AsiaVision/E+ via Getty Images

Upstart Holdings (NASDAQ:UPST) has lately become a topic of heated debate in investing forums. While bulls believe near-70% decline in the last year makes it undervalued and leaves limited downside potential, bears believe there are fundamental risks associated with investing in the company which could drag its shares even lower. In this article, I’ll look at both sides of the coin and attempt to explain why Upstart Holdings remains a risky stock to own.

Attractive Valuations

Let me start by saying that Upstart Holdings’ shares are down 65% over the last 3 months alone, crashing more than most of the other popular growth stocks. The stock currently trades at just 3-times its trailing twelve-month sales which is seemingly an attractive multiple for a high-growth company. The picture turns even more bullish when we factor-in Upstart’s pace of revenue growth with that of its peers.

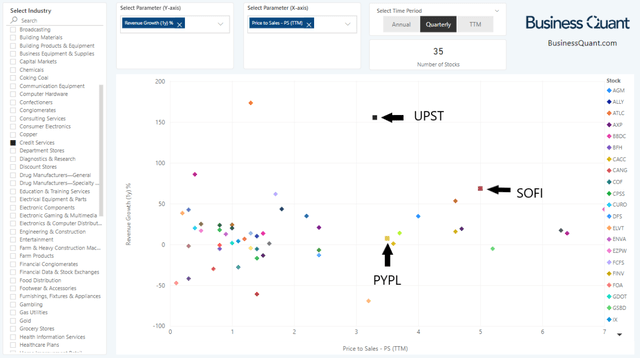

The scatter chart below should help in putting things in perspective. The X-axis highlights the Price-to-Sales multiples for 35 US-listed stocks that are classified under the credit services industry. Note how Upstart is positioned towards the right of a broad swath of its peers, indicating that its shares are trading at a premium relative to the median industry multiple. PayPal (PYPL) and SoFi Technologies (SOFI) are positioned further towards the right, indicating that they’re trading at even higher P/S multiples.

Now, let’s shift attention to the Y-axis, which plots the revenue growth rates for the same set of companies. Note how Upstart Holdings is positioned vertically much higher than nearly all the other stocks. This indicates that Upstart’s revenue growth is one of the highest in the entire industry. Also, note how PayPal and SoFI’s revenue growth rates are dwarfed in comparison.

The collective takeaway from both the axes is that Upstart is trading at a slight premium compared to a broad swath of its peers but that’s because the company is growing at a breakneck pace in its industry, thereby justifying the price premium. There’s actually just one other stock that’s growing faster than Upstart and is trading at a relative discount, whereas all the other stocks in our study group are either growing at a slower pace and/or trading at a steep premium. With this in mind, it’s understandable why many investors find Upstart Holdings an attractive buy at current levels.

But all’s not roses and sunshine when it comes to evaluating Upstart’s growth prospects.

Muddy Waters

See, Upstart Holdings is a technology firm that uses artificial intelligence and data science to help its partner banks with originating loans with higher approval rates and lower loss rates. Since there’s minimal human intervention involved, the automated process brings along cost savings for the partner banks which allows them to pass on these benefits to end borrowers in the form of lucrative interest rates and a speedy approval process.

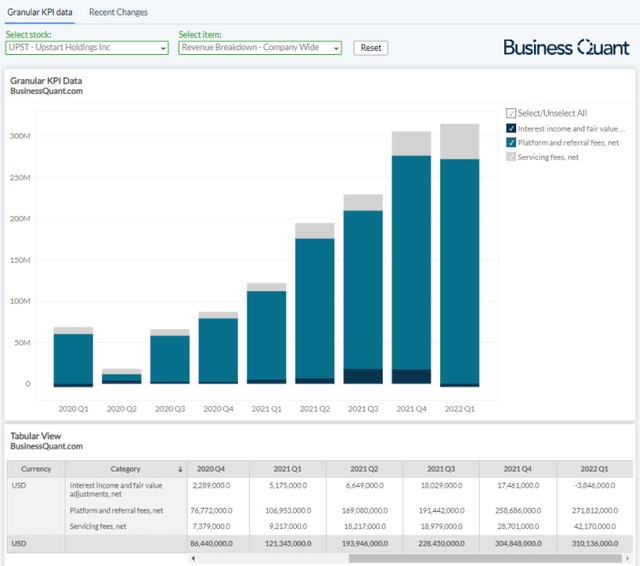

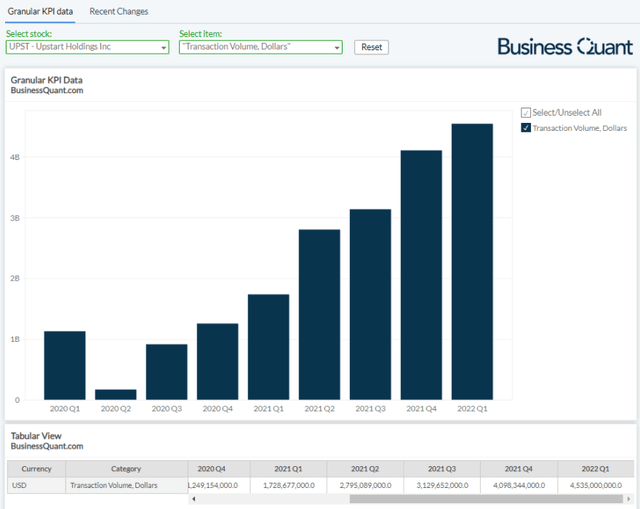

This is a win-win for Upstart, its partner banks and end-borrowers. This disruptive credit scoring methodology has what’s basically allowed Upstart to scale its top-line at breakneck rates in the past several quarters. To put things in perspective, Upstart’s revenue in Q1 has become five-fold from the comparable quarter 2 years ago. Their growth momentum was so healthy that Upstart’s management raised their guidance just 2 quarters ago.

But that’s where the problem begins. The Fed raised interest rates this year which wreaked havoc for nearly all growth stocks. Upstart’s management also reacted to the slowing down economy by lowering their revenue growth forecasts. This may be a normal knee-jerk reaction for all the other companies but it casts doubt on the predictive prowess of Upstart’s machine learning and AI algorithms.

I bring this point up because investing forums are rife with bullish narratives about how the company will be able to navigate the recessionary phase with relative ease, thanks to the predictive capabilities of its machine learning algorithms. But the recent lowering of guidance suggests that Upstart’s models don’t predict interest rates well and the company may be prone to more guidance cuts as the Fed hikes interest rates. Another plausible scenario is the default rates of Upstart-powered loans could rise with more interest rate hikes.

See, Upstart-powered loans are unsecure in nature. Individual borrowers that financially crunched are likely to prioritize their secured loans, where the collateral or their equity is at risk, whereas they might not be as pressed to repay unsecured loans which only pose a risk to their credit ratings. From its 10-Q filing:

The Company enters into contracts with bank partners to provide access to a cloud-based artificial intelligence lending platform developed by the Company (the “Upstart platform”) to enable banks to originate unsecured personal and secured auto loans.

Bear in mind that default rate forecasts have already started to inch up and they’re estimated to keep heading north in 2023 amidst the rising interest rate and an overall recessionary macroeconomic environment.

Besides, Upstart Holdings disclosed in its last 10-Q filing that it has trained its AI and machine learning models based on data from recent years, during periods of economic growth. Its models are yet to be battle-tested in a full-fledged recessionary environment. We already know that Upstart’s growth momentum took, in the form of lowered revenue guidance, well before we officially entered into a recession. So, it’s anyone’s best guess as to how adversely its growth rates would be affected when unemployment rates spike, personal disposable income shrinks and default rates surge.

While our AI models have been refined and updated to account for the COVID-19 pandemic, the bulk of the data gathered and the development of our AI models have largely occurred during a period of sustained economic growth, and our AI models have not been extensively tested during a down-cycle economy or recession and have not been tested at all during a down-cycle economy or recession without significant levels of government assistance.

One might argue that Upstart doesn’t stand to lose even if default rates go up as it’s just a technology provider that measures credit worthiness of individuals. But that’s another area where the water is muddy. The company held $595.9 million in loans on its balance sheet last quarter, up 136% sequentially and comparable to the $757 million cash on its books. So, Upstart has a sizable credit risk. Besides, if the default rates go up, Upstart’s partner banks may not be as willing to fund these loans and they might switch to conventional secured loans during times of uncertainty. This scenario could hamper Upstart’s loan originations and consequently hurt its revenue.

Final Thoughts

There’s no denying that Upstart has grown at a stellar pace in the past several quarters and its attractively valued when compared to industry peers.

However, there are fundamental risks involved with investing in the company. We don’t know how well its AI will be able to predict delinquencies and defaults, how its revenue growth momentum stands to be affected with more interest rate hikes and whether its partner banks will continue funding Upstart-powered loans at the peak of the recession. So, in my opinion, risk-averse investors may want to avoid the stock for the time being. Good Luck!

Be the first to comment