Pgiam/iStock via Getty Images

By Mycroft Friedrich and Mark Bern, CFA

Covid-19 is Still a Major Problem

Around Christmas time, back in 2021, the markets were at all-time highs and people around the world were starting to celebrate the Covid-19 pandemic nightmare supposedly being somewhat controlled, with the help of one of our largest holdings Pfizer (PFE). Planes started to fill up as did cruise ships and theme parks. People wanted to get out and celebrate, but the celebration turned out to be premature for those outside of the USA as Covid-19 hit China hard and forced that country to not only impose major lockdowns, but to also force many of its factory workers to live in factories, so they could continue to work. This caused major riots among workers, but in communist nations riots do not last long as major crackdowns resulted. Nevertheless, the virus caused things to come to almost a complete halt on the production side in China and that created repercussions throughout the world in the form of shortages of parts and products, as most things sold globally have at least some parts made in China.

In Europe people started to go on vacation in droves (to get out of the house) and hot travel destinations like Greece got flooded with tourists. This was all well and good, but recently Covid-19 cases have started to spike in places like Greece and I know this as my niece, her mother-in-law (from Northern Ireland), husband and daughter each got Covid-19 just two weeks ago. They were all fully vaccinated (except for my grandniece who is just a baby). The virus is still out there and as people start to travel this summer, the spread could get really bad this fall again.

As for supply shortages, I ordered a stair climbing cargo machine back in December 2021 and it was finally installed last week, even though the manufacturer is in Miami, Florida. What would have normally taken a week took 7 months to complete. Multiply this problem by billions of parts and you have truly little supply to meet demand which causes people and companies to overpay for parts, as those parts may be needed to run a factory machine that by being down would shut down part of a production line. Companies are resorting to hiring machinists to make the parts individually, rather than import them, because factory production lines cannot be shut down for one or two parts. But there are not enough trained machinists. Clearly this is inflationary.

Russian Invasion of Ukraine

Now we get to the war in Ukraine, which is an absolute nightmare and could escalate into a much worse situation than just a war between Russia and Ukraine as Ukraine is petitioning to enter the European Union. This is all making Putin furious, to say the least, and he has started not only cutting off oil supplies to Europe but has recently started to reduce the amount of natural gas (by about half) that Russia sends to Europe. It has gotten so bad that Germany has started reopening coal plants that it shut down a decade ago.

This again is inflationary as prices for oil, gas and petrol are skyrocketing and consumers in Turkey, for example, are not only experiencing an 80% inflation rate, but are also paying $10 a gallon for gas at the pump. Putin, it has been rumored, is sending oil and gas at reduced prices to China in exchange for good and services, but I do not think that is going too well as the price of a gallon of gas in Hong Kong just hit $11.31. Clearly China is importing goods from the west and then trading them for oil and gas to Russia, but the average Chinese is still paying close to $6 a gallon in Beijing, even with the government subsidizing the cost. $6 in China feels like $18 would feel here as they make 1/3rd as much there. That, of course, is for unleaded gas and not Diesel, which runs the cargo ships and trucks that transport all supplies of parts and consumer goods.

Average Cost of One Gallon of Diesel:

June 2020 = $2.40

June 2022 = $5.71

With the average 18-wheeler’s fuel capacity being 150 gallons (about 567.81 L), it used to cost this much to fill up a truck vs. today.

June 2020 = $360

June 2022 = $857

The average Diesel Semi gets 6.5 miles per gallon, so it can go 975 miles on a tankful. So now we can break down the cost per mile:

June 2020 = $0.37

June 2022 = $0.88

We have parts shortages, gas shortages and supply shortages for billions of products and unless the war in Ukraine ends soon and relations go back to normal between the west and Russia, we should have inflation around for quite some time. Let us see what history has to say about all this.

A History Lesson

On October 19, 1973, immediately following President Nixon’s request for Congress to make available $2.2 billion in emergency aid to Israel for the conflict known as the Yom Kippur War, the Organization of Arab Petroleum Exporting Countries (OPEC) instituted an oil embargo on the United States. The embargo ceased U.S. oil imports from participating OPEC nations and began a series of production cuts that altered the world price of oil. These cuts nearly quadrupled the price of oil from $2.90 a barrel before the embargo to $11.65 a barrel in January 1974. In March 1974, amid disagreements within OPEC on how long to continue the punishment, the embargo was officially lifted. The higher oil prices, on the other hand, remained.

In the 694 days (about 2 years) between 11 January 1973 and 6 December 1974, the Dow Jones benchmark suffered the seventh-worst bear market in its history, losing over 45% of its value. 1972 had been a good year for DJIA, with gains of 15% in twelve months. 1973 had been expected to be even better, with Time Magazine reporting just 3 days before the crash began that it was ‘shaping up as a gilt-edged year’. In the two years from 1972 to 1974, the American economy slowed from 7.2% real GDP growth to −2.1% contraction, while inflation jumped from 3.4% in 1972 to 12.3% in 1974.

The Ford and Carter administrations did not help the inflation situation and by 1979 the inflation rate was 13.3%. Even worse the Federal Funds rate hit 18% in 1980 and allowed Reagan to defeat Carter and it was not until 1986 that the Fed got inflation down below its target rate of 2%. So, as you can see, inflation is not something that can be controlled very easily as it took 14 years to get it under control the last time we had to deal with it. The reason for this is because once manufacturers raise prices it is exceedingly rare that they will tend to lower them again. Companies like Amazon and Costco sell everything at cost, but those firms must now deal with inflation. The Amazon model has never been tested in an inflationary period, as it was founded in 1994, while Costco has been around since 1976 and may have had some experience.

Most investors today though have never seen an inflationary period and believe that the Fed will just come to the rescue of the world in a few months, and all will be well. Well, if history is any guide, that is not the case and going forward the companies that should do well on Main Street are those that have exceptionally low capital expenditures, high profit margins and extremely low fixed costs. The reason for this is because if you have, for example, a 20% profit margin on average and because of inflation the economy has a -2% negative growth rate or what is called a recession, then a 20% profit margin could go down to 15% at the most, and the company can still easily pay its bills and function normally. But those companies that have low profit margins of 1 to 3% on average could see their profits go negative if inflation were to continue.

Wall Street, in all its wisdom, has currently sold off the low cap ex high profit margin companies with strong free cash flow and have invested in cyclical low profit margin high capital expenditure firms instead, so Wall Street is going against logic and history.

Inflation jumped from 3.4% in 1972 to 13.3% by 1979 and the Fed, during all those years, was confident it could deal with inflation like what our current Fed is broadcasting. But from listening to Chairman Powell’s testimony this week he used the word “unconditional” a lot. During World War II the Allies slogan was that they would fight until Germany, Italy and Japan surrendered unconditionally. That meant that the Allies would do whatever was necessary to win the war. And the Fed Chairman said the same thing when discussing inflation and in doing so signaled that the Fed would no longer be backstopping the stock market, would be raising rates and worst of all selling off its bond holdings and not buying anymore on the open market, meaning that interest rates are going up.

As interest rates rise, companies will be forced to raise their dividends to compete with the going rate as money chases the highest interest rate as a rule. Bond holders, that do not hold their fixed income bond holdings to maturity, will get a wakeup call from hell, because the bond market has been on a Fed inspired and backed bull run since 2009, as the Fed kept the Fed Funds rate at 0.25% from 2009 to 2021. Those days are over and as interest rates rise, the principal of those bonds will drop, and if the Fed really pushes hard then interest rates on mortgages will skyrocket as well and suddenly investors in real estate will discover that they will not only be unable to refi their homes, but the interest rates on all those ARM (or Adjustable Rate) Mortgages they used to buy their home, or second investment property will shoot up. That will create nothing but sellers and no buyers. So, everything going forward is all dependent on interest rates and inflation.

Wall Street Manipulation

Stocks have been beaten up this year as the S&P 500 fell 1000 points or -21% from its high of 2021 (including this week’s rally) and the Nasdaq is down -29% from its 2021 high. The rally this past week was the result of Treasury Secretary Janet Yellen saying that she saw little chance of a recession. Also, what I view as the “manipulators” are out in full force this week as JPMorgan issued a report saying that we could see a 28%+ rally in the S&P 500 by the end of the year. But just two weeks ago JP Morgan’s CEO said that he was preparing his bank for a financial Hurricane that is coming and he warned investors to beware. So, as you can see, the Den of Thieves are out in full force performing their “Pump and Dump” and from the market reaction there are more than enough investors ready to play elevated risk Russian roulette (literally). Money managers are going all in as the quarter ends in 6 days, and they want to increase the fees that they get. They can always sell everything in July since IT’S NOT THEIR MONEY after all.

Bear Market Rallies

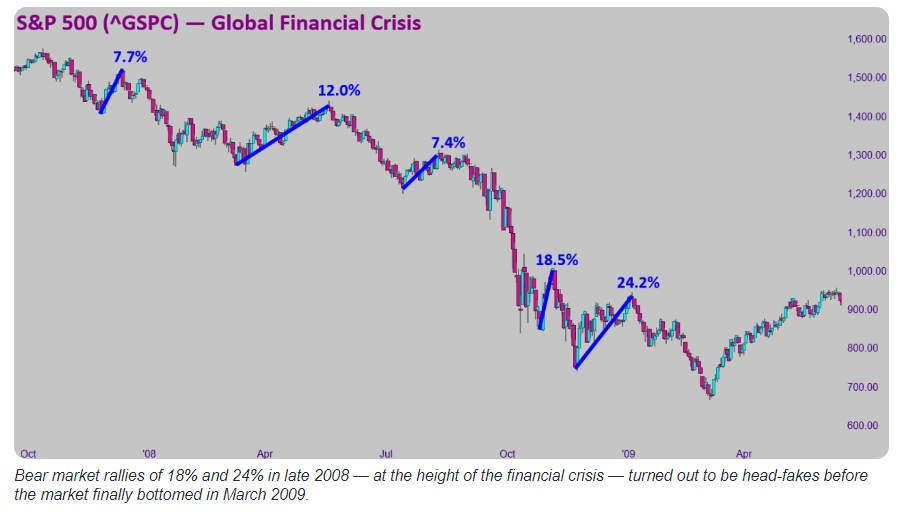

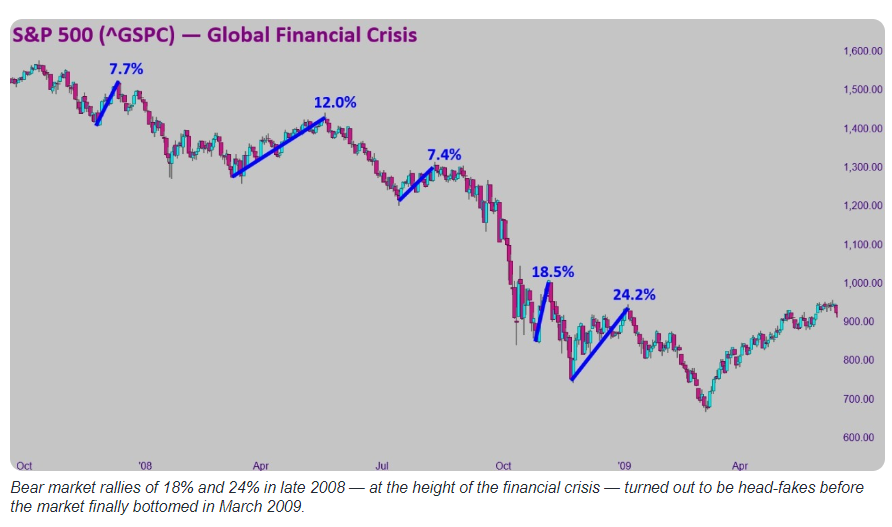

If we go and analyze the history of Bear Markets, you will find that they are the ultimate example of a perfect combination of greed that is ultimately turned into panic as investors try to keep hope alive, as the manipulators are constantly telling everyone to buy the dip or are preaching FOMO (Fear of Missing Out) of the next Bull. I have seen this phenomenon in 1987, 1990, 2001 and 2008 where Bear Market rallies based on nothing, but emotion came and went. Bear Market rallies like the one we are seeing this week are the stuff of legends. The market lures in new longs, only to eventually send stocks to new lows. At the beginning of bear market turns, these rallies are flashy and short lived. As the markets grind lower, these rallies tend to grow bigger. During the financial crisis three minor rallies occurred from the fall of 2007 to the summer of 2008 of 8%, 12% and 7% suckering in new longs eventually to only wipe them out as the S&P 500 Index fell 56% from top to bottom.

Yahoo! Finance

But those were not the worst rallies during that bear market. Rallies of 18.5% and 24.2% came later before the eventual bottom. Even in the bear market of 2001-02 there were 5 strong rallies.

Yahoo! Finance

The current rally just reminds us that bear markets are rarely over when investors want them to be over.

Don’t Fight the Fed

For those leveraging it can be even worse because you never know when the extreme panic button could be hit. In 1987 the markets fell 23% in 8 hours for example and as a 23-year-old high risk trader at the time, I lost 30% in one day as I was leveraged. In 2000 investors were buying into the dot com boom that turned into a 24-month prolonged bust. Markets always eventually recover and go higher, but the older one gets the less risk one should try to take, because all is wonderful when markets are in a bull cycle, but when the Bear shows up it is clearly buyer beware. Since 2009, the slogan has been “Don’t Fight the Fed” as the Fed has kept the Fed Funds rate at 0.25% but those days are now over as the Fed really screwed up in keeping rates so low for so long. It caused irrational/gambling behavior among investors. Going forward the Fed is not interested in helping the stock market, the bond market, the real estate market or even the Government (Federal, State, and local) and is hinting that “Everyone is on their own from now on.”

As I showed everyone the facts about inflation previously in this summary, inflation is something that never goes away quickly and as you can see from the Fed’s recent move of a .75% rate hike, after it telegraphed a .50% raise previously, the Fed is really worried and is having a tough time getting inflation under control. The Fed was created in 1913 for the sole purpose of dealing with inflation and unemployment. Those are its only two mandates, but unfortunately, its board members became demigods after 2009 and felt they could solve any problem that arose as everyone worshiped at the altar of the Fed, even though the value of the US dollar is down 97% from when the Fed was originally incorporated in 1913. That is inflation.

Buying now is a vote that says the Fed has everything under control. It is also going against what the Fed is doing or fighting the Fed when the Fed itself tells us it may need to cause a recession in order to get inflation under control.

It Does Not Feel Like the Worst is Over

Going forward one should never go 100% to cash as rallies like we have experienced this week will come from time to time. The markets do not like doing analysis or research these days and that is why great companies and poorly managed companies are going up and down at the same rate. At the end of bear markets the ones that tend to shine are those with incredible free cash flow and those are the ones we own. We have more than enough cash on hand to ride this bear market out and will be ready to come out of the gate buying when some form of normalcy returns.

Again, we cannot control what happens in the world, whether it be inflation, supply chain disruptions, interest rates or Putin, but we can protect ourselves by having a strong reserve of cash on hand. No one on the planet knows when this inflationary period will return to normal or whether the war in Ukraine will escalate to include other nations. Good times will return, but since we can’t control those events, we cannot tell you when these nightmare scenarios will end. The market manipulators found a lot of suckers to take advantage of this week, but going forward, will these same manipulators do the “Dump” after they just did the “Pump”? Was this a dead cat bounce, where the market fell so heavy in the previous two weeks that it hit the ground and bounced?

All I can say is I am trying to do my best to weather this storm, working off my 50 years of experience in the markets and have tried to protect everyone from the carnage that the previous two weeks brought. On listening to Chairman Powell’s testimony, I saw no catalyst to make me turn bullish. We bought shares after they had fallen hard, and they unfortunately kept falling despite being such bargains and that shows that this could be quite a prolonged bear market. I hope not, but nevertheless we went more to cash to protect everyone this quarter.

Be the first to comment