designer491

Both Lumen Technologies (NYSE:LUMN) and AT&T (NYSE:T) are telecommunications businesses that currently offer very attractive dividends yields of 10.2% and 6.5%, respectively. While LUMN offers a vastly superior current dividend yield, AT&T has an investment grade balance sheet, implying that it is lower risk.

In this article, we will compare them side by side and offer our take on which one is a better buy.

Lumen Technologies Vs. AT&T – Business Model

LUMN operates two main business segments: Business and Mass Markets. Within these segments, it offers various telecommunications related services, such as cloud services, managed security services, intellectual property and data services information technology solutions, colocation and data center services, and unified communication and collaboration solutions. It is also investing aggressively in rapidly growing its Quantum Fiber business as it seeks to capitalize on the growing demand for fiber infrastructure services. LUMN highlights its edge computing services and significant quantum fiber growth runway as key competitive advantages for its business. However, these capabilities have as of yet to translate into generating strong overall topline growth for the company.

Recently, LUMN has sold off several of its non-core businesses and assets in an effort to deleverage the balance sheet and streamline its capital expenditure budget in order to be able to maximize capital investments into its growthiest and best-positioned assets. Thus far, management has struggled to build a sustainable business model that is able to generate stable or even growing cash flows. However, organic revenue declines are decelerating, and management continues to believe that organic revenue growth is only a year or two away for the company.

Meanwhile, AT&T operates a more broadly diversified telecommunications business as it offers wireless voice and data communications services, wireless computing devices, handsets, data cards, and carrying cases. It also offers similar services to LUMN, including security, cloud solutions, data, and outsourcing services. Its clients include individuals, small and mid-sized businesses, multinational corporations, and governments. AT&T also offers broadband fiber and legacy telephone services to residential customers.

Also similar to LUMN, AT&T has recently made moves to streamline its business model and deleverage its balance sheet. It spun off its media assets along with a large pile of debt, and now is solely focused on its core telecommunications business. However, it is struggling to generate any sort of meaningful growth in this business while also having to pour a lot of money into it via capital expenditures.

We rate this segment as a draw between LUMN and AT&T. While AT&T is slightly better diversified, both businesses face significant competition in their businesses and are struggling to generate high returns on invested capital, so ultimately neither has anything impressive to stand on.

Lumen Technologies Vs. AT&T – Balance Sheet

LUMN has a junk credit rating from S&P at BB, with a negative outlook. That said, it is making some strides to improve its balance sheet and it is not in any sort of near-term risk of financial distress. Year-to-date in 2022, it has reduced net debt by nearly $900 million, while generating substantial free cash flow. Furthermore, it continues to divest non-core assets, generating billions of dollars in proceeds that it is largely using to pay down debt. Between its impressive free cash flow generation, net proceeds from divestures, and well-laddered debt maturity calendar, LUMN should not have any issue meeting financial obligations for years to come.

Meanwhile, AT&T has an investment grade BBB credit rating from S&P with a stable outlook. Furthermore, between the debt that it recently spun off along with its media assets and its meaningful retained free cash flow at the moment thanks to its recently slashed dividend, AT&T is able to continue paying down debt to further strengthen its balance sheet. As management said on its latest earnings call:

Importantly, we maintained our focus on paying down debt, with the $40 billion in proceeds from the completion of the WarnerMedia Discovery transaction in April helping us to significantly reduce our net debt in the quarter.

Overall, neither business is in trouble in this segment, but we give the win to AT&T given that it has an investment grade balance sheet and is more focused on reducing debt at the moment thanks to its lower dividend payout ratio.

Lumen Technologies Vs. AT&T – Growth Potential

This is an area where both businesses are currently struggling while also investing aggressively in an attempt to drive a turnaround. Both businesses have seen revenues and EBITDA decline since 2020 (LUMN also saw revenue decline in 2019, but its EBITDA edged up slightly that year), and analysts expect revenue to continue declining for both businesses in 2023, though AT&T is expected to see EBITDA increase slightly next year. LUMN, meanwhile, is not expected to see EBITDA return to growth until 2024 and revenue will likely be flattish in 2024 and then post solid growth beginning in 2025.

While neither business has strong growth potential moving forward, we give AT&T the slight edge here as analysts have a rosier outlook for its business relative to LUMN’s, and AT&T is also retaining more cash flow at the moment for reinvesting in growth.

Lumen Technologies Vs. AT&T – Track Record

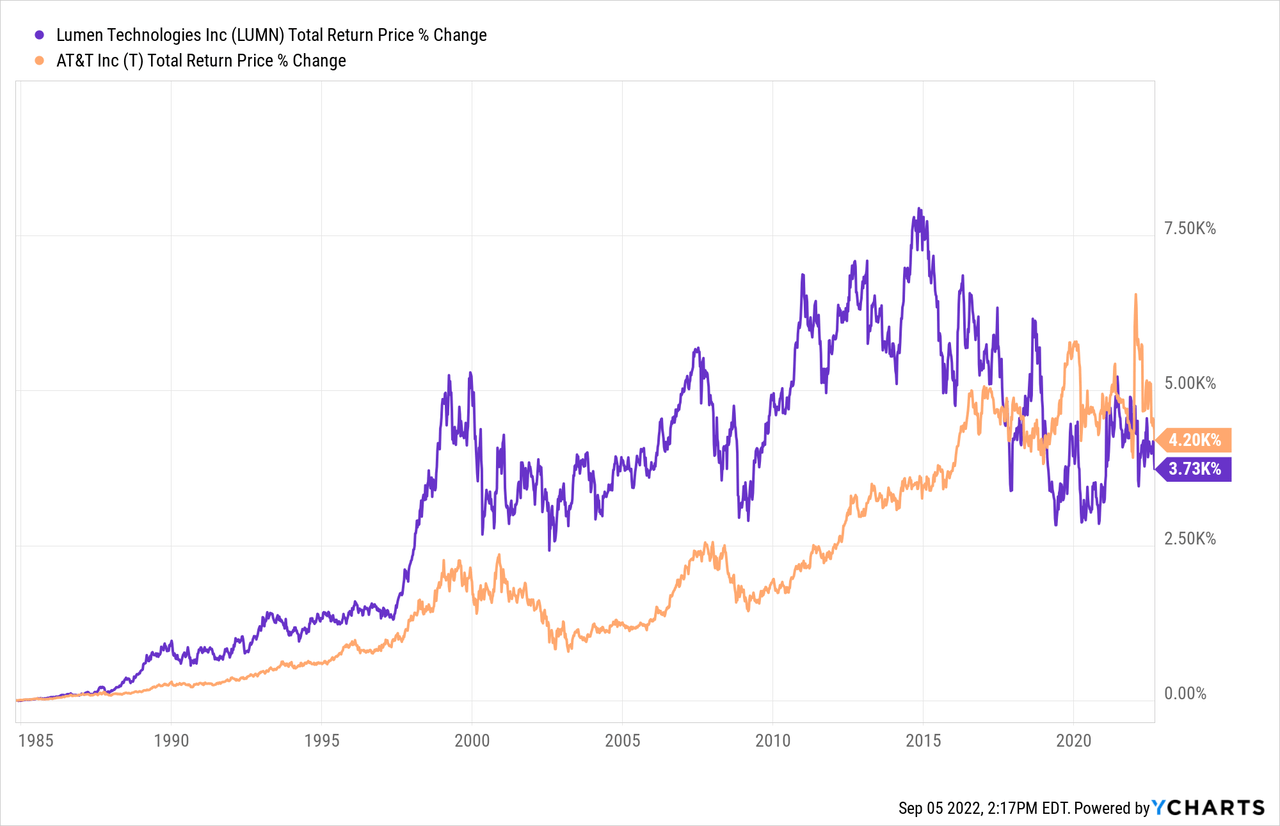

When it comes to track record, neither business is particularly impressive in recent years. However, over the long term, LUMN and AT&T have posted similar results, with AT&T enjoying a slight edge:

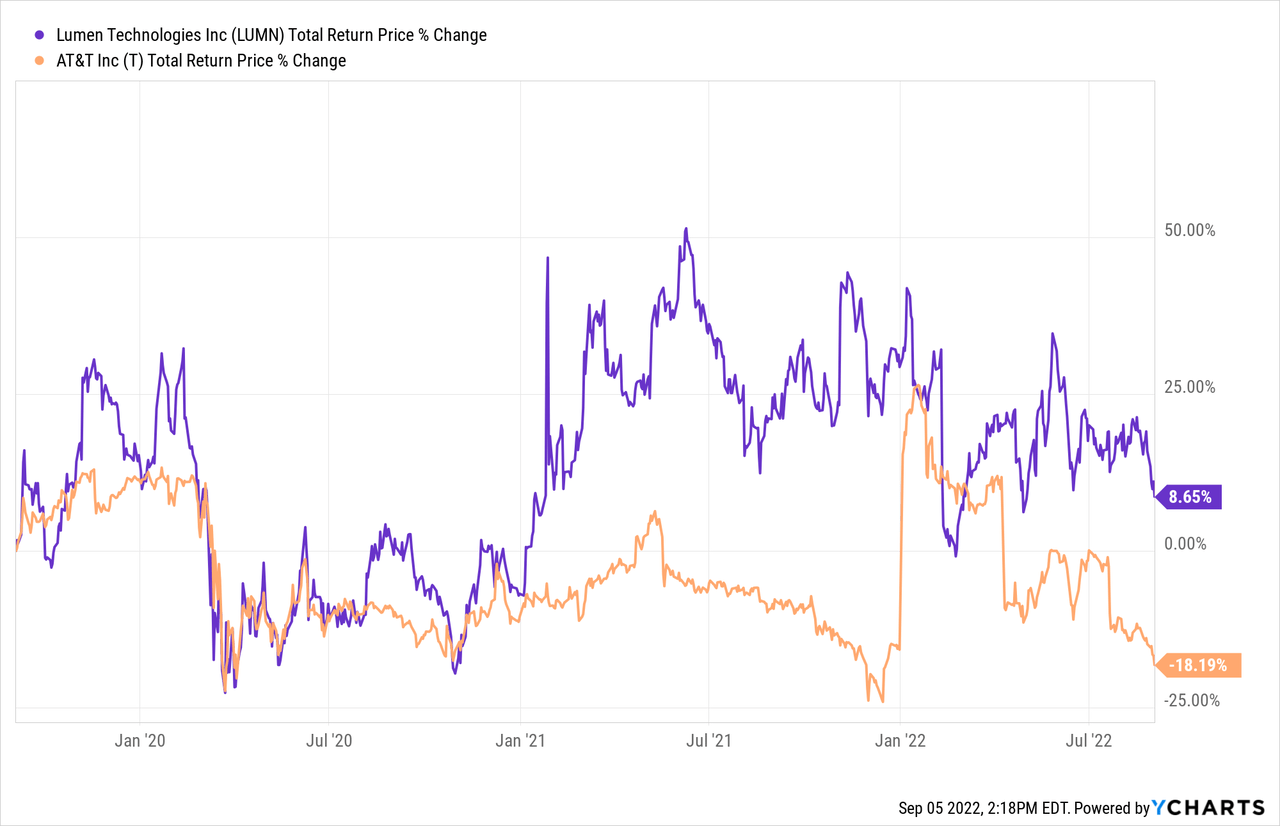

However, over the past three years, LUMN has significantly outperformed AT&T:

Overall, we rate this comparison as a draw as neither business has done anything to particularly earn the trust of shareholders that they will be able to generate outperformance or be particularly shrewd capital allocators moving forward.

Lumen Technologies Vs. AT&T – Stock Valuation

On a valuation basis, LUMN appears to be clearly cheaper on an EV/EBITDA and dividend yield basis, though AT&T does look cheaper on a P/E basis:

| LUMN’s Metrics | Current | 5-Yr. Average |

| EV/EBITDA | 6.42x | 5.67x |

| P/E | 9.11x | 10.29x |

| Dividend Yield | 10.15% | 9.60% |

| AT&T’s Metrics | Current | 5-Yr. Average |

| EV/EBITDA | 7.14x | 7.26x |

| P/E | 7.05x | 9.38x |

| Dividend Yield | 6.51% | 6.58% |

While LUMN may look overvalued relative to its five-year average, it is important to note that it has recently sold off some of its lower value assets at EV/EBITDA multiples that imply its remaining assets are significantly undervalued. Meanwhile, AT&T’s long-term average EV/EBITDA multiple is even lower at 6.38x, so it is really not trading at any meaningful discount to its long-term EV/EBITDA averages. Overall, we give the edge to LUMN in this area.

Investor Takeaway

Neither AT&T or LUMN impress us when it comes to the strength of their business models or track records. While they both have solid – but not great – balance sheets, we give the edge to AT&T given its investment grade status and greater focus on paying down debt at the moment. Neither is very growthy either, but AT&T is probably slightly better situated there, at least in the short run. As a result, AT&T is clearly the better choice for investors looking for security. Therefore, for conservative retirees looking for reliable income and not ultimately concerned about total return potential, we would rate AT&T as the better option of the two.

However, LUMN is cheaper relative to the intrinsic value of its businesses and assets. Furthermore, it is smaller in size, and management is openly considering selling additional assets in order to unlock further value embedded in its current valuation. As a result, LUMN has more total return potential than AT&T and could potentially generate considerable upside for current shareholders if management can effectively sell more of its assets, or even the entire company. As a result, we rate AT&T a Hold and LUMN a Strong Buy.

Be the first to comment