SeventyFour

This article was coproduced with Wolf Report.

As most readers know, I’m a huge fan of net lease REITs, for a few reasons:

First. I was a net lease developer for around 20 years in which I learned the industry literally “from the ground up”. I’ve built over 100 free-standing stores for companies like Advance Auto (AAP), O’Reilly (ORLY), Walgreens (WBA), and others.

Second. As an investor, I’m attracted to the very predictable income that net lease properties generate. That’s why I consider this sector the ultimate “sleep well at night” classification.

Third. Net lease properties are extremely liquid as the 1031 exchange marketplace provides robust capital flows for investors. In addition, many net lease properties are smaller ($500,000 to $3 million) which makes them much more fungible.

In this article, we’ll be looking at investing in Net lease REITs – a specific subset of REITs that have very attractive qualities that make them appealing investments with a long-term timeframe.

It also makes them attractive from a pure safety perspective – because good net lease REIT cash flows are based on extremely credit-worthy tenants which ideally are spread in a diversified manner among the REITs collective ABR (or annualized base rent).

If we have the combined qualities of:

- Fundamental quality (at least BBB or equivalent safety, decent market cap, good management)

- Portfolio diversification in terms of both square footage and ABR.

- Good history in terms of FFO growth, and growing their dividend.

- Around 4%, or more than 4% dividend yield.

- A realistic, conservative upside of around double digits or higher

Then you can probably beat inflation while staying safe, and while getting appealing dividend payments from good companies.

And there are interesting net lease REITs available – at low value and with great safeties. There are plenty of appealing places to, as I see it, invest your money with a high likelihood of good returns.

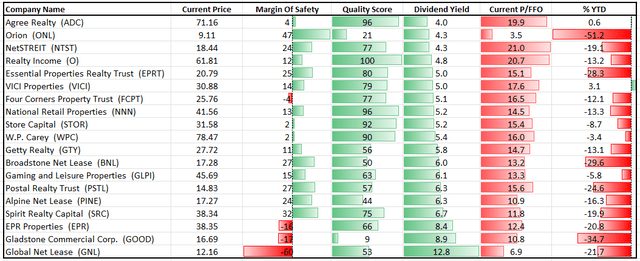

In this article, we’re going to show you 3 of our current top picks in the sector, and why we’re recommending them – especially with STORE Capital (STOR) recently being taken private and essentially being “out of the game”.

We still want a good yield and good growth out of our investments – here are some good picks for that.

1. Spirit Realty Capital (SRC)

Spirit Realty is our currently highest conviction buy in the net lease space. There are a few reasons for this.

First of all, let’s make it clear that the company fulfills all of the bullet points set out above. There’s significant fundamental quality to be had here. The company is BBB rated with a good market cap, of above $5.6B.

It has good diversification, with top tenants in its ABR. Most of its square footage/ABR is aimed at distribution, not manufacturing or flex, and the company has an average lease length of over 10 years, which is very good in the context of net lease. The average size of an SRC asset is just above 100k sq. ft.

SRC is not the same company it was even only 4 years ago. Diversification has gone down 3%, meaning that the top 10 tenants are now less than 22.5%.

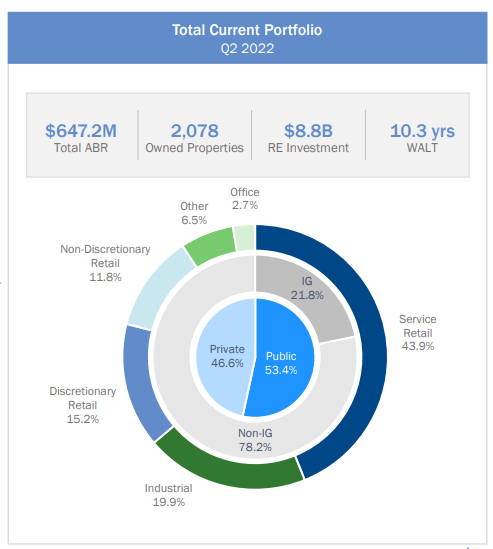

The company’s industrial exposure is up to 20%, from close to 8% back in 2017, and public exposure is up to 53.4% from 36.7% in 2017. The company did have some lost rent during COVID-19 and even before COVID – but it’s now down to 0.0% as of the latest quarterly.

SRC IR

There are so many good tenants to like here – from Walgreens to things like Circle K, Dollar General, Advance Auto Parts, CVS (CVS), Home Depot (HD), and others. The top 20 tenants have less than 45% of the company’s ABR as of 2Q22.

FFO growth history and dividend growth history are “okay”.

The company has had down years and bounced back. But the dividend has stayed stable or growing since at least 2018 – which is the period we compare the company in, given its portfolio changes. But I will be clear that there are net lease REITs that have better dividend and FFO growth histories than SRC.

However, SRC makes up for this with a few things.

First of all, the dividend is excellent. At the current share price, you’re getting a very well-covered 6.45% when investing in SRC.

Secondly, even if FFO growth isn’t really stellar beyond this year – 1-3% annually in 2023E and 2024E based on current forecasts – the total RoR or upside is closest to 28% until 2024E, and that’s based on extremely conservative multiples.

SRC trades at an FFO multiple of no higher than 11.4x, and the upside I mentioned is based on a 12.1x forward P/FFO. Comps are valued at far higher multiples. If we look at what this would imply in terms of cap rates when we invest in SRC, the current LTM Cash NOI gives us a cap rate of 9.8% based on the current NAV when investing in SRC.

This is an expression of just how the market undervalues SRC – the same number for Realty Income (O), as an example, is bought at a less than 5% cap rate at this time, making sense given its trading range of 17-20x P/FFO.

This in itself isn’t enough – we also need to ask whether the company’s assets are qualitative enough to make sure this isn’t a value trap. I would suggest that this is not the case, based on diversification, tenants, and safeties here.

All in all, we give this business a margin of safety of almost 26.5% and consider Spirit Realty a “STRONG BUY” here. The upside is 25% conservatively, easily.

So, SRC is the first “BUY” here.

2. Essential Properties Realty Trust (EPRT)

Another net lease that I recently co-produced an article on with Brad. Its focus is on long leases with high unit-level rent coverage.

The company’s WALT is longer than SRC at almost 14 years, and the company also has very high unit-level rent coverage, adding another appealing dimension to a mix that’s already very appealing. Some of these very appealing things are covered in the article that you’ll find here.

This includes qualities like:

- 4.6x net debt/EBITDAre, and 32% gross debt/gross assets on an undepreciated basis.

- A 0.01% vacancy.

- 99% of ABR is covered by unit-level P&Ls.

- Low average asset size.

- Over 84% of the company’s business is internally originated sale-leaseback.

- Excellent underwriting standards.

And the portfolio, with its tenants, is pretty great too.

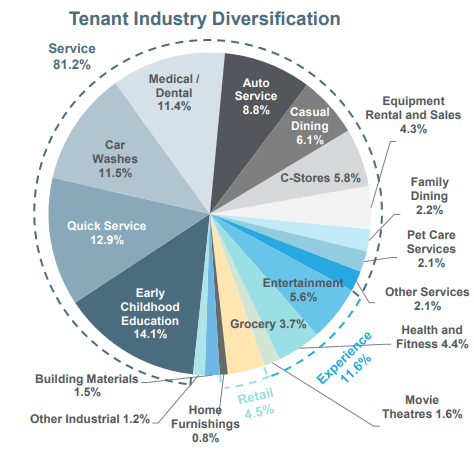

EPRT IR

With closing on 1,600 properties totaling 14.3M sq. ft. leased to 325 customers. No portfolio company is in any sort of major distress here, and coverage metrics are excellent. While tenants with sub-1x current coverage ratios do exist, almost 75% have 2x or higher. Cleanup notwithstanding, this is a superb net lease REIT. And low leverage is exactly what we’re looking for in this environment.

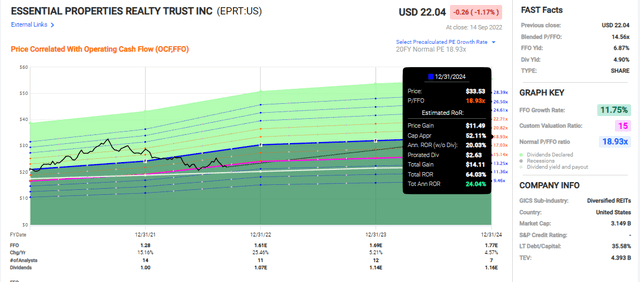

The yield is well above 4.5% as well. Not as high as SRC – but some of its metrics are even better. It trades at a higher multiple than does SRC, but it also has a higher historical premium, much closer to O than SRC. At a current P/FFO multiple of just south of 14.6x, the company has a significant upside to its 5-year average.

FAST Graphs

As before, the cap rate here implied by valuation is impressive. The company has significantly higher margins than SRC and O, managing to eke out around 59% on LTM with adjusted NOI (D&A added back in), coming to a current cap rate of 7.4% given how the market is valuing things here. This isn’t as good as SRC (The multiple is higher), but to me, it’s more attractive than O at this time, even if yields are closer to comparable than SRC and O.

We consider EPRT a “STRONG BUY” with a price target of no less than $27.5, considering reversal likely for the company in the mid to long-term. It’s not as though we at iREIT on Alpha are alone in this estimate. Analysts following the company have a $27.1 PT, with 9 out of 12 analysts at a “BUY” or equivalent rating here. The upside for EPRT is clear to us.

That’s why we’re buying more.

3. Netstreit (NTST)

We understand why some might prefer some of the safety of credit ratings to just the safety of an amazing portfolio. However, it’s our job as analysts to find undervalued businesses with perhaps as good upsides and safeties as are offered by some of the higher rated yet less appealingly valued peers.

Here we have Netstreit. Why is Netstreit so good, then, in our estimate?

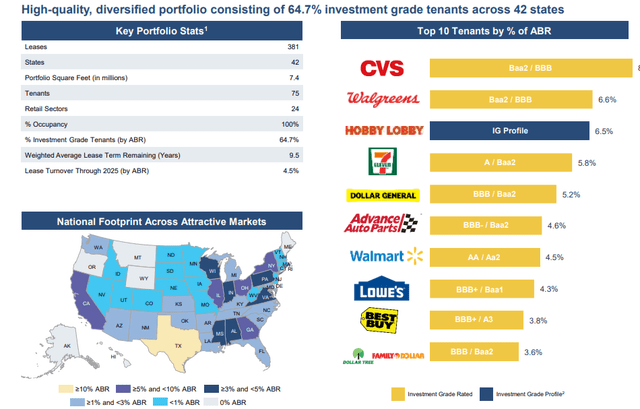

Netstreit lacks a credit rating – so we look at tenant credit ratings here, which are arguably as important for a net lease REIT such as this one. Like the other companies on this list, NTST operates with very stringent underwriting requirements, and it’s one of the very, very few REITS with a perfect occupancy ratio – meaning no vacancies at all. NTST has maintained this for over 2.5 years at this point.

The REIT focuses on defensive industries and discount-oriented retailers which have a higher likelihood of being able to make ends meet and thrive during a difficult time, such as a downturn, a recession, or stagflation.

NTST is perhaps the worst performer here in terms of average diversification – top 10 make up around 45%.

NTST IR

However, these tenants are all stellar and shouldn’t really be considered “bad” as such. 54.5% of the portfolio is leased to necessity businesses like Walgreens, Walmart (WMT), Target (TGT), Lowe’s (LOW), Kroger (KR), CVS. 18.1% discount, such as Big Lots (BIG), TJX (TJX) and 14.8% service, such as Taco Bell, 7-11, Wawa, or KFC.

It could therefore be said that the company, while least diversified, might be best prepared for an eventual downturn. NTST’s portfolio diversification has changed significantly since its Pre-IPO back in 2019.

Back then, the company had 93 leases in 28 states, 12% of which were CVS. Now the company is 8.2% CVS with 381 leases in 42 states. The company has expanded massively.

However, it’s also still the smallest of these REITS, generating less than $100M in rental revenue. It would be completely unfair to call this REIT “too risky”, but if we want to look at the riskiest of these three, then it’s NTST.

It’s simply the smallest, and it’s still in what can be considered a “higher growth” phase for a net lease REIT. It’s annual FFO growth for 2021 was 56%, and it’s expected to grow another 16% this year – averaging almost 10% until 2024 on an annual basis.

The yield is the lowest of the bunch – around 4.1%, but it’s growth potential warrants a higher potential upside than do the other REITs, which gives it a potential for the by-far-highest rate of outperformance until 2024E – over 88% RoR until 2024E based on the 5-year average.

Like other REITs, this one has been trading down slightly over the past few weeks and months, and is relatively cheap, seen to its averages.

Netstreit is a buy for a few reasons – but the main ones are its perfection in occupancy, being able to grow $100M/quarter at its current size. A 20x P/FFO average, or even 25x P/FFO isn’t unattractive to me if we consider the fact that the company grows the way it does.

This REIT is our current third choice. We give Netstreit a current valuation target of no less than $24.2, an upside of 18.5% here.

S&P Global has an overall average target of $24.3 here, in line with ours, and 10 out of 10 analysts consider the company a “BUY” or equivalent at this time.

Nothing But Net!

These are the 3 REITS we currently consider to be the most buyable on the market among those that we follow.

This, of course, does not mean that there aren’t risks to REITs and net lease ones specifically. Rent growth rates typically lag inflation quite significantly, but despite this, many net lease REITs are on pace to deliver double-digit FFO growth rates for this year.

Typically, such outsized growth rates come as a result of mixing attractive external growth factors which in turn offsets a lower internal rent growth rate.

The thing to keep an eye on, and which (unfortunately) favors either scale-capable REITs or REITs with very low leverage is that cost of capital is becoming ever-more important in this market environment.

“Free money” is over at this point – and the REITs that have access to growth opportunities that require capital have this for one of two reasons. Low debt, allowing for gearing, or low cost of debt, allowing for adding more (usually as a result of scale).

It’s impossible to say when this inflation environment abates. What we can say is that we won’t be in 7-9% inflation forever. The current base case we have is a 1-4% standardized rate of inflation.

If we look at historical performance indicators for net lease REITs, these tend to work alongside with expectations of inflation and long-term interest rate patterns, as opposed to short-term and actual, current rates of inflation. In this, they work much like their rent growth rate – more for the long term.

Many investors expect REITS to go down when rates go up – this is nothing new. The assumption that REITs underperform in a rising interest rate environment is one we field often – and let’s just say that historical patterns do not give this assumption any credence.

It does not seem this way this time around either – as earnings assumptions and performance have kept net lease REITs relatively high. Many net leasers have increased their upsides, with Realty Income, EPR (EPR), Spirit Realty and others only a few among them.

Inflation risks are definitely present – and we do acknowledge them. However, neither historical nor current indicators for earnings growth give any sort of credence to the concept of a major downturn.

Even with rent growth showing an expected massive lag to realized inflation numbers, these companies still have double-digit FFO growth in their estimates – several of them, at the very least.

These reasons, together with the basic appeal of these companies, are why we continue to invest in net lease REITs, and why we believe you should consider doing the same.

As always, thank you for the opportunity to be of service!

Be the first to comment