even helping it on the cost side.

The recession resistance of the company is not lost on the markets. In fact, together with recurring revenues and low capital intensity, it creates the PE triumvirate. With private markets still being as crazy as ever before, especially as money has retreated somewhat from public markets, the Rollins multiple at 30x EV/EBITDA might even reflect what some on private markets would believe is a fair value for the stock. Without the privilege of having a public markets mandate, you actually will have to struggle with limited opportunities and still seemingly unlimited dry-powder. For either a minority investor that might value the founder-owned model or for a company looking to leverage the excellent economics and debt capacity for an LBO, the Rollins multiple is likely where it belongs.

Conclusions

Does this mean it’s undervalued? Well, we’d never in our lives buy this stock at this price because we could never trust its price, historically impervious to any meaningful discounting, to stay where it belongs. On the other hand, we are not going to expect that the price would ever come down to what we’d consider a good bargain. At a 50x PE and a 30x EV/EBITDA, the price would have to halve before we’d consider it good value. We have our own picks that match it in economics but trade at single-digit multiples. Investing in it at these levels just because of the solid price and possibility of being a good store of value (with limited upside) where a halving of the price would still mean it’s premium in our eyes would not make sense, even if we didn’t have alternatives. Between cash and Rollins we’d go with cash for now, and between cash and our own ideas we’d of course go with our own. Rollins just can’t be considered at these levels given alternatives regardless of any of its qualities. Only a highly disadvantaged institution should ever consider it with the lack of alternatives. A great company at a bad price.

Be the first to comment