janiecbros/E+ via Getty Images

With biotech back momentarily in vogue this month, investors might find it worthwhile to re-acquaint themselves with Karuna Therapeutics (NASDAQ:KRTX). This clinical-stage biopharmaceutical company was the best first-year IPO performer of 2019 (admittedly, a year now lost to some collective pre-pandemic haze). KRTX’s price was driven sky-high by a torrent of analyst enthusiasm over a positive Phase 2 outcome.

Cut to 2022: KRTX is expected to drop Phase 3 results later this quarter. To say that the data will be “destiny-changing” for the company is an understatement.

What makes this release so important? KRTX has an experimental therapy that could overcome the challenges of traditional psychiatric drug development. It is pursuing a mechanism of action clearly differentiated from all current standards of care in schizophrenia and dementia-related psychosis.

Current antipsychotic treatments inhibit D2 dopamine receptors. A new approach did emerge in the 1990s, which worked to stimulate the muscarinic receptors in the central nervous system, but unfortunately the approach created nasty cholinergic side effects (due to the stimulation of muscarinic receptors in peripheral tissues).

Karuna’s lead drug candidate KarXT (Karuna-xanomeline-trospium) is unique in that it avoids the traditional blockade of dopamine or serotonin receptors and mediates via muscarinic cholinergic receptors, but its trospium component specifically operates as an effective muscarinic receptor antagonist. By combining tested and approved muscarinic-agonist xanomeline with muscarinic-antagonist trospium chloride, the detrimental effect to peripheral tissues is curbed.

Schizophrenia affects nearly 3 million patients respectively in the U.S., and more than 24 million globally, according to the WHO. It is one of the most disabling diseases that afflicts humankind, and it affects about .45% of all people worldwide. Likewise, dementia-related psychosis is quite common; it plagues about 2 million Americans and that number is estimated to grow steadily with the demographic aging of our population.

With a novel mechanism and strong data, Karuna could seize a sizable market opportunity. Prior drugs in this category have attained peak sales ranging from $3 billion to over $9 billion. By reducing the adverse events associated with xanomeline, it has the potential to produce a safe, differentiated therapy to address the negative symptoms of schizophrenia. KarXT could be a blockbuster.

Phase 2 Success And Efficacy:

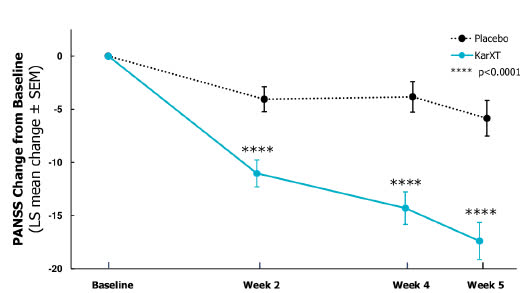

Released in November 2019, KarXT’s Phase 2 data were impressive. Its study for use to treat acute psychosis in patients with schizophrenia demonstrated robust efficacy, meeting the primary endpoint, with an 11.6-point mean reduction in total Positive and Negative Syndrome Scales core compared to placebo.

Karuna Therapeutics

At the time, Jeffrey Lieberman, M.D., a member of Karuna Therapeutics’ scientific advisory board, had this to say about the results:

The results of the Phase 2 trial are impressive and encouraging because they indicate that KarXT, if approved, could represent a game-changing therapeutic advance in the treatment of patients with schizophrenia. In addition to its novel mechanism of action, KarXT could be a new therapeutic option that has the potential to offer robust efficacy devoid of weight gain, metabolic effects and extrapyramidal side effects.

Published in the prestigious New England Journal of Medicine, those results catapulted the stock from 17 to 85 within days, making it the most successful IPO of 2019. The ticker -despite a momentary dip to 62 in March 2022, has stayed at a plateau ranging between 98 and 155 over the past 18 months.

Technicals: A New Momentum Cycle?

Karuna’s market capitalization is presently $3.60 billion with 31.26 million shares outstanding, more than 90% held by institutions and firms. It has a rather tight public float and a beta of 2.04.

Looking at KRTX’s weekly chart over the past two years, you can see that the early Nov 2021 top of $155 was not confirmed by the MACD and that, in fact, the momentum indicated by KRTX’s MACD topped out in Feb. 2021 and finally fully troughed only in March 2022. That price drop below 100 in late March found a “W leg” in early June, but I would argue that the “higher low” of the MACD suggests that we are in a new cycle.

The following chart also suggests there has been a noticeable bifurcation from sector performance since mid-March:

Phase 3: The Details

What has kept the ticker this elevated? What has investors revving up? Quite simply: Phase 3. Topline data from the Phase 3 EMERGENT-2 trial is expected in the third quarter (and EMERGENT-3 in the first quarter of 2023.)

As Phase 3, 5-week, randomized, double-blind, parallel-group, placebo-controlled, multicenter inpatient trials, both EMERGENT-2 and EMERGENT-3 will examine the efficacy and safety of KarXT in about 246 adult subjects each. These are individuals who are “acutely psychotic” -designated with a DSM-5 diagnosis of schizophrenia. The primary objective of the study is to assess the efficacy of KarXT versus a placebo in reducing PANSS total scores in adult inpatients with a DSM-5 diagnosis of schizophrenia. The secondary objectives of the study are to evaluate improvement in disease severity and symptoms, safety and tolerability in adult inpatients with the specific DSM-5 diagnosis of schizophrenia.

Positive results from these five-week trials, plus some additional safety data, ought to be enough to support a New Drug Application filing. If approved, KarXT could get 7.5 years of regulatory exclusivity in the U.S. with the possibility of a 6-month pediatric extension.

Regarding the Chinese market, Karuna has already inked a deal with Zai Labs. Under the terms of the agreement, inked in November 2021, it will receive a $35 million upfront payment and is eligible to receive up to an additional $80 million in development and regulatory milestones. It is also eligible to receive up to $72 million in sales milestones and low-double-digit to high-teens tiered royalties based on annual net sales of KarXT on the mainland.

Success would send the stock up nicely, probably to above $160 within hours of a positive Phase 3 result (breaking through an “upward ascending triangle” arguably established by the November 19th 2019 intraday high).

Success would also make the company a takeover target.

Clear And Present Dangers

As analyst Edmund Ingham has thoughtfully written, treatments for schizophrenia – a truly complex disease–are plagued with a high late-stage trial failure rate, with only 51% of CNS treatments progressing from a Phase 3 trial to approval (in fact, the lowest rate amongst all therapeutic areas except for oncology).

The existing treatments for the disease, including generics, aren’t going away and there are other biotech firms at work on new efforts. Last summer, Cerevel Therapeutics unveiled positive results of a trial of its drug CVL-231 in adult schizophrenia patients, setting off a shake-up amongst stocks of biotechs focused on the disorder. Yes, it was a tiny Phase 1b trial. But as it showed “clinically meaningful antipsychotic activity,” the (CERE) study suggests that Karuna’s competitive landscape is ever-evolving.

In KRTX’s recently reported quarter, R&D expenses were up 117% year over year (to $43.8 million) due to increased clinical program costs. General and administrative expenses also jumped 51.3% from 2020 to $14.8 million due to higher employee-related costs.

At the end of 1Q-2022, Karuna had a cash balance of $443.19 million, a 10% drop from the prior quarter. Is this sufficient to support all aspects of operation, including the multiple milestones needed following a potential NDA submission of KarXT in schizophrenia? Karuna believes it is.

At present, Karuna Therapeutics is a highly speculative call option on a potential blockbuster. Phase 3 is for all the marbles.

Be the first to comment