markrhiggins/iStock via Getty Images

Investment Thesis

Alliance Resource Partners (NASDAQ:ARLP) is well-positioned for the strong coal pricing environment.

Not only is coal pricing strong domestically, but internationally too. In fact, coal companies with some international exposure, as ARLP, are likely to have a very strong 2023.

In fact, I make the argument that while ARLP’s year is going to be strong, 2023 will be even stronger.

Hence, I rate this stock a buy.

Alliance Resource Partners’ Near-Term Prospects

ARLP is one of the largest coal producers in the eastern United States. It’s a master limited partnership (”MLP”), meaning that it will return most of its earnings back to shareholders. I’ll address this soon.

Before that, let’s get a bit of context. Everyone has come to recognize that the US as well as many countries around the world are suffering from an energy crisis. This has led to coal prices moving high and staying high. Commensurately, share prices from coal companies had also moved higher. Until recently.

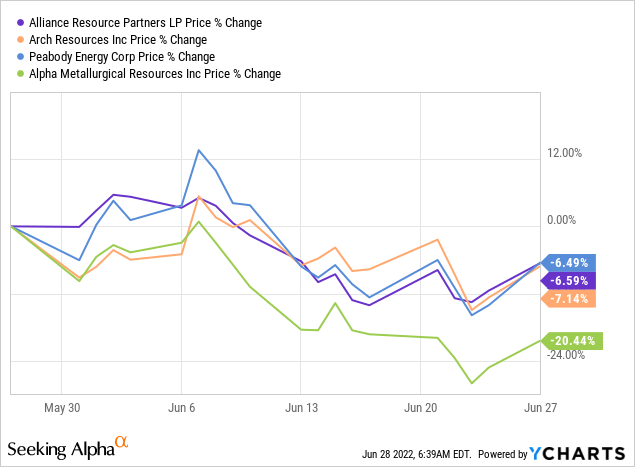

In the past month, we’ve seen investors turn their back on coal companies.

Above I’ve highlighted a small group of peers and you can see that they have all traded lower over the past month. Why?

Ultimately, there has been the pervasive thesis that in a higher interest environment the demand for energy would be reduced.

After all, keep in mind that Alliance produces coal for electric power generation (thermal) and the production of steel (metallurgical).

During a slowing economy environment, there’s the expectation that the demand for steel would decrease. And as such, demand for metallurgical coal should also come down.

But I’m not entirely convinced that the market is looking at this the right way. Because after all, steel prices appear to have now stabilized.

Why 2023 Could Be Stronger For ARLP Than 2022

Moving on, recall that many coal companies struggled with transportation challenges experienced during Q1 2022.

The narrative at the time throughout the peer group indicated that transportation bottlenecks could improve by H2 2022. If that dynamic still holds water, investors that were previously anxious about ARLP struggling to meet demand would now probably be more likely to revisit the bull case.

Lest we forget, so many investors have been unwilling to pay up for coal stocks, because everyone become so obsessed with clean energy.

And even though I firmly believe it was the right move to make, to strive for low carbon emissions, the facts remain, that we still need a lot of energy today.

Nevertheless, what we know today is that high coal prices appear to be high across the board. I’m referring to not only coal prices in the US, but Europe, and Asia.

Particularly noteworthy has been Germany’s stance on coal, with the country clearly struggling to meet its energy demands and looking to increase its coal usage, as it looks to wean itself off Russian natural gas consumption.

There’s also been anecdotal evidence that China is once again resuming its steel production, which would further support high metallurgical coal prices since metallurgical coal is used in steel production.

In sum, I contend that while countless analysts still believe that coal usage will turn lower in the coming few quarters, the underlying fundamentals that got us here in the first place are not turning back any time soon.

If anything, these dynamics are intensifying. And I’m now starting to consider that perhaps it’s not nonsensical to assume that Alliance’s 2023 EPS could perhaps be even stronger than 2022?

Get Your Capital Back, +11% Yield

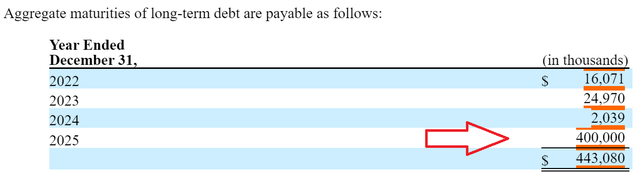

ARLP has a net debt position of $300 million. And no near-term debt maturities, see below.

As you can see, its main debt stack is 2025.

Moreover, as it stands right now, ARLP is looking to return to shareholders $0.35 per quarter. While at the same time stating that,

ARLP [is] targeting increases to unitholder distributions of 10.0% to 15.0% per quarter over the balance of this year.

Consequently, it’s possible that in Q2 2022 ARLP will announce a $0.40 distribution per unit. But keep in mind that from Q1 2021 into Q2 2022, ARLP actually increased its distribution by 40% sequentially.

Hence, I wouldn’t be surprised to see a similar increase in distributions in Q2, to somewhere close to $0.50 per unit. This would be annualized at 10.8%.

Looking further ahead, if we were to see just a 10% sequential increase from Q2 into Q3, we would then see somewhere close to $0.55 distribution per unit.

And then, if we were to see a similarly small 10% increase from Q3 into Q4, we would see a cash distribution of $0.61.

Then, if we now annualize its Q4 cash distribution, investors would be able to see around 13% yield from present values ($0.61*4=$2.44; $2.44/$21.60=13.1%).

And management believes this cash distribution is likely to continue to increase going forward too!

ARLP Stock Valuation: Less Than 5x EPS

ARLP is priced at less than 5x this year’s EPS. While this is not the cheapest coal player going, it is very much in the right range.

Arguably, the reason why this stock could perhaps be priced at 1x or 2x turns higher than some of its peers, is that it’s an MLP, which means that the business by its very setup is designed to return capital to shareholders.

There’s very little ambiguity that investors will get a return here. The only question is will it be an 11% yield? Or perhaps closer to 13% annualized return?

The Bottom Line

ARLP is a cheaply valued coal producer. The business is very likely to positively surprise investors when it announces its cash distribution together with its Q2 earnings in a matter of weeks.

I laid out different assumptions for why investors could be on the receiving end of at least 11% yield at current prices.

Be the first to comment